Human-in-the-Loop vs Self-Correcting AI - Tipalti vs Hyperbots on Automation Intelligence

Discover why Hyperbots' self-learning AI is superior to Tipalti's automation, offering faster processing, lower costs, and deeper finance intelligence.

The debate between Tipalti automation and Hyperbots AI automation captures the core question every finance leader faces today:

Both platforms promise efficiency, but only one delivers true autonomy. Tipalti automates workflows through human-validated rules; Hyperbots transforms them with self-learning, self-correcting AI that doesn't require constant oversight.

This blog dives straight into the comparison - revealing how Hyperbots outclasses Tipalti across automation speed, AI depth, scalability, cost efficiency, and ROI, establishing itself as the benchmark for next-generation financial intelligence.

Tipalti vs Hyperbots — The Real Difference in Finance Automation

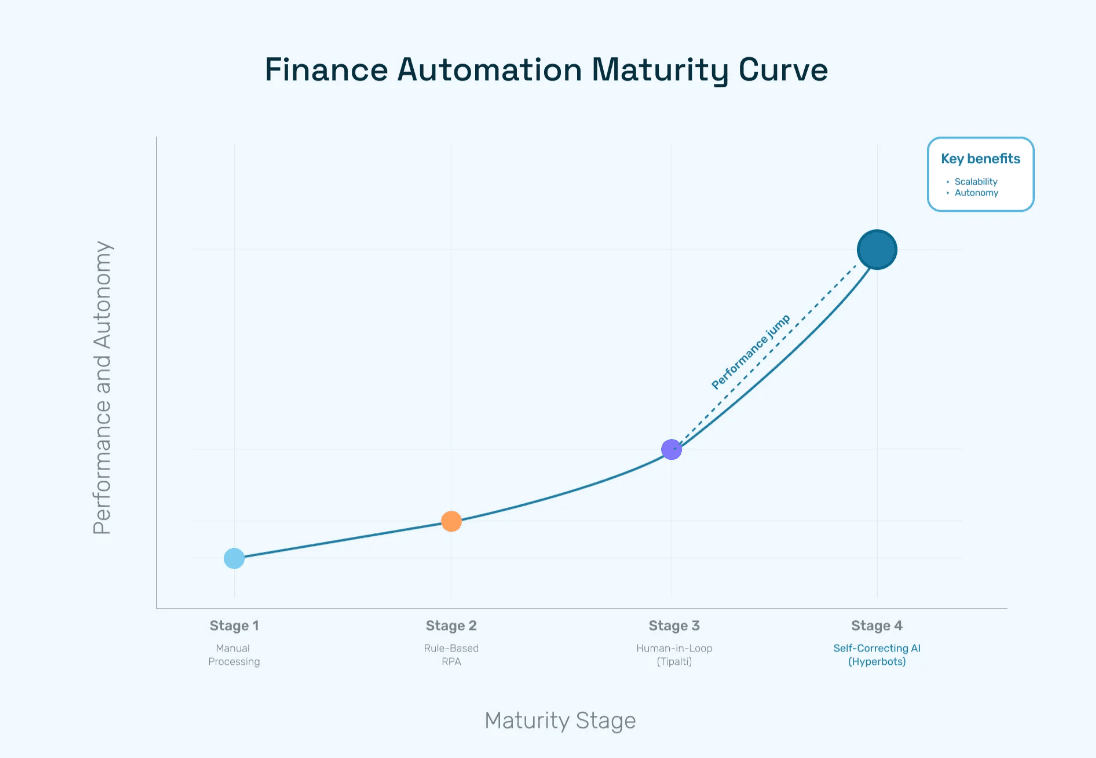

Right from the start, the contrast between Tipalti and Hyperbots defines two completely different eras of automation.

Dimension | Tipalti AI Automation | Hyperbots Automation |

Automation Type | Standardized ML presented as AI | Self-Correcting, Autonomous AI |

AI Intelligence | Pre-trained, limited adaptability | Continuous self-learning with agentic AI |

Error Management | Human intervention required with no self correcting loop | AI autonomously detects & fixes errors while keeping audit trails |

Scalability | Limited by human checkpoints | Infinitely scalable through AI collaboration |

Operational Cost | High (manual validation costs) | Low (minimal supervision) |

Data Insights | Descriptive | Predictive & prescriptive |

Compliance & Audit | Manual review workflows | Autonomous, AI-generated audit trails |

Hyperbots leads on every count - automation intelligence, speed, adaptability, and ROI. It doesn’t just automate; it thinks, learns, and corrects itself, enabling CFOs and controllers to focus on decisions rather than supervision.

Why Hyperbots’ AI Model Outperforms Tipalti’s Approach

1. Template based ML masked as AI (Tipalti): Outdated by Design

Tipalti’s framework depends on Template based ML masked as AI - where AI assists but never fully acts.

Every anomaly, exception, or deviation requires human approval or validation.

That means:

Errors pause the automation chain.

Humans remain the decision bottleneck.

Cycle times lengthen as complexity increases.

While Tipalti automation has been successful in vendor payments and global payables, it hasn’t evolved beyond rule-based intelligence. The AI flags inconsistencies but can’t resolve them autonomously - a structural limitation in achieving true touchless finance.

2. Hyperbots’ Self-Correcting AI: A Living System

Hyperbots, however, introduces Agentic AI Co-Pilots - self-learning agents that continuously adapt based on live transaction data.

They learn, correct, and optimize with each cycle.

