Ramp Invoice Processing vs Hyperbots: Who Wins on Speed, Accuracy, and STP?

Discover how Hyperbots outperforms Ramp with faster processing, higher accuracy, and autonomous STP execution.

Finance Automation Is No Longer Optional

Modern finance teams aren’t struggling because of a lack of tools; they’re buried under manual effort. Even with ERP systems and workflow automation platforms, controllers and finance managers still chase approvals, validate GL codes, reconcile mismatched POs, and fix invoice errors at month-end.

That’s why finance automation, and more specifically, invoice processing automation, has become a priority for mid-market organizations. The shift isn’t from paper to digital. It’s from automation to autonomy.

Two players are often compared in this space: Ramp, known for spend management and AP automation, and Hyperbots, an Agentic AI platform built specifically for Finance & Accounting, spanning AP, AR, and real-time FP&A intelligence.

In this blog, we break down Ramp invoice processing vs Hyperbots Invoice Processing Co-pilot, and answer the key question: Who wins on speed, accuracy, and straight-through processing (STP)?

What Ramp Offers: AP Automation With Invoice Capture & OCR

Ramp positions its accounts payable automation as an easy way to digitize AP workflows. They have capabilities like:

AI-powered invoice capture & OCR:

Ramp uses AI-powered invoice capture to automatically extract vendor information, invoice number, amount, and due date, minimizing manual data entry and transcription errors.2-way / 3-way matching (PO + Invoice + Receipt):

Ramp supports structured invoice matching workflows. It automatically compares invoice data against purchase orders and goods receipts to ensure what was ordered matches what was received and billed.Automated approval routing via digital workflow:

Ramp includes rule-based routing that sends invoices to the correct approver, reducing delays and eliminating back-and-forth emails. Approvers can review and approve from any device.ERP sync, particularly with NetSuite for GL posting:

Ramp integrates with ERPs like NetSuite to sync invoices and accounting details, reducing duplicate entry and enabling faster reconciliation and GL posting.Centralized invoice visibility, from receipt through payment:

Ramp provides a single dashboard for invoice intake, status tracking, and payments, helping finance teams easily monitor which invoices are pending, approved, or paid.Analytics & audit logs that help maintain compliance:

Ramp automatically tracks actions taken on invoices, updates, approvals, and coding changes, enabling audit readiness and ensuring process transparency during reviews.End-to-end automation of invoice lifecycle:

Ramp automates invoice processing from receipt → validation → approval → payment scheduling. This reduces touchpoints, making invoice handling faster and less error-prone.

Ramp highlights that using AP automation and OCR reduces cycle time “from days or weeks to minutes,” improving AP automation productivity and reducing backlogs caused by manual data entry.

Ramp is especially strong at:

Spend controls and approvals - Tightly connects invoice spend to budgets & card transactions

Corporate cards + AP + payments - Invoice processing sits inside a broader spend management suite

Digitizing AP quickly - Ideal for teams shifting from spreadsheets or email-based approvals

Who it serves: Ramp mainly benefits finance teams who want to digitize AP workflows, reduce manual work, and introduce automation without major change management.

However, Ramp mainly focuses on automation of tasks, not autonomous decision-making.

Ramp’s automation still requires user intervention:

Finance teams approve, validate exceptions, correct mismatches

OCR extracts data, but doesn’t always resolve complex invoice logic

No published accuracy rates or autonomously generated GL coding

Ramp is automation, not execution.

Hyperbots Invoice Processing Co-pilot: Built for Autonomous Finance

Hyperbots takes a fundamentally different approach: instead of simply assisting invoice processing, its Invoice Processing Co-pilot executes the entire workflow end-to-end - shifting finance teams from manual oversight to strategic oversight.

From the moment an invoice arrives, the Co-pilot offers:

Invoice discovery across email, shared drives, and vendor portals -Hyperbots automatically finds invoices from emails, shared folders, and vendor portals, filters irrelevant documents, and separates true invoices from noise, eliminating manual collection efforts and invoice chasing.

Extraction of 140+ fields with 99.8% accuracy - Using Agentic AI combining vision-language models and reasoning engines, Hyperbots extracts 140+ invoice fields - including line-item detail, tax components, and item descriptions, achieving 99.8% data accuracy, far beyond traditional OCR.

Performs 2-way & 3-way matching using reasoning AI - The Co-pilot performs dynamic 2-way and 3-way matching across PO, invoice, and goods receipt, reasoning across 140 fields, flagging mismatches, and offering explanations before posting into the ERP.

Suggests and posts GL codes directly into the ERP - Hyperbots automatically determines correct GL codes using learned patterns from previous transactions, posts to ERP, then performs read-back validation to ensure error-free posting without manual intervention.

