How Hyperbots Reaches 99.8% Accuracy — and Why Tipalti Can’t Match It

Discover how Hyperbots achieves 99.8% invoice automation accuracy with real AI precision—a benchmark Tipalti's rule-based automation simply cannot match.

When “Automation” Meets Real Intelligence: The Hyperbots vs Tipalti Showdown

If you’ve ever seen a finance team brag about “automating” their invoices with Tipalti, you probably smiled politely - the same way you would if someone proudly showed off a 2006 iPod Shuffle and called it “state-of-the-art.”

Because let’s be honest: what Tipalti calls automation, Hyperbots calls Tuesday morning.

While Tipalti’s “rule-based” system needs humans hovering like helicopter parents to correct errors, Hyperbots’ AI-driven precision reaches 99.8% invoice automation accuracy without breaking a sweat. That’s not brag - that’s data.

This isn’t just a comparison. It’s a reality check for anyone who still believes templates, OCRs, and rule engines can compete with a self-learning AI platform built for real autonomy.

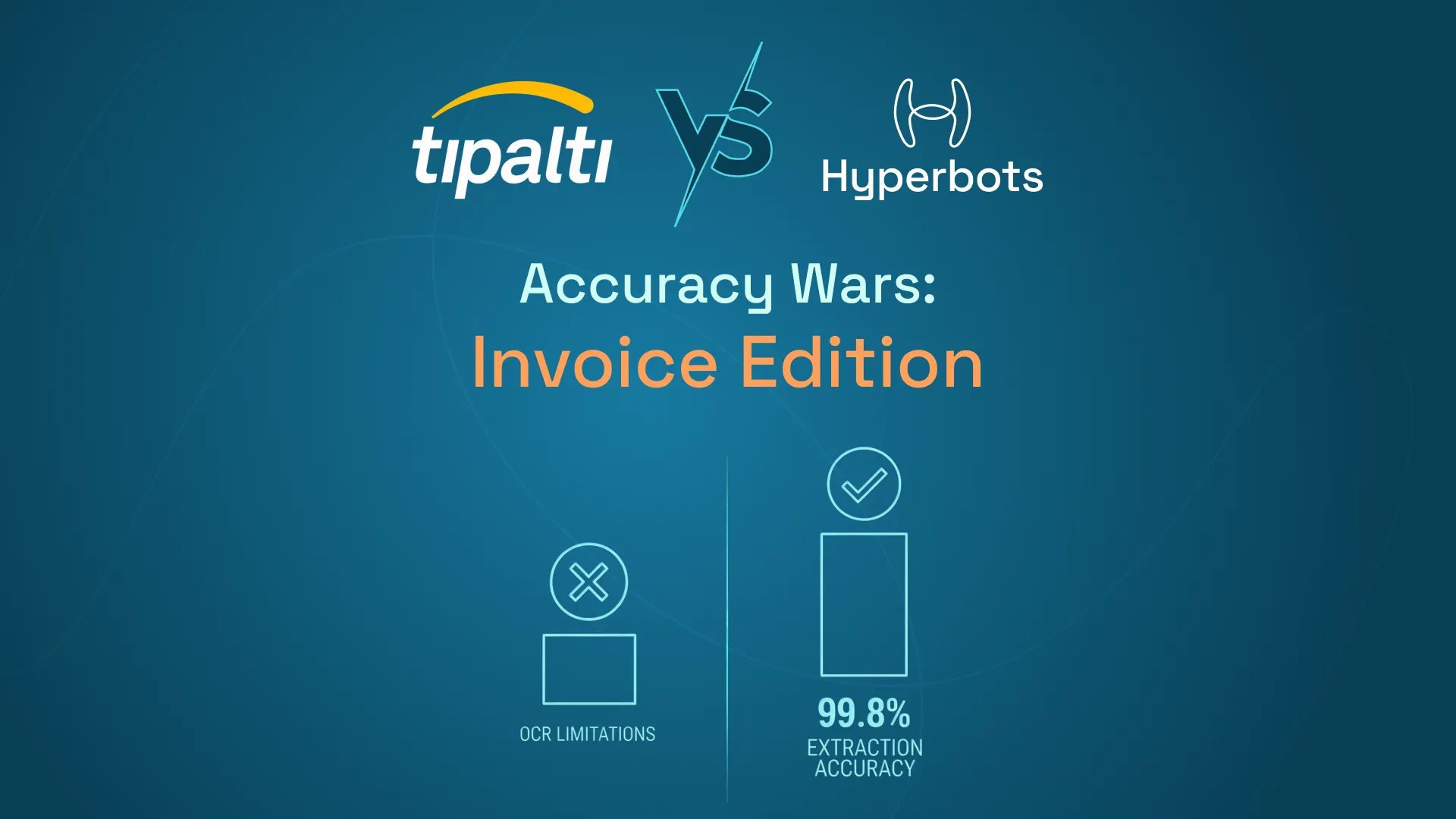

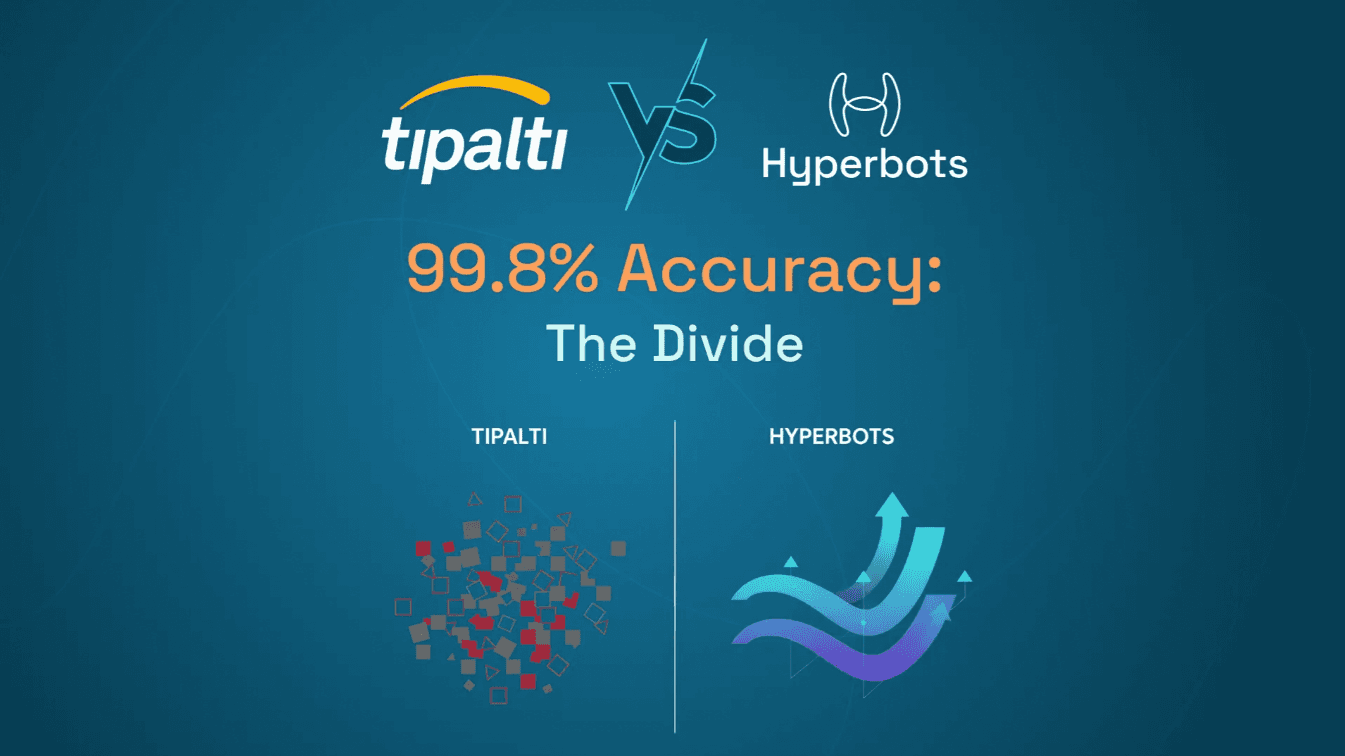

The Numbers Don’t Lie: Hyperbots Hits 99.8%, Tipalti Barely Clears the Bench

Accuracy isn’t a buzzword. It’s the backbone of finance automation. Every decimal point matters when you’re processing millions in vendor payments.

