Agentic AI vs Template-Based OCR: Why Hyperbots Wins on 99.8% Accuracy

Why agentic AI outperforms template-based OCR and delivers 99.8% invoice accuracy that finance teams can trust every day.

Finance teams implementing AI invoice processing face a fundamental technology choice: legacy template-based OCR systems or modern agentic AI platforms. This decision determines whether your accounts payable operation achieves 85% accuracy with constant manual corrections or reaches 99.8% accuracy with true automation.

Traditional OCR technology, including solutions like Tipalti, relies on predefined templates and rule-based extraction. When invoices match expected formats, these systems perform adequately. When formats vary (different vendors, multi-page documents, complex line items), template-based approaches collapse, requiring extensive human intervention.

Agentic AI represents a paradigm shift in invoice extraction. Rather than matching invoices against rigid templates, agentic systems apply reasoning models to understand document structure, context, and relationships between data fields. This analysis compares template-based OCR (Tipalti) against agentic AI invoice processing (Hyperbots) across accuracy, adaptability, and operational impact.

The Fundamental Limitations of Template-Based OCR

Template-based OCR technology dominated invoice automation for the past decade. The approach seems logical: create templates for each vendor's invoice format, train the system to extract data from expected field positions, and process invoices matching those templates automatically.

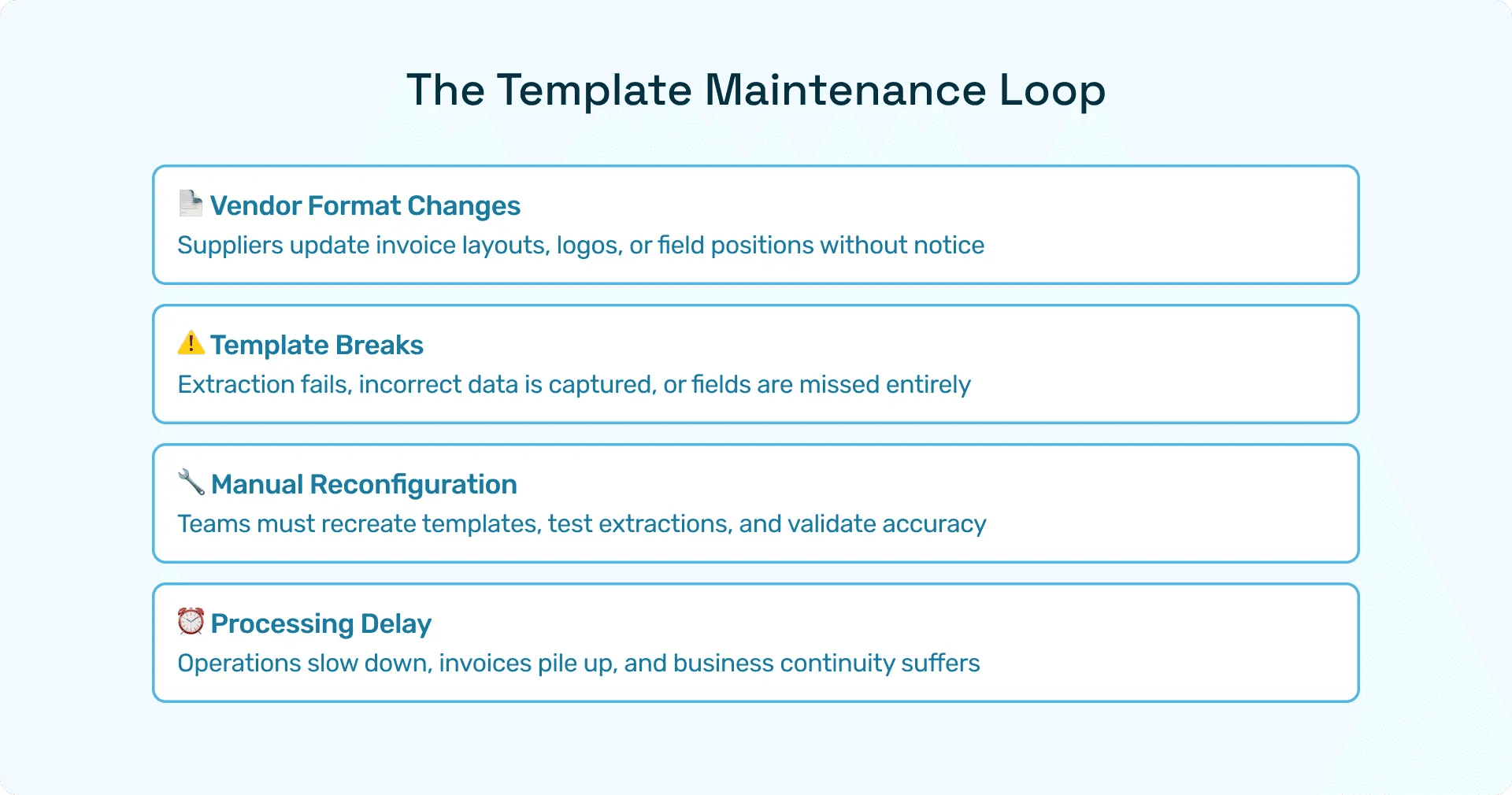

Reality proves more complex. Invoice formats change when vendors update accounting systems, merge with other companies, or modify their invoicing processes. Each format change breaks existing templates, requiring manual template updates and retraining. Organizations with hundreds of vendors face constant template maintenance, transforming promised automation into a configuration management burden.

Multi-page invoice handling exposes template OCR's structural weaknesses. When invoices span dozens of pages with hundreds of line items, positional extraction fails. Template systems struggle to maintain context across pages, frequently misaligning data fields and creating cascading errors throughout line-item details.

Template OCR Reality: User-Reported Challenges

User reviews on G2 and Capterra reveal consistent challenges with template-based OCR accuracy and reliability:

OCR Accuracy Concerns

"The OCR feature is just Ok. There is still a thorough invoice review by our internal accounting team," notes one Capterra reviewer. The platform handles single-page invoices with structured data effectively, but multi-page invoices with hundreds of line items or non-standard formats require significant manual intervention.

Performance and Speed Issues

