Tipalti Invoice Processing vs Hyperbots - Accuracy, STP & Error Rate Compared

Compare Tipalti and Hyperbots on key invoice processing metrics—accuracy, Straight-Through Processing (STP), and error rate—to achieve truly autonomous finance.

As finance operations scale, manual data entry and error-prone approvals become bottlenecks. Modern invoice automation software now enables teams to process, verify, and post invoices with minimal human input, improving accuracy, speed, and compliance.

Among the top AP automation tools, two names often stand out: Tipalti and Hyperbots. While Tipalti provides trusted payables automation, Hyperbots brings a new generation of Agentic AI built for Finance & Accounting, designed to learn and act autonomously.

This blog compares Tipalti invoice processing features and Hyperbots’ Invoice Processing Co-Pilot, focusing on accuracy, straight-through processing (STP), and error rate, the three metrics that define modern finance efficiency.

Tipalti: Global Payables and Invoice Automation

Tipalti is a finance automation platform known for streamlining accounts payable and supplier management for mid-market businesses. Its invoice-processing capabilities are AI-driven, using OCR to extract header and line-item data from multiple formats and languages.

The platform automates coding, approval workflows, PO-matching, exception handling, and e-invoicing, reducing errors and accelerating payment cycles. By integrating seamlessly with ERP systems and ensuring tax and compliance checks, Tipalti provides finance teams with real-time visibility and a highly efficient Accounts Payable (AP) process.

Core Features of Tipalti Invoice Processing

AI Smart Scan / OCR: Tipalti captures both header and line-item data directly from invoices using Tipalti AI Smart Scan. It pre-populates fields so AP teams don’t have to manually key in values.

Auto-Coding & GL Mapping: Tipalti automatically suggests GL codes and applies coding rules so invoices are ready for ERP posting without manual intervention.

Approval Routing & Workflow Engine: Tipalti supports multi-tier routing, notifications, and exception routing to ensure invoices are routed to the right stakeholders.

PO Matching (2- / 3-way): Tipalti offers automated 2-way and 3-way matching with tolerance rules to reduce mismatches.

Supplier Onboarding & Portal: Tipalti includes a supplier portal for onboarding, W-9/W-8 collection, compliance docs, and status tracking.

Tax & Compliance Support: Tipalti handles VAT/GST support, e-invoicing formats, and compliance for multi-entity companies.

Payments Integration: Tipalti integrates native linkage from invoice approval to payment execution, including ACH, wires, cards, and mass payouts.

ERP Integrations: Tipalti offers pre-built ERP connectors for NetSuite, Sage Intacct, and QuickBooks, so invoices sync to GL and subledgers automatically.

Analytics & SLA Reporting: Tipalti provides dashboards, processing time analytics, and lifecycle visibility for audit readiness.

Machine Learning Enhancements: Tipalti improves extraction accuracy with machine learning and offers managed services for scaling.

Tipalti AP Automation Solution

Tipalti offers an AP automation solution, ideal for global businesses managing large invoice volumes. It combines AI-powered OCR (“Smart Scan”), automated coding, PO matching, and approval routing to streamline invoice processing. Tipalti delivers automation accuracy for structured, standardized invoices and maintains robust payment compliance across regions.

However, its automation relies primarily on rule-based workflows and static AI models, meaning for unstructured or dynamic invoices, manual exception handling and approval interventions remain frequent. This limits true straight-through processing (STP) and autonomy, often requiring AP teams to review mismatched GL codes or missing fields before posting.

Hyperbots: Agentic AI Built for Finance & Accounting

Hyperbots introduces a new paradigm: Agentic AI that performs, learns, and improves continuously. Unlike RPA or OCR tools that extract data and wait for human approval, Hyperbots’ Invoice Processing Co-Pilot performs the work end-to-end, learns from outcomes, and continuously improves with every invoice.

Its Agentic AI autonomously executes finance workflows from Invoice Intake → Extraction → Validation → Approvals → ERP GL posting. By combining vision-language AI, real-time ERP read/write, and continuous learning, Hyperbots delivers 99.8% extraction accuracy and intelligent decisioning without human intervention.

Key Capabilities

Vision-Language Models trained on 35M+ invoice fields

Hyperbots uses VLMs + LLMs to achieve cognitive accuracy, reading tables, line items, handwritten documents, and unstructured vendor PDFs.

Real-time ERP read/write synchronization (not just integration)

Unlike tools that only push data into an ERP, Hyperbots reads and writes to the ERP in real time, including GL codes, vendor master, item master, assets, liabilities, and custom fields.

Continuous learning from user corrections and workflow behavior

Every human action improves future automation — the system watches how exceptions are handled and updates its decisioning logic, making the process increasingly autonomous over time.

80%+ Straight-Through Processing (STP)

Hyperbots achieves < 1-minute invoice processing and up to 80% STP with zero human touch.

