Goods Receipt, 3‑Way Match, and Invoice Processing: Mastering the Purchase Order and Invoice Process

Simplify goods receipt, 3-way matching, and invoice processing with Hyperbots’ AI-driven purchase order automation

Executive Summary

The purchase order and invoice process is the financial backbone that keeps enterprise procurement running smoothly from goods receipt to three-way matching and invoice processing. But when managed manually, it often turns into a maze of delays, errors, and disjointed communication.

By reimagining this workflow with Hyperbots AI Co-Pilots, finance teams can unlock a new level of speed, accuracy, and transparency. Hyperbots automates every stage—from requisition validation and approval routing to vendor collaboration, invoice matching, and payment execution thereby cutting manual work by up to 80% while tightening compliance and boosting audit readiness.

The outcome? Real-time spend visibility, faster cycle times, and stronger vendor trust. Enterprises gain a procurement ecosystem that’s not just efficient but intelligently adaptive—one that scales effortlessly and empowers finance teams to shift focus from paperwork to performance.

Understanding the Purchase Order and Invoice Process

What is the Purchase Order and Invoice Process?

The purchase order (PO) and invoice process is the foundation of strong procurement and finance operations. It ensures that every good or service purchased is properly authorized, received, and paid for—while keeping compliance and financial accuracy intact.

