The Transparency Gap: Why Hyperbots’ Explainable AI Beats Ramp’s Black Box

How Hyperbots gives finance teams full visibility into AI decisions-while Ramp leaves them guessing.

Beyond Speed: Why Transparency Defines the Next Generation of Finance Automation

Automation once meant speed. Today, it means trust.

In modern finance, efficiency alone isn’t enough - leaders need to see and understand every automated decision. As AI takes on complex financial tasks, transparency has become the true measure of technological maturity.

This is where the debate between Hyperbots and Ramp takes center stage.

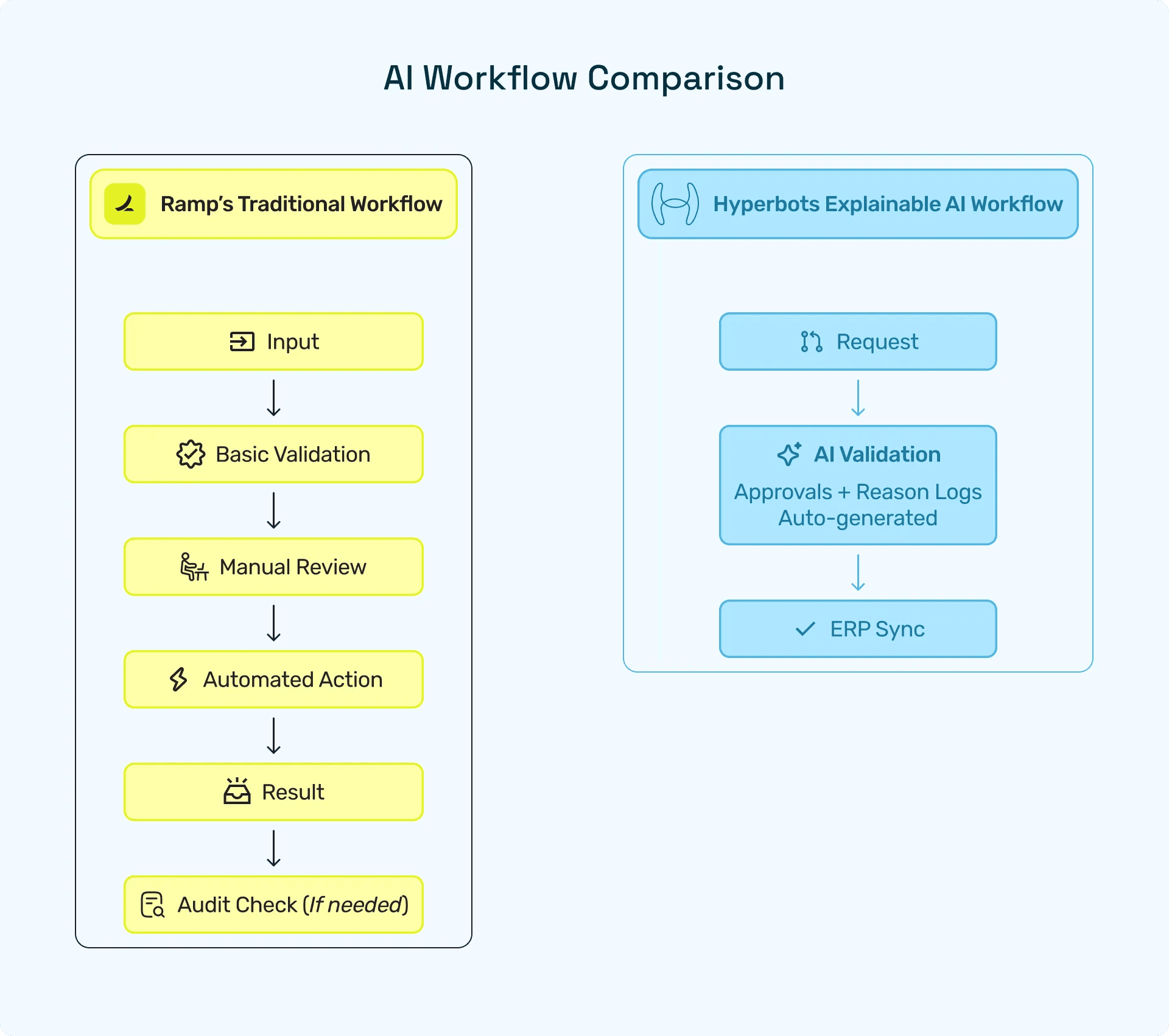

Ramp’s platform has made waves in spend management and expense automation. But while it emphasizes speed and control, its inner workings remain largely opaque - a “black-box” AI approach where outcomes appear without a clear explanation of how they were reached.

