Tipalti Integration vs Hyperbots — ERP Connectivity & Accuracy Compared

Compare Tipalti and Hyperbots for ERP setup speed, connectivity, and data accuracy, and see why Hyperbots guarantees real-time sync with fewer issues.

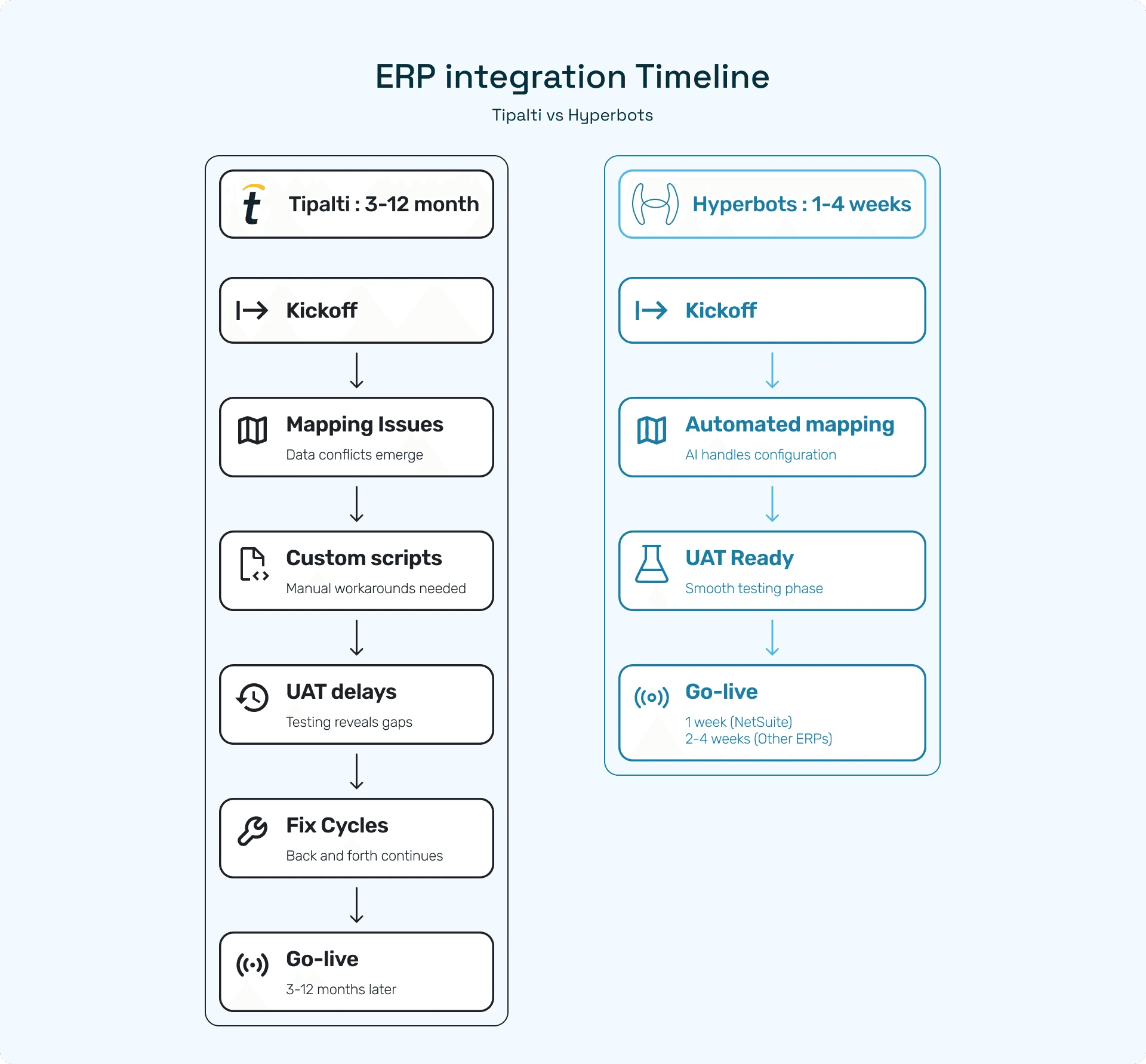

ERP integration can often feel like a root canal. Even though we know it’s necessary, it’s expensive, and best forgotten once it’s over. Many finance teams that have implemented platforms like Tipalti have been led on with the “6-week promise” only for it to turn into a year.

