From Spend Control to Finance Automation: Why Ramp Stops Where Hyperbots Starts

Where Ramp focuses on limits and controls, Hyperbots delivers real automation, removing manual work from every finance workflow.

The Comparison Everyone Thinks - But No One Writes Down

Here’s the truth: Ramp is great at one thing - making spend management look modern. It gives you slick corporate cards, neat spend limits, real-time alerts, and receipt reminders that are passive-aggressive in the nicest way possible. It’s a good tool… for what it does.

But after a few months, most finance teams reach the same painful realization:

Ramp tells you what happened.

Hyperbots does the work for you.

Invoices? Still manual.

GL coding? Still manual.

Vendor checks? Still manual.

Matching? Still manual.

Approvals? Still manual.

Reconciliation? Oh, absolutely still manual.

This is exactly why so many leaders search for Ramp alternatives. Finance functions today aren’t craving prettier dashboards - they’re craving automation. The kind McKinsey highlights as a top driver of finance productivity and cycle-time reduction (McKinsey Intelligent Process Automation).

Hyperbots is not a spend-control tool. Hyperbots is a finance automation platform that uses multi-agent AI to execute full P2P, AP, matching, reconciliation, vendor intelligence, and GL operations - not just organize them.

Simply put: Ramp gives you oversight. Hyperbots gives you outcomes.

Why Finance Teams Quickly Outgrow Ramp

Ramp is a fantastic start for organizations that want to issue cards and tighten spending discipline. It centralizes transactions, gathers receipts, and makes expense reporting less painful. But modern finance leaders know that spend control represents only 5–10% of their operational workload.

The heavy lifting lives elsewhere:

vendor onboarding

invoice interpretation

PO workflows

approval routing

tax checks

2-way / 3-way matching

contract validation

accruals

ERP reconciliation

audit trails

payment optimization

This is where Ramp’s capabilities flatline.

Automation is no longer optional - it’s a core pillar of finance transformation, as Deloitte outlines in its research on the future of digital finance (Deloitte Automation in Finance). Visibility alone doesn't solve problems. Execution does.

And this is the philosophy Hyperbots is built on.

Hyperbots doesn’t help finance teams manage work - it helps them stop doing the work manually altogether.