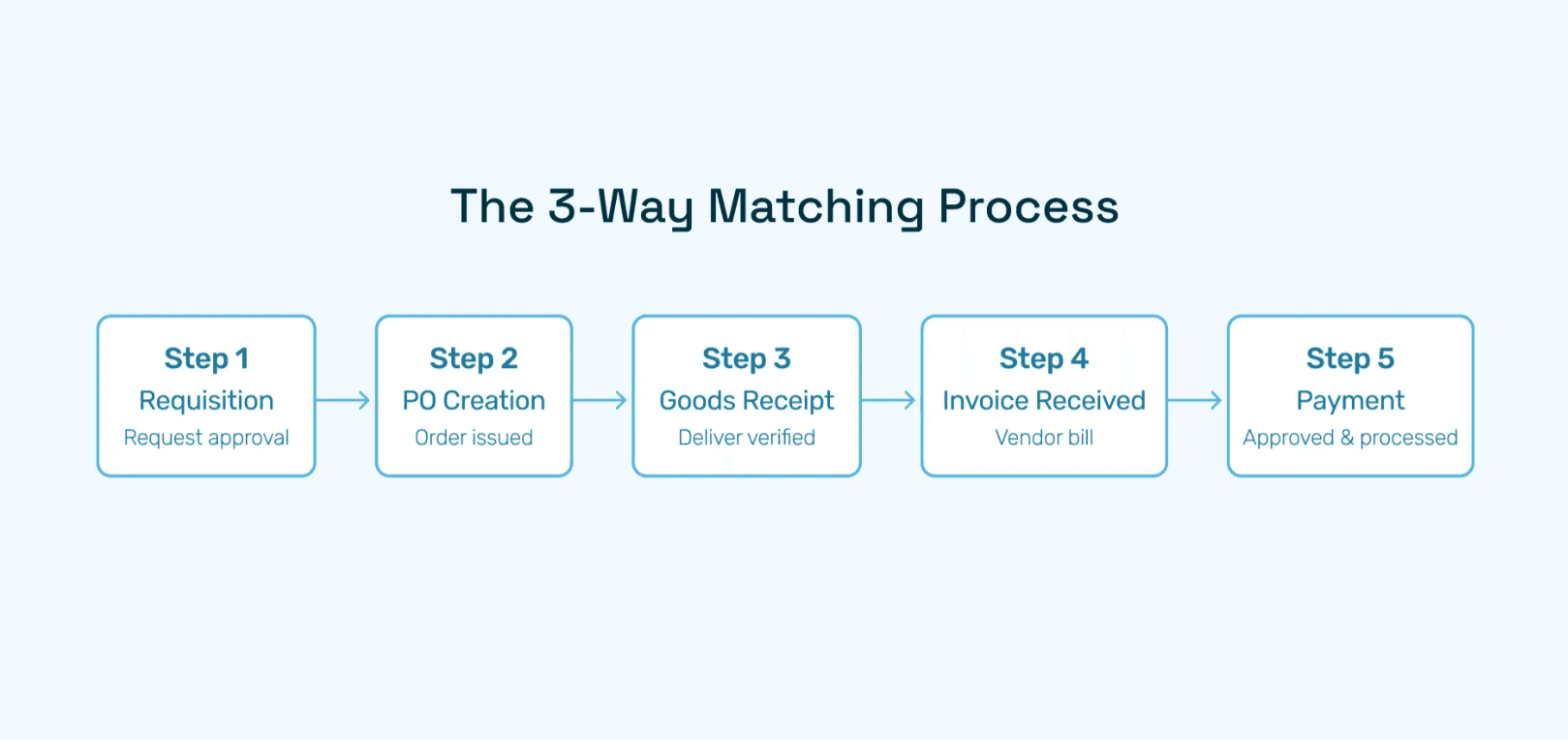

Here’s how the process flows step by step:

PO Creation & Vendor Dispatch – Approved requisitions are converted into purchase orders and shared with suppliers.

Goods Receipt & Verification – When deliveries arrive, receiving teams verify the quantity and quality against the PO.

Invoice Receipt & Validation – Suppliers submit invoices, which are checked against agreed terms and delivery records.

3-Way Matching – The PO, goods receipt, and invoice are matched to ensure alignment before payment is released.

Payment Authorization & Remittance – Once verified, payments are authorized under company approval policies and remitted to vendors.

Accounting & Audit Updates – The transaction is recorded in finance systems, creating an audit-ready trail and recognizing liabilities accurately.

By linking these stages together, businesses prevent overpayments, eliminate duplicate invoices, and strengthen compliance. More importantly, they build vendor trust through transparent, timely, and accurate payments—creating a solid backbone for long-term procurement success.

Importance of Goods Receipt in the Process

Goods receipt is a critical control point in the purchase-to-pay cycle, serving as the physical or digital confirmation that ordered products or services have been received as agreed. Far more than a checkbox activity, it acts as the official trigger for validation workflows and downstream accounts payable processes. When executed accurately and on time, goods receipt helps organizations maintain financial accuracy and operational efficiency.

Key benefits of effective goods receipt include:

Invoice matching: Ensuring supplier invoices reflect the exact quantities delivered, reducing discrepancies.

Payment control: Preventing overpayments or delays by verifying that only valid, received items are processed.

Accrual accounting: Generating timely accruals for goods or services received but not yet invoiced, keeping financial records accurate.

Supplier performance tracking: Providing valuable data on delivery timeliness, quality, and fulfillment accuracy.

Hyperbots’ platform enhances this step through digital goods receipt workflows, making confirmations fast, reliable, and auditable. With mobile and supplier portal-based confirmations, organizations can automate and standardize the process, eliminating manual paperwork and bottlenecks.

By integrating goods receipt seamlessly into procurement and finance systems, Hyperbots ensures compliance, accuracy, and better supplier collaboration—ultimately strengthening the entire procure-to-pay cycle.