Dealing with the same ordeal: endless calls with consultants, “minor” custom scripts that somehow take three sprints, and the inevitable data mismatch that shows up five minutes before reporting day, words fail to stress the importance of seamless integration. When issues like these become rampant, finance teams are left with wondering, “was this integration even worth it?”

And to tell you, yes, it is worth it because integration DOESN’T have to be a pain point. It can actually work smoothly, intelligently, and in real time.

That’s where Hyperbots enters the game. Designed for modern finance teams and pre-wired for every major ERP like NetSuite, SAP, SAGE, Quickbooks, Dynamics 365, and even more, it’s not just another “plug-and-pray” connector. It’s integration reimagined with faster setup, deeper intelligence, and zero drama. Because your data deserves better than “close enough,” and your team deserves better than an integration déjà vu.

Tipalti’s NetSuite Integration Nightmares: What’s Breaking and How Hyperbots Fixes It

Tipalti’s NetSuite integration has faced major criticism for delays, recurring sync failures, poor implementation support, and lack of proactive monitoring. Users report frequent posting errors, inconsistent UI design, and limited functionality often requiring manual fixes and extra costs, making the experience unreliable and frustrating for finance teams. Let’s unpack the issues with Tipalti’s NetSuite integration:

Posting failures that demand manual fixes: When purchase orders are updated after invoices are matched, records often fail to post correctly. Cue spreadsheets, support tickets, and frustration.

Implementation delays that overstay their welcome: What’s promised as a 6-week setup can stretch into months, sometimes because of limited support or incomplete project planning.

Mapping and matching headaches: Known issues in mapping transaction lines, customer fields, or multi-entity data often go unresolved, forcing finance teams to “work around” automation.

No proactive error monitoring: Sync failures happen silently. By the time anyone notices, it’s already affected the month-end close.

Fragmented user experience: Each screen feels like it was designed by a different team. You can’t access key actions where you need them most, and consistency is a luxury.

Most NetSuite integration challenges don’t come from the ERP itself, they come from systems that weren’t built to keep up with it. When automation lacks intelligence, errors multiply, teams scramble, and “efficiency” becomes another spreadsheet marathon.

That’s exactly where Hyperbots changes the story. Instead of patching problems after they occur, it prevents them with real-time sync, adaptive mapping, and AI that actually understands your financial workflows.

Here’s how:

1. Smart Sync Engine; No More Posting Failures: Hyperbots uses a bi-directional, real-time sync with NetSuite that validates data before posting. So if a PO is updated after an invoice match, Hyperbots automatically adjusts and revalidates it with no failed records, no manual rework. It’s like giving your integration a sixth sense for accuracy.

2. Lightning-Fast Implementation (Not even a week): Forget endless kickoff calls and “we’ll circle back next sprint.”

Hyperbots’ pre-built NetSuite connector and AI-assisted mapping mean you can go live in a fraction of the time other platforms take. Implementation feels less like a project and more like flipping a switch.

3. Adaptive Field Mapping Built for Complexity: Multi-entity setups? Custom fields? Conditional mappings? Hyperbots handles them all with dynamic field mapping and self-learning configuration. It learns from your chart of accounts data, remembers your preferences, and adapts automatically so your finance team doesn’t need to play detective when something doesn’t match.

4. Proactive Error Detection Fixes Before They Break: Instead of waiting for failures to appear, Hyperbots runs continuous sync health checks.It flags anomalies in real time and even auto-corrects common mismatches. That means no silent errors lurking until month-end, just peace of mind and smoother closing.

