How Hyperbots’ Automated Accruals Outperform Ramp’s Alpha-Stage Feature

From manual estimation to real-time accuracy: the automation gap between Ramp’s early feature and Hyperbots’ mature AI agents.

Let’s be honest - not all automation is created equal.

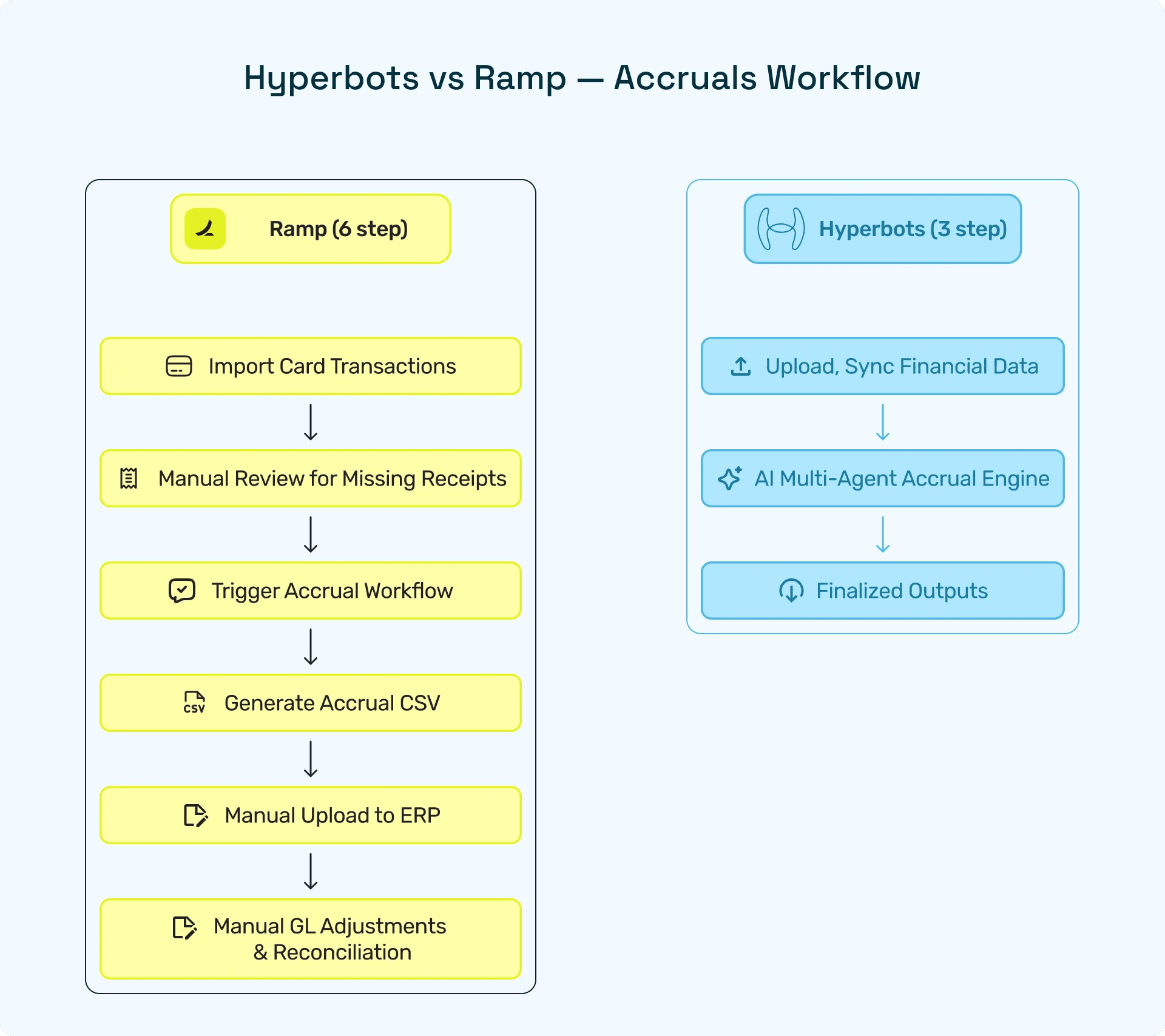

When it comes to automated accruals, Ramp has just entered the game with an alpha-stage feature that promises visibility but still leans heavily on manual logic. Hyperbots, meanwhile, has already mastered accrual automation with an AI-first platform that autonomously calculates, reconciles, and posts accruals in real time.

