Ramp vs Hyperbots: The Agentic AP Advantage Mid-Market Teams Need Now

Discover how Hyperbots’ Agentic AI outperforms Ramp with deeper automation, accuracy, and end-to-end AP intelligence.

Why Finance Automation Matters for Modern Teams

In the mid-market finance world, teams are under pressure to do more with less: faster month-end closes, tighter controls, real-time cash-flow visibility, and shrinking manual cost per invoice. That’s where finance automation, especially in Accounts Payable (AP), becomes critical. Enter two contenders: Ramp and Hyperbots. This blog gives finance leaders like CFOs, Controllers, and FP&A heads a clear comparison in the “Ramp vs Hyperbots” discussion. The goal is to help you decide which platform better enables intelligent, autonomous finance operations in 2025 and beyond.

Overview: Ramp - What They Offer

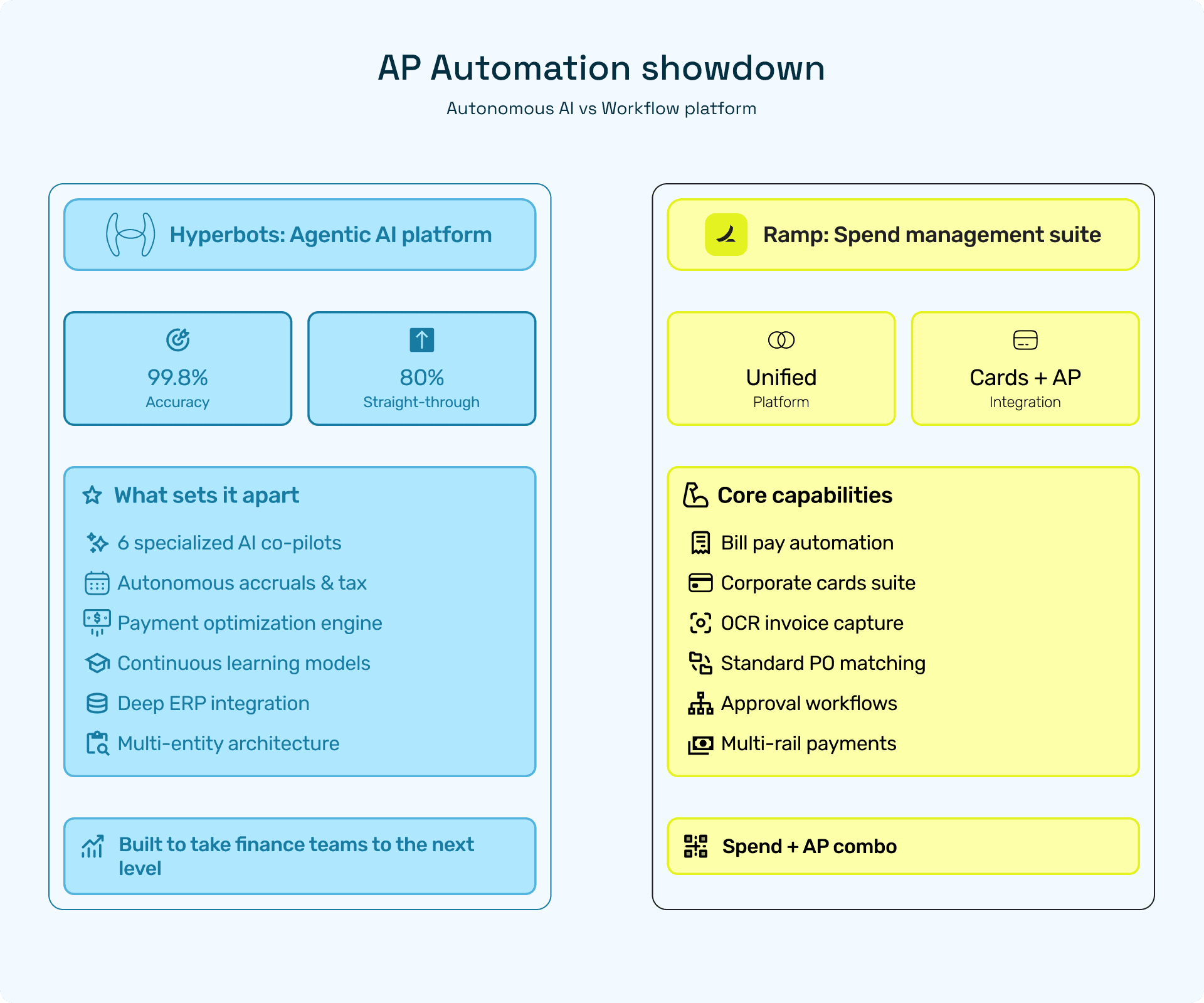

Ramp presents itself as a unified finance operations platform that spans spend management, corporate cards, vendor payments, and AP automation. On its AP front, the “Ramp Bill Pay” module automates bill-entry, approvals, and global vendor payments in one platform.

