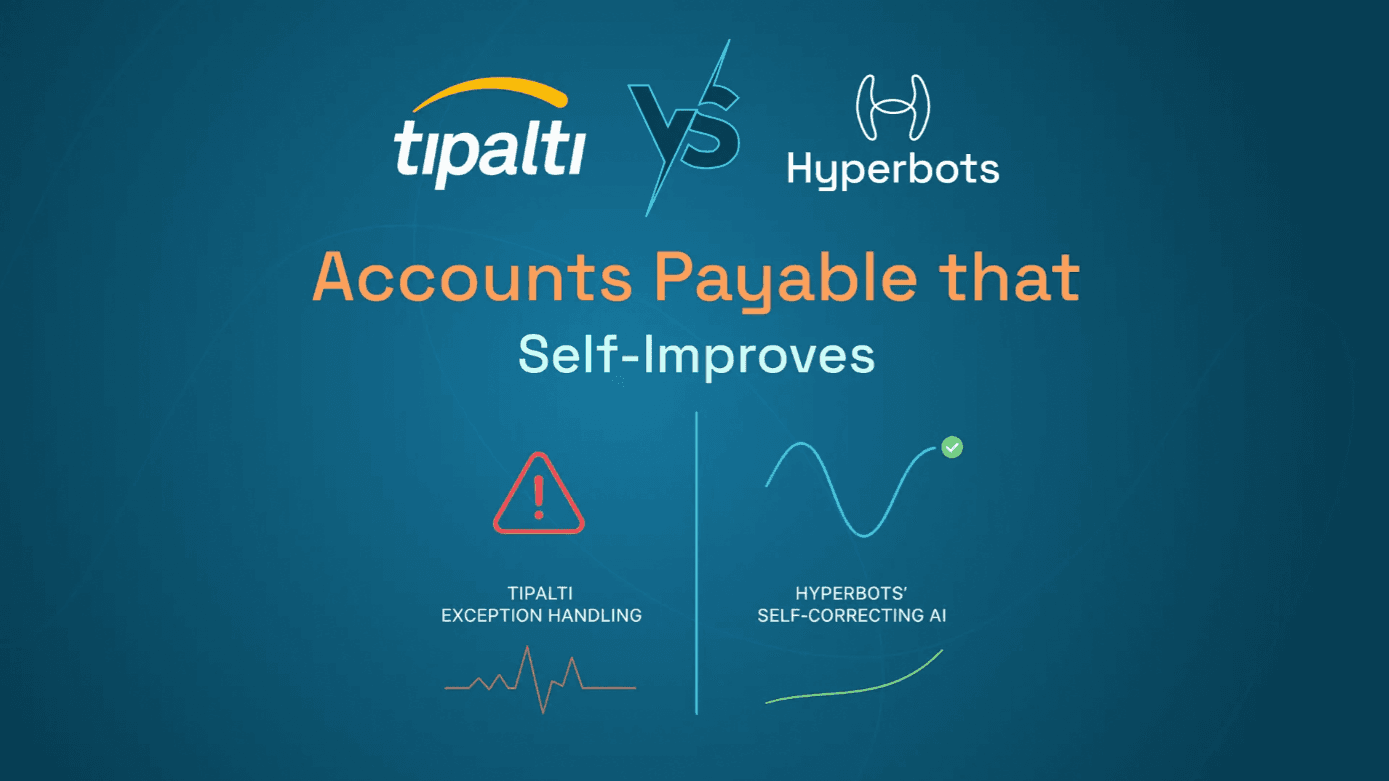

Tipalti Exception Handling vs Hyperbots’ Self-Correcting AI: The Future of AP Automation

Discover how Hyperbots' self-correcting AI eliminates the errors and exceptions common in Tipalti, enabling faster, smarter, and truly autonomous AP automation.

Tipalti vs Hyperbots: Who Fixes Errors Smarter?

Automation promised finance teams freedom - fewer errors, faster approvals, and happier vendors. But anyone using Tipalti knows that promise comes with a catch: exception queues.

Every mismatch, data gap, or duplicate payment gets flagged for human review. And what starts as “helpful automation” turns into another layer of manual supervision.

Hyperbots challenges that. Instead of waiting for humans to clean up, it uses self-correcting AI that learns from every exception, fixing issues system-wide. It’s not automation that works for you - it’s automation that thinks like you.

Let’s break down how Tipalti errors keep AP teams stuck in rework mode - and how Hyperbots’ AI-first architecture turns those same problems into self-healing workflows.

