Hyperbots vs Tipalti: A Complete Comparison of AP & Finance Automation Capabilities

The future of AP and finance automation.

As finance teams race to modernize their AP operations in 2026, two clear philosophies have emerged. On one side are end-to-end suites like Tipalti, designed to handle everything from invoice capture to global payments under one roof with the “do-it-all” approach. On the other are specialized, precision-first systems like Hyperbots, built to perfect the one thing that can make or break your month-end close: data accuracy.

Tipalti has long been a familiar name in the AP world as the reliable all-rounder that keeps the lights on and the vendors paid. Hyperbots, on the other hand, is more like that quiet genius on the team who doesn’t talk much but delivers flawless results, boasting a 99.8% accuracy benchmark that practically makes exceptions extinct.

So when it comes to Tipalti vs Hyperbots, this isn’t just another software comparison, it’s a look at two very different visions for the future of finance automation. One aims to cover every base, the other aims to make every base perfect. And in a world where CFOs lose sleep over duplicate payments, perfection might just be the better pillow.

Why It Matters: Bad Extraction = Manual Mayhem

In AP, bad data doesn’t just hurt, it multiplies. Every misread line item or mismatched PO sends another invoice into the dreaded exception queue, where time goes to die and FTE hours quietly disappear. Line-item errors remain the number one culprit behind manual rework which is exactly why extraction accuracy matters so much.

Here’s how Tipalti and Hyperbots tackle the problem:

Tipalti (AI Smart Scan):

Uses an AI/ML layer over OCR to extract header and line-level data.

Adapts to different invoice formats to replace “traditional OCR.”

Integrated within Tipalti’s broader AP platform, invoice capture is one piece of a much larger puzzle.

Good news: It significantly reduces manual entry compared to old-school OCR.

Bad news: Since it’s part of a massive platform, invoice extraction doesn’t always get the spotlight it deserves.

Hyperbots (Extraction-First Design):

Built ground-up for accuracy — using multi-stage document understanding and semantic table parsing.

Normalizes currencies, dates, and line-item structures across suppliers and languages.

Continuously improves through active learning from user corrections.

Publishes a 99.8% accuracy benchmark (vendor figure) on standard invoice fields and line items.

In short: It’s obsessed with making sure your team never has to touch an invoice twice.

In the end, it comes down to focus. Tipalti’s Smart Scan does a respectable job at keeping invoices flowing, but it’s part of a much larger orchestra and sometimes, the violin gets drowned out by the drums.

Hyperbots, on the other hand, plays one instrument, data accuracy, and plays it flawlessly. For teams tired of chasing down mismatched totals and fixing typos at month-end, that single-minded precision isn’t just a feature; it’s freedom.

Handling Messy Inputs, Exotic Templates, and the Chaos We Call “Invoices”

If you’ve ever opened a supplier invoice and thought, “Was this designed by a cryptographer?”, you’re not alone. Vendors have an uncanny talent for creative formatting, from multi-currency PDFs to low-DPI scans, embedded logos, and the occasional handwritten “note” that looks more like modern art than finance documentation. Here’s how Tipalti and Hyperbots deal with the chaos:

Tipalti:

Uses OCR preprocessing and AI enhancements to improve readability.

Recommends supplier portals and e-invoicing to reduce bad inputs (a polite way of saying “please send better invoices”).

Advertises 26,000+ business rules for duplicate detection and common error prevention.

Reality check: These measures help, but they mostly patch over the variability instead of truly fixing it at the capture layer.

Hyperbots:

Trained on over 35 million+ invoice fields, including “ugly” scans full of skew, blur, and creative formatting.

Uses augmentation techniques (adding skew, noise, and distortions during training) so the model learns to handle real-world mess.

Focuses on table reconstruction and line grouping for complex layouts with merged or nested cells.

Applies high-granularity confidence scoring, routing only low-confidence fields for human review so that people are focused on the 1% and not the 99.

When invoices get messy (and they always do), platforms built around bolt-on OCR + workflows start to wobble with more manual checks, more configuration, more sighs from AP.