AI-driven compliance, tax validation & anomaly detection

Hyperbots detects duplicates, mismatches, tax irregularities, fraud signals, and vendor inconsistencies.

With Hyperbots, finance teams move beyond automation, achieving autonomous finance that anticipates, validates, and acts without manual input.

Tipalti vs Hyperbots: Feature Comparison

Feature / Capability | Hyperbots – Invoice Processing Co-Pilot | Tipalti – Invoice Management / AP Automation |

AI Type | Agentic AI for Finance & Accounting (self-learning) | Rule-based AI + OCR with limited adaptability |

Invoice Data Capture | Vision-Language Model trained on 35 M fields (99.8% accuracy) | OCR Smart Scan for header and line items |

Duplicate / Fraud Detection | Multi-layer semantic anomaly checks | Pattern-based duplicate recognition |

PO / GRN Matching | 140 + field logic with natural-language explanations | Standard 2- / 3-way matching |

GL Coding & ERP Integration | Real-time read/write access with custom field support | Auto-coding + pre-built ERP connectors |

Workflow & Approvals | Adaptive workflows by business unit/cost center | Configurable approval flows |

Compliance & Accuracy | Embedded validation; 99.8% accuracy | Regional VAT/GST guidance |

Straight-Through Processing (STP) | < 1 minute processing; 80% STP | ~ 60% reduction in manual AP workload |

Exception Handling / Audit Trails | AI-led contextual resolutions; full transparency | Dashboard visibility + manual review |

AI Depth & Adaptability | Agentic Co-Pilots with multi-step reasoning | OCR + rule-based machine learning |

