AI in Accounts Payable—From OCR Fatigue to Agentic Autonomy

Invoices land in hundreds of formats, across five inboxes. Traditional OCR “automation” captures a header or two, then hands over hard work to AP clerks.

When AI enters Accounts Payable - Vision Language Models (VLMs) read every field, Large Language Models (LLMs) reason over tax and payment terms, and decision agents post directly to ERP APIs.

Hyperbots’ Invoice Processing Co-Pilot leads this new wave. Trained on millions of invoices, it achieves 99.8% accuracy, routes approvals, triggers BACS/ACH or virtual-card payments, guaranteeing a 90%+ touchless SLA. That is true AI-powered AP automation, not template re-skin.

Table of Contents |

|

|

|

|

|

|

|

|

|

|

|

Why AI and Why Now?

Market Pressures

Inflation squeeze → CFOs chase days payable optimisation.

Productivity → Every CFO wants the AP team to be super productive, doing more with less.

Regulatory complexity → Accuracy of GL codes, tax compliance, and regulatory filings.

Template-based tools miss half the data; bots break on UI updates. Agentic AI in Accounts Payable solves those pain points by “understanding” content instead of copying pixels.

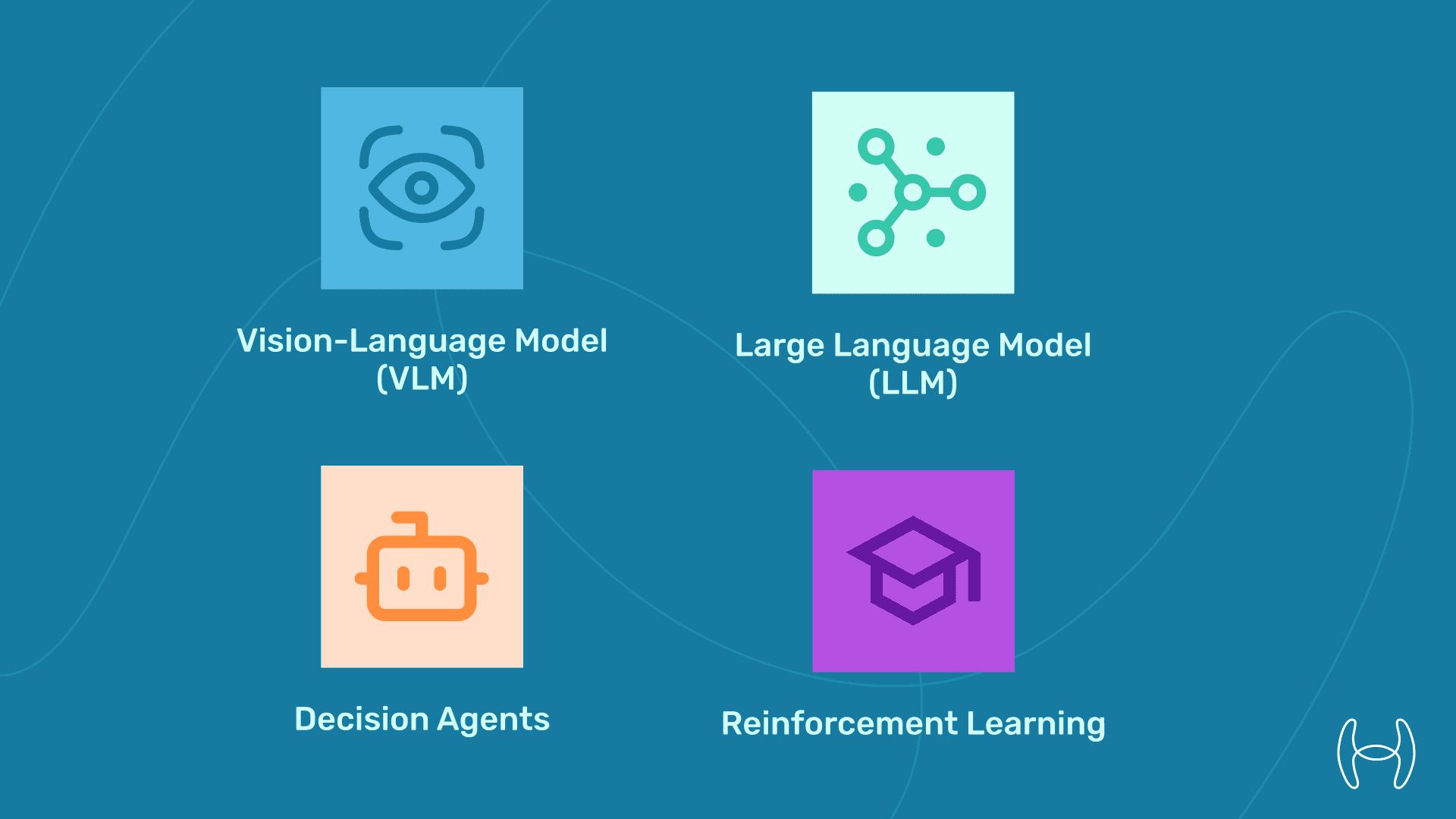

Key Technologies

Tech Layer | Role in AP | Hyperbots Advantage* |

Vision-Language Model (VLM) | Reads header and line-item tables | Dual encoder handles any layout and templates |

Large Language Model (LLM) | Interprets “2/10 Net 30,” multi-tax splits | Continual fine-tune loop |

Decision Agents | Risk-score, GL-code, choose pay-rail | 15 specialised agents |

Reinforcement Learning | Improves from each exception | Less than 0.5 % residual exception rate |

*Source: functional capabilities matrix, Hyperbots

End-to-End AI-Powered AP Automation Workflow

Capture – Emails auto-ingested; EDI JSON parsed.

Extract – VLM hits 99.8 % field accuracy.

Validate – Matching, VAT/GST, FX; LLM flags anomalies.

Approve – Slack/Teams bot asks the correct approver; escalates if idle for 24 h.

Pay – BACS, Faster Payments, virtual card; FX settled at BoE spot.

Audit – Hash ledger; SOC 2, GDPR, SOX ready.

That closed loop embodies AI-powered AP automation.

Flowchart: Legacy vs. AI-Native (AP Automation Process)

