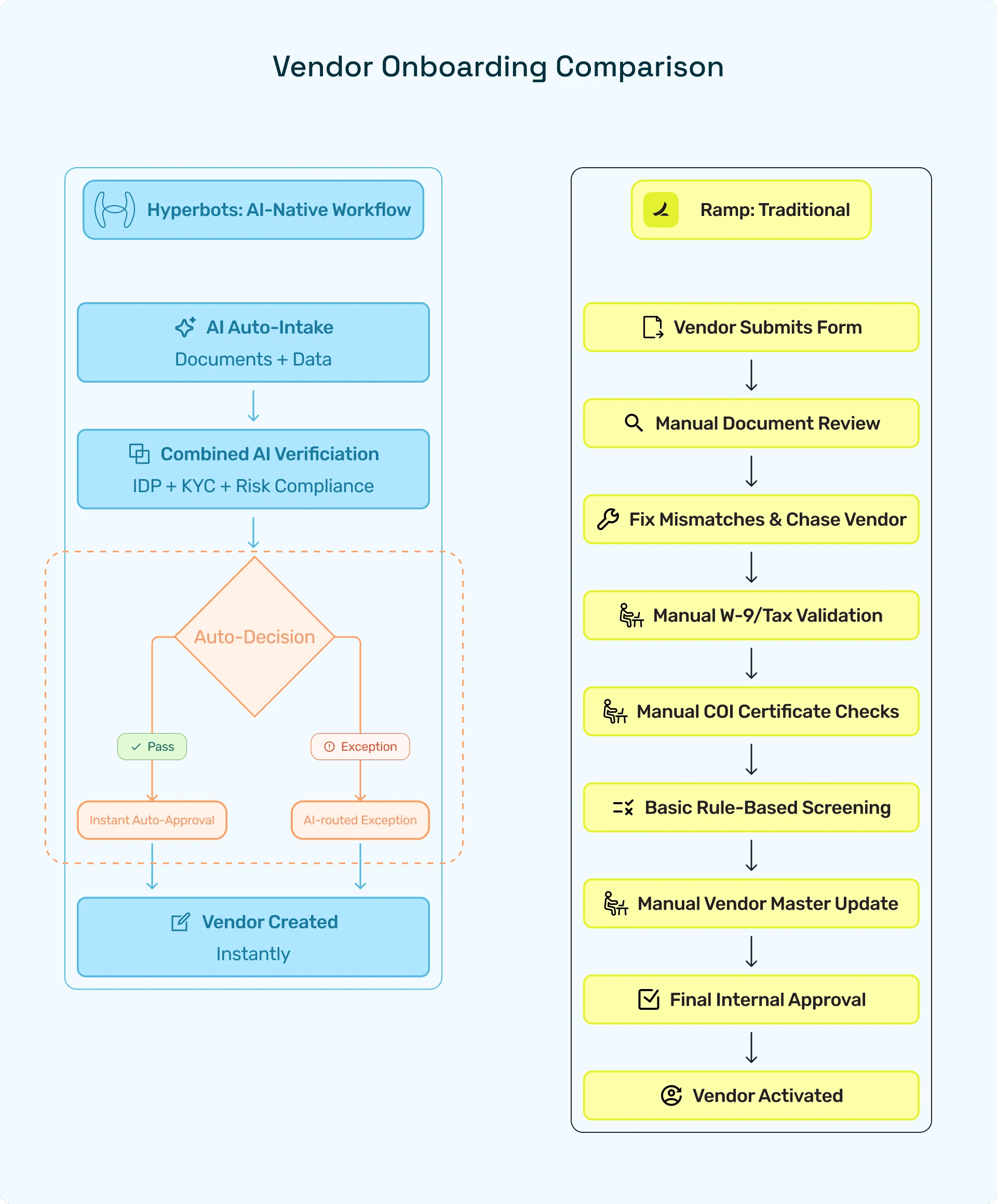

Why Finance Teams Are Replacing Ramp with Hyperbots for Vendor Onboarding and Compliance

Where Ramp still relies on human intervention, Hyperbots delivers hands-free vendor verification and compliance management.