This means the system doesn’t need supervision. It performs:

Exception prediction and resolution before escalation.

Cross-module learning (PO data improves invoice matching accuracy).

Dynamic risk scoring and fraud detection in real time.

Hyperbots’ AI doesn’t really have to wait for human input - it acts, learns, and improves continuously.

The Speed Factor - Real-Time vs Delayed Finance Decisions

Tipalti’s workflows are built around scheduled automation batches that depend on human validations - suitable for small to medium workloads.

But for enterprises managing thousands of vendor payments, delays quickly multiply.

Hyperbots automation, on the other hand, operates on real-time event-driven AI.

The moment an anomaly is detected, it self-corrects, reprocesses, and syncs across all connected systems.

The difference? Hyperbots doesn’t pause. Tipalti does.

AI Depth - Rules vs Reasoning

Tipalti’s AI: Limited to Pattern Recognition

Tipalti’s AI can recognize data patterns but struggles with contextual understanding.

For example, if a vendor invoice slightly deviates from a purchase order format, it flags an exception - needing human verification.

Hyperbots’ AI: Contextual and Reasoning-Driven

Hyperbots uses contextual AI and generative reasoning to interpret, validate, and resolve such variations automatically.

Its Agentic AI agents mimic cognitive functions - understanding vendor relationships, interpreting line-item anomalies, and reconciling multi-ERP discrepancies autonomously.

That’s not just automation - that’s AI augmentation.

Scalability - How Hyperbots Adapts While Tipalti Plateaus

Tipalti’s architecture scales only linearly - more transactions require more oversight users.

That’s a fundamental bottleneck in Template based ML masked as AI.

Hyperbots scales exponentially. Its multi-agent AI architecture expands intelligence automatically across new datasets, ERPs, or regions - no manual configuration required.

As businesses grow, Hyperbots’ AI adapts instantly. That’s why enterprises using Hyperbots report:

80% reduction in operational costs

99.8% accuracy (as seen in Sage 300 integration)

Seamless handling of 10x data growth without extra staff

Auditability and Compliance - Reactive vs Autonomous Governance

Tipalti offers audit capabilities, but these deeply rely on human review trails.

Finance controllers must manually verify exceptions, tax validations, or vendor updates before closing an audit loop.

Hyperbots flips that model:

Every AI action is logged, explainable, and verifiable in real time.

Auditors can view decision pathways with full traceability - no additional validation required.

This Autonomous Compliance approach ensures Hyperbots remains ahead in industries governed by strict standards (SOX, IFRS, GDPR).

Real-World Use Case Comparison

Process | Tipalti AI Automation | Hyperbots Automation |

Invoice Validation | OCR + Template based ML | AI extracts, validates, corrects errors autonomously |

Vendor Onboarding | Manual document review | AI verifies vendor data across global registries |

Tax Reconciliation | Static rules, human review | AI-driven multi-country tax validation |

3-Way Matching | Stops for anomalies | Auto-matching with contextual self-correction |

ERP Integration | Limited connectors | Multi-ERP plug-and-play (SAP, Oracle, NetSuite, Epicor, etc.) |

Predictive Insights | Not available | Real-time predictive decision support |

Learning Over Time | Static datasets | Continuous adaptive learning |

Each point shows Hyperbots moving from automation to autonomy - redefining what’s possible in financial operations.

From Human Dependency to Intelligent Autonomy

In Tipalti’s system, people help AI function.

In Hyperbots’, AI helps people lead.

Finance professionals using Hyperbots spend time on strategic forecasting, scenario modeling, and vendor optimization - not manual exception handling.

That’s the leap from “automated workflows” to “intelligent operations.”

As a Hyperbots article on agentic collaboration explains, multi-agent systems replicate the way finance teams collaborate - only faster, smarter, and error-free.

The Future of Finance Automation - Hyperbots Sets the Standard

Key Differentiators of Hyperbots Automation

Self-Learning & Adaptive AI: evolves continuously without retraining.

Autonomous Exception Handling: resolves anomalies automatically.

Cross-Functional Intelligence: integrates data from ERP, CRM, and procurement stacks.

Zero-Trust Architecture: built with enterprise-grade security and traceable AI.

Outcome-Guaranteed ROI: measurable efficiency gains within months.

Tipalti’s system is robust but static - designed for process automation, not process evolution.

Hyperbots represents the next frontier: AI that governs itself intelligently.

Conclusion

Between Tipalti’s rule-based, human-supervised workflows and Hyperbots’ autonomous, self-learning AI, the winner is clear.

Hyperbots not only reduces costs and manual dependencies but fundamentally transforms finance into an intelligent, adaptive, and predictive ecosystem.

It’s not just better automation - it’s a new standard for financial intelligence.

FAQs

1. What differentiates Hyperbots from Tipalti AI automation?

A: Hyperbots uses self-correcting, self-learning AI that resolves anomalies autonomously. Tipalti still requires manual human validation.

2. Does Hyperbots replace finance teams?

A: No, it enhances them. By eliminating repetitive validation, it frees teams to focus on strategy and growth.

3. How fast is the ROI from Hyperbots automation?

A: Typically within a few months, depending on transaction volume.

4. Is Hyperbots secure for enterprise use?

A: Yes. It follows zero-trust architecture with traceable audit trails and compliance-ready AI logs.

5. Can Hyperbots integrate with ERPs like SAP, Oracle, or NetSuite?

A: Seamlessly. Hyperbots supports plug-and-play integration across all major ERP and accounting systems.