When Automation Still Needs Supervision

Tipalti’s model relies on rules-based automation. It’s good at detection - bad at adaptation. When something doesn’t fit the rulebook, the system stops and waits.

For mid-market and enterprise AP teams managing thousands of invoices monthly, that’s not automation — that’s a slowdown.

The Most Common Tipalti Issues

Invoice Format Mismatches: Even a header variation (“Invoice #” vs “Bill ID”) can trigger rejections.

Vendor Data Errors: Bank details, tax IDs, and payment preferences must match exactly, or payments are paused.

Duplicate Flags: The system frequently misidentifies legitimate repeats as errors.

Payment Delays: Exceptions escalate into missed discounts and strained vendor relations.

Instead of evolving, Tipalti locks users into endless manual verification loops. The platform identifies issues - but never learns how to stop them from recurring.

Gartner’s 2024 AP Automation report found that nearly 47% of finance teams using semi-automated systems still spend one-quarter of their time on exception management.

Hyperbots: Automation That Heals Itself

Hyperbots takes exception handling to the next level. Its Agentic AI framework mimics human reasoning and cross-functional collaboration.

Each “bot” functions like a specialized team member - one focuses on policy compliance, another on data validation, another on anomaly correction. Together, they create a self-correcting AP ecosystem.

When a mismatch occurs, the AI doesn’t flag it - it understands why it happened, resolves it, and applies that learning across all similar workflows.

Key Advantages of Hyperbots’ Self-Correcting AI

Learns from every transaction: No repeated Tipalti-style errors.

Understands policy context: Adjusts dynamically to new thresholds.

Adapts to data irregularities: Works even with unstructured vendor formats.

Cross-corrects automatically: Fixes one issue and prevents 100 more.

As Hyperbots’ AI roadmap explains, this transition from rules to reasoning is what defines modern finance automation.

Tipalti vs Hyperbots: The Real Comparison

Feature | Tipalti | Hyperbots |

Error Handling | Manual exception queues | Self-correcting AI logic |

Learning Capability | Static rule sets | Continuous machine learning |

Processing Speed | Limited by human reviews | Autonomous and real-time |

Cost Efficiency | High oversight cost | Lower cost, compounding ROI |

Auditability | Manual reconciliation | Automated audit trail |

Scalability | Human-dependent | Infinitely scalable |

User Experience | Reactive | Predictive and hands-free |

Why Tipalti Errors Never Truly Go Away

Tipalti’s rule-based structure works well for clean, structured data - but finance isn’t always that tidy.

Invoices vary by region, tax format, and vendor. POs contain special pricing terms or partial shipments. Tipalti’s “one-rule-fits-all” logic collapses in the face of such complexity.

Why These Tipalti Issues Keep Returning:

Rigid 3-way match: The system flags legitimate mismatches instead of reasoning through them.

Limited data comprehension: Can’t interpret intent from invoices with missing fields.

Static vendor configuration: Doesn’t update validation logic unless users intervene.

High dependency on templates: Template drift creates endless false positives.

As discussed in Hyperbots’ blog on OCR fatigue, legacy automation often “reads text” but fails to “understand meaning.” That’s where Hyperbots wins — it comprehends data contextually.

How Hyperbots Outsmarts Exceptions

Hyperbots embeds intelligence at every layer of the AP process. It doesn’t just automate — it thinks.

1. Smart Invoice Capture

Instead of static OCR, Hyperbots uses cognitive extraction to interpret fields based on intent. Whether the document says “Ref ID” or “Invoice Code,” it maps it correctly.

2. PO Matching That Understands Logic

Its PO automation module performs semantic 3-way matching, tolerating logical variances (partial receipts, multi-currency rounding, etc.) that Tipalti flags as errors.

3. Dynamic Payment Validation

The Payment Co-Pilot automatically detects duplicate vendors, invalid tax codes, and banking mismatches — and fixes them preemptively.

