Top 10 Tipalti Alternatives (2026): How Hyperbots Leads on Accuracy

If accuracy, fewer exceptions, and true autonomy matter, the best Tipalti alternatives aren’t just OCR tools, they’re platforms built for precision. Here’s why Hyperbots leads the 2025 shortlist.

The accounts payable automation landscape has evolved dramatically, and finance leaders are increasingly seeking solutions that go beyond basic invoice processing. While Tipalti has established itself as a player in the AP automation space, many organizations are discovering that its limitations around accuracy, implementation complexity, and exception handling are prompting them to explore alternatives that better meet their evolving needs.

Why Finance Teams Are Searching for Tipalti Alternatives

The shift away from Tipalti isn't arbitrary. Organizations face three critical pain points that drive their search for better solutions.

First, accuracy gaps remain a persistent challenge. Despite automation promises, users report ongoing integration complications, with one reviewer noting they "run into at least one integration complication each month" even after four years of use. These recurring issues create downstream effects on financial reporting and vendor relationships.

Second, implementation timelines often stretch far beyond initial promises. Reviews describe projects extending from the promised weeks into six months or more, citing ERP sync issues and necessary rework. One reviewer described how their implementation consultant "simply could not deliver," causing a full month delay on what was supposed to be a five-week project.

Third, the platform presents a steep learning curve and limited reporting flexibility. Users note that mastering the interface and extracting custom analytics often requires heavy support or even third-party tools, limiting the agility finance teams need.

Modern AP automation demands more than just processing invoices. Teams expect AI-driven accuracy that learns from patterns, seamless ERP integration without months of troubleshooting, and intuitive systems that reduce rather than increase training burden.