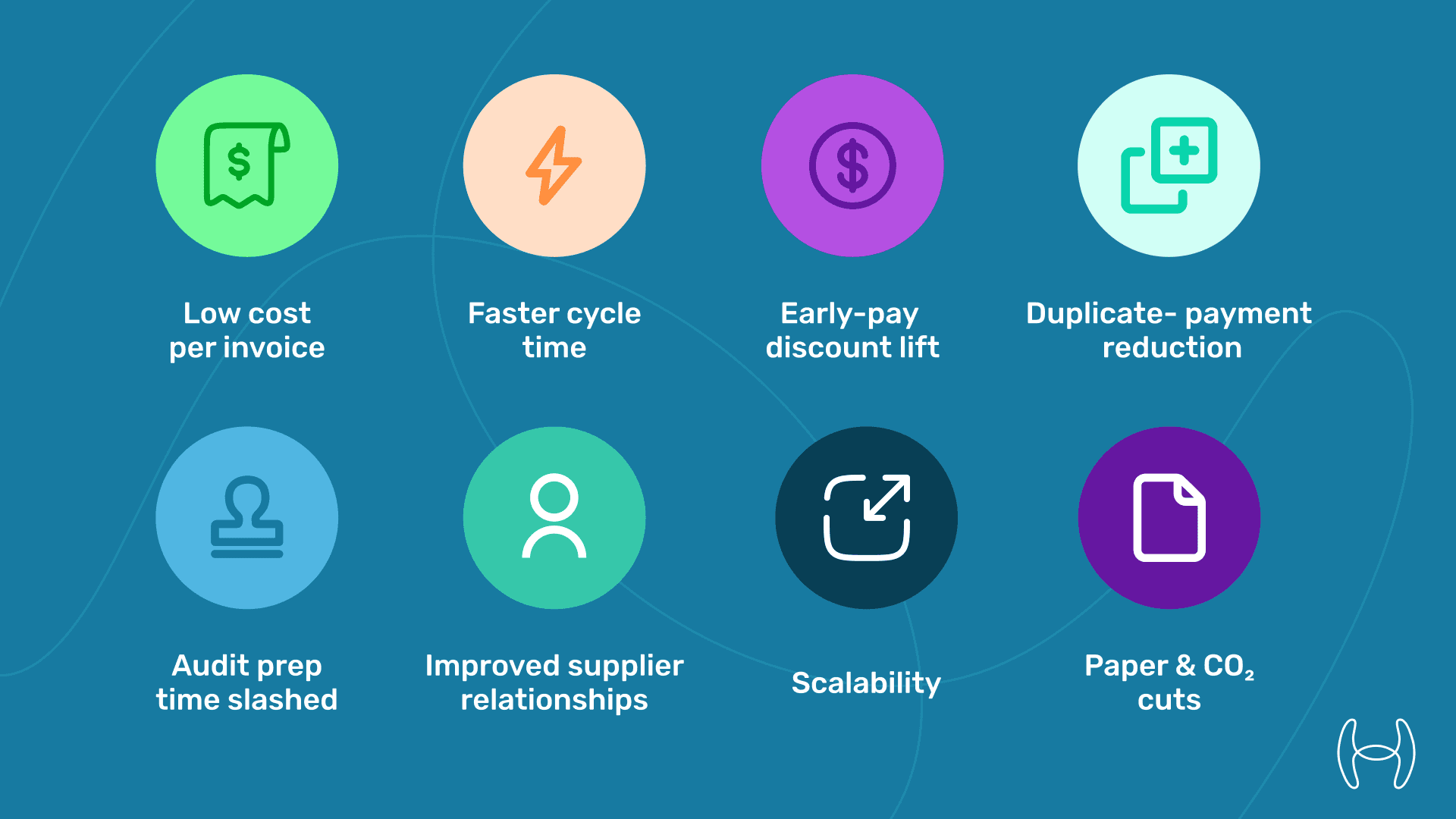

Six Game-Changing Benefits of AP Automation + Machine Learning

# | Benefit | Impact Metric | Keyword Tie-In |

1 | Accuracy leaps to 99.8 % | <2% exceptions | AP automation machine learning |

2 | Cycle time ↓ 75 % | 10 days → <1 days | AI-powered APautomation |

3 | Duplicate payments ↓ 90 % | 0.3% → 0.03% | Automated AP operations |

4 | Discount capture ↑ 3× | 25% → 90% | AI in Accounts Payable |

5 | Audit prep ↓ 80 % | 5 days → 1 day | Accounts Payable Audit Software |

6 | Scales linearly | 30 k → 1 M invoices w/o head-count | End to end AP automation |

Hyperbot's Architecture

Data Lake & Model Hub

Invoice embeddings stored; new layouts auto-clustered

Agent Mesh

15 microservices: Tax agent, Duplicate agent, Discount agent, FX agent, Fraud agent.

Vendor Portal

Bilingual upload, W-9/TIN validation, PEPPOL e-timeline—removes supplier paper.

Compliance & Risk

SALES Tax Verification: Automated through AI

VAT & MTD – Agent forms digital-link chain.

GDPR – PII masked; DPS in EU West and UK South.

SOX Segregation – Role-based approvals & immutable ledger.

AI Ethics – Model-governance board; drift-monitor dashboard.

Building a Business Case & ROI

Equation