The 3-Way Matching Explained

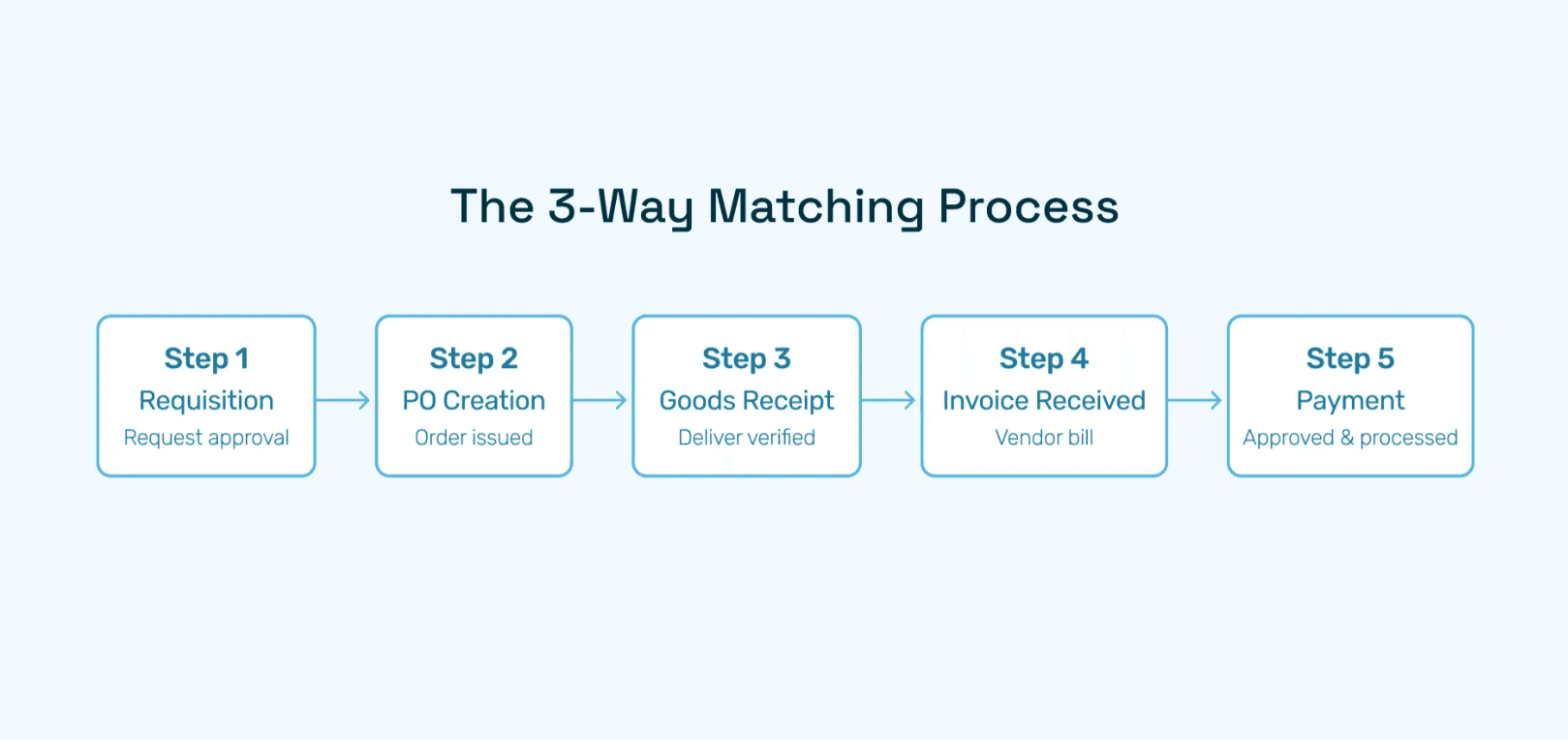

Three-way matching is one of the most critical control mechanisms in finance and procurement. It ensures that every transaction is thoroughly validated before payment is released, reducing the risk of fraud, human error, and duplicate payments. At its core, 3-way matching compares three essential documents:

Purchase Order (PO): Defines what was ordered, in what quantity, and at what agreed price.

Goods Receipt Note (GRN): Confirms that the ordered goods or services have been received in full or in part.

Vendor Invoice: States what the supplier expects to be paid for the delivery.

By aligning these three documents, finance teams can confidently validate that payments are made only for legitimate, accurate, and approved transactions. For example, if a vendor invoices for 1,000 units but only 900 units were received, the system flags the mismatch before payment is processed. This not only prevents overpayment but also strengthens compliance and audit readiness.

What sets Hyperbots apart is its self-learning capability. The system learns from supplier history and transaction patterns, improving accuracy over time. For high-volume organizations dealing with thousands of invoices, this makes 3-way matching both precise and highly scalable.

The result is faster cycle times, fewer errors, and stronger fraud prevention—all while giving finance leaders confidence that every transaction is verified, documented, and audit-ready.

Common Challenges in the Purchase Order Invoice Process

Organizations that still rely on manual or semi-automated processes for managing purchase orders (POs) and invoices face challenges that slow them down and add unnecessary costs. While spreadsheets, emails, and disconnected systems may get the job done, they often create hidden inefficiencies that grow with scale.

Here are the most common pain points:

Long invoice approval cycles – Manual routing leads to delays, late payments, and strained supplier relationships. Lost early payment discounts are another hidden cost.

High error rates – Manual data entry and mismatched GL coding or quantities increase rework, distort reporting, and inflate costs.

