Accounts Payable Automation Canada - The 2025 Playbook for True Touchless Processing

Canadian finance teams face unique AP pressures: GST/HST complexity, bilingual invoice flows, cross-border FX, and strict PIPEDA data-privacy rules.

Yet most Accounts Payable automation Canada deployments still rely on template-bound OCR or bolt-on bots, delivering only 20–30% productivity gains.

Hyperbots breaks through that ceiling. Our Agentic-AI Co-Pilot achieves 90%+ straight-through processing, understands French & English invoices, and complies with CRA/CBSA audit demands, making us the go-to Accounts Payable automation software Canada trusts.

The State of AP Automation in Canada

68% of midsize Canadian firms still print, sign, and file at least some invoices.

The average cost per invoice hovers around C$7.20 (CPA Canada, 2024).

Existing Accounts Payable automation software in Canada typically promises “paperless” but still needs human line-item entry for bilingual or multi-currency invoices.

Key pain: Complex tax splits (GST/HST/PST) and bilingual documents crash OCR templates.

Why Legacy Canadian Solutions Plateau at 30% Gains

Limitation | Impact on Canadian AP |

OCR templates choke on French layouts | Manual key-in for Québec suppliers |

Bots don’t understand GST/HST allocation | Tax miscoding -> CRA audits |

No FX intelligence | Over- or under-payment to US vendors |

No PIPEDA encryption | Compliance risk, fines up to C$100k |

Legacy “OCR-plus” vendors claim AccountsPayable automation Canada compatibility, yet cannot read “30 jours fin de mois” payment terms, let alone prorate HST on freight.

