Why Accuracy Matters More Than Speed in Invoice Automation (Tipalti vs Hyperbots)

A fast workflow means nothing if the data is wrong. Here’s why accuracy with speed is the real driver of efficiency, and how Hyperbots outperforms Tipalti by eliminating rework at the source.

Modern finance teams are under more pressure than ever. Month-end close is compressed, vendors expect faster payments, and leadership wants real-time spend visibility. As a result, finance automation tools have moved from “good to have” to mission-critical for CFOs, Controllers, and Finance Managers.

Invoice automation platforms promise faster AP cycles and reduced manual data entry, but here’s the truth most platforms don’t say out loud:

“Speed means nothing if the data is wrong.”

Processing an invoice in seconds doesn’t help if the GL code is incorrect, if duplicate invoices slip through, or if exceptions bounce back to AP analysts. Rework destroys the time savings. That’s why the new metric for AP automation isn’t speed, it’s invoice automation accuracy.

In this comparison, we evaluate Tipalti, a well-known AP automation and payables platform, against Hyperbots, an Agentic AI platform built specifically for Finance & Accounting that delivers 99.9% accuracy and continuous learning from workflows.

Understanding Tipalti’s Approach to Invoice Automation

Tipalti is positioned as a comprehensive, end-to-end AP automation platform, designed to streamline the entire Accounts Payables (AP) lifecycle, from vendor onboarding, invoice capture, approvals, to global mass payments at scale. It is built for organizations that manage large volumes of suppliers and international payouts, providing a unified hub for invoices, payments, and compliance.

Tipalti’s Core Invoice Automation Features

1. Invoice capture & OCR/IDP

Tipalti captures invoice data from email, PDF, or paper using OCR/IDP, reducing manual keying, preventing data entry errors, and speeding overall AP processing significantly.

2. PO / GRN matching (2-way / 3-way)

Tipalti performs rule-based 2-way or 3-way matching against purchase orders or receipts to validate accuracy, prevent overbilling, ensure correct billing amounts, and reduce reconciliation work.

3. Approval routing & workflow automation

Tipalti automatically routes invoices to appropriate approvers based on internal rules and approval thresholds, sends reminders, removes workflow bottlenecks, accelerates approvals, and shortens AP cycle time meaningfully.

4. Supplier self-service onboarding & vendor hub

Tipalti enables suppliers to enter banking and tax details themselves, improving the onboarding experience, reducing manual data collection, lowering errors, and simplifying vendor information management overall.

5. Global payables & mass payments (multi-currency / compliance)

Tipalti manages global vendor payments across multiple currencies with compliance controls, tax checks, FX handling, and automated processes that simplify international payables execution end-to-end.

6. Duplicate invoice/fraud prevention

Tipalti identifies duplicate or suspicious invoices, flags potential risks early, reduces overpayment exposure, and minimizes fraud across the vendor payment lifecycle.

7. ERP / GL system integration Syncs vendor data, invoices, and payments with ERP systems to minimize manual reconciliation; Integrates with leading ERPs and GLs and helps maintain data consistency across systems

Tipalti’s core promise to finance teams is straightforward: "Reduce manual work. Increase speed and efficiency."

Tipalti emphasizes faster invoice processing, scalable payables, and global payment execution.

However, in Tipalti’s positioning, accuracy is treated as a benefit rather than the core outcome. The product prioritizes moving invoices faster through the process, not necessarily optimizing for accuracy at the field level or reducing exceptions long-term.

What Hyperbots Offers: Invoice Automation Powered by Agentic AI

Hyperbots is not a traditional AP automation tool; it is an Agentic AI platform purpose-built for Finance & Accounting. Instead of automating individual tasks, Hyperbots orchestrates entire workflows across AP, AR, FP&A, Accruals, Vendor Management, Tax Verification, and Payments, making finance operations autonomous rather than dependent on manual intervention. Unlike fixed, rule-based automation platforms, Hyperbots uses multimodal AI, reasoning models, and continuous learning to achieve accuracy first, not just speed.