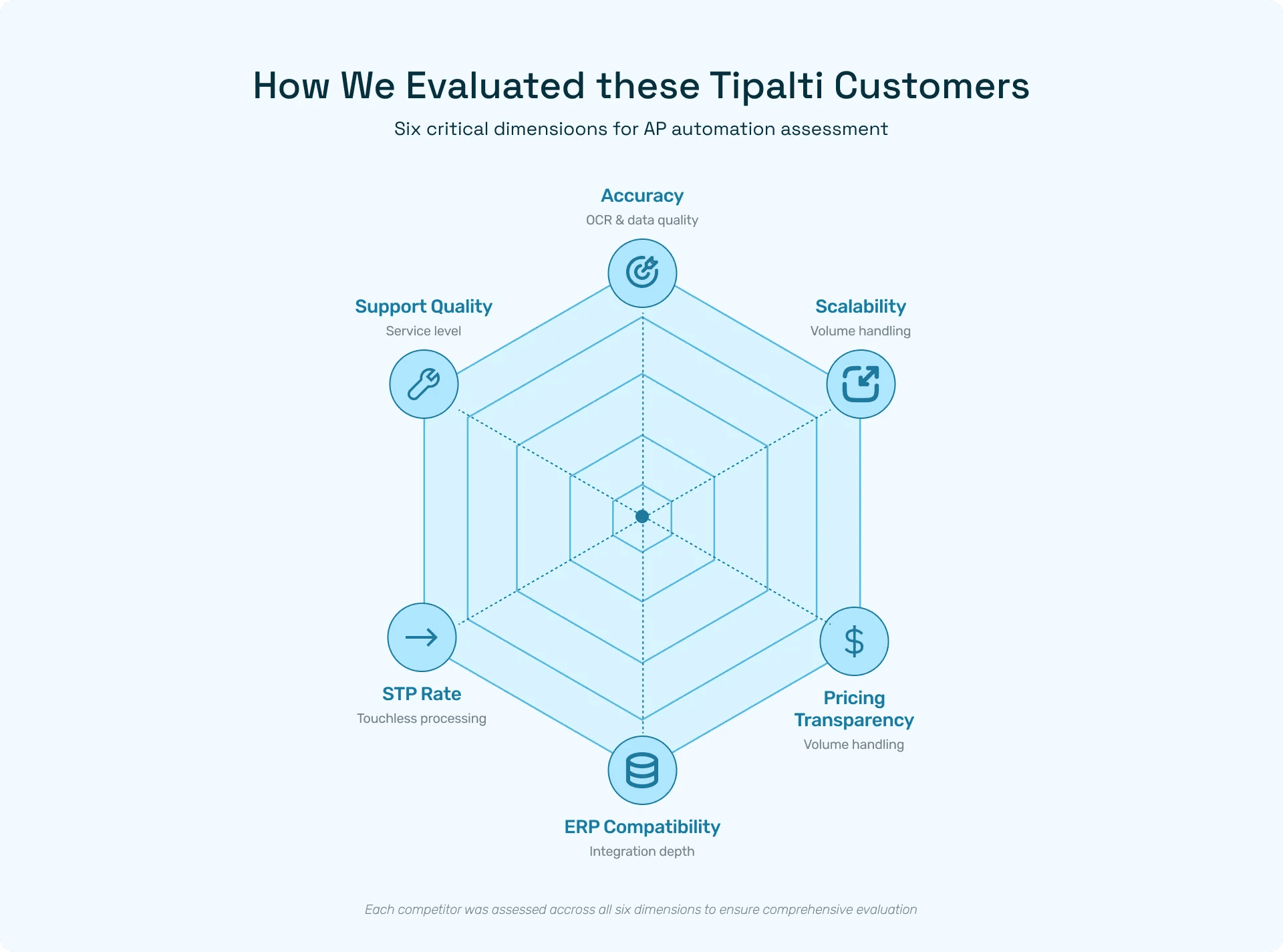

How We Evaluated These Tipalti Competitors

Our evaluation framework focuses on the metrics that matter most to finance leaders making strategic technology decisions. We assessed each platform across six key dimensions: invoice capture accuracy and straight-through processing rates, scalability from mid-market to enterprise, transparent pricing models, depth of ERP compatibility, and quality of ongoing support.

Our research draws from verified user reviews on platforms including G2, Capterra, TrustRadius, and GetApp, and publicly available product documentation and case studies. We've prioritized platforms with substantial user bases and verified implementation track records, ensuring our recommendations reflect real-world performance rather than marketing claims.

This analysis specifically targets organizations processing 1,000+ invoices monthly, managing multi-entity structures, or requiring high accuracy rates to support faster close cycles and better cash visibility.

The 10 Best Tipalti Alternatives in 2026

1. Hyperbots: AI-Driven Accuracy Leader

Hyperbots isn’t just an AP automation platform, it's the first autonomous procure-to-pay system built on an Agentic AI architecture, designed to eliminate manual invoice intervention rather than merely reduce it.

Where legacy AP tools rely on OCR and rule engines, Hyperbots uses context-aware validation across POs, GRNs, contracts, vendor histories, and approval policies to understand transactions the way a senior controller would. The platform’s contextual validation engine doesn't just extract data — it understands it, cross-referencing purchase orders, contracts, and historical patterns to catch discrepancies before they ever reach your ERP.

The system handles complex three-way matching, validates GL coding based on learned patterns, and even flags unusual vendor behavior automatically, preventing fraud, duplicate payments, and policy violations in real time. Instead of pushing exceptions downstream for humans to fix, Hyperbots focuses on eliminating exceptions at the source.

Implementation takes 2–4 weeks, not months, with native ERP integrations for NetSuite, SAP, Oracle, Microsoft Dynamics, Workday, Sage, and Infor — without middleware or prolonged sync troubleshooting.

Finance teams switching from Tipalti consistently cite that Hyperbots breaks the “rework cycle”: no more recurring exceptions, no reclassification loops, and drastically fewer vendor disputes. CFOs also get real-time liability visibility, cash flow forecasting, and audit-ready trails through conversational analytics powered by finance-specialized LLMs.

These capabilities translate into industry-leading performance outcomes, with finance teams reporting 99.8% line-level extraction accuracy and 80% straight-through processing on go-live. Month-end close timelines accelerate by up to 5×, while overall manual intervention drops dramatically, resulting in up to 50% reduction in exception-related workload across AP operations.