Where Ramp Stops - and Hyperbots Begins

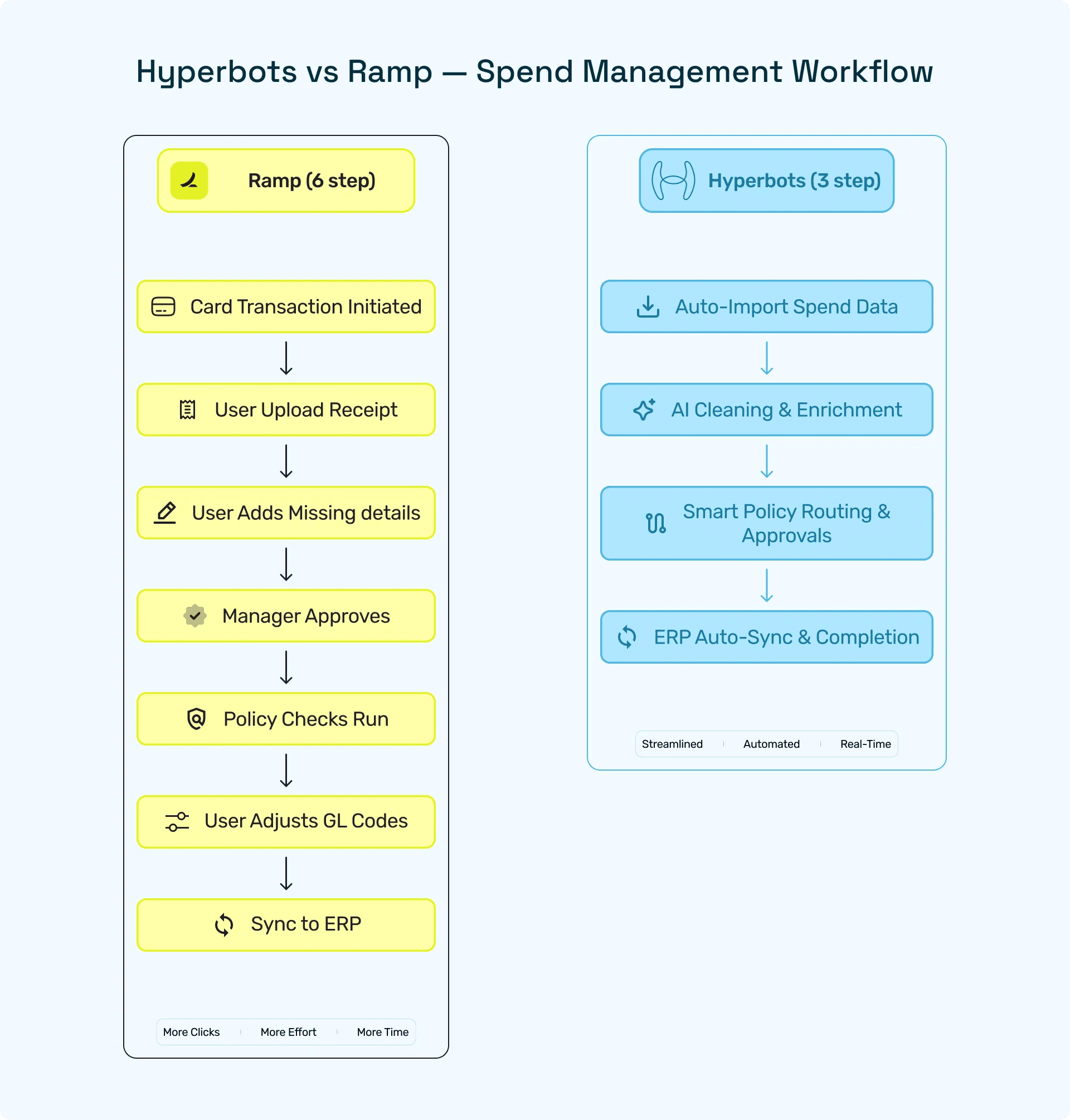

Ramp is built as a spend control system. Cards → limits → alerts → receipts → reports.

Useful? Yes.

Sufficient? No.

Hyperbots is built for operational finance - the part that actually consumes time, cost, and accuracy.

To illustrate the difference:

In Ramp:

You get visibility, some OCR, and a to-do list.

In Hyperbots:

You get a network of finance-trained agents that:

read invoices intelligently

match them to POs and GRNs

verify tax lines

assign accurate GL codes

check vendor payment terms

apply policies

resolve exceptions

route for approvals

sync perfectly to the ERP

Ramp provides structured inputs.

Hyperbots provides completed workflows.

Ramp vs Hyperbots - The Real Comparison

Ramp handles spend oversight.

Hyperbots handles the finance engine.

Gartner’s research on IDP explains why OCR and rule-based extraction cannot scale to enterprise financial operations. Hyperbots bypasses these limitations by using reasoning-based AI agents.

Here’s how the difference plays out in reality:

Ramp: Spend Management and Expense Control

Ramp is fundamentally focused on empowering financial teams to manage spending and expenses from the point of purchase. Its core offerings are designed to provide control and visibility over employee-initiated spending:

Financial Control Tools:

Card issuance for employees and departments.

Pre-set spend controls to limit transactions.

Tools for setting and tracking budgets.

Employee Workflow Tools:

Automated expense reporting and receipt capture.

Seamless reimbursement tools for out-of-pocket spending. Hyperbots takes a much deeper, system-centric approach, aiming for complete automation and transformation across the entire Finance & Accounting (F&A) function. It extends far beyond the expense card to fully automate complex workflows like Procure-to-Pay (P2P) and month-end closing, acting as an intelligent layer over the ERP:

Hyperbots: Agentic Finance Process Automation

Hyperbots takes a much deeper, system-centric approach, aiming for complete automation and transformation across the entire Finance & Accounting (F&A) function. It extends far beyond the expense card to fully automate complex workflows like Procure-to-Pay (P2P) and month-end closing, acting as an intelligent layer over the ERP:

1. Deep Procure-to-Pay Automation

Hyperbots drives true straight-through processing across the entire P2P cycle:

Requisitions & PO Management

Autonomous requisition drafting based on demand, policy limits, and historical vendor patterns.

Intelligent PO creation, routing, and approval orchestration.

Policy-aware budget checks, vendor recommendations, and risk flags.