Hyperbots Invoice Processing Co-Pilot - Key Capabilities

1. Multimodal AI (vision + language + reasoning)

Hyperbots applies multiple AI models together, including vision-language models(VLMs), layout models, and reasoning models, to understand invoices like a human would.

Reads invoice structure, context, tables, line items, and vendor formats

Works across PDFs, scans, images, forwarded emails, and portals

Handles formatting variations without manual templates or rules

This allows Hyperbots to extract the right data even from messy or non-standard invoice formats.

2. 99.8% field extraction accuracy with contextual validation

Hyperbots consistently extracts invoice header and line item fields with 99.8% accuracy, and uses contextual validation to reach 100% accuracy in production deployments.

Ensures GL fields, vendor details, tax fields, currency, PO numbers and line items are accurate

Validates extracted data against ERP/Vendor master

Reduces manual touchbacks and exception handling

Accuracy-first design eliminates the “fast but wrong” problem common in AP automation.

3. Up to 80% Straight-Through Processing (STP)

Hyperbots automates the entire invoice lifecycle, from invoice discovery to GL posting, achieving up to 80% STP with no human involvement.

Extracts → Matches → Codes → Posts → Validates

Reduces reliance on AP analysts or shared service centers

Minimizes repetitive work and accelerates close cycles

4. Automated Invoice Discovery

Hyperbots automatically finds invoices from email inboxes, shared folders, portals, and file drives, and consolidates them in one place.

No manual downloading/uploading of invoices

Eliminates missed invoices and late payment fees

5. Duplicate invoice & fraud detection

Hyperbots identifies duplicates using invoice content and vendor metadata, not just invoice numbers.

Detects disguised duplicates (e.g., different file names, vendor changes)

Flags risk before invoices enter the approval cycle

Prevents accidental overpayments and fraud attempts

6. 140+ field PO / GRN matching with reasoning engine

Matches invoices not only against PO headers but also individual line items using a reasoning engine.

Intelligent tolerance handling (quantity / price / tax differences)

Configurable to business rules (project, cost center, BU)

This is far deeper than standard 2-way/3-way matching based on amount and PO number.

7. Automatic GL coding and read-back validation in ERP

The Co-Pilot learns from every correction users make and uses that insight to auto-assign GL codes accurately.

Reads vendor master & COA from ERP

Learns coding patterns over time

Posts into ERP and performs read-back validation to ensure posting success

8. Deep ERP read/write sync (Cloud + on-prem)

Hyperbots integrates deeply with ERPs, reading and writing into vendor master, COA, PO, GRN, and invoice/bill modules.

Supports both cloud and on-prem ERPs

Handles custom fields and custom workflows

Provides full audit trails for every AI and human interaction

Hyperbots’ platform also supports full finance process automation (AP, PO, Accruals, Vendor Management, Tax Verification, Payments), each offered as a Co-Pilot. Because Hyperbots is built as a platform of Co-Pilots, teams can automate end-to-end finance processes, not just individual tasks. This creates a system where finance can operate with minimal manual intervention, true autonomous finance.

Hyperbots vs Tipalti - Feature Comparison

Category | Tipalti | Hyperbots |

AI Type | OCR/automation | Agentic AI (Vision + Reasoning + Learning) |

Invoice extraction accuracy | Error reduction is mentioned but not positioned as a core differentiator. | 99.8% accuracy, 100% accuracy for deployed agents |

Learning & Adaptation | No continuous self-learning from GL corrections. | Learns from every correction (continuous learning). |

PO/GRN matching | Yes (standard) | 140+ field reasoning and tolerance rules |

Duplicate detection | Yes | Advanced AI duplicate detection even for different spacing, formatting, or letter casing |

ERP Integration | Integrates with/ ERPs | Deep read/write + custom field sync + validation |