Best for: For mid-market to enterprise organizations evaluating Tipalti alternatives because of accuracy issues, exception overload, ERP integration headaches, or rigid reporting, Hyperbots resolves every underlying root cause - not just the workflow symptoms around them.

Where it excels: Invoice capture precision, contextual validation, self-learning systems that improve over time.

2. Stampli: Collaboration-Focused Automation

Stampli has built its reputation on making AP automation collaborative. The platform's communication hub keeps all invoice-related discussions, approvals, and documentation in one centralized location, reducing the email chaos that plagues many finance departments.

The system integrates with major ERPs without requiring workflow changes, which accelerates deployment. Users appreciate the intuitive interface and responsive customer support. However, while Stampli handles collaboration exceptionally well, organizations seeking higher straight-through processing rates may find themselves wanting more advanced AI validation capabilities.

Best for: Teams that need to maintain their existing ERP processes while adding automation and improving collaboration.

Where it falls short: Lower STP rates compared to AI-first platforms, less sophisticated validation logic.

3. Bill.com: SMB-Focused Simplicity

Bill.com serves the small to mid-sized business market effectively with straightforward invoice processing and payment capabilities. The platform's strength lies in its simplicity and quick setup, making it accessible for companies without dedicated IT resources.

For growing SMBs, Bill.com provides solid baseline automation. However, as organizations scale and complexity increases, the platform's limited enterprise features become apparent. Accuracy rates sufficient for smaller volumes may not meet the standards required for high-volume, multi-entity operations.

Best for: Small businesses and startups needing basic AP automation without enterprise complexity.

Where it falls short: Limited scalability for enterprise needs, basic validation rules, fewer advanced features for complex approval workflows.

4. Airbase: Spend Management First

Airbase approaches AP from a spend control perspective, offering robust pre-approval workflows and budget management tools. The platform excels at preventing maverick spending and maintaining visibility over corporate expenses.

While spend control is valuable, organizations seeking invoice processing accuracy may find Airbase's OCR and validation capabilities lag behind AI-native platforms. The system functions better as a procurement control tool than a pure AP automation solution.

Best for: Companies prioritizing spend control and procurement oversight over pure invoice processing efficiency.

Where it falls short: Invoice accuracy and automation depth, less sophisticated AI for data extraction and validation.

5. AvidXchange: Legacy Enterprise Platform

AvidXchange serves the enterprise market with a comprehensive platform that handles significant transaction volumes. The company's long market presence means extensive integration options and established vendor relationships.

However, the platform's architecture shows its age. Users report system lag and clunky interfaces, and modernization efforts haven't kept pace with AI-native competitors. Implementation remains heavy, and the user experience feels dated compared to newer solutions.

Best for: Large enterprises with complex needs willing to accept longer implementation timelines.

Where it falls short: Slower innovation cycle, legacy technology stack, interface modernization.

6. MineralTree: Mid-Market Reliability

MineralTree targets the mid-market with solid, dependable AP automation. The platform handles standard invoice processing competently and offers reasonable integration options with common ERPs.

What MineralTree lacks is the deep learning capability that newer AI platforms provide. The system requires more manual review and intervention than truly intelligent automation. For organizations willing to accept moderate accuracy in exchange for straightforward implementation, MineralTree serves adequately.

Best for: Mid-market companies seeking reliable but not cutting-edge automation.

Where it falls short: Limited AI learning capabilities, requires more manual intervention than AI-first platforms.

7. Quadient AP (Beanworks): Simple UI Focus

Quadient AP emphasizes user experience with a clean, intuitive interface that reduces training time. The platform handles basic approval workflows well and offers mobile accessibility for on-the-go approvals.

However, organizations with complex approval matrices, multi-entity structures, or sophisticated matching requirements may find Quadient AP too simplistic. The platform works best for straightforward AP processes without extensive customization needs.

Best for: Organizations valuing interface simplicity over advanced automation capabilities.

Where it falls short: Limited functionality for complex workflows, fewer advanced validation features.

