From Rules to Reasoning: How Hyperbots’ AI Outsmarts Ramp’s Automation

Ramp automates. Hyperbots reasons. Learn how Hyperbots’ AI interprets invoices, context, and policy logic to deliver cleaner books, fewer exceptions, and smarter AP automation end-to-end.

Automation is easy to promise and hard to get right, especially in finance, where every rule has three exceptions and every exception has a CFO waiting for an explanation.

That’s where the difference between rule-based automation and reasoning AI becomes more than a tech nuance. It’s the difference between software that follows instructions… and software that actually thinks because efficiency is easy when everything is predictable, but the moment ambiguity enters the chat, rules can only take you so far. This gap between clean logic and messy operations is exactly where reasoning AI begins to shine. Hyperbots doesn’t just follow instructions, it understands the intent behind them, adapts to context, and keeps processes moving even when the variables change.

The Hyperbots vs. The Hard Truth of Ramp’s Automation

Ramp has earned a reputation for sleek UX, quick onboarding, and solid expense automation. Their platform helps finance teams with spend controls, approvals, and invoice uploads through a rules-driven workflow engine.

That part works beautifully until the data gets weird.

The cracks appear when invoices stop behaving

Ramp’s automation depends on if-this-then-that logic:

If the invoice comes from Vendor X → then assign it to Department Y.

If the amount exceeds $5,000 → then route to CFO.

If the PO number is missing → then flag for review.

It’s neat, predictable, and totally fine… until you face:

Vendor name variations (Acme Ltd., ACME Limited, Acme Global),

Unstructured PDFs with embedded tables,

Multi-entity accounting rules that change mid-quarter,

Or, let’s be honest, handwritten invoices from legacy vendors who still fax things.

At that point, Ramp’s workflow logic starts to hit hard-coded walls.

Automation rules fail silently. Exceptions pile up. Humans jump in.

That’s the not-so-secret truth behind many Ramp automation limits, it’s fast for simple tasks, but fragile when context changes.

Why Rule-Based Automation Stops Short

To understand where rule-based automation hits its ceiling, imagine teaching a robot to make coffee.

You tell it:

If it’s 8 AM, make espresso.

If it’s 3 PM, make decaf.

If someone asks for oat milk, add 30ml.

It works until someone wants a double shot with oat milk at 2:59 PM.

Now the system freezes because that exact combination wasn’t in the rules.

Ramp’s automation engine runs on the same principle: it can only handle the logic you’ve already defined. Every new vendor, every special approval condition, every formatting glitch means writing new rules.

And then you’re left with:

Endless logic maintenance,

High dependency on admins,

And a fragile automation layer that cracks under operational nuance.

That’s the core limitation of AI vs rule-based automation: one follows logic; the other learns context.

Reasoning AI: The Next Step in Automation Evolution

Hyperbots was built on a simple question:

What if finance automation could reason like an analyst, not just react like a macro?

A system that doesn’t just see patterns but understands the why behind them.

Unlike Ramp’s rule-based engine, Hyperbots uses multi-layered reasoning models trained to interpret context, correlate data, and make decisions the way experienced finance professionals do.

Here’s what that looks like in practice:

Scenario | Ramp (Rule-Based) | Hyperbots (Reasoning AI) |

Vendor name mismatch | Needs explicit rule mapping (“Acme Ltd.” = “Acme Limited”) | Recognizes vendor identity |

Missing PO or invoice number | Flags for manual review | Cross-references internal data |

Unusual payment amount | Sends for approval automatically | Checks historical spend patterns |

Multi-entity posting | Applies fixed routing | Dynamically maps to the correct entity based on GL code. |

Reasoning AI doesn’t just automate, it adjudicates.

It learns patterns, resolves ambiguity, and gets smarter with every invoice, payment, or approval cycle.

The Problem with “Automation Theatre”

Let’s call out what’s happening in most finance tech stacks today: automation theatre.