Invoice Automation

End-to-end invoice handling: ingestion → extraction → validation → posting.

Self-learning models for line-level and header-level data accuracy.

Handling of complex invoices (multi-entity, multi-currency, multi-tax).

Matching & Reconciliation

Advanced 2-way, 3-way, and N-way matching with tolerance rules.

Automated exception identification and resolution, with agent-based reasoning.

Vendor Intelligence

Continuous vendor scoring, reliability assessment, and risk analysis.

Duplicate vendor detection and master-data cleansing agents.

2. AI-Native Financial Intelligence & Compliance

Hyperbots embeds compliance into every step of execution:

Multi-agent validation for document integrity, fraud signals, and supporting evidence checks.

Autonomous policy interpretation that evaluates exceptions contextually — not through static rules.

Automated tax determination, validation, and jurisdiction-specific logic.

Context-driven approvals based on amount, category, GL budget, history, and risk.

Highly accurate AI-powered GL coding at both header and line level.

Enforcement of controls, auditability, segregation-of-duties, and version tracking.

3. ERP-Ready Posting & Month-End Close Automation

Hyperbots integrates deeply with ERP systems and supports finance teams through the close cycle:

ERP-Grade Outputs

Produces clean, validated, audit-ready journal entries.

Standardized outputs aligned to ERP schemas, chart of accounts, and entity structures.

Month-End Close

Automatic creation of accruals, amortizations, and adjustments.

Intelligent cutoff testing and completeness checks.

Continuous anomaly detection across transactions, vendors, and ledgers.

Identification of duplicate entries, outliers, and mispostings.

Intercompany & Allocations

Automated intercompany matching and settlement.

Dynamic cost allocation rules powered by AI pattern recognition.

4. Workflow, Collaboration & Decision Automation

Hyperbots acts as a collaborative execution engine:

Multi-step workflow orchestration across humans, systems, and agents.

Smart notifications, decision suggestions, and risk explanations.

Automatic generation of reasoning logs, audit trails, and compliance evidence.

Ability to simulate policy changes and forecast process outcomes.

5. Data, Reporting & Continuous Monitoring

A constant intelligence layer runs across all finance operations:

Real-time risk monitoring, anomaly alerts, and trend analysis.

Automated reconciliation checks across subledgers.

Proactive surfacing of cash flow insights, spend patterns, and vendor risks.

6. Platform & Integration Capabilities

The system-centric foundation that makes Hyperbots unique:

Deep, bi-directional ERP integration (Oracle, SAP, Netsuite, Workday, etc.).

Cross-system data stitching: procurement tools, banks, tax engines, analytics, and more.

Multi-agent reasoning framework with explainability for each decision.

Secure, enterprise-grade deployment with full auditability and controls.

In essence, Ramp helps finance control spending at the source, while Hyperbots helps finance automate, validate, and close the entire accounting lifecycle.

Ramp keeps track.

Hyperbots keeps operations running.

Feature-by-Feature Comparison

Feature | Ramp | Hyperbots |

Card management | Excellent | Not the focus |

Invoice automation | Basic OCR | Intelligent multi-agent IDP |

3-way matching | Not available | Fully autonomous |

Vendor scoring | None | AI-powered |

GL coding | Rules-based | Contextual reasoning |

Tax validation | Minimal | AI-based |

Approvals | Simple | Policy-aware routing |

ERP integration | Standard | Deep, intelligent, contextual |

Automation impact | Low | Transformational |

Why Hyperbots is the #1 Ramp Alternative

If companies needed only spend visibility, Ramp would be the entire story. But most organizations quickly realize their operational pain lives outside of card transactions. Hyperbots solves the problems that actually matter - the ones that drive accuracy, cost, cycle time, and compliance. This is why Hyperbots is widely viewed as the #1 Ramp alternative.

Unlike Ramp’s card-first architecture, Hyperbots is a finance AI automation engine engineered for complexity. It doesn’t assist analysts; it replaces repetitive analyst-level work through finance-trained AI agents that reason, compare, match, validate, code, and reconcile across systems and documents.

Here’s why finance teams inevitably upgrade from Ramp to Hyperbots:

1. Hyperbots eliminates work - Ramp organizes it

Ramp makes processes cleaner.

Hyperbots makes processes autonomous.