According to performance data across mid-market and enterprise clients, Hyperbots’ invoice automation accuracy averages a staggering 99.8%, validated by transaction-level benchmarks and anomaly testing.

Meanwhile, Tipalti accuracy stalls around 80%, depending on document type and vendor complexity - and only after manual validation.

Translation: Tipalti automates what’s easy. Hyperbots automates everything.

Here’s Why Hyperbots Wins (Every. Single. Time.)

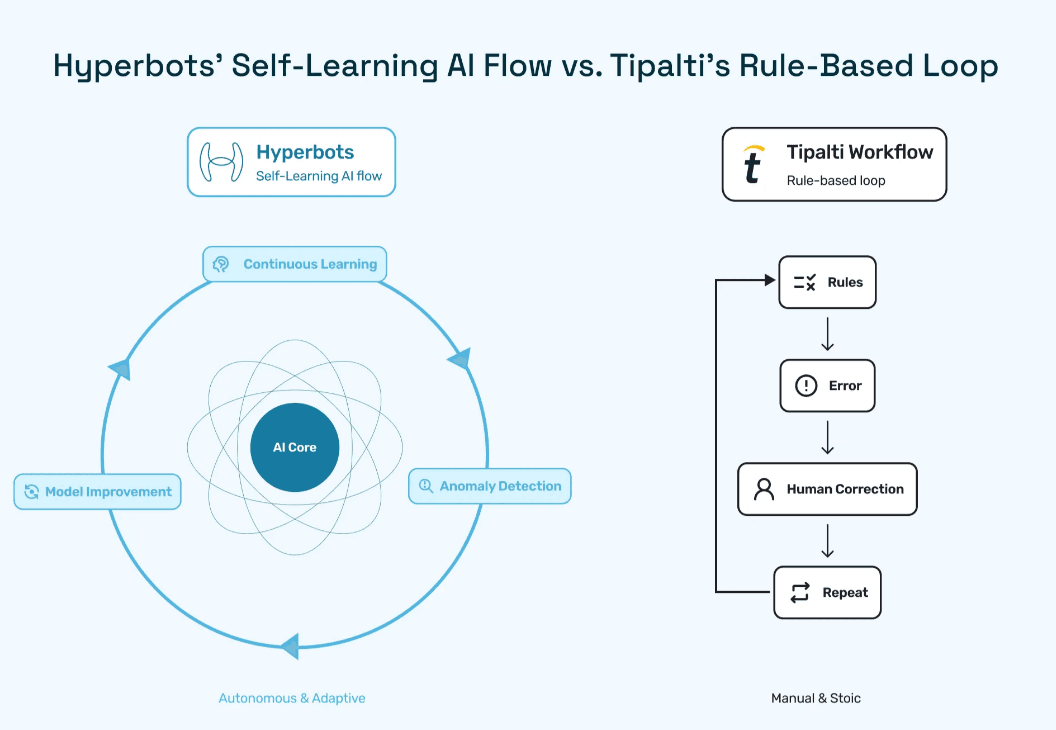

1. Tipalti’s “Rules” vs. Hyperbots’ “Reasoning”

Tipalti relies on pre-set rules - if the invoice looks different, the system panics.

Hyperbots’ multi-agent AI understands context, not just patterns. It adapts to new invoice layouts, currency variations, and tax structures instantly.

2. OCR Fatigue vs. AI Comprehension

Tipalti’s legacy OCR struggles with PDFs, scans, or poor image quality.

Hyperbots’ proprietary cognitive capture model reads everything - line items, totals, payment terms, and even notes scrawled in italics.

