Tipalti vs Hyperbots for Global Payments & Compliance

Compare Tipalti and Hyperbots for global mass payments, multi-currency support, and tax compliance to find the platform that truly masters cross-border finance.

Tipalti vs Hyperbots for Global Payments & Compliance

Modern finance teams are under pressure to do more than automate tasks; they’re expected to ensure compliance, reduce risk, and create real-time financial insights. Traditional AP automation platforms streamline processes but often stop short of decision-making and learning. Today, the next wave of finance transformation is driven by agentic AI, software that can autonomously perform tasks, make decisions, and continuously improve.

This blog compares Tipalti global payments capabilities with Hyperbots’ Payments Co-pilot, focusing specifically on global payments, cross-border compliance, ERP accuracy, and decision intelligence. If you’re a CFO, Controller, or Finance Manager evaluating payment automation software, this analysis will help you understand which platform enables true autonomous finance operations.

An Overview of What Tipalti Does

Tipalti is a well-known finance automation and mass payments platform used by many mid-market and enterprise businesses. Its value proposition is simple: “simplify global payments, controls and compliance.”

Core offerings include:

Global mass & cross-border payments:

Supports payments to 200+ countries and 120+ currencies with multiple rails (ACH, wire transfers, global banking networks). Helps streamline payouts at scale.Self-service vendor onboarding with tax form automation:

Suppliers enter their own information via a branded portal, including W-9/W-8 forms and tax ID/TIN validation, reducing admin work.Automated tax compliance engine:

KPMG-approved tax engine captures tax forms and validates global tax IDs to reduce compliance risk.Automated payment reconciliation:

Matches outbound payments with banking data and posts into the ERP/GL, reducing manual reconciliation.Fraud prevention and anomaly detection:

Built-in checks for suspicious activity, sanction list screening, and payment fraud detectionGlobal reimbursements / expense automation:

Supports employee reimbursements in multiple countries/currencies with expense-to-ERP sync.ERP & accounting integrations with services support:

Integrates with NetSuite, SAP, Oracle, QuickBooks, Dynamics, etc., supported by professional services for implementation.

Tipalti is strong if your goal is to standardize vendor onboarding, reduce payment friction, and centralize payouts, making it a widely adopted payment automation software.

But Tipalti’s automation is still rule-based. It relies on rules and manual exception handling. Workflows need to be configured, exception handling requires manual intervention, and the system doesn’t learn from finance team decisions.

Introducing Hyperbots: Agentic AI Built for Finance & Accounting

Unlike legacy AP automation platforms that accelerate workflows but still depend on finance teams for judgment calls, Hyperbots brings Agentic AI purpose-built for Finance & Accounting — software that can think, act, and continuously improve.

Hyperbots’ Payments Co-pilot doesn’t just route payment files or validate forms — it makes context-aware decisions, executes payments end-to-end, and feeds intelligence back into the ERP and FP&A models in real time.

Traditional AP automation platforms like Tipalti are designed to execute rules — they follow predefined workflows, route approvals, validate forms, and push transactions into the ERP. Hyperbots operates on a fundamentally different plane: instead of executing rules, it makes decisions. The Payments Co-pilot doesn’t wait for users to resolve exceptions, it resolves them autonomously. It doesn’t focus on automating workflows; it automates outcomes. And rather than simply recording transactions, it understands financial context — why a payment is being made, how it impacts vendors, cash flow, forecasting, and compliance — and uses that understanding to improve every time. The result is a shift from faster processing to true autonomy, where finance teams stop managing payment operations and instead oversee a system that manages itself.

What Hyperbots’ Payments Co-pilot does:

1. AI-driven selection of the optimal payment method

For every transaction, Hyperbots evaluates payment rail, currency, settlement time, fees, jurisdictional regulations, and historical vendor behavior — and automatically selects the smartest route (ACH vs. wire vs. wallet vs. card) without human intervention.

2. End-to-end compliance without extra workflows

The system autonomously collects and validates vendor data, tax forms, legal documentation, and SOX-grade audit trails — before payment execution. This means compliance isn’t a separate workstream; it’s embedded into execution.

3. ERP-native execution and verification

Hyperbots doesn’t just “push” payment postings; it writes to ERPs with atomic precision and performs read-back checks to confirm every line hits the right vendor, GL, cost center, department, and entity. No reconciliation. No mismatch. No cleanup.

4. Self-improving accuracy using finance context

Every approval decision, coding change, or exception resolved by a finance user becomes future training data. The system learns continuously until it reaches 99.8% autonomous payment accuracy, eliminating manual finance tasks over time.