Hyperbots handles:

invoice ingestion

PO routing and validation

2-way, 3-way, and N-way matching

GL coding and account logic

tax checks and compliance mapping

vendor scoring and anomaly detection

approval routing

ERP postings

payment timing optimization

month-end accrual estimation

Ramp simply doesn’t operate here.

2. Hyperbots’ multi-agent AI makes real decisions

Ramp’s OCR extracts text.

Hyperbots’ agents interpret documents like humans.

This is why Hyperbots achieves 99.8% straight through processing accuracy versus Ramp’s manual review requirements.

3. Hyperbots integrates deeply into ERPs

Ramp pushes card and reimbursement data.

Hyperbots:

reads ERP metadata

mirrors structures

ensures compliance

flags inconsistencies

syncs both ways

This eliminates reconciliation headaches.

4. Hyperbots provides vendor, tax, and policy intelligence Ramp does not offer

Hyperbots checks whether invoices match contracts, rates, terms, and tax rules - insights finance teams never get from Ramp.

5. Hyperbots delivers ROI across the entire finance org — not just card spend

McKinsey notes automation can improve finance productivity, and Hyperbots aligns perfectly with these gains (McKinsey: Future of Automation).

Ramp saves time on expenses.

Hyperbots saves time everywhere.

Conclusion - Hyperbots Isn’t Just an Alternative. It’s the Upgrade.

Choosing between Ramp and Hyperbots isn’t a competition - it’s a clarity exercise. Ramp solves card spend beautifully. It simplifies reimbursements and embeds strong controls. But finance functions today aren’t struggling with card swipes; they’re struggling with manual AP tasks, lengthy approval cycles, invoice exceptions, tax variations, mismatches, and ERP reconciliation errors.

Ramp improves visibility.

Hyperbots improves operations.

Hyperbots is designed to eliminate exactly the kind of repetitive, error-prone work that slows down finance teams. It doesn’t add structure around your workflow - it becomes the workflow. With deep AI-driven validation, matching, coding, approvals, and reconciliation, Hyperbots delivers the type of automation that Deloitte identifies as the backbone of next-generation finance teams.

When organizations switch to Hyperbots, they consistently gain:

Faster cycle times

Dramatically fewer manual interventions

Higher coding accuracy

Cleaner ERP data

Stronger vendor relationships

Proactive insight instead of reactive firefighting

A finance backbone that scales automatically

If you want a card program, Ramp is enough.

If you want true automation, real accuracy, and a future-ready finance function, Hyperbots isn’t just the better choice - it’s the necessary one.

To explore what automation looks like in your workflows, talk to our team of experts: https://www.hyperbots.com/request-demo

Hyperbots doesn’t replace Ramp.

Hyperbots replaces the work.

FAQs

1. What is the best Ramp alternative for finance automation?

A: Hyperbots is the top Ramp alternative because it automates the full procure-to-pay and AP lifecycle - including invoice processing, 3-way matching, GL coding, vendor checks, and ERP posting - areas where Ramp does not offer automation. Hyperbots goes far beyond spend control by providing true finance AI and end-to-end workflow execution.

2. How is Hyperbots different from Ramp?

A: Ramp focuses on card spend, limits, and expense management, while Hyperbots automates entire finance operations. Hyperbots uses multi-agent finance AI to perform tasks like coding, matching, approvals, compliance checks, and reconciliations automatically. Ramp shows you spend; Hyperbots completes the work behind it.

3. Does Hyperbots support invoice automation and 3-way matching?

A: Yes. Hyperbots offers autonomous invoice capture, validation, and 2-way/3-way/N-way matching - powered by reasoning-based AI. This eliminates manual verification and significantly reduces cycle time. Ramp does not support 3-way matching.

4. Does Hyperbots integrate with ERPs like NetSuite, SAP, Oracle, Dynamics, and QuickBooks?

A: Absolutely. Hyperbots provides deep, bi-directional ERP integrations, syncing clean, validated data back into your system of record. It understands ERP structures and accounting logic, not just basic push/pull transactions.

5. Is Hyperbots only for large enterprises?

A: No, Hyperbots is used by mid-market and enterprise companies, but its modular design makes it accessible even for teams that want to automate one workflow at a time (AP, P2P, matching, etc.). Ramp is suited for smaller teams focused mainly on spend management, while Hyperbots is built for operational automation.