Hyperbots, by contrast, is redefining automation with explainable AI - a transparent, accountable system that delivers AI audit trails and governance-grade visibility across every transaction, approval, and workflow.

Let’s explore how these two platforms diverge, and why Hyperbots’ model of automation accountability represents the next evolution of finance technology.

Hyperbots vs Ramp: The Transparency Divide

The finance automation landscape has shifted from manual oversight to AI-driven autonomy. But autonomy without visibility leads to governance blind spots.

When comparing Hyperbots and Ramp, the difference lies not just in functionality - but in approach.

Feature Category | Hyperbots (Explainable AI) | Ramp (Black-Box Automation) |

Transparency / Audit Trail | Complete AI audit trail with explainable reasoning at every stage of the automation flow. Finance teams can trace who did what, when, and why. | Reports and dashboards available, but underlying AI logic remains opaque. Users can view outcomes, not decision paths. |

Automation Accountability | Designed for controllers and CFOs - supports overrides, justifications, and reasoning logs. | Primarily focuses on automation of spend and expense tasks, not governance visibility. |

Procure-to-Pay Coverage | Full lifecycle PO automation: vendor onboarding, PO creation, invoice matching, GL posting, and exception handling. | Limited procurement capabilities; emphasis remains on corporate card automation and expense reconciliation. |

ERP Integration | Deep integration with SAP, NetSuite, Microsoft Dynamics, Sage and more offering bidirectional sync and real-time validation. | Integrations are functional but focused mainly on accounting connections rather than deep P2P process control. |

Explainability of AI | Explainable AI models - each automation action is interpretable, logged, and auditable. | Uses AI for pattern recognition and anomaly detection, but decisions lack detailed justifications. |

Vendor Visibility | Vendor portals with end-to-end lifecycle tracking, duplicate detection, and real-time updates. | Vendor data is available but siloed; lacks transparency into lifecycle history or duplicates. |

Governance Readiness | Built-in audit tools, approval routes, and reason codes for compliance and accountability. | Relies on exportable logs and approval settings; less robust governance reporting. |

User Transparency Features | In-app explainability layers, error rationales, and override logging. | Focus on simplified user experience - less information depth for audits. |

Platform Philosophy | Transparency by design - built for financial accountability, not just automation. | Efficiency-first - prioritizes speed, often at the expense of interpretability. |

Verdict:

If your finance and procurement teams prioritize transparency, AI audit trail integrity, and automation accountability, Hyperbots’ platform offers an unmatched advantage.

Understanding the Transparency Gap

Finance leaders once equated automation success with reduced manual effort. But as AI systems took over decisions - vendor selection, invoice matching, payment timing - the question changed:

Can we see and verify how those decisions were made?

Ramp’s model accelerates transaction flow but often conceals the logic behind automation. Finance teams get results, not reasoning.

Hyperbots eliminates this gap through Explainable AI which ensures every AI-driven outcome comes with human-understandable context.

That means:

Each decision - PO approval, invoice match, or vendor risk score - is logged with rationale and references.

Any anomaly or exception includes a reason code visible to auditors and managers.

Every process stage is supported by a machine-readable audit log for regulatory and compliance teams.

This depth of transparency builds trust, reduces audit friction, and reinforces accountability at every level of automation.

AI Audit Trail: The Backbone of Modern Finance

An AI audit trail is more than a compliance checkbox - it’s a control mechanism. It ensures automation doesn’t replace human oversight, but extends it.

Hyperbots embeds this trail across its workflows:

Vendor onboarding records include document checks, validation timestamps, and approval context.

Each PO creation logs the reasoning behind vendor choice, quantity, and budget justification.

Invoice-to-PO matching records include similarity metrics and confidence scores.

Overrides are captured along with human annotations, closing the loop between AI logic and user intent.

In contrast, Ramp’s automation stack - optimized for expense control - records transaction outcomes but omits interpretive context.

This lack of explainability makes audits reactive rather than proactive. Hyperbots, by contrast, transforms audits into continuous visibility processes - every decision is pre-audited in real time.