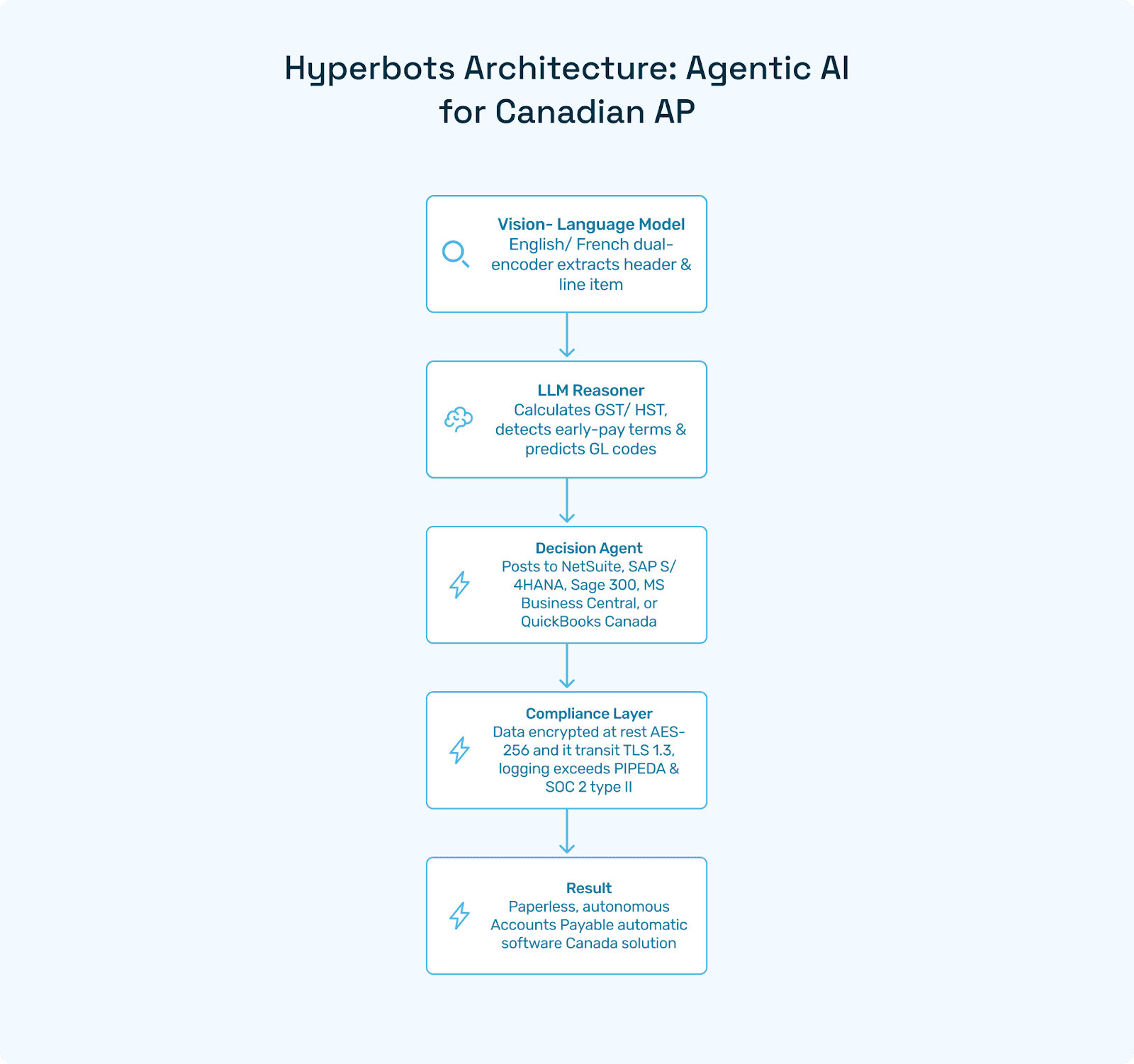

Hyperbots Architecture: Agentic AI for Canadian AP

Vision-Language Model—English/French dual-encoder extracts every header & line item.

LLM Reasoner—Calculates GST/HST, detects early-pay terms, and predicts GL codes.

Decision Agent—Posts to NetSuite, SAP S/4HANA, Sage 300, MS Business Central, or QuickBooks Canada.

Compliance Layer—Data encrypted at rest (AES-256) and in transit (TLS 1.3), logging exceeds PIPEDA & SOC 2 Type II.

Result: A true paperless, autonomous Accounts Payable automation software Canada solution with no templates, and no rescans.

Flowchart—OCR vs. Hyperbots in a Québec-Toronto Workflow

Compliance Deep Dive

PIPEDA & SOC 2

Hyperbots stores data on Canadian-hosted AWS regions; audit logs satisfy both SOC 2 and PIPEDA breach-notification guidelines.

GST/HST/PST

Agents calculate composite tax: e.g., Ontario 13 % HST, BC 5 % GST + 7 % PST, Québec split remittance. No other Accounts Payable automation software in Canada has built-in CRA rate tables plus auto-remittance file export.

CBSA Customs

For cross-border freight invoices, Hyperbots attaches CBSA Form CI1 to the digital record, ensuring customs documents are audit-paired.

ROI Model for Canadian Mid-Market CFOs

KPI | Legacy OCR | Hyperbots |

Cost/invoice (CAD) | 7.00 | 2.10 |

Touchless % | 30 | 80 |

GST/HST errors | 0.4% invoices | <0.05% |

Early-pay capture | 25% | 70% |

A 150 k-invoice firm saves ≈C$750k yearly; payback in less than 5 months.

Implementation Roadmap: 10 Weeks

Week | Milestone | Output |

0–2 | Data & tax mapping | Québec/Atlantic splits are configured |

3–4 | Sandbox calibration | 95 %+ extraction accuracy |

5–6 | ERP API link | Posting to CAD & USD ledgers |

7–8 | Vendor portal launch | Suppliers switch to e-upload |

9 | Parallel run | KPI baseline |

10 | Cut-over | OCR retired |

Vendor Checklist—Choosing Accounts Payable Automation Software Canada

✅ Bilingual English/French extraction

✅ Embedded CRA tax engine

✅ PIPEDA & SOC 2 compliance

✅ FX & cross-border workflow

✅ More than 99 % field accuracy SLA

✅ Vendor self-service portal

✅ Agentic AI, not template OCR

Hyperbots is the only vendor in Canada meeting all seven criteria.

Conclusion & Next Steps

OCR had its decade; Canadian compliance and bilingual complexity outgrew it. Hyperbots delivers the only agentic Accounts Payable automation software in Canada that:

Exceeds 90% touchless processing

Understands French & English invoices

Auto-calculates GST/HST/PST and FX

Meets PIPEDA, CRA, and SOC 2 in one platform

Ready to modernize your AP from Halifax to Vancouver?

Book a Canadian Hyperbots demo today and receive a custom savings analysis.