In this blog, we’ll explore how Hyperbots’ automated accruals outperform Ramp’s accruals across depth of AI, automation speed, ERP integration, and ROI - showing why enterprises are switching to Hyperbots as their AI finance co-pilot for accruals, AP, and month-end close.

Ramp vs Hyperbots: The Real Difference

When you stack the two platforms side by side, the gap is hard to miss.

Ramp’s accruals module (still in alpha testing) is designed to track expenses from corporate cards and reimbursements. That’s helpful for startups looking for quick visibility - but it stops there. There’s no AI estimation engine, no cross-ledger prediction, and no closed-loop GL posting.

Hyperbots, on the other hand, is built for enterprise-grade automation. It doesn’t just track; it thinks. Its multi-agent AI architecture analyzes POs, invoices, GRNs, and even contracts to auto-generate accruals for unbilled liabilities - without a single spreadsheet.

Comparison Table: Hyperbots vs Ramp Accruals

Feature | Hyperbots Automated Accruals | Ramp Accruals (Alpha) |

Stage of Maturity | Enterprise-ready, fully deployed | Alpha-stage beta |

AI Intelligence | Multi-agent AI for reasoning, forecasting, and reconciliation | Basic expense tagging |

Coverage | End-to-end: PO, invoice, GRN, and contract data | Limited to card & expense transactions |

ERP Integration | Deep integrations with SAP, Oracle, NetSuite, QuickBooks | Basic sync via Ramp platform |

AP Month-End Close | Reduces close time | Still manual in key stages |

Cost Efficiency | One license, infinite users | Per-seat SaaS pricing |

Audit Readiness | Auto-trail creation & reconciled entries | Manual downloads |

Forecasting Accuracy | 99.8% AI-backed estimation | Manual human inputs |

Scalability | Designed for mid-market & enterprise | Best for startups |

Why Ramp’s Accruals Are Still Alpha - and Why That Matters

Ramp’s move into accrual automation is notable - it shows where the market is heading. But its current feature set reveals it’s still in early experimental mode.

The system primarily helps track what’s already been spent, not what’s yet to be accounted for. It lacks the ability to generate accruals dynamically, forecast liabilities, or match partial invoices.

Finance teams still need to:

Manually export expense data to Excel,

Estimate accruals based on partial transactions, and

Import entries back into their ERP systems.

That’s not automation - it’s digitization with manual dependency.

In contrast, Hyperbots’ AI Accrual Engine eliminates this manual dependency entirely. It reads every transaction, identifies unposted liabilities, generates entries, and automatically updates your general ledger - all autonomously.

Inside Hyperbots’ Automated Accrual Engine - The Secret Sauce

The power of Hyperbots lies in its Agentic AI architecture.

Here’s how it works:

1. Data Extraction & Contextual Normalization

Hyperbots continuously pulls data from POs, invoices, contracts, statements of work, GRNs, and vendor activity across your ERP and connected systems.

Its context-aware AI agents then:

Standardize line-level and header-level data

Interpret contract clauses, delivery timelines, and pricing terms

Resolve inconsistencies (units, currency, receipt formats, vendor naming)

Create normalized datasets ready for matching and accrual logic

This gives finance teams a single, structured, and trusted view of accrual-relevant information.

2. Intelligent Matching & Accrual Discovery

Beyond traditional 3-way or 2-way matching, Hyperbots applies multi-dimensional matching logic, linking:

PO quantities

Goods received

Work performed

Pending invoices

Contractual obligations

This allows the system to discover accrual opportunities automatically, even when:

A PO has no receipt

A service has been rendered but not formally documented

Vendors delay invoicing

Recurring expenses have no PO reference

It eliminates manual hunting, email chasing, and spreadsheet reconciliations.

3. Predictive Accrual Forecasting

Hyperbots’ AI agents forecast accruals using:

Historical expense curves

Vendor behavior patterns

Seasonality

Contract terms

Delivery or service timelines

Instead of month-end guessing, finance gets AI-driven predictions that surface missing, delayed, or understated accruals with confidence scores, making the close cycle more accurate and repeatable.

4. Automated GL Coding, Posting & Reversals

Once accruals are identified, Hyperbots automatically:

Assigns the correct GL codes using learned patterns

Validates cost center, project codes, and accounting rules

Posts accrual entries into the ERP

Schedules and executes automatic reversals based on configured rules or when actual invoices arrive

This removes one of the most time-consuming steps for accounting teams and keeps books continuously accurate.

5. Audit Trails, Exception Handling & Approvals

Every action the system takes - from data extraction to posting - is logged with:

Timestamped activity trails

Decision context

Source-document references

Change history

Exception workflows, approvals, and business-user notifications ensure accountants retain full control without manual workload.