Where Hyperbots Excels Over Tipalti

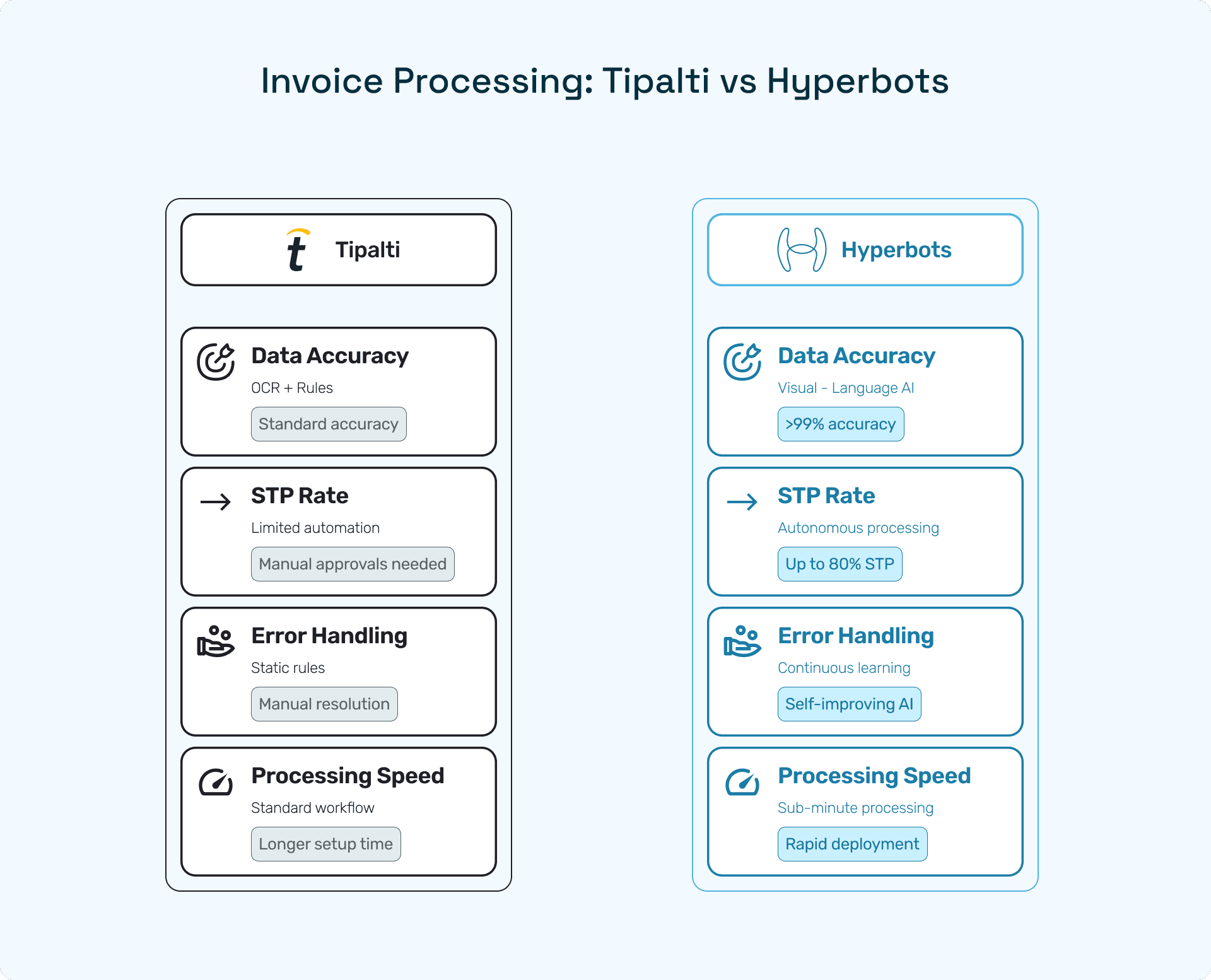

1. Data Capture & Accuracy

While Tipalti’s invoice processing relies on OCR and rule-based extraction templates, Hyperbots leverages cognitive Vision-Language Models trained on over 35 million invoice fields. This allows the Co-Pilot to interpret not just data but context, recognizing structure, semantics, and relationships within invoices. The result is >99% field-level accuracy, even for scanned PDFs, unstructured formats, or email-based invoices, dramatically reducing manual data entry and rework.

2. Straight-Through Processing (STP)

Hyperbots achieves true end-to-end automation with up to 80% straight-through processing. Its Agentic AI automatically validates, approves, and posts compliant invoices without human intervention, compressing invoice cycle times to under a minute. In contrast, Tipalti’s STP is limited by manual validations and exception handling steps, where human approvals are still required for outliers and workflow mismatches.

3. Error Rate & Exception Handling

Unlike static rule engines, Hyperbots’ AI learns continuously from user feedback and correction patterns, reducing exception volume with every cycle. It proactively suggests contextual resolutions, freeing AP teams from repetitive reviews. Tipalti, meanwhile, still experiences exception backlogs that must be manually resolved within approval workflows, creating delays and increasing processing costs.

4. AI Depth & Adaptability

Hyperbots’ Agentic Co-Pilots think and act independently across finance systems, reconciling GL codes, validating vendors, aligning tax rates, and initiating actions across connected ERP environments. Its AI dynamically adapts to workflow changes and data patterns. By comparison, Tipalti’s automation is largely rule-based and reactive, requiring manual configuration for new invoice types, vendors, or tax scenarios.

5. Speed to Value

Hyperbots integrates seamlessly with existing ERP ecosystems, offering rapid deployment and ROI within 4 weeks. Its plug-and-play approach eliminates heavy IT setup and allows instant scalability across entities. Tipalti implementations, especially for multi-entity or global configurations, can require longer setup times upto 6 months and extensive workflow tuning before teams see full automation benefits.

Why Finance Leaders Prefer Hyperbots

Superior Accuracy:

Hyperbots’ vision-language AI understands both the structure and meaning of financial documents, delivering near-perfect data accuracy across invoices, receipts, and purchase orders, even from scans or unstructured formats.Higher STP Rates:

With autonomous validation and GL posting, Hyperbots achieves exceptional straight-through processing, drastically reducing manual touchpoints and accelerating invoice approval cycles.Lower Error Rates:

Its continuous learning engine refines extraction and validation with every correction, minimizing recurring errors and driving ongoing process optimization.Deeper Integration:

Seamless real-time ERP synchronization ensures financial data remains consistent, traceable, and audit-ready across all systems.Smart Compliance:

Embedded tax, vendor, and anomaly validation proactively prevents compliance risks, enabling finance teams to operate with greater confidence and control.

Why Hyperbots Works Better

Comparison Area | Why Hyperbots Wins |

Invoice Data Capture & Accuracy | Cognitive extraction vs rule-based OCR → 99% accuracy. |

STP Performance | 80% touchless processing vs manual approvals. |

Duplicate & Fraud Detection | Multi-layer semantic AI catches hidden anomalies. |

PO / GRN Matching | 140 + fields with contextual reasoning and auditability. |

Error Rate Reduction | Continuous learning = Fewer exceptions. |

AI Depth & Adaptability | Agentic AI automates cross-system tasks. |

Speed to Value | Plug-and-play integration → Faster ROI. |

Visibility & Control | Real-time audit trails and explainable insights. |

Compliance & Governance | Validation is embedded at the capture stage. |

From Tipalti Automation to Agentic Finance Intelligence

Both Tipalti invoice processing and Hyperbots deliver strong invoice automation capabilities, but their approaches represent two different stages of evolution in finance automation. Tipalti focuses on dependable, rule-based automation for global payables, ensuring compliance and operational consistency across large enterprises.

Hyperbots, on the other hand, move beyond automation into autonomous finance, powered by Agentic AI that learns, reasons, and acts across workflows. When accuracy, straight-through processing (STP), and error reduction are the key priorities, Hyperbots clearly outperforms Tipalti, empowering finance teams to move from managing repetitive tasks to driving strategic, data-driven decision-making.

Explore how Hyperbots is redefining finance workflows at hyperbots.com.