Vendor onboarding has quietly become one of the most expensive bottlenecks in modern finance. While platforms like Ramp offer lightweight onboarding features, most controllers, CFOs, and vendor-management leaders are now realizing the limits of “form-based automation.” Hyperbots, with its AI-native, multi-agent vendor onboarding and compliance engine, is rapidly emerging as the preferred alternative - offering deeper KYC automation, richer supplier compliance checks, risk scoring, document intelligence, and complete policy adherence.

This blog breaks down why mid-market and enterprise finance teams are replacing Ramp with Hyperbots - through conversational comparisons, data-backed insights, practical breakdowns, feature-by-feature evaluations, and clear demonstrations of how Hyperbots’ platform transforms vendor risk management, onboarding efficiency, and downstream procurement workflows.

Introduction: The Conversational Comparison Finance Teams Are Actually Having

Let’s be honest - when finance teams compare Ramp vendor onboarding to Hyperbots, the conversation usually sounds like this:

“Ramp makes onboarding look simple… until vendors start uploading documents that aren’t standard forms. Then things fall apart.”

“Hyperbots? That thing reads ANY document. Even the messy ones. And it flags risks before I even know they exist.”

“Exactly. Ramp is good for card spend. Not so much for compliance-heavy onboarding.”

And that’s where the shift begins.

Ramp is undeniably sleek - but its onboarding is still built on structured templates, manual reviews, and basic automations. Hyperbots, on the other hand, is built from the ground up as an AI-powered vendor onboarding and risk engine, using multi-agent intelligence, document extraction, automated policy checks, and compliance workflows that CFOs actually need.

By the end of this blog, you’ll see why finance teams across the U.S. - especially mid-market and enterprise - are transitioning to Hyperbots for vendor onboarding, vendor risk management, KYC automation, and supplier compliance.

Why Ramp Vendor Onboarding Falls Short for Modern Finance Teams

Ramp is great for spend controls, virtual cards, and basic expense management. But when it comes to vendor onboarding, teams commonly report three major limitations:

1. Limited Vendor Risk Management Capabilities

Ramp covers basic tax and banking intake, but:

No dynamic risk scoring

No document interpretation

No AI-based anomaly detection

No multi-step compliance logic

Finance teams end up performing manual validations, which increases errors and lead time.

2. Template-Dependent Onboarding

Ramp’s onboarding breaks when:

Vendors upload irregular formats

Contracts or certificates aren’t standardized

Policies require multi-level validation

Non-U.S. vendors come into the picture

Structured intake ≠ intelligent compliance.

3. Minimal KYC & Supplier Compliance Automation

There’s no deep-layer analysis of:

Tax IDs beyond format verification

COIs, W-9s, W-8s

Certificates of insurance

Vendor master data risks

Expiry tracking

Third-party validation

Compliance tasks end up falling back on humans - exactly what automation is supposed to remove.

How Hyperbots Fixes These Problems With AI-Native Vendor Onboarding

Hyperbots doesn’t use “form-fill automation” like traditional tools. Instead, it operates using multi-agent AI, as detailed in its own articles on agentic AI and autonomous document intelligence

Here’s how Hyperbots transforms vendor onboarding

1. AI-Powered Intake That Reads ANY Document

PDFs, images, contracts, certificates, W-9s, tax forms, ID proofs - Hyperbots’ AI can decode them instantly.

It doesn’t rely on templates or fixed layouts. Instead, it employs:

Intelligent document classification

Adaptive extraction

Contextual understanding

Policy-based validation

This eliminates the #1 issue finance teams face: vendor documents never arrive in a clean, uniform format - especially W-9 forms that are often scanned, handwritten, or incorrectly filled.

2. Real-Time KYC Automation

Hyperbots automates KYC using:

ID verification

Business validation

Entity lookup

Sanctions checks (OFAC, AML)

Address cross-verification

Combined, these make supplier verification hands-free, while Ramp requires manual checks.

3. Multi-Agent Compliance Checks

Hyperbots uses independent agents to check:

EIN & tax classifications

Certificate of insurance validity

Contract terms

Banking information patterns

Risk score triggers

Policy exceptions

If anything looks suspicious, the system alerts AP / procurement teams automatically.