Hyperbots’ extraction-first DNA means it thrives in chaos; the uglier the input, the more it flexes. And as expected, you get fewer exceptions, cleaner data, and AP teams who spend less time deciphering invoices and more time actually closing books.

Vendor Management: Why Hyperbots Makes Tipalti Look Like It’s Still Collecting Paper W-9s

Vendor management can sometimes feel like herding cats armed with tax forms. For many teams, onboarding vendors and keeping their data clean is still a painful, email-heavy process. Here’s how Hyperbots makes it refreshingly easy (and how Tipalti tries, but doesn’t quite get there).

Tipalti:

Offers a self-service Supplier Hub, where vendors upload tax forms, banking details, and payment preferences.

Validates data through 26,000+ business rules and syncs supplier info across ERPs for global consistency.

Focuses on compliance like collecting W-9/W-8 forms, validating TINs, and preventing payout errors.

Strength: reliable and secure collection of supplier data in a unified platform (great if you also use Tipalti for payments and tax).

Hyperbots:

Introduces an AI-driven Vendor Management Co-Pilot that not only collects vendor info but verifies it instantly - from identity checks to W-9 form validation - using pretrained models and multi-way data matching.

Handles “ugly” onboarding data (missing fields, mismatched tax IDs) gracefully - like a polite concierge fixing typos before you even notice.

Supports multi-entity and multi-ERP setups with a single vendor view, automatically identifying duplicates and even recommending supplier consolidation.

Gives suppliers real-time status on invoices, POs, and payments with actionable feedback (“Hey vendor, your W-9 is missing a signature - click here to fix it”).

Tipalti helps vendors help themselves be structured, compliant, and reliable. Hyperbots, on the other hand, helps vendors not mess up in the first place. It’s faster, cleaner, and built for teams who’d rather automate vendor verification than chase missing tax forms. So instead of manually policing supplier entries, your AP team can finally retire those detective hats and let the bots handle the busywork and be faster, cleaner with way less drama.

PO Matching, Exception Rules & Workflow Orchestration: When Hyperbots Leaves Tipalti in the Dust

If you’ve ever watched your AP team sift through mismatched invoices and POs like detectives on a crime show, you know the reality: matching accuracy and smart exception routing determine how many invoices actually flow straight through, and how many get sent to PIT-town (Painful Invoice Territory).

Here’s how each vendor addresses the challenge:

Tipalti

Supports automatic 2-way and 3-way PO matching, comparing invoices to POs (and optionally receipts).

Enables tolerance thresholds (e.g., 5% variance) and configurable rules so near-matches can slip through or get flagged.

Provides a dashboard where exceptions are highlighted and must be manually reviewed or approved.

Essentially: it’s rule-based; it catches mismatches after capture and relies on human intervention to resolve them.

Hyperbots

Powered by AI that links extraction confidence and contextual PO/ERP signals — meaning matching isn’t just about “does amount X equal amount Y?” but “does invoice Z make sense given what we ordered and received?”

Matches across 140+ fields (unit price, quantity, vendor name, payment terms, descriptions) using math reasoning, language models and pattern recognition.

Instead of flagging everything, only invoices with low confidence or context mismatch get routed for human review. The rest glide through fully automated.

The workflow engine adapts: per vendor, per category, even per service. For example, hardware might be a 3-way match; utilities 2-way. It also supports 4-way matching and even no-way matching, all of which can be customized as per the vendor.

Why this matters (and why Hyperbots wins):

With Tipalti, you still end up with a rule pile-up and although plenty of matched invoices make it through, it’s always the ones that don’t require time and review.

With Hyperbots, the upstream extraction is so sharp and the matching so context-aware that fewer invoices ever become exceptions, meaning fewer humans digging through mismatches, less “why is this stuck” Slack traffic, and more actual AP throughput.

Simply put: Tipalti reduces noise with rules; Hyperbots prevents the noise in the first place with smarter data.

Tipalti gives you a better checklist for catching mistakes; Hyperbots rewrites the questions so mistakes rarely happen at all. For teams measuring success by Straight-Through Processing (STP) and minimal human intervention, Hyperbots isn’t just a better option — it’s the smarter workflow.