It looks like automation on the surface with shiny dashboards, instant alerts, and lots of green checkmarks. But behind the curtain, humans are quietly cleaning up OCR errors, reassigning workflows, and manually coding invoices.

Ramp’s system, while efficient for expense management, still relies on OCR-based extraction and predefined logic. That’s not “AI reasoning”; it’s just fast data entry with a rulebook.

Hyperbots breaks the act by replacing the rulebook with reasoning. It flags and explains anomalies.

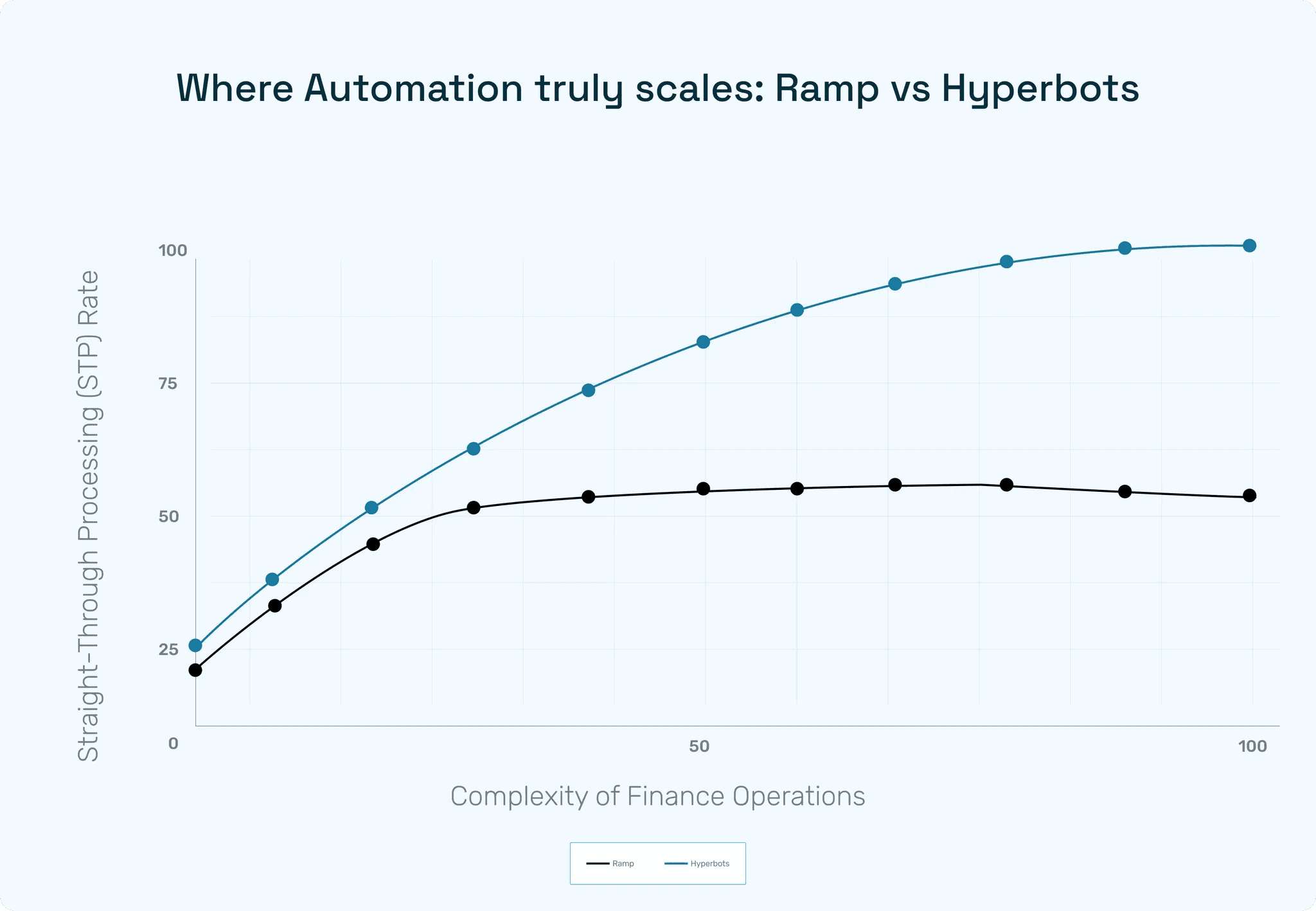

That’s how finance teams move from 50% automation on paper to 80+% straight-through processing in production.