5. Unified, Intuitive Experience and No More Click Mazes: Every screen in Hyperbots follows a consistent, modern design. You can view, approve, and act on data without jumping tabs or hunting through menus. Think of it as a UX built by finance, for finance and NOT by a committee of confused engineers.

Hyperbots’ One-Week NetSuite Integrations That Actually Stick

Hyperbots is basically synonymous with seamless NetSuite integration. We deliver it, week after week, across real finance teams who’ve had enough of endless implementations and late-night error hunts. Every one of our live NetSuite customers went from kickoff to full integration in under seven days with no drama, no custom scripts, no “we’ll get back to you next sprint.”

Our clients' finance teams are finally able to spend a lot more time analyzing data and a lot less time chasing it. Hyperbots automatically syncs transactions, validates every posting, and adapts to complex entity structures.

Here’s what makes the process so effortless:

Guided Setup: Hyperbots offers a step-by-step onboarding process that eliminates the traditional confusion of ERP integration.

No complex configurations, no dependency on developers, and no endless documentation hunts.

Every stage, from authentication to field selection, is guided through an intuitive interface that ensures a clean, predictable setup from day one.

Automated Mapping: Instead of manually mapping hundreds of fields or entities, Hyperbots’ AI does it for you.

It recognizes existing relationships across invoices, purchase orders, and payments, automatically aligning them to your NetSuite schema.

No guesswork, no backtracking, and no “field not found” errors during validation.

Adaptive Intelligence: Unlike rigid integration tools, Hyperbots continuously learns from your workflows.

It detects unique patterns such as conditional field logic or entity-specific rules and dynamically adjusts to them.

Whether you operate across multiple subsidiaries or custom objects, the system adapts instantly, keeping configurations aligned even as your business evolves.

Continuous Validation: Every transaction that moves between Hyperbots and NetSuite undergoes real-time verification.

The platform checks data integrity, posting readiness, and sync accuracy before errors can surface.

This proactive layer ensures that failed postings, duplicate entries, and data mismatches are virtually eliminated.

Instant UAT Readiness: Hyperbots drastically shortens the testing cycle.

Finance teams can review live data, validate results, and approve workflows within days all without depending on IT or engineering teams for adjustments.

By the time go-live arrives, the system is already stable, predictable, and fully aligned with business rules.

Here’s what they tell us they love most:

No broken mappings: Hyperbots’ adaptive engine ensures every field, entity, and relationship stays aligned, even in complex multi-entity environments.

No late-night sync errors: Continuous validation catches and corrects mismatches before they can cause downtime or posting failures.

No “why didn’t this post?” email chains: Real-time visibility means every transaction is tracked, validated, and confirmed automatically.

When go-live day arrives, it’s refreshingly uneventful as any great automation should be. Hyperbots plugs into NetSuite like it’s always been part of your tech stack, enabling clean, real-time financial data flow with zero friction.

Beyond NetSuite: Because Every ERP Deserves a Smooth Ride

You’re probably thinking, “But what about other ERPs?” and Hyperbots absolutely has your back. Beyond blazing-fast NetSuite integration (under a week), its platform supports real-time, bidirectional sync with a broad set of ERPs all with the same intelligence and reliability.

Finance teams using Hyperbots report seamless integrations with major systems like SAP S/4HANA, Microsoft Business Central, Sage 300, Deltek Costpoint, QuickBooks Desktop and Online, and more. Here’s how it works in practice:

1. Deep, Read-Write Connectors

Hyperbots Co-Pilots deliver full read/write access to ERP data: GL accounts, vendor/item masters, liabilities, assets, invoices, and POs.

The system supports on-premise and cloud ERP deployment, giving flexibility regardless of your infrastructure.

Even when ERP fields are heavily customized (custom dimensions, subsidiary-specific fields), Hyperbots adapts via its configurable integration framework.

2. Real-Time, Bidirectional Sync + Exception Handling

Data between Hyperbots and your ERP synchronizes in real time, so invoices, vendors, COA updates, and item masters stay perfectly aligned.