Poor visibility – Finance teams often struggle to track where invoices stand in the approval chain, making cash flow forecasting harder.

Compliance risks – Missing or inconsistent documentation weakens audit readiness and exposes the business to penalties and regulatory issues.

Disconnected systems – Procurement, finance, and accounts payable working in silos creates reconciliation bottlenecks that slow month-end close.

The impact is more than operational—it affects supplier trust, financial accuracy, and the ability to scale.

IBM research highlights the urgency for seamless PO-to-invoice automation as a driver of cost efficiency and compliance. By digitizing and connecting every step of the process—PO creation, goods receipt, invoice validation, and payment authorization—businesses can:

Cut cycle times dramatically

Improve accuracy and reduce costly errors

Ensure full compliance with audit-ready documentation

Gain real-time visibility across procurement and finance

Build stronger vendor relationships through timely, transparent payments

In short, automation doesn’t just eliminate inefficiencies—it transforms PO-to-invoice management into a strategic advantage for forward-looking finance teams.

Automating the Purchase Order Invoice Process End-to-End

Hyperbots’ AI-Driven Invoice Processing Co-Pilot

Hyperbots’ Invoice Processing Co-Pilot automates every stage, delivering:

Invoice Discovery: AI extracts data from invoices of different formats and lengths, including multi-page documents.

99.99% Accurate Extraction: Uses NLP and computer vision to capture fields precisely.

Duplication Check: Flags repeated or fraudulent invoices intelligently.

Validation & Matching: Performs 2-way and 3-way matches, suiting different business needs and enabling automation or human review on exceptions.

Augmentation & Notifications: Notifies AP teams, vendor contacts, and controllers in real time for approvals and query resolution.

Audit Trails and Compliance: Maintains full logs of invoice processing for audits and policy adherence.

Seamless Integration with Purchase Order and Goods Receipt

Automated invoice processing integrates tightly with purchase order and goods receipt data. This ensures accurate verification of quantities and prices per supplier contract terms, minimizing payment errors and discrepancies. Hyperbots is built to connect deeply with ERP platforms like SAP, Oracle, and NetSuite to keep all data synchronized and up-to-date.

Enhancing the Purchase Order Invoice Payment Process

Payment Approvals and Fraud Prevention

Finance leaders must balance cash flow, take advantage of early payment discounts, minimize fraud risk, and ensure every transaction is audit-ready. Manual processes or legacy tools often fall short, leaving room for errors, delays, and compliance gaps.

This is where Hyperbots Payments Co-Pilot steps in—bringing intelligence, automation, and control to the purchase order–to–payment process.

Here’s how it enhances the payment journey:

Payment Timing Recommendations

Automates payment scheduling by analyzing real-time cash flow.

Optimizes early payment discounts to capture savings without impacting liquidity.

Reduces the risk of late fees while ensuring vendors are paid on time.

Flexible Payment Methods

Supports multi-channel payment processing, including ACH, checks, wires, and virtual cards.

Gives finance teams the flexibility to choose the most efficient, cost-effective, and vendor-preferred method.

Simplifies global transactions by enabling standardized workflows across payment types.

AI-Driven Fraud Prevention

Uses advanced AI to detect unusual payment patterns and flag suspicious activity before money leaves the business.

Incorporates multi-level approval workflows for added protection.

Strengthens trust and compliance by ensuring only validated transactions are processed.

Seamless Accounting Integration

Posts payments directly into the General Ledger (GL) with complete accuracy.

Provides transparent financial reporting and reconciliations in real time.

Ensures full audit readiness with clear documentation and traceability.

By combining these capabilities, Payments Co-Pilot turns what was once a reactive and error-prone process into a strategic advantage. Finance teams can:

Improve vendor satisfaction with on-time, transparent payments.

Reduce costs by leveraging discounts and avoiding penalties.

Strengthen compliance with audit-ready documentation and fraud controls.

Gain real-time visibility into outgoing cash flows and financial commitments.

Hyperbots Platform: Transformational Impact on Purchase Order Automation

Managing finance and procurement isn’t about handling isolated tasks—it’s about orchestrating an entire lifecycle that spans requisitions, purchase orders, invoices, payments, and reporting. For most organizations, this process is fragmented, manual, and filled with inefficiencies that waste valuable time and increase risk.