Where Hyperbots Stands Out

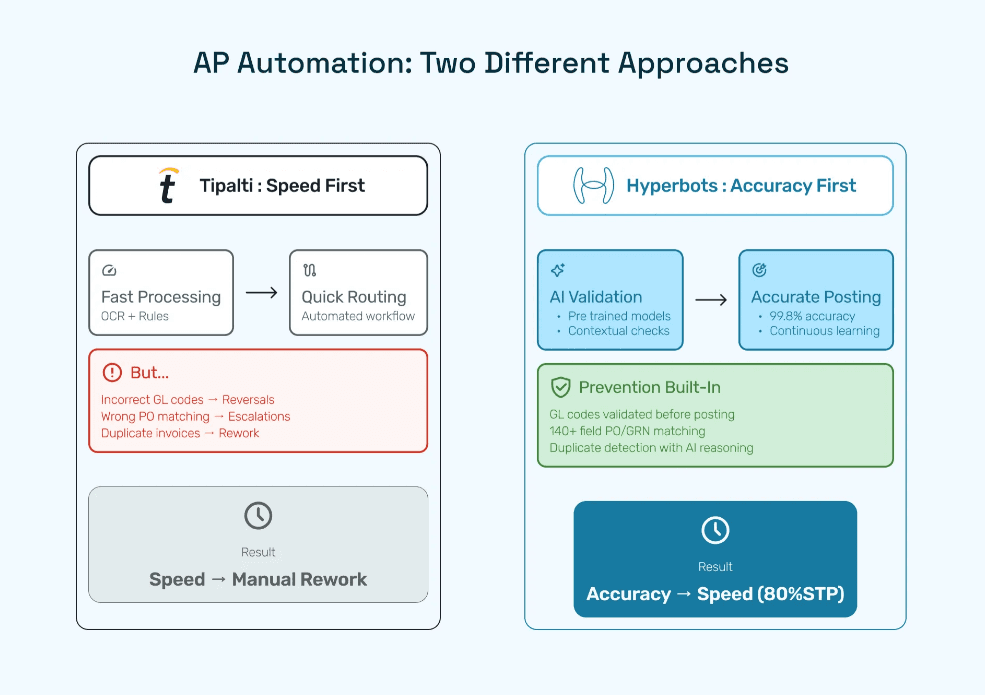

Most AP automation platforms, including Tipalti, are fundamentally designed to move invoices through the system faster. They focus on speeding up routing, approvals, and payment execution. But in finance operations, speed without accuracy creates rework. Hence, Hyperbots approach the problem differently.

Tipalti focuses just on faster AP.

Hyperbots focuses on correct and fast AP, end-to-end, with no rework.

Hyperbots uses Agentic AI to deliver accurate, autonomous, and audit-ready invoice processing across the entire lifecycle, not just extraction.

The Reality Inside Finance Teams

When invoices are processed quickly but inaccurately, problems show up elsewhere:

What goes wrong when accuracy is low | Impact on finance |

Incorrect GL codes | Reversals, journal corrections, and delayed close |

Incorrect PO matching | Escalations with procurement, delayed payments |

Duplicate invoices | Overpayments, vendor disputes, audit findings |

Even if an invoice moves through the system quickly, any error sends it back to AP, creating the same manual work that automation was supposed to eliminate. That’s why Hyperbots builds speed on top of accuracy, not instead of it.

How Hyperbots Prevents Errors Before They Happen

Hyperbots eliminates rework using four core capabilities:

Pretrained finance models: Trained on millions of invoice fields and workflows, not generic OCR.

Reasoning and contextual validation: The AI does not just extract text, it understands context. It validates vendor, PO, tax, currency, GRN, and GL mapping using ERP data.

Continuous learning from corrections: Every time a user corrects a field (GL code, Cost Center, Project, Tax). Hyperbots learns from it, permanently.

140+ field PO / GRN matching with reasoning engine

Deeper matching than the standard 2-way / 3-way matching most tools use.

Hyperbots doesn’t just automate, it improves.

This leads to up to 80% straight-through processing (STP), with 99.8% data-field accuracy and 100% accuracy for deployed agents.

The Difference in Philosophy

Tipalti automates for speed | Hyperbots automates for accuracy & speed |

Moves invoices through the workflow quickly | Ensures invoices are correct while keeping up with Tipalti’s pace |

Standard OCR + automation rules | Agentic AI, reasoning and continuous learning |

The final result is increased capacity. | Decision confidence is the outcome |

“Speed gets invoices processed. Accuracy gets invoices completed. Where Tipalti prioritizes volume, Hyperbots prioritizes confidence.”

