Accounts Payable Automation Benefits—From Definition to ROI

Going “paperless” is table stakes—modern finance teams demand an Accounts Payable approval software

Modern finance teams need an end-to-end AP automation stack that captures, understands, and pays invoices without human effort.This guide unpacks the Accounts Payable automation benefits that matter, explains the full AP automation process flow, and shows why Hyperbots’ Agentic-AI Co-Pilot leads the market in automated AP operations.s

Accounts Payable Automation - Definition & Scope

Accounts Payable automation uses AI-driven capture, rule-based approvals, and integrated pay rails to transform invoices into a self-driving workflow. A true solution delivers:

Intelligent capture (email, EDI, supplier portal)

AI-driven 2-/3-way matching plus tax validation

AP approval software that nudges approvers in Slack or Teams

Auto-payment via ACH, BACS, SEPA, virtual card

Immutable audit logs

When all five stages run on one platform, you achieve genuine end-to-end AP automation.

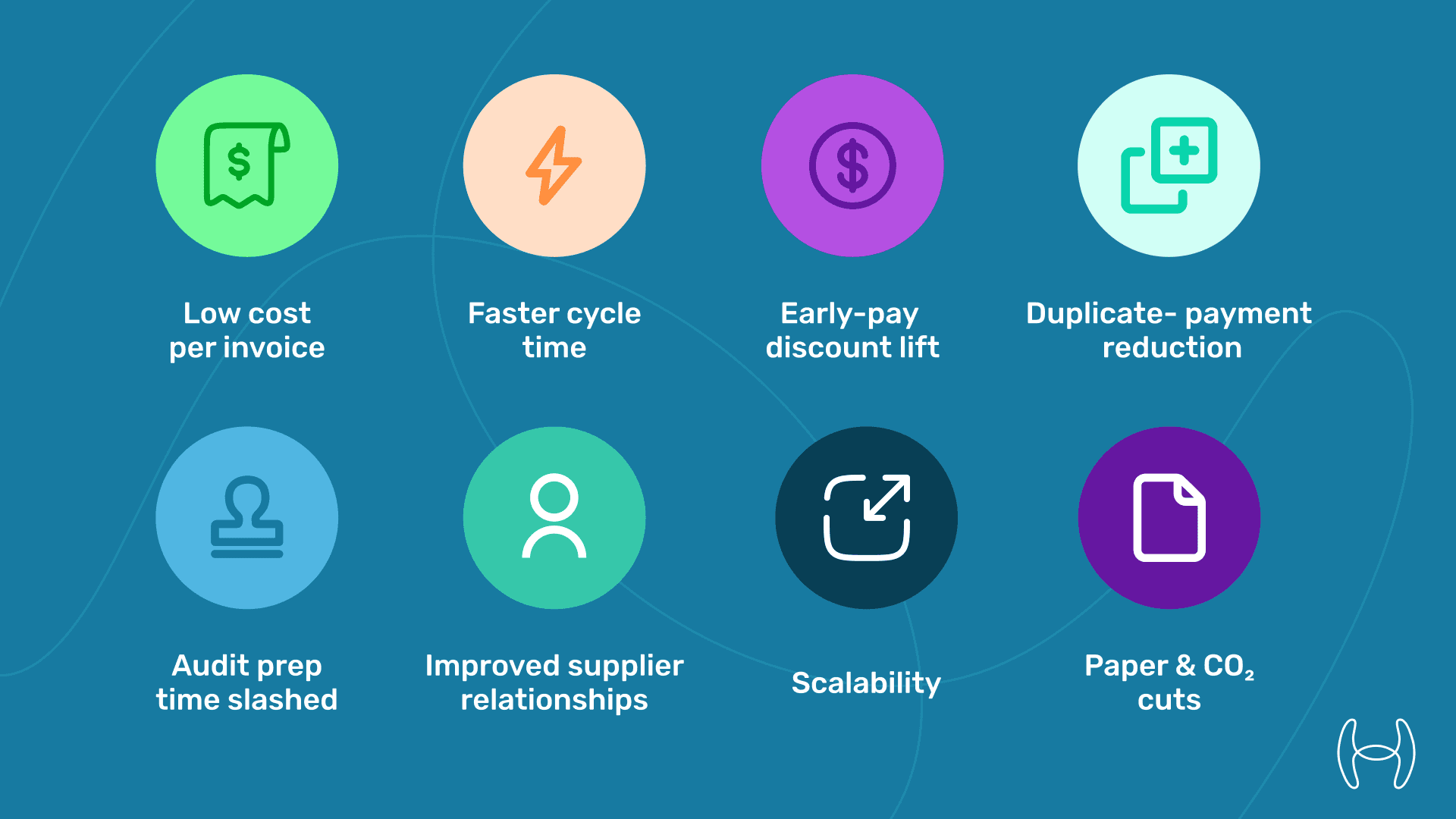

Eight High-Impact Accounts Payable Automation Benefits

# | Benefit | Typical Gain* | Keyword Tie-In |

1 | Lower cost per invoice | $6.50 → $2.00 | AP automation benefits |

2 | Faster cycle time | 12 days → < 1 days | Automated AP operations |

3 | Early-pay discount lift | 25% → 90% captured | Accounts Payable automation benefits |

4 | Duplicate-payment reduction | 0.3 % → 0.03 % spend | AP automation process |

5 | Audit prep time slashed | 5 days → <1 hour | Accounts payable automation definition |

6 | Improved supplier relationships | Real-time status portal | Accounts payable invoice automation |

7 | Scalability | 20 k → 1 M invoices w/o head-count | Best AP automation software |

8 | Paper & CO₂ cuts | Zero printing | Digital accounts payable |

*Benchmarks drawn from Hyperbots client data (2024).

