How Hyperbots Achieves Higher PO Matching Accuracy Over Tipalti

Discover why Hyperbots' AI-driven PO matching automation outperforms Tipalti, delivering superior accuracy, speed, and ROI for modern finance teams.

In finance automation, accuracy is the new currency - and when it comes to PO matching automation, even a 1% deviation can ripple into thousands of dollars in overpayments, delays, or compliance risks.

That’s why CFOs today are rethinking legacy automation platforms like Tipalti, which rely on static rule engines that stop at detecting mismatches but never truly understand them.

Enter Hyperbots - a next-generation AI platform that doesn’t just automate purchase order (PO) matching, it thinks, learns, and self-corrects.

By combining multi-agent AI, contextual intelligence, and predictive matching, Hyperbots achieves up to 99.8% accuracy in PO-to-invoice alignment - far beyond what rule-based systems like Tipalti PO matching can deliver.

This blog breaks down exactly how Hyperbots outperforms Tipalti - from real-time 3-way match automation and exception prediction to measurable ROI impact across enterprise-scale procure-to-pay cycles.

If your finance team still spends hours resolving mismatched invoices, this deep dive shows why it’s time to move from automation… to autonomy.

Understanding the Core - What is PO Matching Automation?

Purchase Order (PO) matching automation ensures invoices are automatically compared with corresponding POs and goods receipts to verify accuracy before payment - known as three-way matching.

Traditional solutions rely on static rules (e.g., match invoice line items by SKU, quantity, and price). However, data inconsistencies, vendor format variations, or partial deliveries often cause false mismatches, forcing manual intervention.

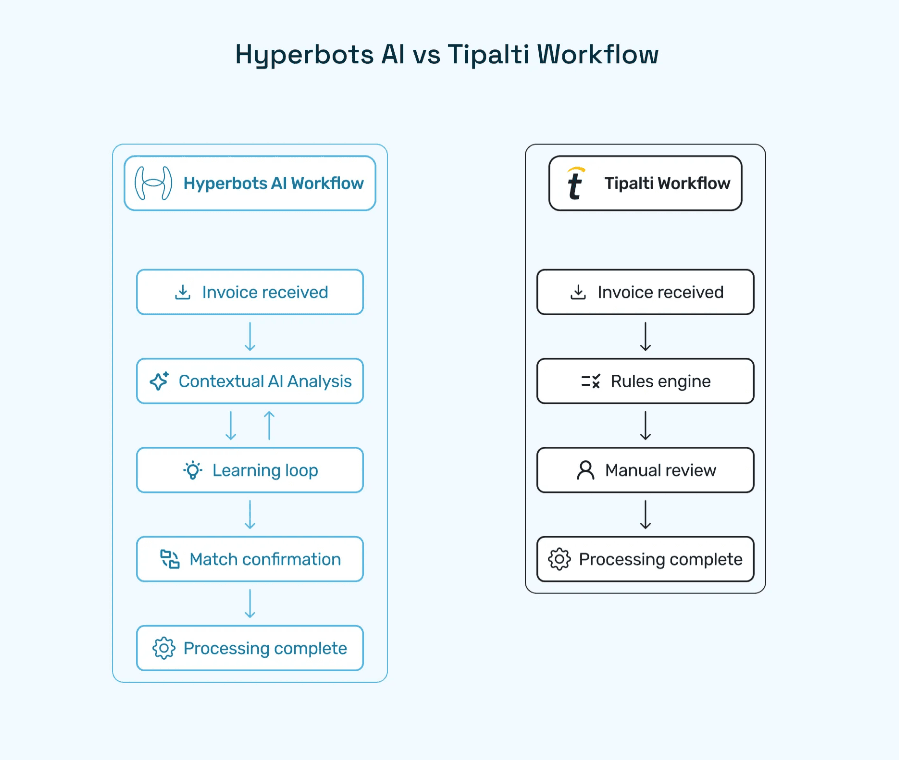

This is where Hyperbots’ multi-agent AI steps in - continuously learning from matching patterns, past corrections, and contextual supplier behaviors to perform intelligent invoice matching that evolves over time.