Automation Accountability: The Human-in-the-Loop Advantage

Hyperbots is not just explainable - it’s accountable.

Its automation accountability framework gives users control without sacrificing speed:

Humans can override AI actions with contextual justification.

Every override becomes part of the decision history, ensuring traceability.

The system learns from overrides, improving model explainability over time.

This bridges the gap between automation and governance. AI doesn’t just execute - it collaborates.

Ramp’s system automates spend approvals but provides less space for governance commentary or justification trails. Hyperbots’ model ensures humans remain the final decision layer, backed by visible reasoning.

Transparency in Action: Hyperbots’ Purchase Order Automation

The power of Hyperbots’ transparency architecture becomes clear in purchase order (PO) automation - a critical pain point for enterprises.

Here’s how Hyperbots’ explainable AI transforms it:

AI-Driven Requisition Drafting:

Hyperbots’ AI agents generate purchase requisitions based on contextual needs, policy limits, and historical vendor data. Each recommendation includes the logic behind it.Smart Policy Validation:

Before a PO is issued, the platform validates it against company policies and historical exceptions - logging all validation checkpoints for audit readiness.Automated 3-Way Match:

The AI cross-verifies invoices, POs, and goods receipts, displaying confidence scores and explanations for each match.Audit-Ready Reporting:

Every step generates an AI audit trail - timestamped, explainable, and ERP-integrated.

This cycle ensures no hidden logic and no missing context - every financial event is visible, explainable, and retraceable.

Why Transparency Drives ROI

While we’re not quoting numbers here, the structural ROI of explainable automation is obvious:

Fewer audit failures.

Shorter reconciliation cycles.

Faster user adoption due to visible reasoning.

Reduced governance risk and manual rework.

Ramp’s appeal lies in simplicity, but Hyperbots’ explainability ensures resilience. Finance leaders can defend every automation decision, satisfy regulators, and build digital trust internally.

Expert Insight: Transparency Is Now a Compliance Mandate

Analysts at Gartner and Deloitte have noted that AI governance frameworks increasingly require decision traceability and model interpretability for enterprise adoption.

Hyperbots meets these standards by default - embedding compliance into its AI architecture. Ramp’s approach remains functionally powerful but less aligned with these emerging governance expectations.

When Speed Becomes Blindness

Ramp’s model optimizes for velocity - automated categorization, card controls, and quick insights. But without transparency, speed can create oversight risk.

Imagine approving $10,000 in AI-matched invoices without knowing why they matched.

That’s the trade-off black-box automation imposes - faster results, lower explainability.

Hyperbots resolves this paradox: it provides fast automation and transparent accountability. Finance teams can move quickly without surrendering control.

The Future: Transparent Automation as a Standard

Finance automation is entering its second era: from opaque to open, from black-box AI to explainable systems.

In this new landscape, Hyperbots transparency becomes not just a search term - but a compliance benchmark. Platforms that can’t show how AI arrives at decisions will fall behind.

Hyperbots’ architecture anticipates this shift - positioning itself as the governance-ready AI partner for forward-thinking finance organizations.

Conclusion: Transparency Isn’t Optional - It’s the New Baseline

As finance automation matures, trust, traceability, and explainability define success.

Ramp’s automation helps teams act faster, but not necessarily smarter. Without interpretability, even the best AI can’t support governance or audit confidence.

Hyperbots’ explainable AI closes this transparency gap - providing full AI audit trails, automation accountability, and visibility by design.

For CFOs, Controllers, and Procurement Heads aiming for responsible automation, the choice is clear:

Transparency is the future - and Hyperbots is already there.

FAQ

Q1. How does Hyperbots ensure audit readiness?

A: By maintaining detailed AI audit trails, where every automated action includes reasoning, timestamp, and ERP linkage for compliance verification.

Q2. What does automation accountability mean?

A: It means humans remain in control - able to review, justify, and override AI actions with clear documentation.

Q3. Can Ramp match Hyperbots in procurement transparency?

A: Ramp’s strength lies in spend management, but its procurement automation lacks Hyperbots’ full transparency stack - especially in PO lifecycle and vendor governance.

Q4. Why is explainable AI critical in finance?

A: Because finance teams must justify every transaction. Explainable AI lets them trace logic, avoid compliance risks, and build trust in automation outcomes.