Hyperbots Delivers 99.8% Accuracy: Here's Why Ramp Can't Keep Up

Why accuracy matters more than speed in AP automation

Accuracy in AP automation isn't talked about as much as it should be. Nobody gets excited about it in demos. But here's what actually happens when your Ramp accuracy falls short: invoices get coded to the wrong departments, payments go out for incorrect amounts, your month-end close turns into a scavenger hunt for errors, and your AP team spends more time fixing mistakes than they ever spent on manual processing.

The deep secret of AP automation is that most platforms measure success by how fast they process invoices, not whether they process them correctly. Speed without accuracy just means you're making mistakes faster.

So when we say Hyperbots maintains 99.8% invoice automation accuracy, we're not throwing around a marketing number. We're talking about something that fundamentally changes whether automation actually helps or just creates different problems.

Why Most AP Automation Gets Accuracy Wrong

Here's the thing about AP error rate in automated systems: the mistakes don't happen where you'd expect.

OCR technology (the thing that reads invoices) has gotten pretty good. Ramp can scan an invoice and pull out the vendor name, date, and total amount reasonably well. So can most modern platforms. That's table stakes now. But that's also where most platforms stop thinking about accuracy.

The real errors happen in the interpretation. Getting the numbers off the page is one thing. Understanding what those numbers mean, where they should go, and whether they make sense in context? That's exponentially harder.

Let's say you get an invoice from Office Depot for $1,247.32. Basic automation reads those numbers fine. But:

Is this for the Marketing department's supplies or IT's printer cartridges?

Does it match any outstanding POs, or is this an off-contract purchase?

Why is it 15% higher than last month's Office Depot invoice?

Should this be capitalized or expensed?

Who needs to approve this, and what backup do they need to see?

Ramp's automation can make educated guesses based on rules you set up. But educated guesses mean errors. Lots of them. And each error creates work for your team.

The Learning Problem (Or Why Rules-Based Systems Plateau)

Most AP automation platforms, including Ramp, operate on rules. You tell the system: "Invoices from this vendor always go to this GL code" or "Amounts over $5,000 need VP approval." The system follows the rules. Works great until reality shows up.

Reality looks like this: Your Office Depot invoices usually go to office supplies (account 6420), except when IT orders from them (account 6710), unless it's furniture which needs to be capitalized (account 1520), but only if it's over $2,500, and Marketing sometimes orders signage which is actually advertising expense (account 6310).

You can write rules for all of that. Really detailed, nested rules. And then next month Office Depot starts carrying IT equipment, and your rules don't account for that, so everything gets coded wrong until someone catches it and you write more rules.

Rules-based systems don't learn. They do exactly what you told them forever, even when circumstances change. The invoice automation accuracy starts okay and slowly degrades as your business evolves and edge cases pile up.

Hyperbots takes a different approach. Instead of rules, the system learns patterns. It watches how your AP team handles invoices, sees what decisions they make, understands the reasoning, and applies that understanding to future invoices. When something new comes up that doesn't fit existing patterns, the system flags it, learns from how you handle it, and remembers for next time.

This is why our accuracy actually improves over time instead of degrading. The system gets smarter with every invoice it processes.

Context Is Everything (And Most Systems Have None)

Here's a scenario that happens constantly in AP: You get an invoice for $8,500 from your regular IT vendor, ABC Technology. Should be routine. But today it's wrong. The question is: can your automation system tell?

In Ramp's world, if the vendor name matches and the amount is within normal range, it probably goes through. Maybe it gets routed to IT for approval. Someone might catch the error, or they might not.

What Hyperbots sees: This invoice is for "network maintenance" but your contract with ABC Technology covers that as part of your monthly managed services fee. You already paid for this. This is either a duplicate charge or ABC Technology billing for something that should be included.

The difference? Context. Hyperbots doesn't just know ABC Technology is an approved vendor. It understands your relationship with them. What you usually buy, what your contract covers, what's normal and what's weird. When something doesn't fit the pattern, accuracy means catching it before it becomes an error.

Or take coding accuracy. Ramp might correctly identify that an invoice should go to "office supplies" based on the vendor. Great. But Hyperbots knows that your Boston office is over budget on office supplies this quarter, your Seattle office is under budget, and this order is actually going to Seattle, so it codes accordingly and flags that Boston needs to start ordering through Seattle to stay within budget.

Same invoice. One system gets the basic facts right. The other system understands what those facts mean.

The Three-Way Match Disaster Zone

If you want to see where AP error rates really spike, look at three-way matching. This is the point where Ramp’s accuracy limitations become painfully obvious.

Three-way matching means verifying that your purchase order, receiving report, and vendor invoice all line up. In theory, simple. In reality, it’s a mess of partial receipts, pricing adjustments, vendor-specific exceptions, and quantity variances.

Take a common scenario:

The PO says 100 units at $10.

The receiving report shows 102 units received.

The invoice is for 102 units at $9.85.