Detects duplicates and fraud - The platform checks historical invoice patterns, PO links, and vendor metadata to proactively detect duplicates or suspicious invoice activity, reducing risk exposure and preventing accidental or fraudulent payments.

Processes invoices end-to-end without human intervention - Hyperbots delivers 80% straight-through processing (STP), processing most invoices from receipt to ERP posting without human involvement, drastically reducing cycle time and removing approval bottlenecks.

Sub-one-minute processing speed - from email to ERP posting - Invoices are fully processed in under sixty seconds, transforming AP from task-based automation into autonomous execution - enabling finance teams to handle scale without increasing headcount.

Hyperbots achieves 80% Straight-Through Processing (STP) - meaning no manual touch from invoice to ERP posting. Hyperbots is not just automation, not just OCR. It is Agentic AI built for Finance & Accounting.

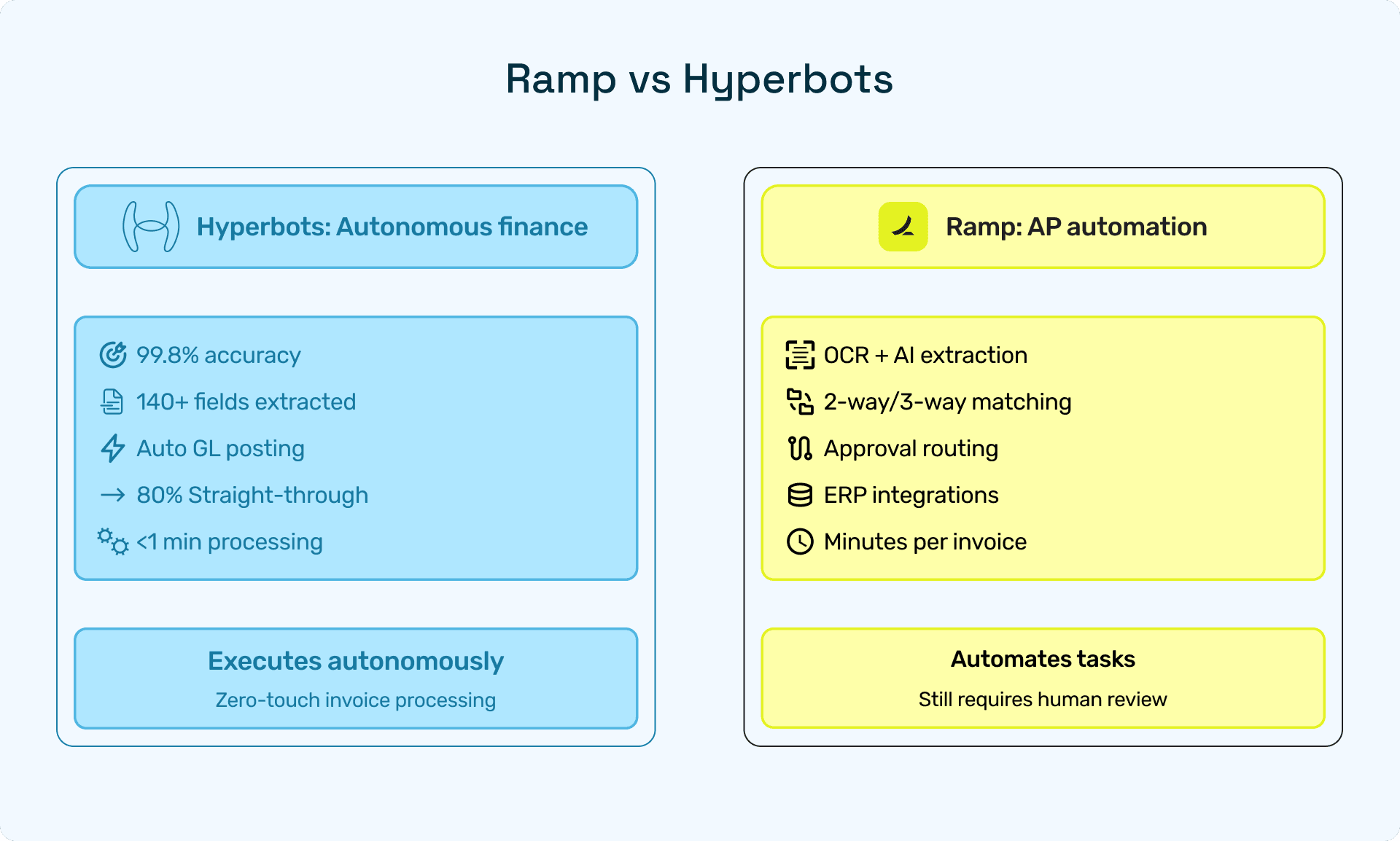

Feature-by-Feature Comparison

Side-by-Side Matrix - Ramp vs. Hyperbots

Category | Ramp Invoice Processing | Hyperbots Invoice Processing Co-pilot |

AI Type | OCR + automation | Agentic AI + vision-language + reasoning models |

Invoice capture | AI + OCR extracts basic info | Extracts 140+ fields, industry-specific, line-item reasoning |