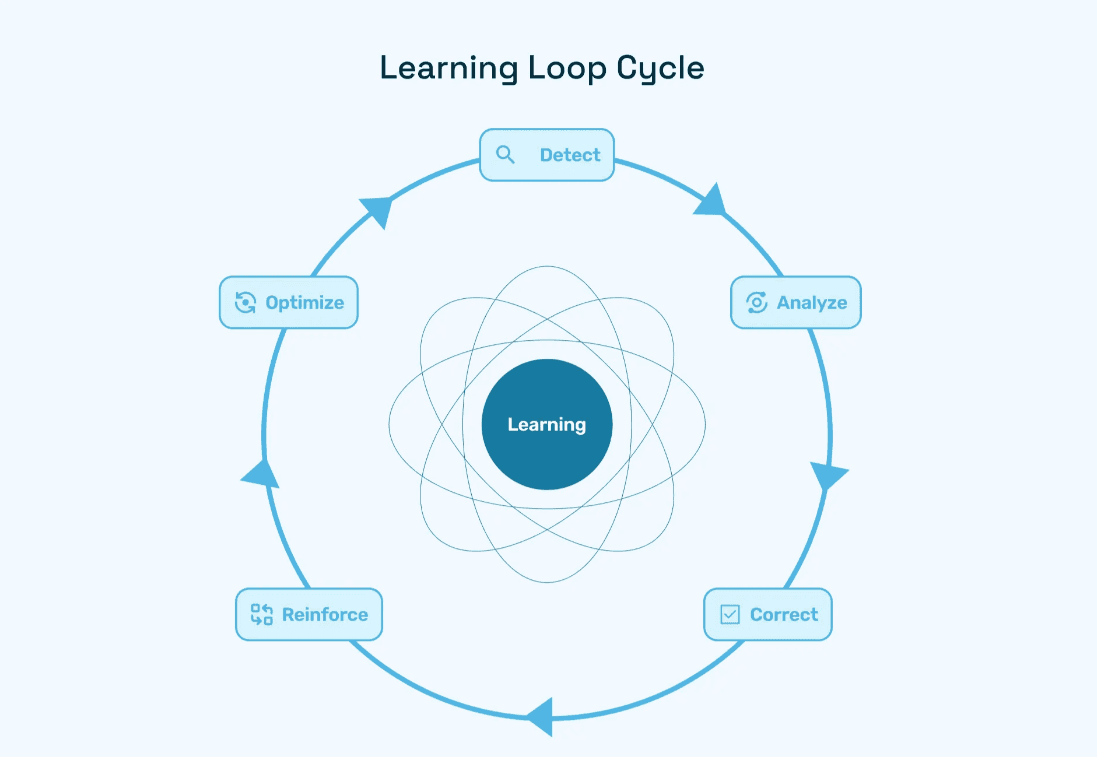

4. Continuous Feedback Loop

Each resolved error becomes training data for future predictions. The AI learns across organizations, making your system smarter every month.

The Magic Behind Self-Correction

At the heart of Hyperbots lies Agentic Collaboration - a concept where multiple AI agents communicate to resolve problems autonomously.

One bot identifies anomalies, another traces the root cause, a third confirms compliance, and the final agent executes the correction. This chain happens in seconds, replacing hours of manual oversight.

It’s like having a virtual AP team that never sleeps - or repeats mistakes.

And unlike Tipalti’s static scripts, these AI agents evolve through every cycle, gradually eliminating recurring errors altogether.

In a 2025 McKinsey study on “AI-Driven Finance,” organizations deploying self-learning AI saw up to 60% fewer exceptions and 30–40% faster AP close cycles.