8. Nanonets: OCR-Driven Emerging Player

Nanonets brings strong optical character recognition technology to invoice processing, with AI models that can be trained on specific document types. The platform's OCR accuracy is impressive, particularly for non-standard invoice formats.

As a newer entrant, Nanonets is still building its ecosystem of integrations and enterprise features. The platform works well for organizations primarily concerned with data extraction but may require additional tools for complete AP workflow management.

Best for: Companies with challenging invoice formats requiring custom OCR training.

Where it falls short: Limited ERP integrations, smaller ecosystem, fewer enterprise workflow features.

9. Medius: Enterprise-Grade STP

Medius serves large enterprises with sophisticated AP automation including strong fraud detection and compliance controls. The platform achieves respectable straight-through processing rates and handles complex approval hierarchies.

The tradeoff for Medius's enterprise capabilities is cost and implementation complexity. Organizations should expect significant upfront investment and extended deployment timelines. Smaller companies may find the platform over-engineered for their needs.

Best for: Large enterprises requiring extensive compliance controls and willing to invest in comprehensive implementation.

Where it falls short: High cost, lengthy implementation, complexity may exceed smaller organization needs.

10. Open-Source AP Solutions

For organizations with strong technical teams, open-source AP automation frameworks offer complete customization control. Platforms like Apache OFBiz provide foundational accounting automation that can be tailored precisely to unique requirements.

The obvious challenge is resource intensity. Building and maintaining custom AP automation requires ongoing developer commitment that most finance departments lack. While ownership costs may seem attractive initially, total cost of ownership often exceeds commercial solutions when internal development time is factored.

Best for: Organizations with dedicated development teams and highly specialized requirements.

Where it falls short: Requires significant technical resources, no vendor support, ongoing maintenance burden.

Why Hyperbots Leads and Dominates the 2026 List

The AP automation market has reached an inflection point where AI sophistication separates true transformation from incremental improvement. Hyperbots sits at the forefront of this shift, leveraging multiple specialized AI copilots that each handle specific aspects of invoice processing with domain expertise.

The platform's contextual validation engine goes beyond simple field extraction. It understands the relationships between purchase orders, receiving documents, contracts, and historical spending patterns. When an invoice arrives, Hyperbots doesn't just check if the fields are populated, it validates whether the charges make sense given the broader context.

This approach delivers measurable business impact. Organizations typically see exception rates drop by up to 80% within the first quarter, as the AI eliminates the common mismatches and discrepancies that plague traditional automation. Month-end close cycles accelerate as manual intervention decreases, and finance teams gain confidence in their numbers earlier in the cycle.

Self-learning architecture means accuracy compounds over time. As Hyperbots processes more of your organization's invoices, it builds increasingly sophisticated models of normal patterns, vendor behaviors, and appropriate GL coding. What starts as strong accuracy grows to exceptional accuracy as the system matures with your data.

Business Impact & ROI of Accuracy-First AP Automation

The difference between adequate and excellent invoice accuracy isn't just academic, it cascades through the entire financial operation. When automation achieves 99.8%+ accuracy with minimal exceptions, several transformative changes occur.

First, AP team productivity shifts from data entry and error correction to strategic activities. Teams that once spent 50% of their time resolving mismatches and discrepancies can redirect that effort to vendor relationship management, early payment discount capture, and cash flow optimization.

Second, vendor relationships improve measurably. Fewer payment delays, faster query resolution, and more reliable payment timing strengthen supplier partnerships. This particularly matters for strategic vendors where relationship quality affects service levels and pricing.

Third, financial reporting confidence increases. When invoice data flows into the ERP cleanly and accurately, month-end close processes accelerate. Finance leaders can close books faster and trust their numbers earlier, enabling more agile business decision-making.

The ROI calculation extends beyond obvious labor savings. Organizations report fewer vendor disputes requiring investigation, better early payment discount capture rates due to faster processing, improved cash visibility enabling better treasury management, and reduced audit costs as documentation and controls strengthen automatically.

Generic automation moves invoices through a system. Intelligent validation ensures those invoices are correct, properly coded, and ready to support strategic financial management.