AP automation performance receives particularly critical feedback. "AP automation features are sluggish and very unreliable," says an IT Manager on Capterra. Multiple users report the system being "buggy at times, which has slowed operations" and becoming "a little slower during month end, which is when we really need the system running smoothly."

Navigation speed poses particular challenges, with users on G2 describing the platform as "Laggy" and noting that "flicking between procurement and bills is too slow."

Integration Stability Problems

While Tipalti integrates with major ERP systems, customers report "connectivity issues, sync errors, and problems transferring data." One user described their challenges: "We had a ton of issues with our connection between Teampay/Tipalti/Netsuite," concluding that Tipalti "definitely have not lived up to the promise."

Another user found the system "quite clunky and slow" with "sync errors with the bookkeeping system which became time consuming to fix," adding "The system feels quite fragile and breaks often requiring support."

Implementation Complexity

"The onboarding process required a significant amount of time and effort to properly integrate the platform with existing systems and workflows," says one G2 review. Several users report that "an implementation can take months, regardless of company size," with limited customization options requiring workarounds for specific business requirements.

These limitations collectively explain why template-based OCR systems typically achieve 85% to 90% accuracy and 60% to 75% straight-through processing rates(industry standards).

How Agentic AI Transforms Invoice Processing

Agentic AI represents a fundamental architectural shift in invoice extraction. Rather than matching documents against predefined templates, agentic systems apply reasoning capabilities to understand invoice structure, interpret context, and extract data regardless of format variations.

Hyperbots exemplifies this agentic AI approach through specialized co-pilots designed specifically for finance and accounting workflows. The Invoice Processing Co-pilot operates as one component within an integrated ecosystem of AI agents handling the complete procure-to-pay cycle.

The Hyperbots platform achieves 99.8% accuracy in converting unstructured invoice data into structured fields. This precision stems from a multimodal mixture-of-experts model integrating large language models, vision-language models, and layout understanding algorithms. The platform trains exclusively on finance and accounting data (millions of invoices, statements, and contracts), creating domain-specific intelligence that generic OCR tools cannot match.

Contextual Understanding vs Positional Extraction

Template OCR extracts data from expected field positions. Agentic AI understands what data means. When processing an invoice, Hyperbots doesn't just read text in specific locations. It comprehends relationships between invoice elements, validates logical consistency, and infers missing information from context.