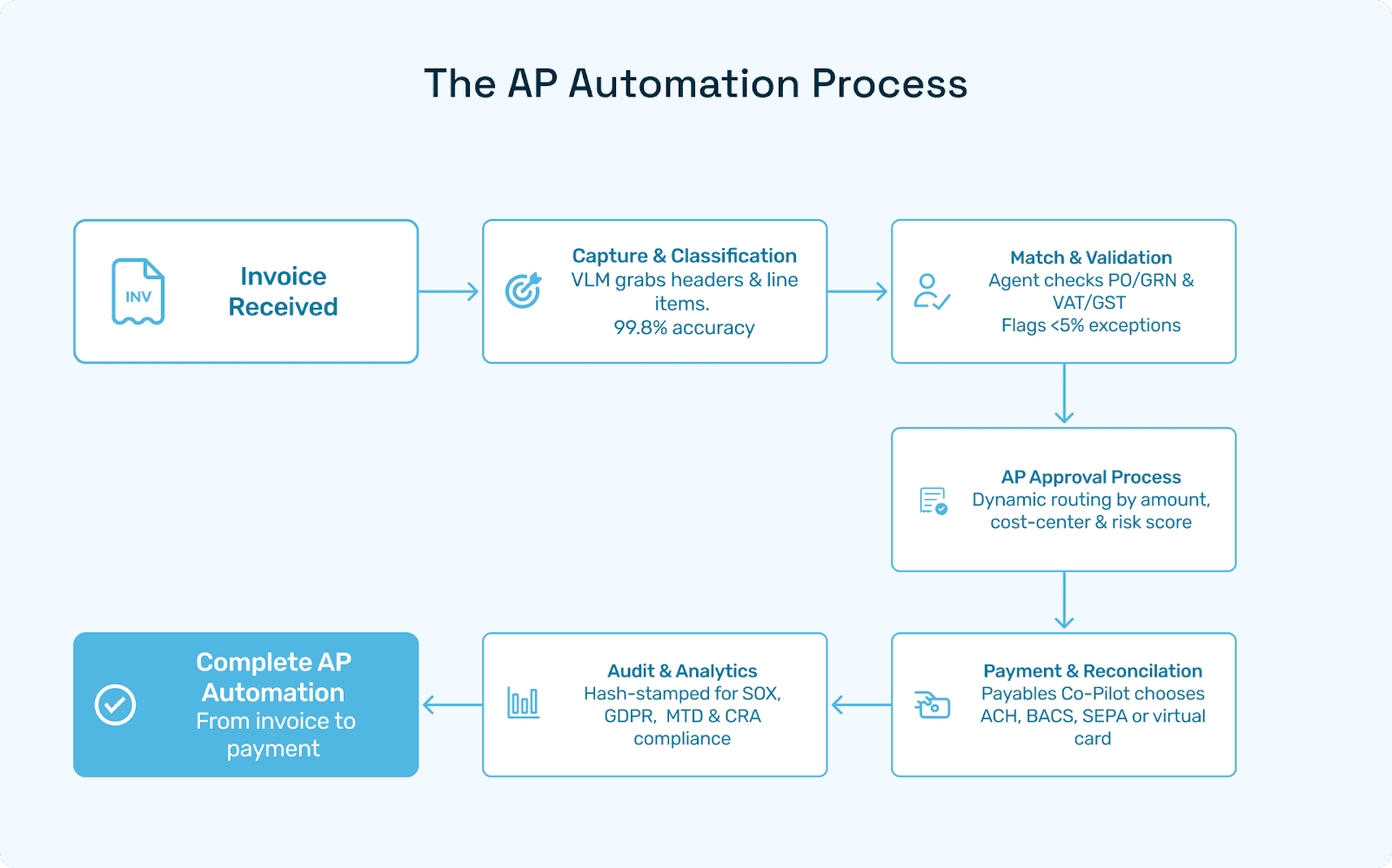

The AP Automation Process

Capture & Classification

Hyperbots’ Vision-Language Model grabs every header and line item (99.8% accuracy).

Match & Validate

Agent checks PO/GRN, VAT/GST, and flags <5 % exceptions.

AP Approval Process

Dynamic routing: amount, cost-centre, and risk score decide the approver chain. This stage embodies AP approval software in action.

Payment & Reconciliation

Integrated Payables Co-Pilot chooses ACH, BACS, SEPA, or virtual card; posts back to ERP.

Audit & Analytics

Every action is hash-stamped, satisfying SOX, GDPR, MTD, and CRA audits—classic Accounts Payable audit software functionality.