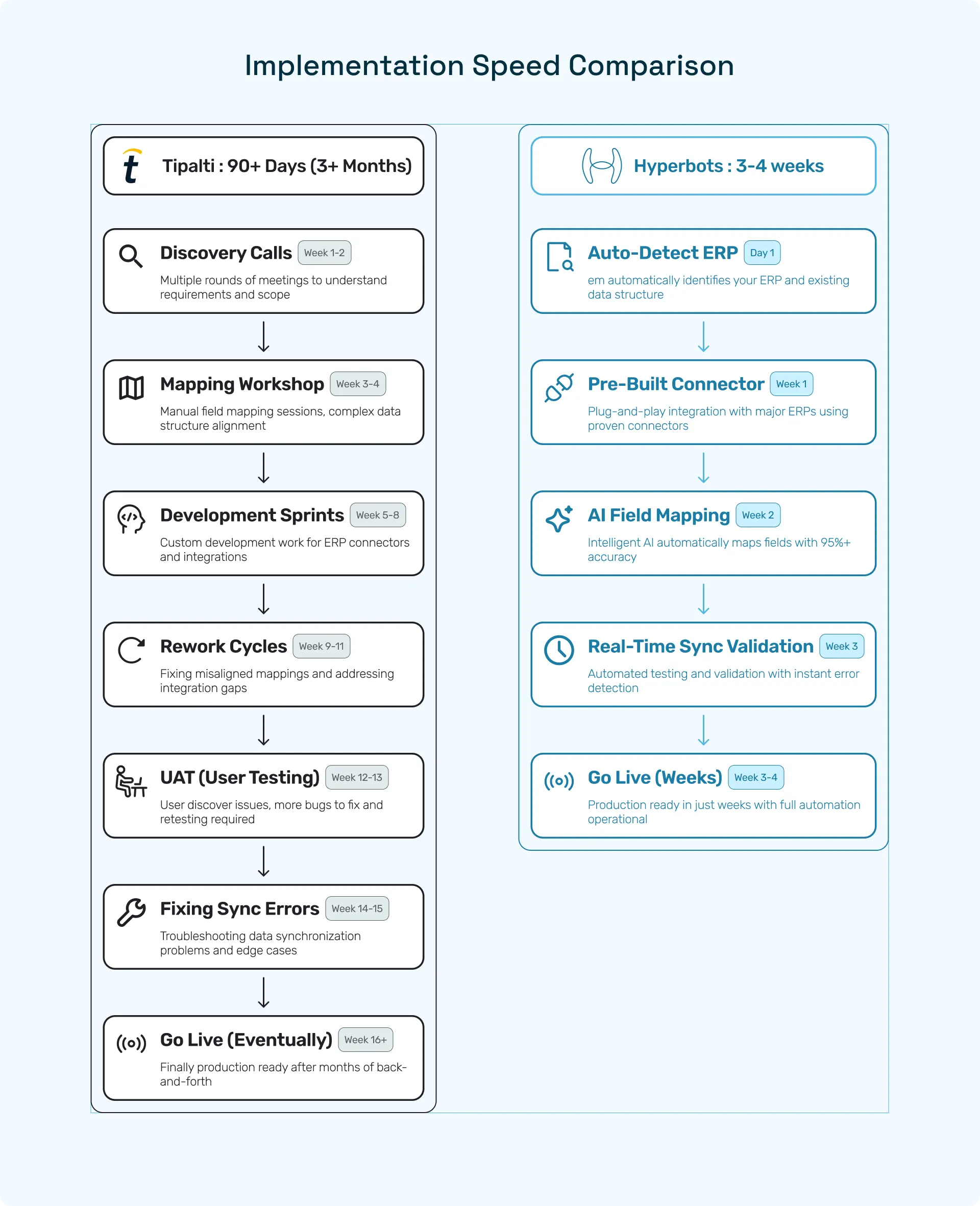

Plug. Sync. Done. Hyperbots Integrates with ERPs in Just Weeks

If integrations were a marathon, some vendors are just stretching their legs while others cross the finish line sipping champagne. Tipalti, despite its strong feature set, has often been flagged for lengthy implementation timelines and tricky ERP integration, particularly with NetSuite. Setting it up can feel like binge-watching an entire season of your favorite show except it’s your AP team’s time being consumed. With Tipalti:

Typical implementation cycles run 6 months while they claim 6 weeks, with some users reporting it took close to a year to fully go live.