This contextual intelligence enables the Invoice Processing Co-pilot to handle format variations automatically. When a vendor changes invoice layouts, agentic AI adapts instantly without template reconfiguration.

Multi-Page Document Intelligence

The Invoice Processing Co-pilot excels at extracting line items from invoices spanning hundreds of entries across multiple pages. This is critical functionality for healthcare, retail, and manufacturing organizations dealing with complex vendor invoices.

Unlike template OCR that processes each page independently and struggles with context maintenance, agentic AI maintains document-level understanding. The system tracks line-item sequences across pages, associates notes and adjustments with correct entries, and preserves hierarchical relationships in complex invoice structures.

Advanced Data Augmentation

When template OCR encounters incomplete data, it stops and requests human intervention. Agentic AI reasons through available information to complete the picture. If a vendor name is missing but the invoice number matches historical patterns and the bank account aligns with known suppliers, Hyperbots confidently completes the extraction.

Hyperbots reports achieving 80% straight-through processing rates, reducing average invoice processing time from the industry standard of 11 days to under one minute for automated invoices.

AI Invoice Processing Performance Comparison

Metric | Template OCR (Tipalti) | Agentic AI (Hyperbots) |

Data Extraction Accuracy | 85-90% | 99.8% |

STP Rate | 60-75% | 80% |

Processing Time | 1-2 days | <1 minute |

System Performance | Sluggish, laggy (user-reported) | Consistent high-speed |

Multi-Page Handling | Requires manual review | Automated extraction |

Format Adaptability | Template-dependent | Self-adapting |

Integration Stability | Sync errors reported | Stable, no-code |

Based on publicly available information as of November 2025.

Accuracy Analysis: Why 99.8% Matters

The accuracy gap between 85% to 90% (template OCR) and 99.8% (agentic AI) translates directly to operational impact. For organizations processing 10,000 invoices monthly, this difference means 480 fewer exceptions requiring investigation. That represents over 200 hours of AP staff time monthly.

Performance and Reliability in Production

User reviews on G2 and Capterra consistently highlight template-based system performance issues. Systems are described as "sluggish," "laggy," and particularly slow during month-end when finance teams need reliable performance most.

Agentic AI platforms maintain consistent processing speed regardless of volume or timing. Hyperbots' architecture handles peak loads without degradation, processing invoices in under one minute while maintaining 99.8% accuracy.

Integration Stability and Operational Friction

Template OCR users report connectivity issues, sync errors, and data transfer problems requiring frequent support intervention. System fragility creates operational friction and extends issue resolution time.

Agentic AI employs no-code integration frameworks that adapt to company-specific ERP customizations automatically. Hyperbots provides read-back validation ensuring posted transactions match intended entries, catching integration errors before they impact financial statements.

Implementation Speed and Learning Curves

Template-based implementations typically span 8 to 16 weeks for mid-market organizations. Users report that implementations "can take months, regardless of company size." Post-implementation, template OCR follows a gradual improvement curve, typically reaching mature accuracy levels within 6 to 12 months.

Agentic AI implementations move faster due to pre-trained models. Hyperbots implementations typically complete sandbox testing within 2 to 4 weeks, validating 99.8% accuracy on sample invoice batches. Full production deployment occurs within 4 weeks for most implementations, with automation performance reaching target levels immediately.

The learning curve difference is fundamental. Template OCR requires organizations to teach the system through extensive configuration and correction cycles. Agentic AI arrives with pre-trained intelligence, requiring only configuration of company-specific business rules and approval workflows.

Business Impact of AI Invoice Processing Accuracy

Organizations upgrading from 85% to 90% accuracy (template OCR) to 99.8% accuracy (agentic AI) eliminate significant exception handling costs and unlock strategic financial capabilities.

Exception Handling Cost Reduction

For an organization processing 10,000 invoices monthly, improving accuracy by 10 percentage points means 1,000 fewer exceptions requiring investigation. At an average of 25 minutes per exception investigation, this represents over 400 hours of AP staff time monthly. That's equivalent to 2.5 full-time positions focused entirely on exception handling.

