Ramp Procurement vs Hyperbots Co-Pilot: Who Really Delivers End-to-End Procurement Automation?

Learn why Hyperbots outperforms Ramp with deeper AI, full lifecycle automation, and finance-native procurement intelligence.

Modern finance teams are operating in an environment defined by speed, accuracy, and rising expectations for real-time financial insight. As organizations scale, finance automation tools become essential, not only to streamline manual procurement workflows, but to enable autonomous, data-driven operations across Accounts Payable (AP), Accounts Receivable (AR), FP&A, and purchasing. Ramp and Hyperbots both position themselves as catalysts for this shift.

However, their approaches to procurement automation differ substantially. This comparison examines Ramp procurement and the Hyperbots Procurement Co-Pilot, helping CFOs, Controllers, Procurement Leads, and Finance Managers determine which platform better supports intelligent, end-to-end procurement automation grounded in finance-ready AI.

Ramp Procurement Overview: Capabilities and Approach

Ramp offers a consolidated procure-to-pay workflow with a strong emphasis on intake, approval routing, spend visibility, and invoice matching. Its procurement offering is designed for organizations seeking a unified purchase request and PO flow within the broader Ramp spend management ecosystem.

Core Procurement Features (Ramp)

Intake-to-pay workflow: Centralized request forms to capture vendor, contract, and cost information, reducing fragmented communication.

AI-assisted intake: Ramp’s AI can parse contracts and screenshots to pre-fill request forms, streamlining PR submission.

Dynamic approvals and parallel routing: Workflows adapt based on vendor, amount, department, or category.

PO creation and virtual cards: Automatically generates purchase orders or issues virtual cards post-approval.

2-way and 3-way matching: Automated matching across PO, receipt, and invoice with mismatch blocking to prevent overpayment.

ERP and accounting integrations: Syncs purchase orders and invoice data with NetSuite and QuickBooks Online.

Vendor management: Maintains vendor documentation, renewal dates, and profiles.

Savings insights: Benchmarks spending patterns to identify optimization opportunities.

Ecosystem integrations: Slack approvals, Okta provisioning, Ironclad contract integrations, and implementation support through partners.

Overall, Ramp provides a structured procurement workflow supported by rule-based automation and a unified finance platform.

Where Ramp Falls Short in Procurement - And Why Teams Look Beyond It

While Ramp delivers a clean, structured procure-to-pay workflow, it still has clear limitations from a procurement depth and finance-operations perspective:

Rule-based, not intelligence-driven: Procurement actions depend heavily on predefined workflows, with limited autonomous decisioning or reasoning.

No true end-to-end PR → PO → invoice execution: Ramp automates steps but still requires manual oversight, coding decisions, and exception handling.

Surface-level contract and vendor intelligence: It can read contracts for intake, but does not deeply interpret terms, obligations, or financial patterns.

Limited multi-entity and complex ERP alignment: Best suited for simpler procurement setups, not scale, hierarchy, or multi-ERP operations.

Not built for finance-grade accuracy: PO matching and validations exist, but lack advanced anomaly detection, inference, or continuous learning.

Minimal automation of downstream tasks: Budget enforcement, GL suggestions, exception reasoning, and PO lifecycle actions still require human involvement.

In short: Ramp is strong for lightweight procurement and intake workflows, but not for teams that need deeper automation, autonomous execution, or finance-native intelligence.

This is where Hyperbots enters as a more advanced, AI-driven alternative built specifically for Finance & Accounting teams.

Hyperbots Procurement Co-Pilot Overview: Finance-Native Agentic AI

Hyperbots, an AI automation company focused exclusively on Finance and Accounting operations, takes a different approach. Its Procurement Co-Pilot is built on an Agentic AI foundation, combining OCR, LLMs, VLMs, MOE models, and finance-trained reasoning engines. Unlike generic automation platforms, Hyperbots uses pre-trained models designed specifically for invoices, contracts, POs, accruals, and enterprise ERP structures.

Core Procurement Features (Hyperbots)

Finance-specific, pre-trained Agentic AI: Understands financial documents, vendor terms, GL structures, and purchasing nuances from day one.

Automated PR creation and field extraction: Contract/SOW fields are auto-extracted, and PRs are generated in ~5 minutes.