Integrations often rely on Tipalti’s professional services or external consultants for mapping and validation.

Changes post-deployment can be complex and even small updates may require new scoping or IT intervention.

In summary, Tipalti connects well, but not quickly. You’ll get there, but it’s a slow climb and your AP team feels every step.

Hyperbots has built integrations to be the exact opposite. Fast, predictable, and refreshingly drama-free.

Ready-to-Deploy Connectors get you live in just 3–4 weeks.

Pre-built ERP connectors with full read/write access for NetSuite and other major ERPs such as SAP, Sage, Microsoft Dynamics and more.

Real-time, bidirectional data sync, ensuring finance and operations stay in lockstep.

Minimal IT involvement, so finance doesn’t have to wait on tech backlogs.

Why it matters:

Faster time to value: See results in weeks, not quarters.

Lower IT burden: Plug-and-play setup with zero custom integration chaos.

Cleaner data sooner: Catch and fix issues before they snowball downstream.

With Tipalti, integration can feel like assembling a 1,000-piece puzzle and while progress is possible, it only comes after a lot of patience.

Hyperbots gets you the full picture from day one so all that needs to be done is plug, sync, and boom you’re live in weeks.

Because automation shouldn’t take an implementation marathon to prove its worth and it should start delivering value while others are still lacing up their shoes.

Business Impact: Why Hyperbots Delivers Real Value

Tipalti’s pitch is essentially: consolidate payments, tax, supplier hub and automate workflows and you’ll get solid efficiency gains. Their own materials talk about using key metrics like straight-through processing (STP) rate and fully-loaded labour cost to calculate ROI.

So: yes, it's useful. But let’s be honest, it’s the broad stroke strategy.

Hyperbots: digging deeper where it hurts

Hyperbots takes aim at the parts of the AP process that silently chew up hours, introduce risk and frustrate teams so you don’t just streamline, you slash the drag.

Here are the numbers and WHY they matter:

Up to 80% straight-through invoice processing (STP): Hyperbots’ Co-Pilot handles discovery, extraction, validation, PO/GRN matching, GL-coding and posting with minimal human intervention.

Processing time reduced from ~11 days to less than 1 minute: yes, you read that right. The benchmark “industry average” of 11 days shrinks to under a minute.

Extraction accuracy ~99.8%: the system is trained on millions of invoice-fields. High accuracy = fewer exceptions, fewer manual fixes.

Staff bandwidth freed by ~80%: when the tool handles the heavy lifting, your AP team can shift from manual firefighting to strategic work (or coffee breaks - okay, strategy).

Why this matters more than “just faster payments”

Many AP automation systems promise “speed” or “workflow simplification” (like Tipalti’s consolidation-centric story).

Hyperbots goes further: it eliminates bottlenecks (exceptions), reduces rework, improves extraction accuracy and turns cost centres into lean operational assets.

From a CFO / Controller perspective: It’s not just about doing things faster; it’s about doing things right, the first time. That difference is where real ROI lives.

Basically, Tipalti offers a strong generalist story around efficiency and consolidation. Hyperbots offers a specialist weapon for the high-volume, high-error AP world where exceptions, manual reviews and extraction errors quietly bleed time and money. If you’re operating at scale, that difference is not just “nice to have”, it’s potentially a game-changer.

Category | Hyperbots | Tipalti |

Core Focus | AI-native automation platform built to deliver highest data accuracy, seamless integrations, and full-cycle finance automation from invoice to insights. | End-to-end AP suite (invoice to payment) focused on process consolidation |

Invoice Capture & Extraction | • Multi-stage document understanding + semantic table parsing • Handles skewed, low-DPI, multi-language invoices • 99.8% accuracy benchmark | • AI Smart Scan built on OCR + ML • Good for structured invoices • Accuracy depends on template quality |

Exception Handling | • Prevents exceptions at the source via precision extraction • Routes only low-confidence data for review • Up to 80% STP | • Catches exceptions post-capture • Manual review dashboard for flagged items • ~50% STP industry average |