5. Payments connected to the entire finance ecosystem

Unlike traditional tools that stop at AP, the Payments Co-pilot links decisions across:

AP → accruals

AR → cash positioning

FP&A → forecasting and budgeting

Treasury → working capital optimization

Payments are no longer a back-office function — they continuously update the financial brain of the company.

Tipalti automates steps and speeds up processes. Hyperbots automates decisions, and removes the need to touch the process at all. This reduces exceptions, manual approvals and repetitive finance work.

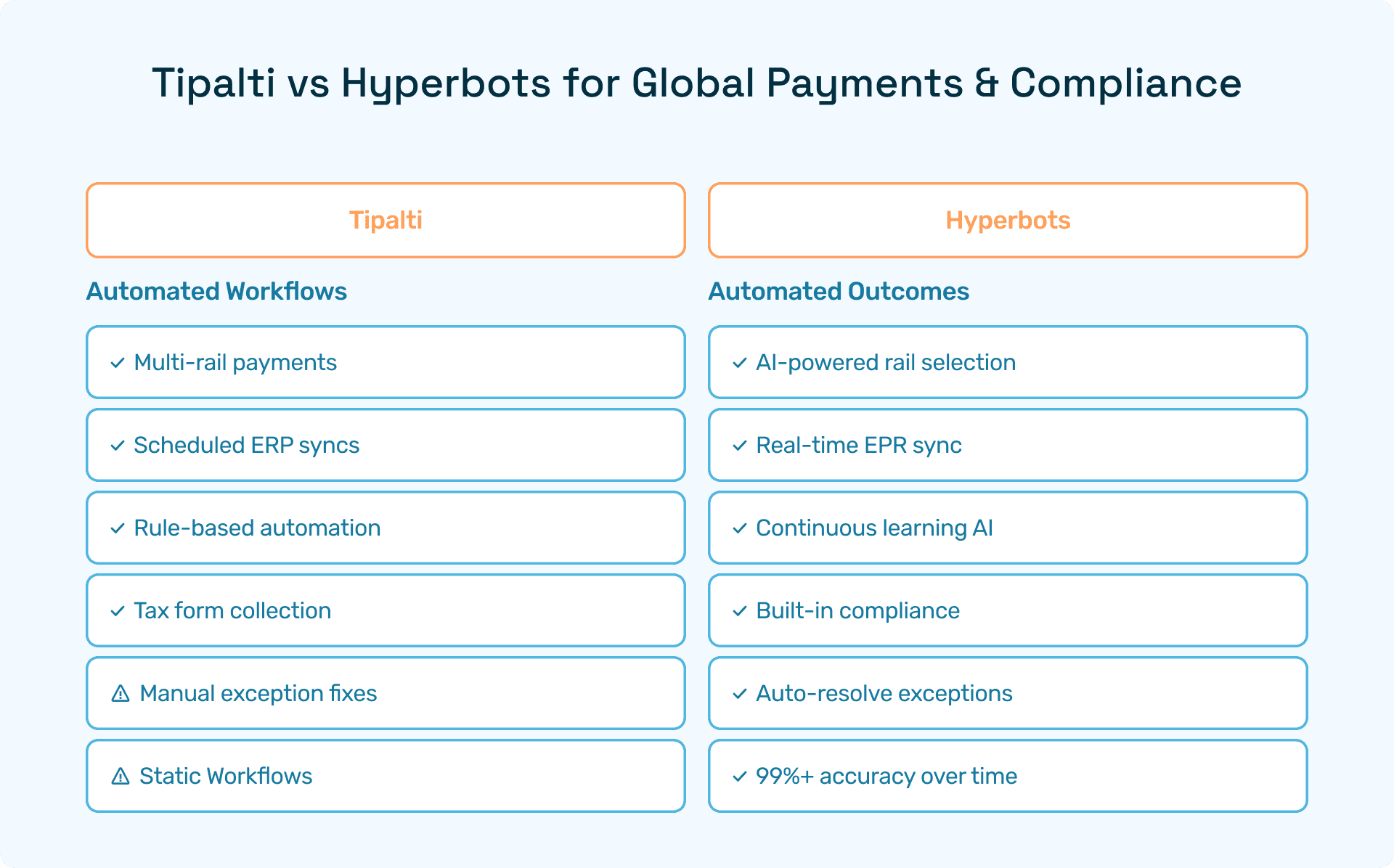

Feature Comparison: Tipalti vs Hyperbots for Global Payments & Compliance

Category | Tipalti | Hyperbots |

Global payment rails | Multi-rail (ACH, wires, etc.) | Multi-rail + virtual cards + AI rail selection |