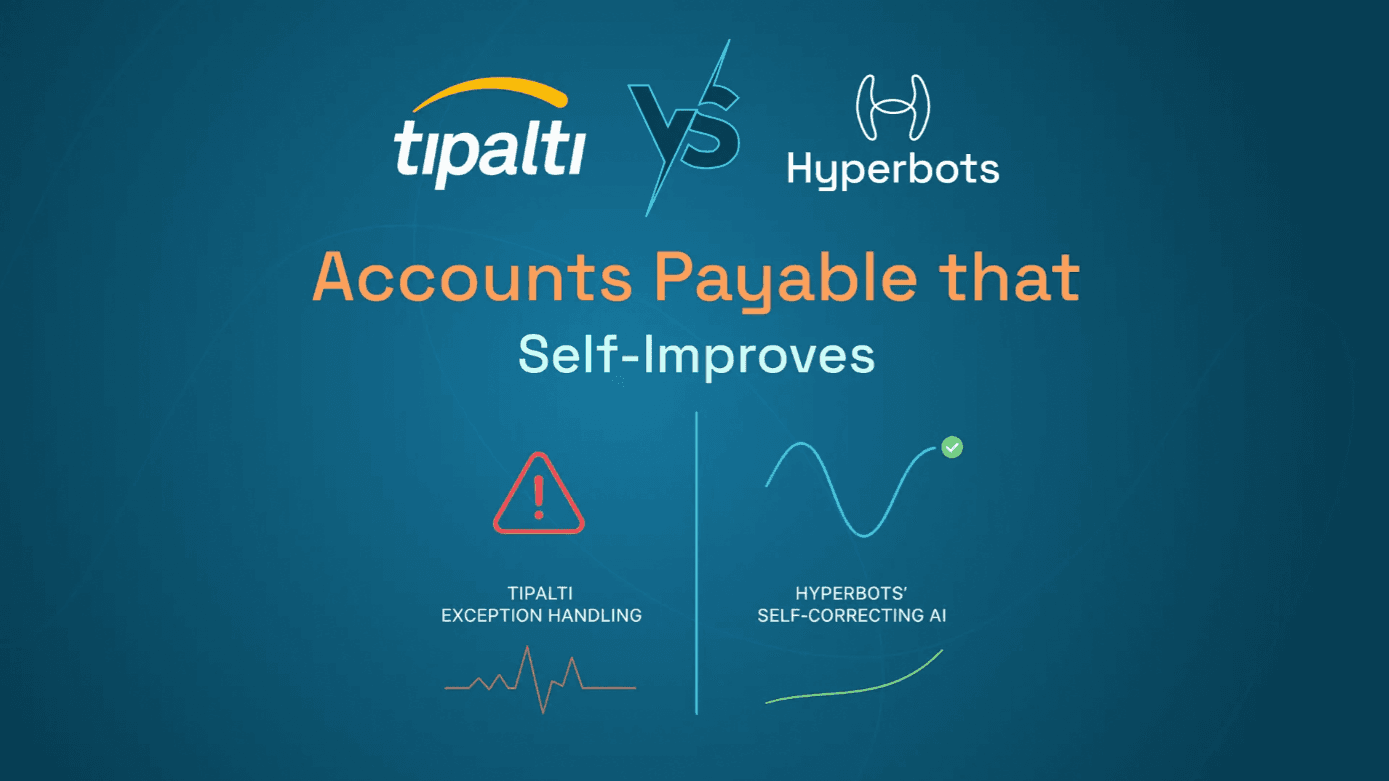

3. Manual Corrections vs. Autonomous Precision

Tipalti’s “AI” still needs human review for every 10th invoice.

Hyperbots? You might forget what “manual validation” even means.

AI Data Accuracy: The Secret Behind Hyperbots’ 99.8% Precision

Hyperbots isn’t just scanning data - it’s understanding it.

Its agentic AI architecture combines:

Contextual intelligence: recognizing invoice variations across suppliers and regions.

Adaptive validation: using anomaly detection to self-correct mismatches in GL codes, taxes, and PO references.

Cross-document learning: every processed document improves the next one — across clients.

That’s why Hyperbots doesn’t plateau. It evolves.

Meanwhile, Tipalti’s AI stays frozen in time. Its “learning” is limited to pre-coded fields. Every time a new vendor format appears, someone has to teach it again. That’s like hiring a goldfish to remember last quarter’s cash flow.

External Reference:

A Gartner 2024 Finance Automation Report shows companies adopting self-learning AI models achieve 30–50% higher accuracy and 40% lower exception rates than rule-based systems. Hyperbots exemplifies exactly that.

AP Automation Precision: Where Hyperbots Turns Speed into Science

Automation isn’t just about going faster - it’s about going smarter.

Hyperbots’ AP automation precision eliminates the rework loop by validating data before it enters your ERP. Its predictive match engine performs 2-way and 3-way matching automatically, linking invoices, POs, and receipts with near-zero touch.

