Straight-Through Processing Comparison: Hyperbots’ 80+% vs Tipalti’s No Claim

Discover how Hyperbots achieves 80%+ Straight-Through Processing (STP) by automating extraction, validation, and ERP posting, minimizing manual work far beyond traditional AP tools.

Sounds like a dream right? Having an AP system that is so autonomous and intelligent that the whole process almost becomes touchless. From the moment your invoices reach your inbox to the moment it’s written to your ERP, all of it can be done with little-to-no manual intervention. Many platforms like Tipalti achieve around 60% STP so almost half of your invoices will still require manual validation, review or fixing which still leaves finance teams babysitting their automation.

Here’s where Hyperbots takes an advanced approach. With a stellar 80+% STP, Hyperbots accurately discovers, extracts, validates invoices and writes it to your ERP so finance teams are no longer burdened by manual error corrections or tedious exception handling. So how exactly does Hyperbots do the heavy-lifting without lifting your finger?

What Really Is Straight-Through Processing (STP)?

Straight-through processing (STP) is like the silent productivity hero of modern finance. It works behind the scenes, quietly moving invoices from capture to payment without needing human intervention (or coffee). It’s not just another dashboard metric; it’s the litmus test for true automation maturity that tells you whether your automation is actually working or just... pretending to.

In today’s fast-paced finance world, a high STP rate transforms how teams work. When your system handles the grunt work, your people can finally focus on strategy, forecasting, and innovation instead of hunting down missing POs.

A strong STP rate reflects:

Fewer exceptions and rework - less “why didn’t this post?” panic.

Lower AP cycle times - payments move faster, and vendors stay happy.

Reduced cost per invoice - every manual touch avoided saves real dollars.

Higher data integrity - fewer human errors mean cleaner books.

While Tipalti straight through processing offers a decent head start, Hyperbots takes it to another level. With an AI-first design that learns and self-corrects, it turns touchless invoice processing from an aspiration into a daily reality so you can scale productivity without scaling headcount.

Why STP Matters More Than Ever in 2025

In 2025, finance teams are chasing speed with certainty. Straight-through processing (STP) has evolved from a back-office metric into a CFO-level performance indicator that measures how efficiently an organization can scale without scaling headcount.

According to Ardent Partners’ “State of ePayables 2024”, global invoice volumes are rising by 8–12% annually, driven by digital procurement adoption and supplier expansion.

This means finance teams are managing significantly more transactions every year often without proportional increases in staff or resources. Yet, manual intervention still creeps into more than half of AP workflows, costing organizations thousands of hours and millions in hidden inefficiencies. A higher STP rate impacts every layer of finance performance:

Operational Efficiency: Invoices move from capture to payment automatically, freeing teams from repetitive validations and manual checks.

Accuracy & Compliance: Touchless processing reduces the risk of errors, duplicate payments, and audit exceptions - ensuring cleaner data and airtight compliance.

Cost Optimization: Each manual touch can cost $3–$8 per invoice; higher STP rates slash those costs dramatically.

Scalability: As businesses grow, AP workloads rise exponentially - but with high STP, headcount doesn’t have to.

In an era where CFOs are measured by agility and insight, not data entry, STP has become the new north star. It signals a finance function that’s not just automated, but intelligent, where humans guide strategy while AI takes care of the grunt work. Because in 2025, automation is the standard.

How Hyperbots Delivers What Tipalti’s STP Can’t

Tipalti does talk about straight-through processing. In fact, Tipalti defines it as the gold standard of automation and even describes its AP platform as enabling “straight-through invoice processing.” But here’s the catch: even Tipalti admits that true STP remains an “incremental and elusive goal.”

And that’s where Hyperbots changes the game. Instead of treating straight-through processing as an aspiration, it makes it a measurable, repeatable reality. Here’s how Hyperbots delivers what Tipalti’s STP still can’t:

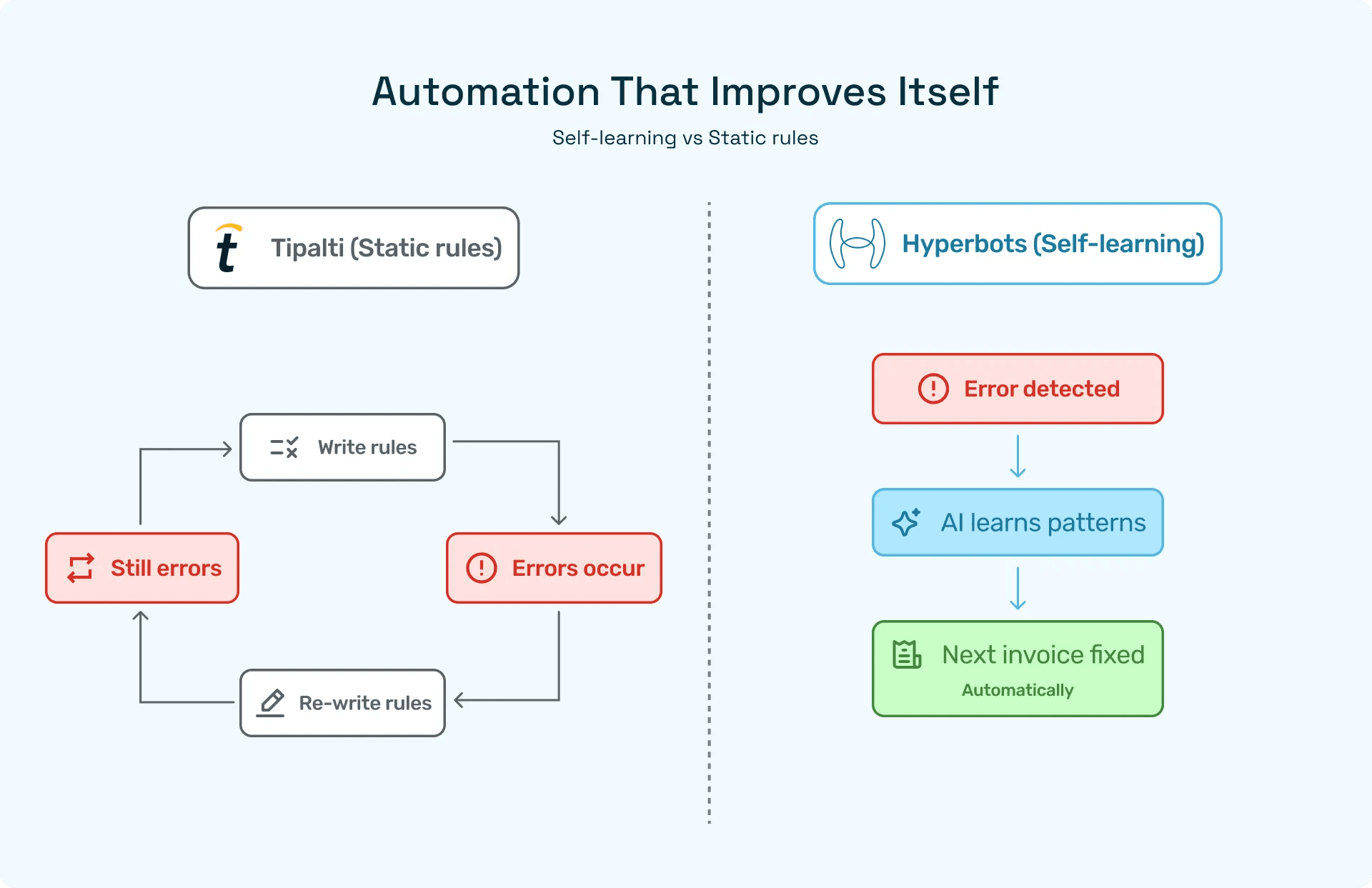

1. AI-Powered Exception Resolution

Tipalti’s automation rate hits a ceiling because it relies on static business rules and business rules age about as well as open milk. When invoices go rogue (missing PO fields, mismatched taxes, or a duplicate vendor pretending to be new), manual intervention becomes the norm.

Hyperbots, on the other hand, learns from past fixes and applies them automatically. It’s like having an accountant who remembers every mistake and never repeats it.

2. Proactive Validation for Touchless Invoice Processing

Tipalti plays catch-up by validating data after invoices are ingested meaning errors pop up late in the game, right when you thought you were done for the day.

Hyperbots flips the script. It performs real-time validation during capture, flagging anomalies before they ever enter the workflow. It’s like spell-check for invoices but smarter, faster, and way less judgmental. Ultimately, your team is left to deal with cleaner data, fewer exceptions, and truly touchless invoice processing from the start.

3. Adaptive ERP Synchronization for Higher Automation Rates

Integration shouldn’t feel like defusing a bomb, but with Tipalti’s complex multi-entity setups in NetSuite or SAP, it often does. Manual field mapping, data mismatches, and sync errors can make finance teams question their career choices.