Automated PO generation, dispatch, and closing: Approved PRs convert into POs, which are dispatched to vendors, reconciled, and automatically closed.

GL coding and budget governance: The system suggests GL codes and performs real-time budget checks to prevent overspend.

Anomaly detection and compliance controls: Duplicate checks, math validations, and anomaly detection run automatically at every stage.

High accuracy and continuous learning: Hyperbots reports ~99.8% accuracy for unstructured → structured field extraction and applies inference-time learning to adapt continuously.

ERP-native integrations: Real-time, bi-directional integrations with multi-entity ERP environments.

Vendor portal and collaboration: Vendors receive POs, view status, and communicate directly within the portal.

Unlimited-user, no-code deployment: Co-pilots are ready-to-deploy with no-seat licensing and no heavy implementation cycles.

The Hyperbots Procurement Co-Pilot is positioned as an ecosystem of autonomous finance agents operating across AP, AR, procurement, FP&A insights, and vendor management, drawing on broader “finance automation” capabilities.

Feature Comparison: Ramp Procurement vs Hyperbots Procurement Co-Pilot

Procurement Automation Comparison Table

Category | Ramp Procurement | Hyperbots Procurement Co-Pilot |

AI Type | AI-assisted intake + rule-based automation | Agentic AI built for F&A (LLM + VLM + OCR + MOE) |

Intake / PR Creation | Contract/screenshot pre-fill | 5-minute PR auto-creation with contract field extraction |

Approval Workflows | Dynamic, multi-step, Slack-enabled | Configurable with human-in-the-loop exceptions |

PO Generation | Auto PO or virtual card | Auto-PO + vendor dispatch + automated PO closing |

Invoice / PO Matching | 2-way / 3-way matching | Intelligent matching + anomaly detection + reconciliation |

GL Coding & Budget Checks | Policy-based approvals | AI-driven GL coding + real-time budget governance |

Integrations | NetSuite and ecosystem apps | Native, multi-entity ERP integrations with real-time write-back |

Learning & Adaptation | Workflow-driven | Continuous learning through inference-time adaptation |

Compliance & Accuracy | Automated blocks and controls | ~99.8% accuracy, audit-ready trails, advanced validations |

Decision Intelligence | Pricing insights & benchmarks | Finance decision intelligence across PR, PO, AP, FP&A |

Where Hyperbots Stands Out in Procurement Automation

1. Agentic AI Designed for Finance & Accounting

Hyperbots uses finance-trained, multimodal Agentic AI to interpret contracts, SOWs, GL structures, and vendor terms with domain accuracy. This reduces manual corrections, minimizes exceptions, and improves PO matching accuracy.

Ramp’s workflow automation is strong, but Hyperbots’ finance-native intelligence delivers a deeper understanding and higher compliance across purchasing workflows.