Key highlights of Ramp’s AP-automation capabilities:

Invoice Capture: Invoices can be forwarded, uploaded, or synced from the ERP; OCR drafts bills automatically.

Approvals & Bills: Custom approval flows and support for recurring bills.

PO Matching: Handles basic 2-way and 3-way matching.via its Bill-Pay module.

Vendors & Payments: Manages vendor data and supports multiple payment rails (ACH, card, wire, check).

Integrations: Syncs bills, vendors, and payments with major ERPs like NetSuite and QuickBooks.

Platform: Cloud-based, mobile-friendly, built for scale.

Positioning: Ramp is a broad spend platform with solid AP automation for coding, approvals, and payments.

Ramp is a solid spend platform with decent AP automation for mid-market teams, but it still has clear limitations, especially for deeper AP and procurement needs.

Overview of Hyperbots’ Accounts Payable Automation Co-Pilots

Hyperbots approaches Accounts Payable very differently from workflow-driven automation platforms. Instead of relying on OCR-heavy data capture and rule-based routing, Hyperbots delivers six dedicated Co-Pilots, each powered by finance-trained Agentic AI.

Together, they automate every stage of the AP lifecycle, from invoice intake to tax validation, vendor management, accruals, and final payments, while continuously learning from your finance data and ERP environment.

Where Ramp consolidates AP automation into a single Bill Pay module, Hyperbots breaks the process into specialized, intelligence-driven Co-Pilots, each designed to remove human intervention, elevate accuracy, and accelerate processing times. This modular but deeply integrated approach gives mid-market teams enterprise-grade autonomy, controls, and visibility.

Hyperbots Accounts Payable Co-Pilots: Overview & Key Capabilities

1. Invoice Processing Co-Pilot

The Invoice Processing Co-Pilot handles end-to-end invoice automation, discovering invoices across email, shared drives, and vendor portals, then validating, matching, and preparing them for ERP posting.

It automates the entire invoice lifecycle, with 80% straight-through processing (STP).

Key capabilities:

Intelligent discovery: Intelligent invoice discovery from multiple sources and filtering out non-invoice documents

Accurate Data Extraction: 99.8% field-level accuracy in data extraction(using pre-trained models on millions of invoice fields)

Duplicate prevention: Duplicate invoice detection and prevention by checking against historical entries and PO data

Data Enrichment: Automated validation and augmentation of invoice data (inferring missing/incorrect values using context and business rules).

Matching capabilities: 2-way matching between invoice and PO/GRN, 3-way matching between invoice, PO and GRN across 140+ fields

Automated GL coding: Intelligent recommender suggests GL codes based on historical invoice data and human corrections.

ERP integration: Automated posting of invoices into the ledger, with read-back validation to ensure correct entries.

2. Accruals Co-Pilot

Month-end accruals are one of the biggest bottlenecks in finance operations. Hyperbots Accruals Co-Pilot automates both recurring and ad-hoc AP-related accruals, ensuring financial statements stay accurate throughout the period.

Key capabilities:

Automated Posting: Automatically posts and books accrual journals into ERP, reducing manual work and errors.

Liability Detection: Detects accrued liabilities for goods or services received but not invoiced yet.

Recurring Accruals: Identifies recurring non-PO expenses (e.g., rent, SaaS) and creates accruals automatically.

Variance Alerts: Flags large variances between accrued and actual costs, improving AP-close accuracy.

Auto Reversals: Reverses accruals automatically when invoices post or at defined cut-offs.

Multi-Entity Assistance: Supports multi-entity and multi-ERP environments for consistent accrual operations across companies.

Audit Assurance: Generates full audit trails of accrual posting, adjustments, and reversals for compliance.

Smart GL Coding: Suggests context-aware GL codes for accruals using self-learning AI and historical data

3. Procurement Co-Pilot (PR/PO)

While not traditionally considered “AP,” procurement processes determine upstream data quality and downstream AP accuracy. Hyperbots Procurement Co-Pilot connects PR/PO seamlessly into the AP pipeline, preventing coding errors and ensuring matched, clean invoices.

Key capabilities:

Automated PR/PO creation from contracts: AI extracts details from contracts and auto-builds clean PRs/POs.

Real-time budget checks: Prevents overspend by validating budgets at the moment of PR creation.

Duplicate PR detection: Flags repeated or overlapping requisitions to avoid accidental duplicate purchases.

Configurable workflows & approvals: Custom workflows by business unit, category or cost centre to ensure compliance.