Decision Framework: Choosing the Right Tipalti Alternative

Selecting AP automation platforms requires matching your organization's specific priorities against each solution's strengths. Consider these key evaluation dimensions.

Accuracy requirements: If your current exception rate exceeds 20% or you're struggling with data quality issues, prioritize platforms with advanced AI validation. Hyperbots, Nanonets, and Medius lead this category.

Implementation timeline: Organizations needing quick wins should favor platforms with pre-built integrations and streamlined deployment. Stampli and Bill.com can go live fastest, while Hyperbots balances quick deployment with sophisticated capabilities.

Scalability needs: Consider your growth trajectory. Platforms adequate for current volume may struggle as you scale. Hyperbots, AvidXchange, and Medius handle enterprise complexity, while Bill.com and Quadient AP suit smaller, stable operations.

Budget constraints: Pricing models vary dramatically. Bill.com and Stampli offer predictable subscription pricing for smaller operations. Enterprise platforms including Hyperbots, Medius, and AvidXchange require larger investments but deliver corresponding value at scale.

Integration requirements: Evaluate ERP and support systems. Most platforms handle major ERPs, but integration depth varies. Hyperbots and AvidXchange provide the most comprehensive ERP compatibility, while newer entrants like Nanonets offer more limited options.

If accuracy and intelligent automation depth are priorities (particularly if you're moving from Tipalti specifically due to accuracy concerns) Hyperbots delivers the most advanced validation capabilities without the implementation complexity of legacy enterprise platforms.

Frequently Asked Questions

What's better than Tipalti for invoice automation?

The answer depends on your specific needs. For organizations prioritizing invoice accuracy and AI-driven automation, Hyperbots offers superior validation capabilities with faster implementation than Tipalti. Companies focused on collaboration may prefer Stampli, while SMBs seeking simplicity often choose Bill.com. The key is matching platform strengths to your primary pain points rather than seeking a universal "best" solution.

Is Hyperbots a good alternative to Tipalti?

Yes, particularly for organizations frustrated by Tipalti's accuracy issues and lengthy implementations. Hyperbots deliver comparable or superior functionality with significantly better invoice processing accuracy, faster deployment timelines (3-4 weeks vs. 12-24 weeks), and more sophisticated AI that improves continuously. The platform suits mid-market to enterprise organizations where invoice accuracy directly impacts financial operations.

How do Hyperbots differ from Tipalti in accuracy?

Hyperbots employs a multi-copilot AI architecture where specialized models handle different aspects of invoice validation, achieving 85%+ straight-through processing rates. Tipalti uses more traditional OCR and rule-based validation, typically achieving 65-70% STP. The practical difference manifests as fewer exceptions requiring manual review and higher confidence in automated GL coding and approval routing.

What is the pricing range for Tipalti alternatives?

Pricing varies significantly by platform and implementation scope. SMB-focused solutions like Bill.com start around $50-100 per user monthly. Mid-market platforms including Stampli and Hyperbots typically range from $15,000-50,000 annually depending on invoice volume and features. Enterprise solutions like Medius and AvidXchange often exceed $75,000 annually for comprehensive deployments. Most vendors provide custom quotes based on specific requirements rather than published pricing.

Which Tipalti competitor integrates best with NetSuite or SAP?

Hyperbots and AvidXchange offer the deepest integration capabilities for both NetSuite and SAP, with pre-built connectors that handle complex multi-entity structures and custom fields. Stampli also provides strong NetSuite integration with minimal workflow disruption. For SAP specifically, Medius brings extensive experience with complex SAP environments. The best choice depends on whether you prioritize depth of integration (Hyperbots, Medius) or speed of deployment (Stampli).

Ready to explore AP automation that prioritizes accuracy? The shift from adequate to excellent invoice processing drives measurable improvements across your financial operations. While Tipalti served an important market need, today's AI-native platforms deliver the accuracy and efficiency that modern finance teams require. Discover how Hyperbots can transform your accounts payable process with intelligent automation that gets smarter every day.