Context is Everything (and Ramp Doesn’t Have It)

Finance data is messy and context is what makes sense of it.

When a vendor changes bank details, a rule-based system just sees a mismatch.

A reasoning AI, on the other hand, considers:

the vendor’s email domain,

recent payment history,

change timing relative to other vendors,

and whether similar changes triggered fraud flags before.

It weighs evidence like a human analyst, not a rigid flowchart and that’s why Hyperbots AI can resolve up to 80% of invoice exceptions automatically.

This leap is about cognition. The ability to understand why something happened, not just what happened.

The Maintenance Trap

One of the most expensive hidden costs in rule-based platforms is logic upkeep.

Every new vendor or policy tweak means updating rules, testing dependencies, and retraining users. Ramp users often mention needing “ongoing admin support” or “manual adjustments” to keep automation clean which is a classic sign of rule brittleness.

Hyperbots eliminates that maintenance treadmill. Its reasoning AI builds an internal “knowledge graph” of your accounting ecosystem (vendors, POs, GL codes, departments, payment histories) and uses it to reason through new inputs automatically.

Think of it as moving from a static instruction manual to a living memory that keeps learning your business.

Why Finance Needs Reasoning, Not Recipes

Automation in finance isn’t about getting tasks done faster. It’s about getting decisions made smarter.

Rules-based systems like Ramp operate like recipes: precise, step-by-step, but unable to improvise when ingredients change.

Hyperbots, built on reasoning AI, works like a chef by adapting to context, substituting intelligently, and still producing the right outcome.

That adaptability translates directly into measurable ROI:

Fewer exceptions → higher straight-through processing (STP) rates.

Less admin overhead → faster month-end closes.

More reliable data → fewer audit corrections.

This is where AI vs rule-based automation stops being theoretical and starts being financial.