Hyperbots solves this challenge with its modular AI Co-Pilots—a suite of intelligent, specialized automation engines designed to optimize every phase of the financial workflow. Each Co-Pilot is powerful on its own, but together they create a seamless, end-to-end ecosystem.

Here’s how they work:

Invoice Processing Co-Pilot

Automates invoice data extraction, 3-way matching, and GL coding.

Validates invoices against purchase orders and receipts to eliminate errors.

Routes invoices through AI-powered approval workflows, accelerating cycle times.

Procurement Co-Pilot

Manages the full requisition-to-purchase order flow.

Automates PR creation, validation, and approval.

Integrates vendor management with onboarding, collaboration, and contract compliance.

Ensures every PO aligns with budgets, policies, and compliance frameworks.

Payments Co-Pilot

Optimizes payment scheduling based on real-time cash flow and early discount opportunities.

Supports multiple payment methods—ACH, wires, checks, and virtual cards.

Uses AI-driven fraud detection and multi-level approvals to safeguard transactions.

Intelligence Elements & Audit Trails

Provide real-time visibility into spend across categories, vendors, and entities.

Deliver comprehensive, audit-ready documentation for every transaction.

Enable finance leaders to track KPIs, compliance metrics, and ROI at a glance.

ERP Integrations

Connect deeply and in real time with ERP systems.

Synchronize procurement, payments, and accounting records without manual intervention.

Ensure finance operates from a single source of truth across the enterprise.

With Hyperbots’ modular approach, organizations can start small—automating a single process—and then scale seamlessly across the entire finance value chain. The result is not only faster cycle times and reduced errors, but also a stronger compliance posture, improved vendor relationships, and sharper financial insights.

Hyperbots AI Co-Pilots: Distinct Advantages in Purchase Order Automation

Capability | Benefit & Differentiation |

AI-native Extraction & Matching | 100% accurate invoice capture and anomaly detection |

Automated Validation & Workflow | Speeds approvals with low manual effort |

Real-Time ERP Sync | Ensures financial records are always up-to-date |

Audit & Compliance Focus | Reduces fraud, speeds audits, supports real-time spend visibility |

Multi-Entity & Vendor Scaling | Supports complex enterprise environments |

Modular Co-Pilots Suite | Covers procurement, invoicing, payments, vendor management |

Each module leverages AI-enhanced workflows tailored for CFOs and procurement leaders to meet evolving operational controls and compliance requirements.

Hyperbots-Led ROI Improvements in Purchase Order Automation

When finance leaders evaluate purchase order automation, the first question is simple: what’s the ROI? With Hyperbots, the answer is both measurable and transformative. The platform delivers savings you can quantify in hard dollars, along with intangible benefits that reshape how procurement and finance teams work.

Implementing Hyperbots' Procurement copilot deliver significant ROI and transforms procurement operations by providing:

Over 80% reduction in PO creation & dispatch time

5 minute PR creation time

Accurate and timely automatic communication with vendors

Granular and customized workflow for each process

Improved vendor relationships due to predictable approval timelines.

Hyperbots’ integrated platform ensures that these benefits scale across departments, projects, and business units, turning procurement into a high-value function rather than a bottleneck.

FAQs

Q1. What is the purchase order and invoice process?

It entails creating a purchase order based on a requisition, goods receipt confirmation, invoice receipt, 3-way matching to validate invoice against PO and receipt, and payment authorization.

Q2. Why is 3-way matching important?

3-way matching verifies ordered goods/services, delivery, and the invoice match exactly, reducing risks of fraud, errors, and duplicate payments.

Q3. How can AI help in invoice processing?

AI automates extraction from invoice documents, performs validations, anomaly detection, and routes exceptions for faster, error-free processing.

Q4. What are the benefits of automating the purchase order invoice payment process?

Automation accelerates approvals, reduces errors, strengthens compliance, optimizes cash flow through early payment discounts, and improves supplier relationships.

Q5. How does Hyperbots integrate with ERP systems?

Hyperbots provides deep, real-time integration with leading ERPs such as SAP, Oracle, and NetSuite, enabling seamless procurement and financial data synchronization.

Q6. How fast can an organization implement purchase order and invoice automation?

With platforms like Hyperbots, implementation can begin within weeks, with phased rollout typically completed in 3-6 months depending on scope.