The Limitation of Tipalti’s PO Matching

Tipalti’s platform offers PO and invoice matching within its AP automation suite, primarily rule-based and dependent on consistent PO formatting. While effective for low-complexity environments, several limitations restrict scalability:

Rigid Matching Rules: Tipalti requires pre-configured logic; any deviation (e.g., mismatched vendor codes or unit price rounding) triggers exceptions.

Limited AI Adaptability: It doesn’t leverage generative or multi-agent AI to interpret incomplete data.

Manual Exception Handling: Finance teams often step in to correct errors Tipalti’s system cannot reconcile automatically.

Data Dependency: Works best with structured POs and invoices but struggles with unstructured or PDF formats.

In contrast, Hyperbots’ PO Matching Co-Pilot uses contextual AI to reconcile mismatched, partial, or multi-line invoices autonomously - transforming accuracy and reducing cycle times.

Why Hyperbots Delivers Higher Accuracy in PO Matching Automation

1. Multi-Agent Intelligence for Continuous Learning

Unlike static rule-based systems, Hyperbots uses Agentic AI - multiple specialized AI agents collaborating to complete each step of the PO match lifecycle: extraction, validation, exception handling, and reconciliation. This means the AI learns from every correction and continuously fine-tunes its models, achieving near-human precision without human involvement.

2. Three-Way Match Automation at Scale

Hyperbots performs real-time 3-way match automation by integrating seamlessly with ERP and procurement systems like SAP, NetSuite, and Oracle.

Its architecture performs:

Intelligent data normalization

Entity-level comparison

Line-item contextual analysis

Predictive matching for partial receipts

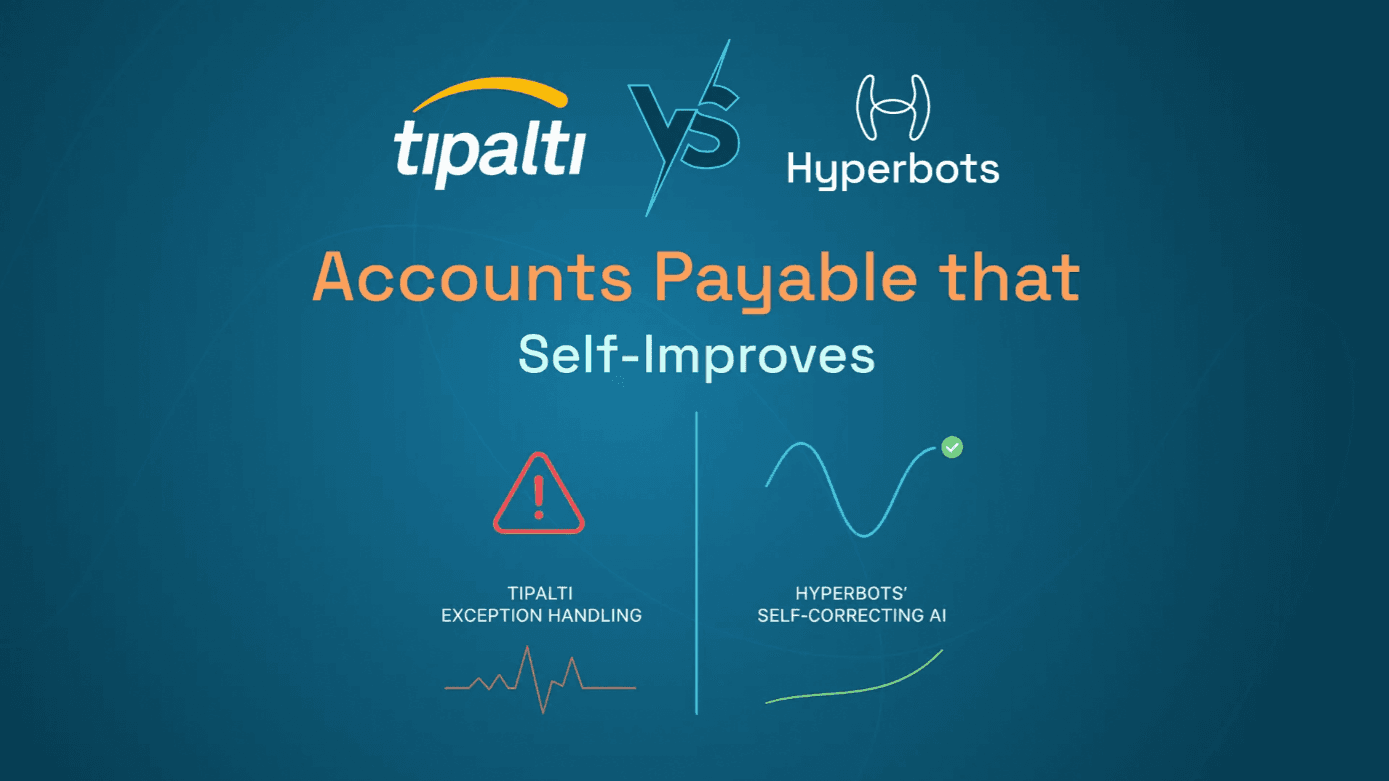

3. Exception Prediction & Self-Healing Automation

Hyperbots leverages predictive analytics to forecast which invoices are likely to mismatch before the error occurs.

It can:

Flag incomplete or duplicate entries

Auto-correct PO data alignment

Route exceptions to the right workflow

This proactive design not only enhances accuracy but also minimizes manual touchpoints by up to 80%.

4. Cross-Document Contextual Awareness

Where Tipalti reads data in isolation, Hyperbots’ AI models interpret invoice, PO, and GRN (Goods Receipt Note) relationships collectively, ensuring consistency across line-item, quantity, and tax codes.

This contextual awareness leads to:

99.8% matching accuracy

Reduction in cycle time

Fewer exception queues

Feature Comparison - Hyperbots vs Tipalti PO Matching

Feature | Hyperbots | Tipalti |

Matching Approach | Multi-Agent AI (Self-learning) | Rule-based (Static) |

Accuracy | 99.8% adaptive precision | Depends on data structure |

Exception Handling | Predictive & autonomous | Manual |

ERP Integration | SAP, Oracle, NetSuite, QuickBooks, Microsoft Dynamics | Limited native integrations |

Data Formats Supported | Structured, unstructured, scanned PDFs, emails | Structured invoices only |

Automation Depth | End-to-end autonomous | Semi-automated |

AI Framework | Agentic AI (Generative + Predictive) | Machine Learning (Basic) |

Customization | No-code rules, dynamic adaptation | Requires IT configuration |

Tipalti vs Hyperbots: A Realistic Perspective for CFOs

While Tipalti remains a dependable automation suite for SMBs and simpler workflows, it lacks the adaptive intelligence needed for high-volume, multi-ERP enterprise environments.

Hyperbots’ modular, agentic, and API-first design makes it the next evolutionary step in invoice matching software.

Key takeaways:

Tipalti = good automation, limited intelligence

Hyperbots = autonomous, learning-driven accuracy

Hyperbots ensures financial control, compliance, and scalability unmatched by rule-based tools

Conclusion - The Future of PO Matching is Autonomous

As finance operations evolve, accuracy, speed, and intelligence define the next frontier of purchase order automation.

Hyperbots outperforms Tipalti by transforming matching from rule-following to self-learning, ensuring precision that scales with business growth.

For CFOs, Controllers, and Procurement Heads, this means:

Fewer errors

Lower costs

Smarter decisioning

To explore how Hyperbots’ PO Matching Automation can modernize your workflows, visit the Hyperbots page or schedule a personalized demo.

FAQs

1. What is PO matching automation?

A: PO matching automation compares purchase orders, goods receipts, and invoices to validate transactions before payment. Tools like Hyperbots make this process AI-driven and autonomous.

2. How does Hyperbots differ from Tipalti in PO matching?

A: Hyperbots uses multi-agent AI and contextual learning, achieving higher accuracy than Tipalti’s rule-based model.

3. Can Hyperbots integrate with existing ERP systems?

A: Yes. It integrates natively with SAP, Oracle, NetSuite, and Microsoft Dynamics without custom middleware.

4. What is 3-way match automation?

A: It’s the automated verification of PO, goods receipt, and invoice details. Hyperbots performs this process intelligently and in real time.