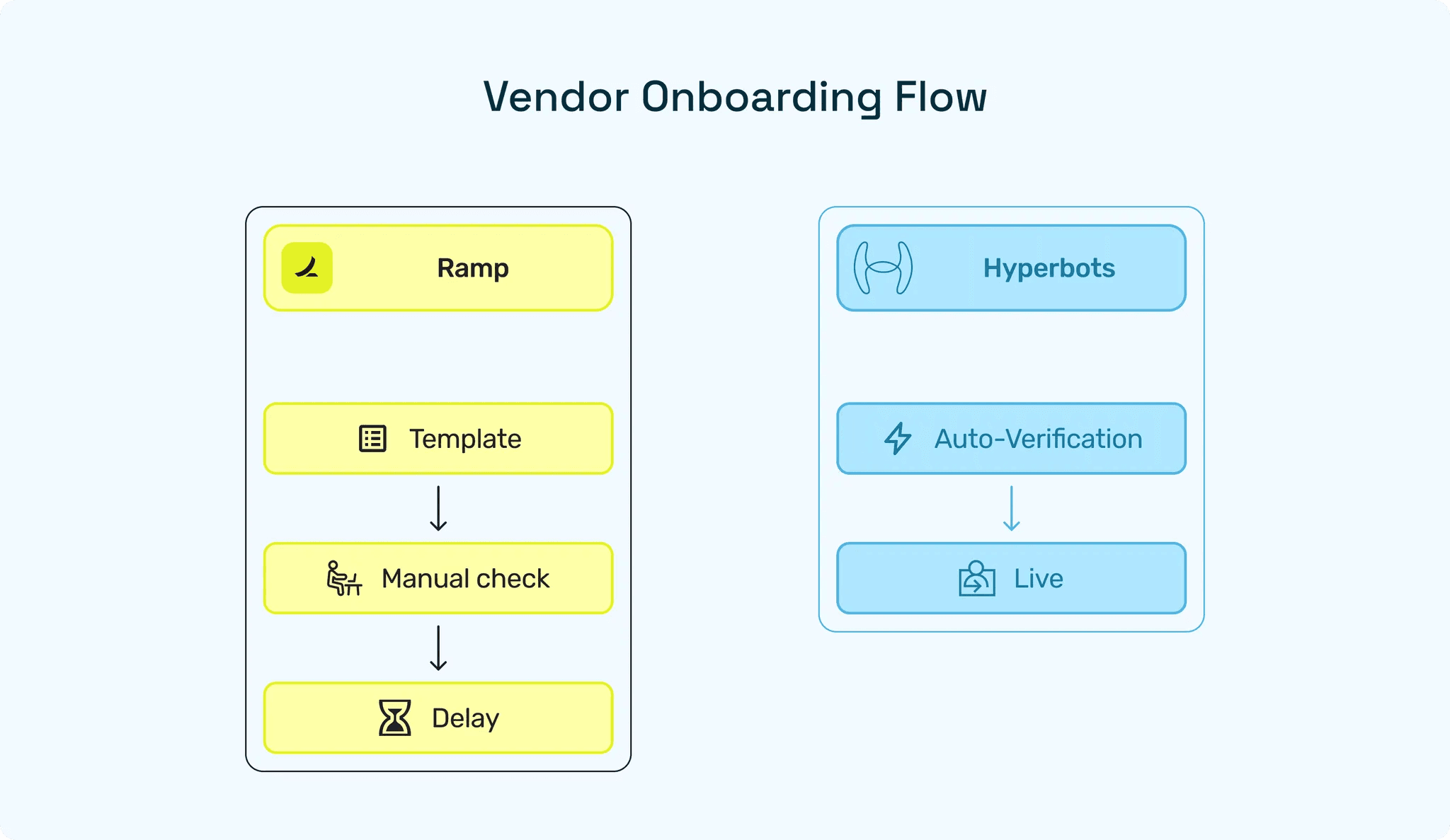

Ramp Automation Limits in Real Terms

Let’s unpack the specific Ramp automation limits finance teams hit most often in AP and expense management workflows:

Automation Aspect | Ramp Limitation | Hyperbots Advantage |

Invoice extraction | OCR-based; struggles with multi-line tables and scanned PDFs. | AI-native document understanding with 99.8% extraction accuracy on production invoices. |

Approval routing | Static rule chains; needs manual updates when org structure changes. | Predictive approval orchestration that adapts to people availability and historical routing behavior. |

Exception handling | Default to manual verification when rules don’t fit. | Contextual self-resolution like AI explains, fixes, and logs its reasoning. |

Vendor onboarding | Relies on pre-filled templates and manual verification. | Autonomous vendor validation using cross-source reasoning (email, payment, and company data). |

Learning over time | Rules stay static unless edited by admin. | Continuous feedback loop as the model improves accuracy automatically with each dataset. |

In short: Ramp’s automation is a great assistant. Hyperbots’ AI is a financial co-pilot.

When Reasoning AI Meets Real-World Complexity

Picture this:

A supplier sends a €4,500 invoice for a US project, referencing an outdated PO.

The invoice format changed last quarter.

The department manager who used to approve it is on leave.

Ramp’s logic-based workflow sees missing data, unmatched PO, and unavailable approver → flag for human review.

Hyperbots’ reasoning AI, meanwhile:

Cross-references the vendor’s tax ID to identify the correct internal vendor record.

Uses prior invoices to infer the right PO mapping.

Recognizes the currency and applies current FX rates.

Reassigns approval based on the manager’s backup policy from historical context.

End result: Invoice processed automatically with 99.8% data accuracy, zero touch required.

That’s reasoning in action which is an automation that thinks instead of just reacting.