Vendor onboarding | Collects tax forms and validates TINs | Auto-validates identity, tax data, and payment rules within the workflow |

ERP integrations | Scheduled syncs and API-based pushes | Real-time read/write + read-back verification + custom field adaptation |

Compliance automation | Tax engine + fraud detection | Built-in audit trails + tax verification + continuous compliance learning |

AI type | Rule-based & template configuration | Agentic AI that learns and improves accuracy from corrections |

Failed/blocked payments | Requires manual correction when errors occur | AI decodes vendor payment rules to prevent errors before processing |

Exception handling | Flags exceptions for manual resolution | Auto-resolves routine exceptions; escalates only complex ones |

Decision Intelligence | Not embedded | Predictive + autonomous — improves straight-through processing |

The key difference?

Tipalti automates workflows. But Hyperbots automates outcomes.

Where Hyperbots Stands Out

🔹 1. Real-time ERP accuracy (not delayed sync)

Hyperbots connects directly with the ERP (cloud or on-prem) and performs real-time read/write. Each payment posting is immediately verified with a read-back check, and the system auto-retries or corrects failures, ensuring audit-ready accuracy with no manual cleanup.

Tipalti syncs payments, but postings may require reconciliation and manual intervention.

Impact: Month-end closes faster with fewer exceptions.

🔹 2. Continuous learning and 99.8% accuracy

Hyperbots’ Payments Co-pilot continuously learns from every finance action — including GL coding decisions, vendor-specific payment rules, approval behavior, and tax/verifications. Each correction becomes a new rule the system applies automatically in future transactions. Over time, the Co-pilot reduces manual touchpoints because it adapts to company-specific workflows, ERP structures, and vendor patterns.

Tipalti, by contrast, relies on user-defined workflows and static rules. Its pages highlight rules-driven automation for global payments, tax form collection, and reconciliation.

Impact: Exception rates decrease over time instead of remaining constant.

🔹 3. Compliance embedded into execution

Tipalti captures compliance documents; Hyperbots enforces compliance during execution:

Tipalti approach | Hyperbots approach |

Collect tax docs before payment | Runs tax checks inside the payment flow |

Validates information | Auto-detects incorrect identities or accounts |

Flags fraud | Prevents risky payments proactively |

Impact: No “compliance backlog”, hence audit trails are built as transactions occur.

🔹 4. Hyperbots reduces failed cross-border payments

Using insights from vendor invoice rules, Hyperbots automatically decides:

Type of payment rail to use (wire vs ACH vs VCP)

Currency and banking format required

Which vendor identity or tax data is valid

By resolving these variables upfront, Hyperbots prevents payment failures and reduces the rework often required with Tipalti cross-border payments.

Why Choose Hyperbots Over Tipalti

You don’t need more automation; you need intelligence.

✅ Better control & compliance

Hyperbots builds compliance into the execution step. Every payment validates vendor identity, bank details, tax information, and approval rules before money moves, reducing failed payouts and audit risk.

✅ Learns and improves every month

Hyperbots can reach 99%+ accuracy by learning from GL coding, vendor rules, and approval behaviour. Tipalti automation remains static unless rules are manually updated. Hyperbots continuously reduces exceptions.

✅ Real-time financial visibility

Because Hyperbots connects AP → Payments → FP&A, payments automatically feed cash flow insights, accrual accuracy, and forecasting. Finance gains visibility in real time, not after a batch sync.

✅ Designed for the mid-market

While Tipalti is built for standardized enterprise workflows, Hyperbots focuses on mid-market teams that need decision automation and faster ROI, without adding platform admins or headcount.

Final Verdict: Tipalti vs Hyperbots for Global Payments & Compliance

Best For | Tipalti | Hyperbots |

Standardized global payouts | ✅ | ✅ |

Intelligent decision automation | ❌ | ✅ |

Continuous learning | ❌ | ✅ |

Real-time ERP control | ✅ | ✅ |

Reduction in exceptions | ⚠️ | ✅ |

👉 If your goal is automation, Tipalti is a proven choice. If your goal is autonomous finance, Hyperbots is the better platform.

Conclusion

Finance leaders no longer want tools that automate keystrokes; they want systems that think, decide, and improve.

Hyperbots shifts finance teams from → automation to autonomy.

If you’re evaluating Tipalti global payments capabilities and want to reduce compliance risk, eliminate exceptions, and build a smarter finance function, Hyperbots is the next logical step.

Explore how Hyperbots is redefining finance workflows at hyperbots.com.