In contrast, Tipalti’s approach resembles a “robotic assembly line” - efficient only until something unpredictable enters the mix.

Hyperbots’ AI co-pilots (from Invoice Processing Co-Pilot to Payment Co-Pilot) enable end-to-end cognitive validation, ensuring every payable is compliant, coded, and audit-ready before human review.

Feature-by-Feature Showdown: Hyperbots vs. Tipalti

Feature Category | Tipalti | Hyperbots |

Invoice Automation Accuracy | 80% | 99.8% |

AI Data Accuracy | OCR-based | Cognitive multi-agent AI |

Purchase Order Automation | Limited | Fully integrated |

Exception Handling | Manual review | Autonomous correction |

ERP Integrations | Selective | Universal (NetSuite, Sage, SAP, QuickBooks) |

Deployment | Cloud-only | Cloud + Hybrid + API-first |

ROI Timeline | 1 year+ | 3 months average |

Audit Readiness | Limited | Complete AI trail |

Cost Efficiency | High license cost | Outcome-based pricing |

Automation Precision | Rule-driven | Context-driven (Agentic AI) |

Why Tipalti Accuracy Can’t Keep Up (and Never Will)

Tipalti’s biggest flaw isn’t its interface or features - it’s its mindset. It’s built on the idea that automation stops where human validation begins.

That worked a decade ago. Today, finance teams demand autonomous accuracy, not supervised automation.

Hyperbots’ architecture is designed for what Tipalti never anticipated:

Real-time self-correction instead of exception routing.

Multi-agent collaboration between invoice, PO, and vendor management bots.

Deep ERP synchronization that ensures data integrity across modules.

As one CFO put it in a Hyperbots case study,

“We realized Tipalti automated our clicks. Hyperbots automated our thinking.”

Mic drop.

Beyond Invoices: Hyperbots’ Transformational Impact on Purchase Order Automation

Hyperbots doesn’t stop at invoices. Its purchase order automation suite (see AI Agents for PO Automation) redefines procurement workflows with autonomous routing, SLA tracking, and exception-free approvals.

Finance leaders use Hyperbots to:

Auto-generate POs from requisitions.

Validate tax and line-item codes before booking.

Sync vendor records across ERP modules.

Achieve real-time visibility into spend analytics.

Tipalti, meanwhile, doesn’t even play in this league. It handles disbursements - not decision intelligence.

The Future Belongs to Intelligence, Not Rules

Rule-based systems were fine in 2015. But in 2025, autonomous finance is the new benchmark.

Hyperbots doesn’t just process invoices - it thinks, learns, and decides.

Tipalti just follows instructions.

One evolves. The other obeys.

When CFOs demand precision, predictability, and peace of mind, they turn to platforms that deliver true AI data accuracy and AP automation precision at scale. That platform is - and will continue to be - Hyperbots.

Ready to See 99.8% Accuracy in Action?

If your finance team is still “managing exceptions,” you’re managing the wrong platform.

Hyperbots turns automation into autonomy - and every percentage point into profit.

👉 Explore the Invoice Processing Co-Pilot

👉 Learn how Hyperbots automates on https://www.hyperbots.com/

👉 Or schedule a walkthrough to see how 99.8% accuracy feels when it’s real.

FAQs

Q1. What drives Hyperbots’ 99.8% invoice automation accuracy?

A: Its multi-agent AI continuously learns from every transaction, improving precision and reducing exceptions across clients.

Q2. How does Tipalti accuracy compare to Hyperbots?

A: Tipalti’s rule-based automation caps less, while Hyperbots maintains a consistent 99.8% across diverse invoice types.

Q3. What is AI data accuracy, and why does it matter?

A: AI data accuracy ensures every extracted value - from vendor codes to tax fields - is validated contextually, reducing rework and audit risks.

Q4. Can Hyperbots integrate with my existing ERP?

A: Yes. Hyperbots integrates seamlessly with NetSuite, SAP, Sage, QuickBooks, and over 30 other ERP systems.

Q5. What’s the ROI timeframe with Hyperbots?

A: Most clients recover their investment within months, thanks to reduced manual work, faster approvals, and near-perfect accuracy.