Hyperbots, on the other hand, make integration so smooth it’s almost suspicious. Using real-time API connections and its Adaptive Integration Mesh, it keeps master data, GL accounts, and project codes perfectly aligned across every ERP so no broken mappings, no “field not found” mysteries. Just a unified, always-synced financial universe that sustains an 80% straight-through processing rate.

4. Predictive Approval Orchestration

Tipalti’s approval routing follows rigid hierarchies which works great until someone’s on vacation, at lunch, or mysteriously “OOO” leaving you with stalled workflows and approval bottlenecks that feel like rush-hour traffic.

Hyperbots keeps things moving by reassigning approvals based on workload, urgency, and context. So even when people vanish from the calendar, your approvals don’t.

While Tipalti’s straight-through processing offers partial automation, it’s a bit like a self-driving car that still asks you to hold the wheel.

Hyperbots takes it further by scaling operations, cutting errors, and speeding up payments without human babysitting. Real automation shouldn’t need supervision, it should just work.

The Business Impact of Higher STP

That extra 20% lift in STP that Hyperbots delivers over Tipalti isn’t just a number; it’s time, money, and sanity saved across your entire AP function.

With Hyperbots, finance teams move from firefighting to forecasting. Instead of spending hours validating invoices or chasing exceptions, they’re focusing on strategic initiatives that actually drive business growth.

Here’s what that looks like in action:

Invoice processing time falls from 11 days to under one minute, thanks to real-time, AI-powered capture and validation.

99.8% accuracy in data extraction means invoices hit the ERP cleanly so no post-processing, no “why didn’t this post?” mysteries.

Audit trails become self-reconciling, giving you a clear, compliant record without needing extra hands.

AP teams free up to 80% of their bandwidth, finally shifting from manual validation to high-impact analysis and strategic projects.

Cash outflows drop by up to 10% because high-velocity, error-free payments eliminate late fees and capture early-payment discounts - while also strengthening vendor relationships through consistent on-time payments.

With over 80% straight-through processing, Hyperbots empowers finance teams to move beyond manual oversight and into true autonomy. Invoices process themselves, exceptions resolve intelligently, and finance shifts from reactive firefighting to proactive decision-making, marking a real leap toward smarter, faster, and more scalable operations.

The Verdict: Tipalti Automates, Hyperbots Dominates

Tipalti straight through processing paved the way for automation in AP, but it stops at semi-automation.

Hyperbots is constantly going further by achieving over 80% touchless invoice processing with predictive intelligence, continuous ERP sync, and self-learning exception handling. If your automation rate isn’t improving quarter over quarter, you’re not automating - you’re just digitizing. Hyperbots ensures your AP processes are not only faster but smarter, setting the new standard for STP invoice automation.

Automation gets you halfway. Hyperbots gets you all the way.

Take free consultation from our finance technology experts and build your AI adoption roadmap for maximizing ROI.

Book a demo today and experience truly autonomous invoice processing in action.

Frequently Asked Questions (FAQs)

1. How is Hyperbots able to achieve 80%+ STP when Tipalti doesn’t publish an STP claim?

Hyperbots uses a multi-model AI engine with real-time validation, adaptive approvals, and ERP-synced intelligence, allowing invoices to process end-to-end without human intervention. Tipalti, on the other hand, relies heavily on static rules and manual exception handling, which limits its automation ceiling.

2. Does Hyperbots require custom templates or field mapping to maintain high STP?

No. Hyperbots’ layout-agnostic extraction and Adaptive Integration Mesh eliminate the need for templates or repetitive mapping updates, so STP stays consistently high even when vendors or ERP structures change.

3. Can Hyperbots handle complex multi-entity ERP environments better than Tipalti?

Yes. Hyperbots is built for multi-entity setups and keeps vendor records, GL codes, projects, and approval logic continuously synchronized across ERPs, significantly reducing sync failures and exceptions.

4. How does predictive approval orchestration improve STP?

Hyperbots proactively reroutes approvals based on urgency, workload, and approver availability, ensuring invoices never get stuck waiting for someone who’s OOO or overloaded which is a key reason STP stays above 80%.

5. What business impact can teams expect after switching from Tipalti to Hyperbots?

Companies typically see faster cycle times, fewer exceptions, cleaner ERP postings, reduced AP workload, and lower cost per invoice. Many recover 50–80% of AP team bandwidth within the first quarter.