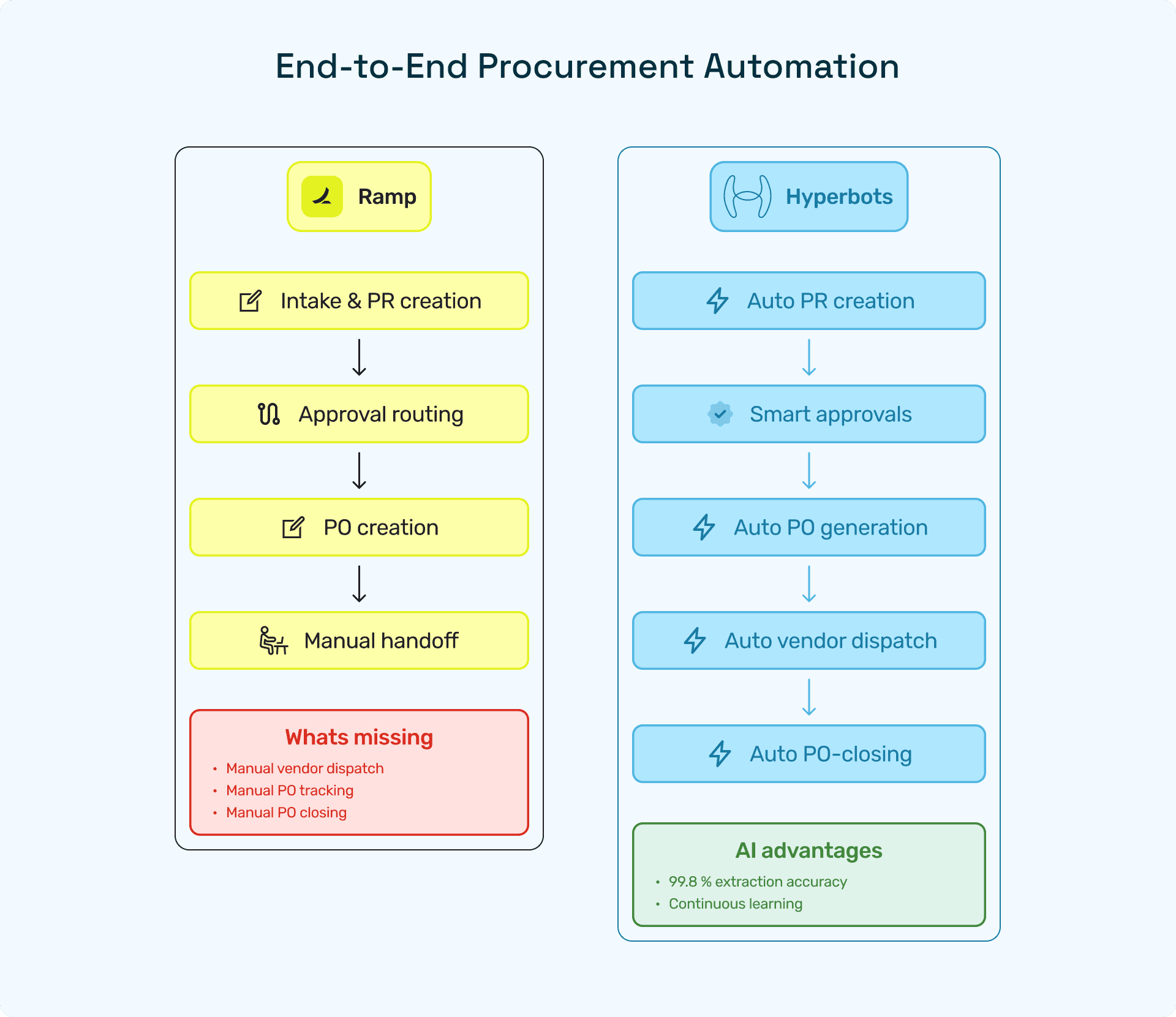

2. End-to-End Procurement Workflow Automation

While Ramp automates intake, approvals, and PO creation, Hyperbots extends automation across the full procurement lifecycle. It generates POs, dispatches them to vendors, manages collaboration, and automates PO closing, connected directly to invoice processing. This eliminates handoffs, accelerates cycle time, and ensures tighter process continuity from requisition through reconciliation, creating a fully unified procurement environment.

3. Continuous Learning for Scalable Operations

Hyperbots incorporates continuous learning, allowing the system to adapt to new vendor formats, changing workflows, entity-level ERP variations, and evolving approval patterns. This reduces ongoing configuration effort and maintains accuracy as organizations grow.

While Ramp provides stable automation, Hyperbots continuously improves with every data point, enabling scalable, adaptive procurement operations with lower long-term maintenance.

4. Higher Accuracy and Stronger Controls

Hyperbots delivers 99.8% accuracy in extracting structured data from unstructured documents and applies anomaly detection, math validations, and duplicate checks across procurement. These controls catch risks early, reduce AP exceptions, and support more reliable month-end close. Compared to traditional rule-based systems, Hyperbots’ finance-trained models deliver greater accuracy, fewer errors, and more consistent compliance coverage.

5. Deep ERP-Native Architecture

Hyperbots integrates directly with ERPs at a detailed level, supporting multi-entity structures, custom fields, real-time read/write access, and configuration-driven adaptations. This ensures procurement data flows consistently into accounting and FP&A without manual intervention.

Ramp’s integrations are robust, but Hyperbots’ ERP-native design offers deeper alignment, better auditability, and greater reliability for complex financial operations.

Why Ramp Procurement Automation Falls Short & How Hyperbots Is a Better Choice

Limited AI Understanding vs. Finance-Native Intelligence

Ramp’s strength: Ramp supports intake forms, custom approval workflows, and even AI-assisted pre-filling from contracts/screenshots.