Early Payment Discount Capture

Organizations typically forfeit 60% to 70% of available early payment discounts due to slow invoice processing. Achieving 80% straight-through processing with agentic AI enables systematic discount capture, translating to 0.5% to 2% annual savings on payable spending. For organizations with $50M in annual payables, this represents $250K to $1M in captured savings.

Vendor Relationship Enhancement

Organizations report 40% to 50% reductions in vendor inquiries regarding invoice status after implementing high-accuracy AI invoice processing. Improved vendor relationships translate to better pricing, priority treatment during supply constraints, and extended payment terms.

Financial Close Acceleration

Month-end and quarter-end close cycles compress significantly with high-accuracy automation. The consistent system performance of agentic AI (without the slowdowns reported for template OCR) means close activities proceed smoothly rather than fighting system limitations when time pressure is highest.

Choosing Between Template OCR and Agentic AI

Choose Template-Based OCR (Tipalti) when:

Your invoice portfolio consists primarily of standard formats from a limited set of established vendors

You need comprehensive finance automation beyond invoice processing

You have IT resources available for ongoing template maintenance and system support

Choose Agentic AI (Hyperbots) when:

Your organization processes diverse invoice formats from numerous vendors

Multi-page invoices with complex line items represent a significant portion of your volume

System performance and reliability during peak periods are critical requirements

You want AI-first architecture with continuous learning capabilities that adapt automatically

Integration stability and minimal support intervention matter to your operations

Frequently Asked Questions

Q: How does AI invoice processing differ from traditional OCR?

A: Traditional OCR extracts text from expected field positions using templates. AI invoice processing applies reasoning models to understand document context, relationships between data elements, and invoice meaning regardless of format. Agentic AI adapts automatically to format variations, while template OCR requires manual configuration updates for each layout change.

Q: Can template-based OCR handle multi-page invoices accurately?

A: Template OCR handles multi-page invoices but requires thorough internal review. Users report that OCR features produce acceptable results for standard formats, but complex multi-page invoices containing hundreds of line items need significant manual intervention.

Q: What STP rates can I expect from AI vs template OCR?

A: Agentic AI platforms like Hyperbots achieve approximately 80% straight-through processing compared to template OCR's typical 60% to 75% for enterprise deployments. This translates to roughly 5% to 20% fewer invoices requiring manual intervention, creating significant operational savings for high-volume organizations.

Q: How quickly does agentic AI reach production accuracy?

A: Agentic AI demonstrates immediate production performance due to pre-trained models. Organizations typically see target accuracy rates (99.8%) within weeks of deployment. Template-based OCR requires 6 to 12 months to achieve mature accuracy levels through template accumulation and learning cycles.

Q: Does Hyperbots integrate with my ERP system?

A: Hyperbots maintains pre-built connectors for major ERP platforms including Oracle NetSuite, QuickBooks, SAP, Microsoft Dynamics, Sage Intacct, and Deltek Costpoint. The platform's no-code configuration framework enables custom field mapping without development effort.

Q: Can I migrate from template OCR to agentic AI easily?

A: Migration complexity depends on implementation maturity and process customization depth. Agentic AI platforms support data migration from existing AP automation platforms including vendor information, historical invoice data, and workflow configurations. Transitions typically require 4 to 8 weeks including data migration, parallel processing validation, and user training.

Conclusion: The Case for Agentic AI Invoice Processing

The choice between template-based OCR and agentic AI invoice processing fundamentally shapes your accounts payable operation's accuracy, efficiency, and strategic value. Template OCR faces consistent limitations regarding extraction accuracy, system performance, integration stability, and ongoing template maintenance requirements.

Agentic AI delivers specialized, purpose-built invoice extraction achieving measurably higher accuracy (99.8% vs 85% to 90%), faster straight-through processing (80% vs 60% to 75%), and superior handling of complex invoice scenarios without the performance degradation inherent in template-based approaches.

For finance leaders prioritizing accuracy, automation reliability, system performance, and rapid time-to-value, agentic AI's architectural advantages present compelling benefits. Platforms like Hyperbots eliminate the operational friction, extended implementation timelines, and ongoing template maintenance associated with traditional OCR technology.

The gap between 85% to 90% accuracy and 99.8% accuracy represents the difference between assisted automation requiring constant oversight and true autonomous invoice processing enabling strategic finance transformation.