Custom fields for industry-specific workflows: Tailors PR/PO structures to sector-specific needs (manufacturing, SaaS, logistics, etc.).

Automated PO dispatch to vendors: Sends approved POs using company-specific templates without manual intervention.

Automated PO Closing: Tracks PO consumption and automatically closes POs once invoices match.

Multi-entity & multi-ERP support: Supports complex mid-market structures with unified procurement across entities and ERPs.

4. Payments Co-Pilot

Hyperbots Payments Co-Pilot transforms payments from a transactional task into a strategic finance lever. Instead of simply releasing payments, it analyses timing, risks, and vendor relationships to maximize cash-flow efficiency.

Key capabilities:

Optimised payment timing: Chooses ideal payment dates using discount opportunities, penalties, and cost-of-capital analysis.

Multi-rail payment execution: Automates payments across ACH, wires, cards, and checks without manual effort.

Fraud and anomaly detection: Identifies suspicious transactions and validates bank files before releasing vendor payments.

Real-time bank reconciliation: Matches payments to bank statements instantly for accurate AP balances and fewer exceptions.

Partial and split payments: Supports splitting invoice amounts or scheduling partial payments based on vendor terms.

Vendor payment visibility: Provides vendors with real-time payment status, remittances, and history through a dedicated interface.

Automated ERP posting: Posts all payment entries to the ERP with real-time sync and full audit trails.

Multi-entity support: Handles payments across entities with consistent rules, approvals, and control.

5. Vendor Management Co-Pilot

Hyperbots Vendor Management Co-Pilot automates vendor onboarding, verification, and lifecycle management with accuracy and compliance in mind, far beyond traditional AP vendor modules.

Key capabilities:

AI-powered vendor onboarding: Verifies W-9 forms and vendor IDs automatically.

Secure vendor information upload: Reusable portal entry, with automated format & duplicate checks.

Real-time vendor portal: Shows PO, invoice and payment status, enabling vendor self-service.

Risk & sanction screening: Vendor identity checked against authoritative sources for fraud prevention.

Multi-entity vendor management: Supports multiple business entities and ERP systems in a unified workflow.

Audit-ready vendor records: Comprehensive logs of onboarding, changes, approvals and vendor lifecycle actions.

6. Sales Tax Verification Co-Pilot

A major gap in most AP systems, including Ramp, is tax accuracy at the line-item level. Hyperbots fills this gap with an intelligent Sales Tax Verification Co-Pilot that prevents over- or under-charged sales tax and reduces audit exposure.

Key capabilities:

Line-item tax extraction & validation: The Co-Pilot reads each invoice line and verifies the correct tax category, rate and amount.

Nexus & jurisdiction mapping: Determines origin and destination addresses to apply the correct tax jurisdiction automatically.

Live tax-dictionary integration: Links to live state/county/city tax rules to ensure real-time tax accuracy.

Real-time mismatch alerts: Flags vendor over-/under-charged tax items before payments or filings are processed.

Compliance-ready audit trail: Maintains full timestamped logs of every decision, adjustment and tax validation for audits.

How These Co-Pilots Work Together

What sets Hyperbots apart is not just the depth of each Co-Pilot, but the coordination between them. Invoice Processing feeds Vendor Management and Tax Verification automatically. Procurement Co-Pilot streamlines matching. Accruals Co-Pilot closes the books with precision. Payments Co-Pilot executes timing-optimized disbursements.

The result is a fully autonomous AP engine, with real-time intelligence across AP, AR, and FP&A, and an accuracy and compliance layer built directly into the workflow. It’s the AP environment mid-market teams have been trying to build manually, finally delivered through Agentic AI.

Feature-by-Feature Comparison: Ramp vs Hyperbots

This is a detailed side-by-side comparison of AP automation capabilities to help mid-market finance teams evaluate:

Feature / Capability | Ramp | Hyperbots |

AI / Automation Type | OCR + AI suggestions (invoice capture, coding) for near full automation. | Agentic AI platform built for Finance & Accounting: pre-trained models, continuous learning, end-to-end Co-Pilots. |

Integrations / ERP Sync | Integrates with major ERPs (NetSuite, QuickBooks, Xero), real-time sync of bills & payments. | Seamless ERP/Accounting integration across multiple ERPs such as SAP B1, Oracle NetSuite, QuickBooks, Microsoft Business Central, SAP S/4 Hana and many more; read-back validations and GL posting automation. |

Learning & Adaptation | Agents learn from historical data and reasonable coding accuracy | Models pre-trained on 35 million+ invoice fields achieve 99.8% accuracy, improving with every workflow. |

Compliance, Accuracy & Controls | Strong control environment: vendor data capture, audit trails, PO matching. Some user feedback notes limitations in complex scenarios. | Built-in line-item tax verification, duplicate detection, full audit-ready trails, and multi-entity readiness. |