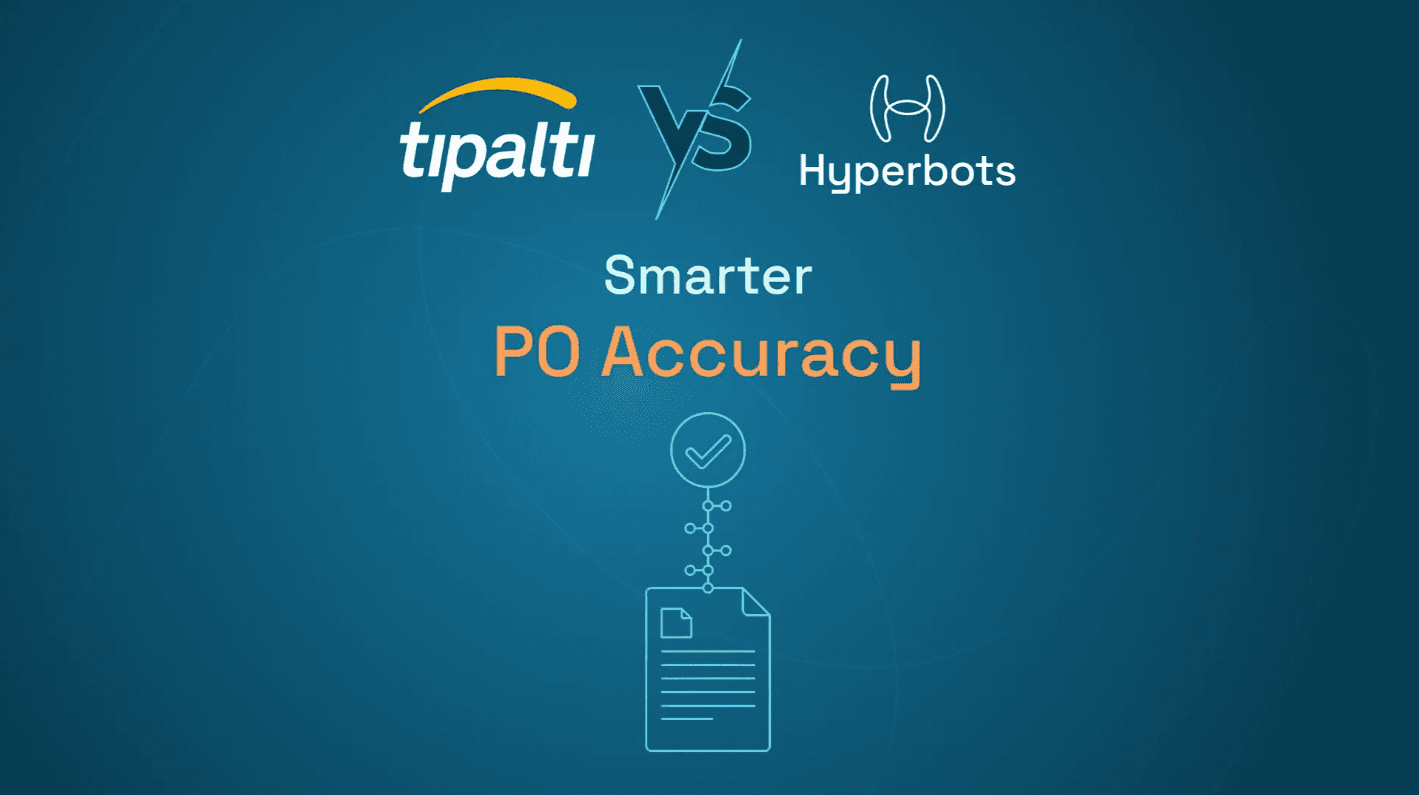

Transforming Purchase Orders with Intelligence

Hyperbots extends its intelligence beyond AP. Its purchase order automation platform redefines how procurement integrates with finance.

By applying self-learning AI to PO management, it achieves:

80% cycle-time reduction across request-to-approval.

99.8% data accuracy in multi-department workflows.

Automated reconciliation between POs, GRNs, and invoices.

What That Means for CFOs

Shorter approval chains.

No missed early-payment discounts.

Better vendor satisfaction through timely payments.

With Hyperbots, purchase orders evolve from manual control points into self-balancing contracts.

From Rules to Reasoning: The Big Shift

The difference between Tipalti and Hyperbots isn’t just speed - it’s philosophy.

Tipalti = Automation 1.0 (Rules)

Flags deviations

Relies on humans to decide

Linear workflows

Hyperbots = Automation 3.0 (Reasoning)

Understands context

Decides autonomously

Adaptive, circular workflows

The AI Advantage in Finance calls this the “Cognitive Leap” - where automation doesn’t just do tasks but understands business logic.

This shift transforms finance from reactive operations to proactive intelligence centers.

The Verdict: End of Tipalti Errors

Aspect | Tipalti | Hyperbots |

Exception Management | Reactive | Predictive |

AI Intelligence | Low | Self-evolving |

Dependence on Users | High | Minimal |

ROI Speed | Slow | Accelerated |

Scalability | Constrained | Infinite |

Vendor Experience | Inconsistent | Consistent and fast |

With Hyperbots, finance teams no longer worry about Tipalti errors, duplicate entries, or slow approval chains. Every interaction - invoice, PO, or payment - becomes smarter than the last.

Hyperbots’ AI is not just automating - it’s amplifying finance performance.

To see it in action, explore the Hyperbots Page and experience self-learning AP automation firsthand.

FAQs

1. Why does Tipalti produce so many exceptions?

A: Because it uses fixed, rules-based automation that can’t adapt to data variability or unstructured formats.

2. How does Hyperbots eliminate those errors?

A: Through AI agents that learn from every transaction, applying corrections across all workflows automatically.

3. Can Hyperbots integrate with existing ERPs?

A: Yes - Hyperbots works seamlessly with NetSuite, SAP, Oracle, and Microsoft Dynamics without disrupting current systems.

4. How long before we see results?

A: Most teams experience ROI in under a few months due to time saved on exception handling and faster payment cycles.

5. Is it suitable for enterprises with complex workflows?

A: Absolutely. Hyperbots is designed for high-volume finance teams that demand adaptive, autonomous systems.