For error resilience, Hyperbots performs read-back checks after write operations. If something doesn’t match, it retries or surfaces it for human resolution.

If an ERP posting fails, the system builds in exception reporting, ensuring data integrity and audit readiness.

3. Multi-ERP + Multi-Entity Support

Hyperbots supports multiple ERP systems simultaneously. Whether different business units use different ERPs or instances, its Co-Pilots handle it.

It also supports multiple instances of the same ERP (e.g., two NetSuite accounts or two SAP instances), letting you run shared or distinct workflows.

With single sign-on (SSO), finance teams access Co-Pilots across all ERPs from one place.

Business processes stay unified across entities or customized where necessary without breaking because the integration is built around a canonical schema.

4. Rapid, Low-Code Onboarding

Thanks to pre-built connectors, Hyperbots can deliver go-live times of 2–4 weeks for supported ERPs.

For ERPs not already supported, Hyperbots offers a flexible integration toolkit that can connect over REST, SOAP, OData, or even flat-file systems so no custom major dev work needed.

Its connector design includes a “schema handshake” and UAT shadow-run processes to validate mappings and postings before going live.

5. Unified Process Intelligence + Auditability

Hyperbots provides field-level visibility across ERPs, allowing you to track approvals, exceptions, and transactions across entities in a unified way.

Its Co-Pilots adapt to company-specific ERP rules (posting logic, GL structure, dimensions) with no-code configuration.

Historical record, retry logic, and read-back checks guarantee that every transaction is auditable and traceable, helping with compliance and controls.

Where Tipalti Falls Short

Tipalti offers a strong finance automation platform — but its ERP integrations often require heavy customization or long implementation cycles, which can increase cost and operational risk. In contrast, Hyperbots was built to deliver seamless, intelligent integration out of the box: fast deployment, maintenance-free sync, and real-time data reliability across ERPs.

Bottom line: With Hyperbots, ERP integration doesn't have to be a multi-month, high-risk IT project. It's plug-and-perform, intelligent, and built for scale. From NetSuite to SAP to QuickBooks to Sage, you get consistent data, trusted processes, and live AI — without the usual integration headaches.

If your current integration still feels like it needs constant supervision, maybe it’s time for an upgrade.

👉 Book a demo with Hyperbots to see how simple, stable, and fast NetSuite integration can truly be.

Frequently Asked Questions (FAQs)

Q1: Why do Tipalti–NetSuite integrations often take longer than promised?

Many finance teams report that Tipalti’s “6-week implementation” often gets extended due to mapping issues, limited configuration flexibility, recurring sync failures, and the need for additional scripts or IT help. When integrations aren’t built to adapt to complex, multi-entity environments, delays compound quickly.

Q2: How does Hyperbots integrate with NetSuite in under a week?

Hyperbots uses pre-built connectors, AI-driven mapping, and a guided onboarding flow, removing the dependency on developers or long configuration cycles. Real-time validation and adaptive intelligence shorten UAT significantly, enabling most teams to go live in just a few days.

Q3: What makes Hyperbots’ ERP sync more reliable than Tipalti’s?

Hyperbots validates every transaction before posting, adapts automatically to changes in POs or custom fields, and continuously monitors for anomalies. This prevents the silent failures, mismatches, and month-end surprises common in rule-based or semi-manual sync systems.

Q4: Can Hyperbots handle multi-entity or highly customized ERP environments?

Yes. Hyperbots is designed for modern, complex finance operations. Its dynamic field mapping, entity-aware logic, and self-learning configurations support custom objects, subsidiaries, conditional rules, and multi-ERP structures without requiring custom scripts.

Q5: Does Hyperbots integrate with ERPs beyond NetSuite?

Absolutely. Hyperbots offers pre-built integrations for SAP, Microsoft Dynamics 365, Sage, QuickBooks, Oracle, and more. Most non-NetSuite ERP integrations go live within 2–3 weeks, with the same real-time validation, adaptive intelligence, and cross-platform consistency that power its NetSuite experience.