Decision Intelligence / Payment Optimisation | Supports batch payments, multiple rails, and scheduling; less emphasis on payment-timing optimisation or vendor risk analytics. | Payments Co-Pilot handles payment-timing analytics (early discounts vs cost of capital), fraud detection, and reconciliation. |

Scope of AP Lifecycle Coverage | Covers essential AP processes such as invoice capture, approvals, payments, and vendor records. | Extends beyond AP: invoice-to-payment, vendor-management, tax-verification, procurement alignment, and accruals. |

Scalability & Mid-Market Fit | Good for small and mid-market teams; the breadth of modules helps smaller finance teams. | Designed for scale with unlimited user access, multi-entity/multi-ERP support, and deep F&A focus. |

Where Hyperbots Stands Out

As you evaluate “Ramp vs Hyperbots” through the lens of a mid-market finance leader, here are the key areas where Hyperbots differentiates itself:

Agentic AI built specifically for Finance & Accounting: Unlike a general automation or spend-platform, Hyperbots is designed from the ground up for F&A tasks (invoice processing, accruals, procurement, payments, vendor, tax). Its pre-trained models and finance focus mean higher automation depth.

End-to-end lifecycle coverage: Hyperbots doesn’t stop at invoice capture or payments; it covers vendor onboarding, tax verification (even line-item), accruals and even procurement alignment. This breadth empowers the finance team, rather than just the AP clerks.

Advanced decision intelligence: The Payments Co-Pilot provides strategic input: when to pay, how to optimise vendor relationships, fraud detection, all elevating AP from cost centre to strategic enabler.

High accuracy and minimal exceptions: With 99.8% field extraction accuracy and up to 80% straight-through-processing (STP) on invoices, Hyperbots dramatically reduces manual intervention.

Compliance and tax depth: The Sales Tax Verification Co-Pilot checks each invoice line item for jurisdictional tax accuracy, economic nexus triggers, and possible vendor over-/under-charging. For mid-market firms facing audit risk, this is a big plus.

Scalable licensing/architecture for growth: Unlimited-user access, no per-seat licensing, support for multiple entities and ERPs means Hyperbots is built with growth in mind, important for finance teams that scale fast.

Why Choose Hyperbots Over Ramp?

Mid-market finance/accounting teams can benefit from incorporating Hyperbots into their finance workflows:

Efficiency & Cost Reduction -

Hyperbots delivers significantly deeper automation than typical workflow tools. With 80% straight-through processing and 99.8% extraction accuracy, most invoices move from ingestion → coding → matching → posting with almost zero human touch.

Where traditional AP cycles take 11 days, Hyperbots brings this down to under a minute, letting teams reallocate time to analysis, vendor strategy, and month-end accuracy, not manual entry.

Scalability & Growth-Readiness -

For mid-market companies dealing with multi-entity structures, complex ERPs, growing vendor ecosystems, or rising invoice volumes, Hyperbots is built for scale.

The platform supports multi-entity, multi-ERP, and global vendor operations without the heavy licensing or configuration burden common with spend platforms. As your business expands, automation depth absorbs the complexity (not headcount).

Continuous Learning & Intelligence -

Instead of static rules, Hyperbots’ Agentic AI adapts as your business evolves. It learns from exceptions, human corrections, vendor patterns, tax rules, accrual behavior, and PO structures, getting smarter every month.

This transforms AP from a rule-driven workflow into an intelligence-driven function that proactively prevents errors, fills missing data, recommends GL codes, and self-corrects.

Control, Accuracy & Compliance -

Mid-market teams face increasing pressure around audits, tax accuracy, vendor compliance, and internal controls. Hyperbots embeds precision at every step, line-item tax verification, vendor onboarding checks, PO/GRN matching across 140+ fields, audit-ready logs, and read-back ERP validation.

The result: fewer surprises at month-end and a far stronger compliance posture.

Conclusion

Ramp is a good option, especially for teams that want a unified spend + cards + AP platform with straightforward workflows. But for finance leaders aiming for true autonomous finance operations rather than surface-level digital enablement, Hyperbots offers far more depth.

Built specifically for F&A, Hyperbots provides an Agentic AI platform with broad Co-Pilot coverage across AP, invoice processing, procurement, accruals payments, vendor management, and sales tax verification. The result is a workflow that’s not just faster, but fundamentally smarter, more accurate, and easier to scale.

Choosing Hyperbots means moving from “automated tasks” to autonomous operations, where AP becomes a strategic value driver, not a bottleneck.

Ready to take finance to the next level? Explore how Hyperbots is redefining modern AP automation at hyperbots.com and see it live in action.