6. Continuous Learning & Adaptation

The Accruals Co-Pilot improves itself each month through:

Feedback from users

Variance analysis between forecasted and actual invoices

Pattern recognition across vendors, categories, and contracts

Hyperbots doesn’t just automate accruals - it gets smarter with your business over time, reducing human intervention cycle after cycle.

Impact on AP Month-End Close - The ROI Story

If you ask any finance controller what keeps them late at the office during close week, they’ll say: “accruals.”

This is where Hyperbots crushes Ramp’s alpha-stage approach.

Hyperbots’ Results (Proven in Enterprise Deployments):

80% less manual intervention for accountants

Meanwhile, Ramp’s feature can provide visibility, but not closure. It can’t yet finalize accrual entries or integrate natively across multi-ledger environments like SAP or Oracle.

AI Depth - Why Hyperbots Outperforms Ramp Technologically

Ramp accruals rely on rule-based logic - essentially, “if spend = X, estimate accrual = Y.”

Hyperbots, however, runs contextual inference through multiple AI agents, using learned patterns across vendor behaviors, payment cycles, and previous month-end data.

For example, Hyperbots can:

Predict recurring unbilled invoices before vendors even send them.

Detect anomalies in vendor cost patterns.

Flag accruals that could affect cash flow projections.

This makes Hyperbots not just a bookkeeping assistant - it’s an intelligent finance analyst that preempts risks, improves forecast accuracy, and strengthens compliance posture.

Cost Efficiency and Scalability - One License, Infinite Potential

Ramp follows a per-seat SaaS model, which scales costs as teams grow. Hyperbots flips that completely.

Its One License, Infinite Users model means organizations can onboard entire finance departments, auditors, and procurement staff under one enterprise license - maximizing ROI from day one.

Moreover, Hyperbots’ agentic design makes scaling effortless. Whether you’re closing for 5 entities or 50, the AI dynamically balances workloads and automates reconciliation at scale.

Compliance, Controls, and Auditability

Ramp accruals help with visibility, but audit preparation remains manual.

Hyperbots, on the other hand, automates complete audit trails - timestamps, source documents, reconciliations, and approval logs - directly accessible through its AP automation dashboard.

This aligns with best practices from Deloitte’s Intelligent Finance report, which highlights automated auditability as a key maturity indicator for finance automation platforms.

When auditors ask for explanations, Hyperbots generates self-evident data lineage - turning audit season into a breeze rather than a fire drill.

Conclusion: Hyperbots Owns the Future of Autonomous Accruals - Not Ramp

Ramp’s accruals feature is a good prototype, but it’s still exactly that - a prototype. With limited maturity, narrow coverage, and ongoing accuracy gaps, it isn’t built for finance teams that close books under pressure.

Hyperbots, on the other hand, delivers fully autonomous, audit-ready accruals powered by multi-agent AI that has already proven itself in live enterprise environments. From real-time accrual generation to continuous reconciliation, 80%+ autonomous accuracy, and month-end close acceleration, Hyperbots treats accruals as a mission-critical workflow-not an experimental add-on.

If your team is done patching spreadsheets, manually estimating expenses, and relying on alpha-stage tools, it’s time to adopt Hyperbots Automated Accruals and experience what production-grade, AI-native finance automation actually looks like.

👉 Explore more on Hyperbots’ Automated Accruals Co-Pilot or schedule a custom demo to see how your accrual process can be transformed in weeks, not quarters.

FAQs

1. What are Ramp accruals?

A: Ramp accruals are an early-stage feature designed to track expenses and reimbursements, currently in alpha. They lack advanced AI forecasting and ERP integration.

2. How do Hyperbots’ automated accruals differ from Ramp’s accruals?

A: Hyperbots’ automated accruals leverage multi-agent AI to auto-calculate, reconcile, and post entries across POs, invoices, and GRNs - while Ramp’s accruals rely mainly on expense data tagging.

3. How much faster can Hyperbots close books compared to Ramp?

A: Hyperbots typically reduces month-end close time, whereas Ramp still requires manual steps for reconciliation.

4. Are Hyperbots’ automated accruals compatible with ERPs like SAP and Oracle?

A: Yes - Hyperbots integrates natively with SAP, Oracle, NetSuite, and QuickBooks, ensuring seamless GL sync and automated postings.

5. Is Hyperbots suitable for mid-market and enterprise teams?

A: Absolutely. Hyperbots is built for scale, designed for multi-entity, multi-ledger finance operations, and delivers tangible ROI within the first quarter.