Human-in-the-Loop (But Smarter)

Hyperbots is about making humans intervene strategically, not constantly.

When an anomaly truly requires attention, the system provides contextual explanations: why it was flagged, what alternatives were considered, and what data supports the recommendation.

That transforms human-in-the-loop into human-on-the-loop oversight, not babysitting.

Ramp, by contrast, often routes exceptions without context, leaving approvers guessing and re-checking data manually. That adds friction instead of reducing it.

ROI That Actually Moves the Needle

Finance leaders buy outcomes. Here’s how Hyperbots’ reasoning (or “Agentic”) AI delivers real, measurable ROI backed by its own data:

80% Invoice Cost Reduction

Hyperbots’ Invoice Processing Co‑Pilot achieves up to 80% straight‑through processing (STP), dramatically reducing the cost per invoice.Lightning-Fast Processing

The Co‑Pilot slashes invoice processing time from an industry average of 11 days to under 1 minute.99.8% Extraction Accuracy

Hyperbots uses a multimodal Mixture-of-Experts (MoE) model (combining large language models, vision-language models, and layout models) to deliver 99.8% data‑field extraction accuracy.Productivity & Fraud Reduction

Through intelligent duplicate detection, GL-code validation, and real-time exception resolution, Hyperbots strengthens controls while saving teams from manual rework.Integration Efficiency

Thanks to pre‑built, bidirectional ERP connectors, Hyperbots deploys faster and maintains real-time sync across systems by reducing dependency on custom integrations.

Why Reasoning AI is the Future of Finance

Rule-based systems were built for predictability. But finance isn’t predictable, it’s probabilistic.

Every month brings new vendors, currencies, entities, and conditions.

You can’t pre-write rules for every possibility.

But you can deploy a system that learns how to think.

That’s the leap from automation to autonomy from tools that do what they’re told, to tools that understand what needs to be done.

Hyperbots’ reasoning AI marks that transition. It learns, adapts, and improves to make automation durable, explainable, and contextually aware.

The Takeaway

Ramp’s rule-based automation delivers solid process efficiency but that efficiency caps out when complexity enters the chat.

Its “smart” workflows still depend on static rules, limited OCR, and human intervention to manage the gaps.

Hyperbots’ reasoning AI, on the other hand, was built to thrive in those gaps by reading nuance, resolving ambiguity, and constantly evolving.

So when you compare AI vs rule-based automation, the difference isn’t cosmetic; it’s cognitive.

Ramp automates rules.

Hyperbots automates reasoning.

And that’s how modern finance teams move from managing automation to manage outcomes.

Ready to experience the difference?

Book a Hyperbots demo and see reasoning-driven automation in action.

Frequently Asked Questions (FAQs)

1. What’s the main difference between Ramp’s automation and Hyperbots’ AI?

Ramp relies on rule-based workflows — it follows predefined logic. Hyperbots uses reasoning AI that interprets context, adapts to ambiguity, and makes decisions like a finance analyst, not a flowchart.

2. Why does rule-based automation break down in AP and finance?

Because real invoices are messy. Vendor variations, missing POs, multi-entity rules, and unstructured PDFs often fall outside predefined rules. This creates exceptions that Ramp can’t resolve automatically — but Hyperbots can.

3. How does reasoning AI improve straight-through processing (STP)?

Hyperbots analyzes vendor patterns, historical behavior, GL context, and policy logic to self-resolve exceptions. That’s how it reaches 80%+ STP, compared to rule-based tools that stall when data is imperfect.

4. Can Hyperbots explain its decisions for audit and compliance?

Yes. Hyperbots provides explainable AI — every decision comes with reasoning, context, and evidence. Ramp logs “what happened,” while Hyperbots also shows why it happened.

5. Which teams benefit most from Hyperbots over Ramp?

Organizations with complex invoices, multi-entity accounting, compliance-heavy workflows, or rapid scaling benefit the most. If your automation needs go beyond simple approvals and routing, Hyperbots’ reasoning AI delivers far deeper value.