Why it's not enough: Their AI is primarily “assistive”, it doesn't deeply understand financial context, GL structures, or vendor nuances.

Hyperbots advantage: Hyperbots’ Agentic AI is built specifically for finance. It’s trained on contracts, GL hierarchies, SOWs, and vendor data, giving much deeper domain understanding. This means fewer manual corrections, better PO matching accuracy, and stronger controls.

Workflow vs True Lifecycle Automation

Ramp strength: Ramp’s procurement module gives a unified place for purchase requests, approvals, and PO creation, and lets you manage PO status and sync POs to accounting.

Why it's not enough: It doesn’t fully automate the entire procurement flow; the handoff from PO generation to vendor dispatch, collaboration, and closure still requires manual intervention.

Hyperbots advantage: Hyperbots automates every step, from PR creation to PO dispatch to vendor collaboration to PO closing via AI. That means less manual work, fewer delays, and a clean, continuous procurement cycle.

Fixed Rules vs Adaptive Learning

Ramp strength: Ramp’s workflow builder allows custom logic, parallel approval paths, and conditions for different spend programs.

Why it's not enough: While flexible, these rules must be maintained manually, especially as business units grow or change. There’s no built-in intelligence that “learns.”

Hyperbots advantage: Hyperbots equips continuous learning: its AI adapts with each document, learns company-specific GL patterns, vendor formats, and approval behaviors. As you scale or evolve, the system improves, reducing admin burden.

Basic Validation vs Rich Controls and Accuracy

Ramp strength: Ramp supports matching (PO/invoice) to enforce compliance and prevent overpayment.

Why it's not enough: Their validation primarily depends on rules and thresholds set by users. These may catch common mismatches but may miss subtle anomalies or duplicates.

Hyperbots advantage: Hyperbots applies deep validation such as anomaly detection, duplicate PR checks, and math verification, powered by AI trained on financial documents. This reduces risk and strengthens procurement governance.

Integration Depth vs ERP-Native Intelligence

Ramp strength: Ramp allows syncing of POs into accounting systems and provides spend visibility via its procurement program setup.

Why it's not enough: Its integration is often transactional: PO sync, but limited read/write interaction or deep understanding of entity-specific accounting structures.

Hyperbots advantage: Hyperbots has deep, two-way ERP-native integration. Its Co-Pilot reads/writes to the Chart of Accounts (COA), item masters, vendor masters, and supports custom fields and multi-entity setups. That closeness to ERP means better accuracy, richer context, and real-time synchronization.

Visibility vs Vendor Collaboration

Ramp strength: Ramp’s procurement module gives spend visibility and tracks POs, but its focus is primarily on internal processes and approval.

Why it's not enough: Vendor interactions like real-time PO status, uploads, or collaboration are limited. This creates friction and manual follow-ups.

Hyperbots advantage: Hyperbots supports a vendor portal where suppliers can view PO status, upload invoices, respond, and collaborate. This transparency accelerates PO acknowledgement and reduces back-and-forth.

Onboarding vs Pre-Trained AI – Speed and Accuracy

Ramp strength: Ramp lets you build procurement programs, configure PO intake forms, and define approval paths. Admins can tailor the system.

Why it's not enough: It still requires manual setup, configuration of field logic, templating, and validation rules.

Hyperbots advantage: Hyperbots comes with pre-trained AI models for procurement, trained on millions of vendor documents and contracts, enabling fast deployment with high accuracy from day one

Conclusion: Automation vs Autonomous Finance

The question of “Ramp Procurement vs Hyperbots Co-Pilot” and who really delivers end-to-end procurement automation ultimately centers on the depth of intelligence and autonomy each platform can provide.

Ramp offers a well-structured procurement workflow that standardizes intake, approvals, and PO management. It is suitable for teams prioritizing basic process consistency.

Hyperbots, however, moves beyond workflow automation into autonomous, finance-native procurement, driven by Agentic AI that understands financial context, learns continuously, and integrates deeply with multi-entity ERPs.

For mid-market finance teams seeking to automate procurement with higher accuracy, stronger controls, and lifecycle-wide automation, Hyperbots delivers a more scalable, future-ready foundation.

Explore how Hyperbots is redefining finance workflows with the Procurement Co-Pilot and see it live in action.