Ramp treats this as a hard exception because the numbers don’t match exactly. A human now has to investigate the discrepancy, dig through emails, check with receiving, and confirm with the vendor - a slow, error-prone loop.

Hyperbots approaches this differently. Its AI-driven 3-way matching doesn’t just compare numbers - it evaluates context. Hyperbots cross-checks PO data, receiving records, and invoice details, applies configurable matching rules, and highlights exactly why something doesn’t align. In many cases, the system can validate that the variance is allowable based on your matching strategy and past patterns, significantly reducing manual exception handling.

The result isn’t just speed - it’s accuracy. Hyperbots’ AI learns from historical transactions, vendor behaviors, and prior resolutions, enabling it to handle many of the nuanced cases that require human judgment in traditional systems. You still maintain control, but the amount of human intervention drops dramatically.

When "Close Enough" Costs Real Money

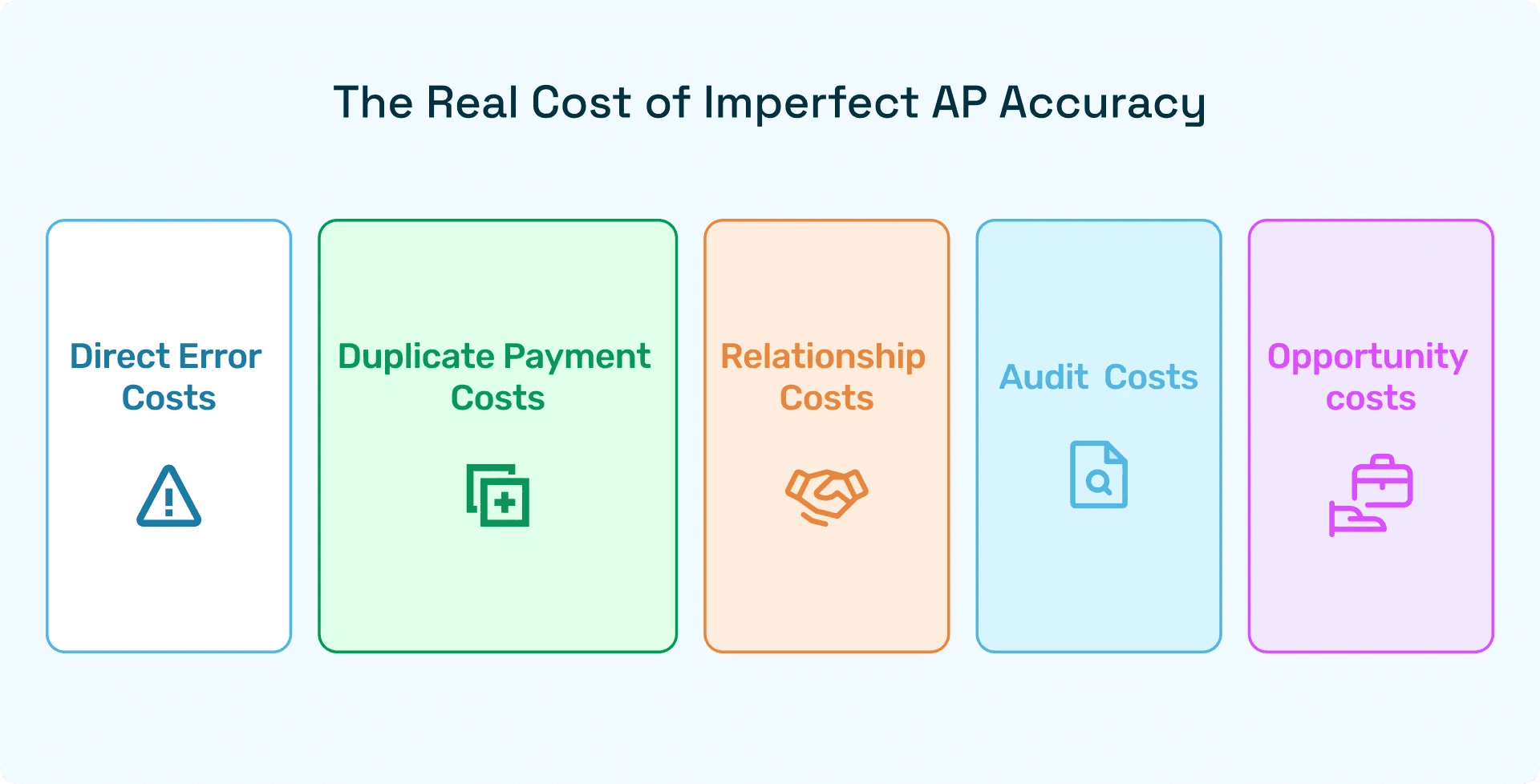

Let's talk about what imperfect accuracy actually costs.

Direct error costs: Wrong GL codes mean your financial statements are wrong. You find out at month-end, panic, and spend days tracking down and correcting entries. Your accounting team works overtime. Your close process extends from 5 days to 8 days. Your CFO is furious because board materials are late.