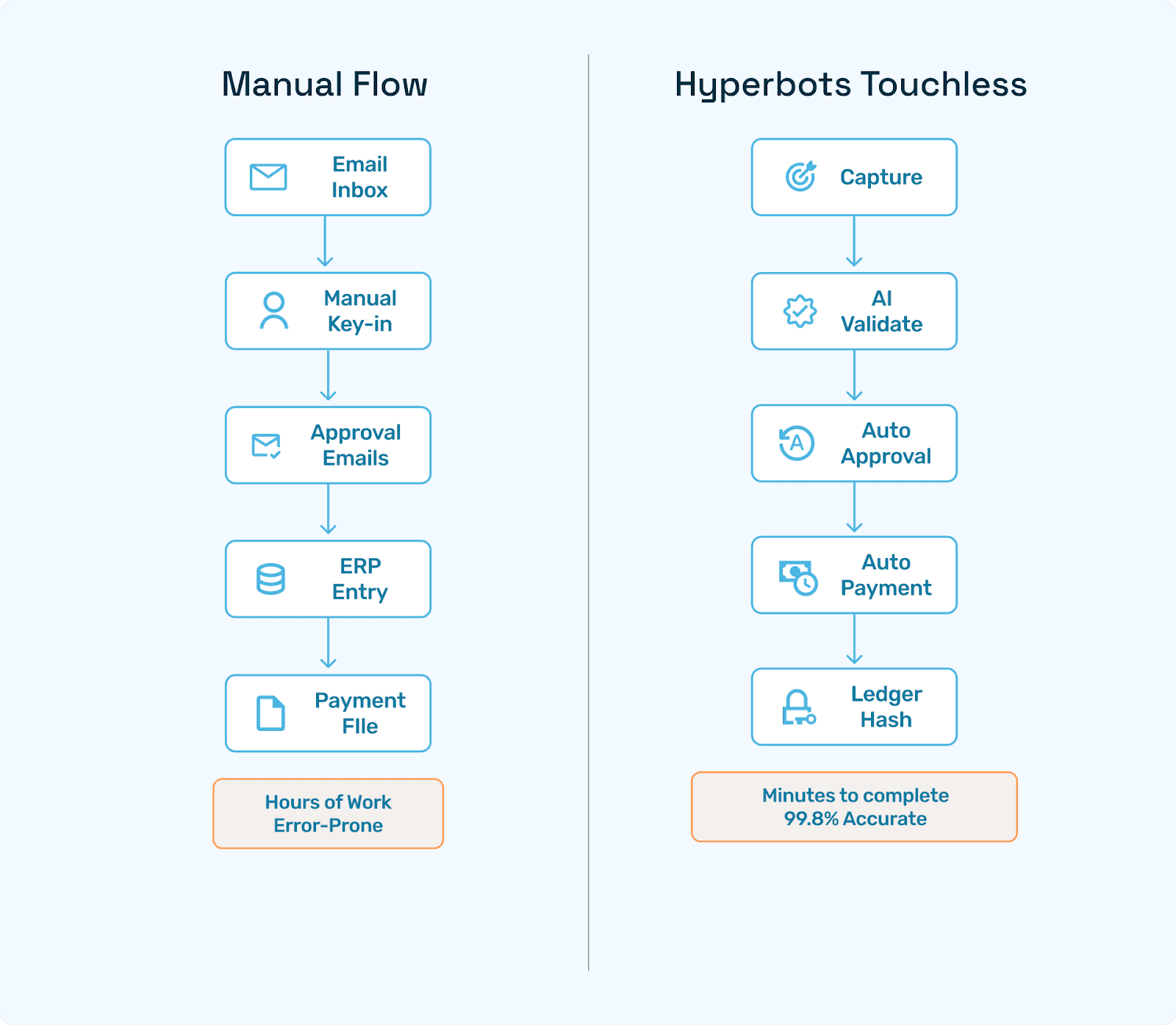

Flowchart: Manual vs. Hyperbots Touchless

Building the Business Case & ROI

Cost-Savings Equation

Savings = (Manual cost - Hyperbots cost) × Volume + Extra discounts + Duplicate recoveries

Example

250 k invoices × ($6.50 - $2.00) = $1.125 M

$180 k duplicate recovery

$300 k extra discounts

= $1.6 M total, payback < 6 months

Planning a Successful AP Automation Project

Phase | Weeks | Deliverables |

Discovery | 0-2 | KPI baseline, vendor master clean-up |

Sandbox | 2-4 | 1,000-invoice proof; refine AI thresholds |

Integration | 4-6 | ERP API, pay-rails, SSO |

Pilot | 6-8 | 50 % live volume; measure touchless |

Roll-out | 8-12 | 100 % live; disable OCR |

Success hinges on aligning the AP automation process with business rules early.

Compliance Gains & Audit Readiness

Regulation | Hyperbots Capability |

HMRC MTD | Digital-link API, real-time VAT file |

CRA GST/HST | Auto tax-split agent |

SOX | Immutable ledger + segregation of duties |

GDPR/PIPEDA | Region-locked data centres (UK & CA) |

Compliance savings are often overlooked when counting AP automation benefits.

10. Conclusion & Demo Offer

The eight Accounts Payable automation benefits—cost, speed, discounts, risk, supplier happiness, scalability, analytics, sustainability—prove why autonomous AP automation process flow is a CFO’s quickest win. Hyperbots delivers the only platform that turns those benefits into contractual SLAs.

See Hyperbots in action.

Book a 30-minute demo and get a personalised ROI forecast within 48 hours.