ROI = (Cost_Save + Discount_Gain + Duplicate_Recover) / AI_Subscription

Example

Vol: 300 k invoices | Manual £6.00 | Hyperbots £2.00

→ £1.2 M direct savings + £350 k discounts + £90 k duplicate recovery

= £1.64 M benefit vs £290 k annual fee → 465 % ROI, payback 4 months.

Implementation Blueprint (90 Days)

Sprint | Weeks | Deliverables |

Data & Tax Map | 0-2 | Vendor master, VAT codes |

Sandbox | 2-4 | 1k invoices, 98% accuracy gate |

API Integration | 4-6 | ERP, bank rails, SSO |

Pilot | 6-8 | 50% live, SLA dashboard |

Cut-Over | 8-12 | OCR off, bots retired |

Future State—Agentic Finance

Predictive cash-conserve agent delays non-discount invoices.

Self-funding payables rebates cover subscription.

Smart-contract auto-pay on IoT-verified delivery.

Hyperbot's roadmap already trials predictive agents.

Conclusion & Demo

Template OCR and RPA have emerged in the last decade. AI-powered AP automation, anchored by vision-language extraction, large-language reasoning, and decision agents, delivers accuracy, speed, and audit trust no legacy stack can match.

Hyperbots lead this shift. Ready to see AP automation machine learning in action?

👉 Book a 30-minute demo and get a personalised ROI workbook.