The Result

Finance teams can finally escape chasing approvers, correcting posting errors, auditing exceptions, and reworking invoices stuck in the queue.

AP stops being a cost center, and becomes a precision engine feeding accurate data into FP&A and decision-making. Accuracy reduces exceptions. Because of fewer exceptions, the speed increases.

Why Accuracy > Speed in Invoice Automation

Most automation tools frame success as:

“How fast can an invoice move from receipt to posting?”

But if speed comes at the cost of errors (leading to re-work, exceptions, vendor issues, audit queries), the argument tilts toward privileging accuracy.

In other words:

A fast mistake is still a mistake. When platforms optimize for speed instead of accuracy, errors move faster through the system, and problems show up downstream:

When invoice automation prioritizes speed over accuracy | Real impact on finance |

Invoices get posted without precise validation | Vendor disputes and escalations |

Incorrect GL or Cost Center coding slips through | Audit exposure and journal reversals |

Duplicates pass into the workflow | Accidental overpayments |

PO mismatches aren’t detected early | Fire drills between AP & Procurement |

A wrong invoice that gets processed quickly doesn’t save time; it creates work later, usually under more stress, with more people involved.

Hyperbots Prevents This by Ensuring Accuracy First.

Hyperbots is designed so that invoices aren’t just processed, they’re processed correctly. Instead of chasing “touchless speed,” Hyperbots eliminates the root causes of rework:

Fewer touchbacks

Because data is correct at the field level, invoices don’t bounce back from approvers or ERP validation.Predictable SLAs

Accurate invoices move straight to posting, giving finance teams cycle time consistency.Better vendor experience

Suppliers receive faster payments, not because workflows are rushed.

But because issues don’t arise in the first place.

Why Choose Hyperbots Over Tipalti

Hyperbots wins not by moving documents faster, but by ensuring that the data feeding finance systems is right the first time.

1. 99.8% accuracy → Fewer exceptions

Tipalti reduces manual entry, Hyperbots removes it entirely.

Hyperbots delivers 99.8%+ field accuracy and real-time validation against ERP data. There are no correction loops, no bounce-backs and no late-stage fixups during month-end.

2. Agentic AI built specifically for Finance & Accounting

Hyperbots isn't just automation; it's Agentic AI that understands finance logic. Processes automated via Co-Pilots include: AP, PO, Payments, Accruals, Vendor Management, Tax Verification. Hyperbots has reasoning-based invoice understanding, context-aware decisioning and can take action, not just extract data.

3. Continuous learning from GL corrections

Every edit made by a user improves future accuracy. The Co-pilots learn cost center mapping, GL patterns and accuracy compounds over time. Hence, the system gets smarter every month.

4. Deep ERP read/write Sync and validation

Unlike light integrations, Hyperbots reads and writes into ERP modules. The Co-pilots can read COAs, vendor master, PO & GRN; post invoices/bills and perform read-back validation to confirm success.

Hence, there will be no incorrect posting, no misaligned data, and no manual reconciliation.

Conclusion: From Automation → Autonomous Finance

Tipalti is a strong AP automation platform for organizations that need fast invoice-to-payment processing and global mass payouts. It is well-suited for teams focused on speed and operational throughput.

Hyperbots is the better choice when the priority shifts to:

Accuracy (zero rework, correct the first time)

Real-time decision intelligence

Autonomous finance operations

Continuous learning from workflows

In other words:

If the goal is to just move payments faster, Tipalti can do that.

If the goal is to make better financial decisions automatically while payments move fast, Hyperbots is built for that.

Hyperbots transforms AP from a manual oversight function into a precision engine that feeds clean financial data into FP&A, reporting, and analytics.

Automation moves work faster, but autonomous finance eliminates the work.

Explore how Hyperbots is redefining how you process your invoices with both accuracy and speed at the same time with Hyperbots Invoice Processing Co-Pilot.