This eliminates the “human quality control” layer Ramp still depends on.

4. Dynamic Vendor Risk Scoring

Hyperbots generates a unified compliance score using:

financial stability

past performance

document completeness

risk flags

anomalies

This aligns directly with Deloitte and McKinsey recommendations for risk-first procurement models, such as in McKinsey’s research on AI-driven compliance.

5. Turnkey Workflow Automation

Hyperbots connects onboarding to:

ERP vendor master creation

Compliance monitoring

Invoice ingestion

PO automation

Finance teams get end-to-end vendor lifecycle automation - something Ramp simply doesn’t offer.

Feature-by-Feature Comparison - Hyperbots vs Ramp for Vendor Onboarding

Comparison Table

Feature | Ramp Vendor Onboarding | Hyperbots Vendor Onboarding |

Document Intelligence | Basic structured intake | AI-native, unstructured document reading |

Vendor Risk Management | Limited | Deep, multi-agent risk scoring |

KYC Automation | Basic tax form capture | Full-stack KYC + ID + entity verification |

Supplier Compliance | Manual | Automated COI, contracts, certificates |

Workflow Automation | Basic | End-to-end policy workflows |

AI Depth | Rule-based | Multi-agent autonomous AI |

Global Vendor Support | Limited | Global-ready, multilingual |

ERP Integration | Partial | Full integrations + sync |

Scaling to Hundreds of Vendors | Manual overhead | Fully scalable, no template dependence |

ROI | Moderate | Extremely high due to automation depth |

Hyperbots’ Platform Capabilities That Transform Purchase Order Automation

Hyperbots doesn’t just stop at vendor onboarding - that’s the beginning.

Once a vendor is onboarded, Hyperbots uses its Purchase Automation co-pilot to streamline the entire procure-to-pay lifecycle:

Capabilities include:

Automated PR → PO routing

Intelligent policy checks

Spend classification

Early payment discount optimization

ERP-sync with multi-level approval flows

Fraud & anomaly detection

Compliance-first matching (3-way, 2-way, GRN validation)

This makes Hyperbots not just a replacement for Ramp onboarding but a full-stack procurement automation ecosystem.

Real-World Impact - What Finance Teams Gain by Switching from Ramp

1. Reduction in Onboarding Time

Through AI-first intake and automated compliance.

2. 99.8%+ Accuracy in Document Interpretation

Supporting unstructured, semi-structured, and multi-format vendor documentation.

3. Lower Compliance Overhead

Thanks to multi-agent verification and exception routing.

4. Zero Manual Risk Calculation

Everything - from tax checks to address validation - is automated.

5. A Single Source of Truth

Vendor master data synced across:

NetSuite

SAP

Dynamics

QuickBooks

Oracle

Conclusion - Why Hyperbots Is Becoming the Default Choice

If your finance team wants:

True AI-native vendor onboarding

Real vendor risk management

Hands-free KYC automation

Unmatched supplier compliance

End-to-end procurement automation

…then Hyperbots is an obvious upgrade over Ramp.

Ramp has strong expense management roots - but onboarding, compliance, and multi-agent automation require a deeper technological foundation. Hyperbots is built exactly for that.

To explore how Hyperbots can automate your vendor lifecycle, visit, https://www.hyperbots.com/

FAQs

1. How does Hyperbots compare to Ramp vendor onboarding?

A: Hyperbots offers multi-agent AI onboarding with KYC, compliance checks, risk scoring, and document intelligence - all missing or limited in Ramp.

2. Does Hyperbots automate vendor risk management?

A: Yes. Hyperbots uses dynamic risk scoring, anomaly detection, and policy-based validation to automate the entire risk evaluation process.

3. Can Hyperbots read unstructured documents?

A: Absolutely. Hyperbots’s IDP engine can interpret any document - PDFs, images, handwritten notes, certificates, contracts, and more.

4. Is Hyperbots suitable for enterprise procurement teams?

A: Yes. Hyperbots is built for mid-market and enterprise teams managing high volume vendor and PO workflows with complex compliance needs.

5. Does Hyperbots integrate with NetSuite, SAP, or Dynamics?

A: Yes, Hyperbots connects bi-directionally to all major ERPs.