Speed | Minutes per invoice | < 1 minute from email → GL posting |

Straight-Through Processing (STP) | Automation helps, but STP% not published | 80% STP, end-to-end zero-touch |

Accuracy | OCR + AI (no published accuracy metric) | 99.8% field accuracy, fraud + duplicate detection |

ERP integration | Syncs with NetSuite and others | Deep ERP read/write, validates posting via read-back Integration with several ERPs such as SAP B1, Oracle NetSuite, QuickBooks, Microsoft Business Central, SAP S/4 Hana and many more |

Learning & adaptation | Rules + workflow automation | Continuous learning across AP, AR, and FP&A workflows |

Compliance & auditability | Audit logs, approval trails | Full audit trail, configurable matching rules, and fraud detection |

Decision intelligence | Confirmation-based automation | Autonomous decisioning (e.g., GL coding, matching tolerances) |

Where Hyperbots Stands Out

1. Speed: <1 Minute Invoice Processing (Hyperbots wins on speed)

Ramp speeds up AP by reducing manual touchpoints and routing delays, claiming invoices can be processed “within minutes.”

Hyperbots eliminates the steps entirely, invoices flow from email to ERP posting in under 60 seconds, achieving end-to-end execution instead of workflow automation. There is no queue or routing delay. Finance automation becomes touchless execution.

2. Accuracy: 99.8% Field-Level Precision (Hyperbots wins on accuracy)

Ramp extracts invoice data using OCR and automation, but does not publish accuracy metrics for field-level extraction.

Hyperbots combines vision-language models + expert systems + reasoning engines, capturing 140+ fields at 99.8% accuracy, including line-level invoice data, taxes, freight, and non-standard invoice formats.

3. Straight-Through Processing (STP): 80% Invoices With Zero Touch

Ramp improves efficiency, invoices move faster, but still require approvals, GL confirmation, and user review.

Hyperbots achieves up to 80% straight-through processing (STP).

STP means:

No human touch

No routing delays

No exceptions unless required

No waiting for someone to code the GL

Finance teams can move from assisted automation → autonomous execution.

4. Agentic AI Across the Finance Stack

Ramp is primarily an AP automation + spend management platform.

Hyperbots is not an AP tool. Hyperbots is a Finance & Accounting automation system, covering AP (Invoice Co-pilot, PR/PO Co-pilot, Payments), AR/Collections, Vendor identity checks, Accruals, and real-time FP&A insights.

The platform continuously learns from past actions and adapts policy, matching logic, GL coding, and approvals, without requiring rules to be manually adjusted.

Why Choose Hyperbots Over Ramp

Benefit | Ramp | Hyperbots |

|---|---|---|

Eliminates manual effort | ✅ Reduces effort | ✅ Eliminates effort (autonomous execution) |

Accuracy confidence | Approvals required | 99.8% certainty → posts to ERP autonomously |

Scaling AP without headcount | Possible | Guaranteed via STP automation |

Real-time finance intelligence | Limited | Integrated across AP + FP&A + accounting |

Hyperbots turns finance teams from process owners into decision-makers.

Conclusion

For mid-market finance leaders evaluating AP automation options, Ramp is a strong choice for digitizing workflows and improving invoice management. It brings structure, visibility, and efficiency to the AP process.

But most finance leaders today are no longer satisfied with efficiency. They want the elimination of manual effort, not just reduction.

If your goals include:

Eliminating manual invoice processing, not just routing invoices faster

Reducing approvals, routing delays, and exceptions, instead of managing them

Closing the books faster, without waiting for invoices to be coded, approved, and reconciled

Redirecting the team to high-value work, instead of invoice firefighting

Then Hyperbots is the clear winner. Unlike Ramp, which automates steps in the process, Hyperbots removes the process from your workload.

Ramp’s strength is the automation of AP tasks and digitization of invoice workflows.

Whereas Hyperbots’ strength is the execution of AP invoice outcomes, removing invoice processing tasks entirely from your to-do list.

Hyperbots doesn’t just automate invoices. It makes invoice processing autonomous.

👉 Explore how Hyperbots is redefining finance workflows with the Invoice Processing Co-Pilot and see it live in action.