Processing Speed | • Reduces cycle time from ~11 days → <1 minute | • Reduces processing time via workflow automation but depends on suite adoption |

PO Matching & Validation | • Context-aware AI matching across 140+ fields • Supports 2-, 3-, 4-way and “no-way” matching • Self-learning exception routing | • Rule-based 2-way/3-way PO matching • Uses tolerance thresholds (e.g., 5%) • Exceptions often require manual resolution |

Vendor Management | • AI-driven Vendor Co-Pilot for instant data verification • Auto-corrects missing/mismatched tax data • Real-time supplier feedback & duplicate detection | • Supplier Hub for self-service onboarding • Validates data via 26,000+ business rules • Strong on compliance and tax validation |

Integration Speed | • Plug-and-play ERP connectors (NetSuite, SAP, Sage, MS Dynamics) • Live in 3–4 weeks • Minimal IT dependency | • Integrations typically take 6 months • Often requires consultants or professional services • Slower change management post go-live |

Learning & Adaptability | • Active learning from user corrections • Trains continuously on new layouts and suppliers | • ML-assisted OCR adapts to formats but limited by platform dependency |

Handling Messy Inputs | • Trained on “ugly” invoices with skew, blur, noise • Excels at reconstruction of complex tables • High-granularity confidence scoring | • OCR pre-processing + AI enhancement • Recommends e-invoicing to improve input quality |

Scalability | • Purpose-built for high-volume enterprises • Exception reduction compounds ROI at scale | • Strong for multi-entity, multi-country operations • Scales well with full suite adoption |

Implementation & Maintenance | • Quick setup, no-code configuration • Continuous model improvement without user intervention | • Requires IT and vendor support for changes • Longer implementation cycles |

Business Impact | • Reduces manual reviews by 80% • Cuts exception handling costs drastically • Turns AP from cost center → strategic function | • Delivers consolidated workflows and tax/payment efficiencies • ROI depends on full-suite usage |

Final Thoughts: The Clear Winner

Tipalti tries to be the all-in-one toolkit for AP with payments, supplier management, tax compliance, and global payouts all bundled up. It’s handy, sure. But when everything’s bundled, something usually gives and that “something” is data accuracy.

Hyperbots, on the other hand, goes straight for the jugular of AP inefficiency: bad data. With its 99.8% extraction accuracy and 80%+ straight-through processing, Hyperbots doesn’t just automate workflows, it removes the need for manual fixes altogether. Think of it as the difference between teaching your AP system to walk faster (Tipalti) versus teaching it to fly (Hyperbots).

FAQs: Hyperbots vs Tipalti

1. Which platform delivers higher invoice extraction accuracy, Hyperbots or Tipalti?

Hyperbots clearly leads with a 99.8% extraction accuracy benchmark, thanks to its multi-stage document understanding and semantic table parsing. Tipalti’s Smart Scan improves on traditional OCR but still relies heavily on template quality and structured invoices.

2. Does Hyperbots support end-to-end AP like Tipalti?

Tipalti is an end-to-end AP suite that includes payments, tax compliance, and supplier onboarding.

Hyperbots is an AI-led automation platform that focuses on the most error-prone areas of AP extraction, matching, and exception elimination while integrating seamlessly with ERPs and existing payment systems.

3. Which system offers better Straight-Through Processing (STP) rates?

Hyperbots achieves up to 80%+ STP, driven by high accuracy and context-aware matching.

Tipalti generally lands closer to the industry average of ~50%, largely because its rule-based approach still creates exceptions that require human review.

4. How long does it take to implement each solution?

Hyperbots goes live in 3-4 weeks with plug-and-play ERP connectors and minimal IT involvement.

Tipalti implementations often take several months (typically 6 months and sometimes longer) due to complex integrations and heavy configuration cycles.

5. Which platform is better for handling messy or unstructured invoices?

Hyperbots is built for “ugly” real-world invoices, low DPI scans, blurred documents, multi-language layouts, skewed pages, and odd table formats.

Tipalti improves quality through OCR pre-processing and encourages supplier portals, but heavily unstructured invoices still tend to result in more exceptions.