Duplicate payment costs: Automation that's 90% accurate at catching duplicates sounds pretty good until you realize that 10% of your invoice volume represents tens or hundreds of thousands of dollars paid twice. Getting that money back is painful and sometimes impossible.

Relationship costs: You keep paying vendors late because your approval routing is wrong and invoices sit in the wrong person's queue. Vendors start demanding payment upfront or adding late fees. Your purchasing power decreases because you're considered a risky customer.

Audit costs: Inaccurate coding and poor matching documentation means your audit takes longer and costs more. Auditors don't trust your systems, so they expand sample sizes and dig deeper. What should be a routine audit becomes an expensive deep investigation.

Opportunity costs: Your AP team spends a lot of their time fixing errors instead of doing useful work. You need to hire more people just to keep up with corrections. Everyone's frustrated and burned out.

The difference between 90% accuracy and 99.8% accuracy isn't 19.8 percentage points. It's the difference between automation that creates more work and automation that actually works.

Why Ramp Gets Stuck At "Pretty Decent"

Ramp's accuracy limitations aren't because they built bad software. They're because they built software for a different primary purpose.

Ramp started as a corporate card company. Their core product is about controlling spend at the point of purchase and automating expense reports. They're excellent at that. AP functionality came later, and you can tell. It's built on the same underlying architecture designed for expense management, adapted for invoices.

The problem? Expenses and AP are fundamentally different.

Expense reports are relatively simple. Employee buys something, uploads the receipt, categorizes it, and the manager approves. Errors are usually obvious (wrong category, duplicate receipt, missing documentation). The volume is manageable. The stakes are lower.

AP is complex. Multiple document types, PO matching, vendor contracts, payment terms, complex approval hierarchies, intricate coding rules, high volume, high dollar amounts. Errors are subtle and expensive. You need a system built specifically for that complexity.

Because Ramp's AP solution is adapted from their expense platform, it handles the simple cases well and struggles with complexity. The accuracy is fine for straightforward invoices from known vendors with simple coding. But anything requiring judgment, context, or understanding of relationships? That's where errors creep in.

Hyperbots was built from the ground up for AP complexity. The AI isn't adapted from some other use case. It's trained specifically on accounts payable workflows, documents, and decision-making. It understands vendor relationships, contract terms, PO nuances, and approval logic at a fundamental level.

The Compound Effect Of Accuracy

Here's what people miss about invoice automation accuracy: the impact compounds.

When your automation is 90% accurate, 10% of invoices have errors. Your team catches maybe 80% of those errors before payment. So 2% of invoices get paid incorrectly. Doesn't sound terrible.

But next month, you're processing invoices that reference previous invoices that had errors. Your reports contain bad data. Your approvers are making decisions based on incorrect information. Your vendors are confused about payment status. The errors cascade.

After six months, you're not dealing with a 10% error rate anymore. You're dealing with accumulated chaos. Nobody trusts the system. Your team double-checks everything manually. You're paying for automation but not getting any benefit from it.

With 99.8% accuracy, the opposite happens. High accuracy builds trust. Your team stops double-checking routine invoices. They focus on genuine exceptions. Your data gets cleaner over time instead of messier. Your reports are actually useful. The automation gets faster and more efficient because fewer things need human intervention.

Real Accuracy Requires Real Intelligence

The fundamental issue is that high accuracy in AP automation requires actual understanding, not just pattern matching or rules.

When an invoice comes in for "Q3 Marketing Consulting Services" from a new vendor, accurate processing means:

Recognizing this relates to the Q3 marketing campaign (even though the invoice doesn't say that explicitly)

Understanding that consulting services need different approval workflow than goods

Knowing that new vendors require additional verification steps

Checking that this aligns with budget allocations for Q3 marketing

Routing to the right people based on campaign ownership, not just department hierarchy

Flagging potential tax implications of consulting vs. other service types

Ramp's automation can read the invoice text and route based on department. That's helpful but not accurate in the sense that matters. The invoice might go to the marketing director when it really needs to go to the campaign manager who actually knows if this work was done and should be paid.

Hyperbots' AI understands context. It knows about the Q3 campaign because it processed the original contract, saw the email approvals, and recognized related expenses. It routes accurately because it understands the work, not just the org chart. And it does this instantly, the moment the invoice arrives.

The Test That Matters: Month-End Close

Want to know if your AP automation is actually accurate? Look at your month-end close process.

With typical automation (including Ramp), month-end close is still painful. The accounting team spends days reviewing accruals, tracking down misclassified expenses, adjusting entries, and reconciling accounts. They're good at it, but it takes forever and everyone dreads it.

With truly accurate automation, month-end close is boring. Most accounts reconcile automatically. Accruals are correct because coding was correct all month. There are still some adjustments, but they're genuine judgment calls, not error corrections.

Companies using Hyperbots report closing their books 3-5 days faster than before. Not because the system is faster at calculations. Because the data going into those calculations is accurate from the start. Their accounting teams spend close period doing actual accounting (analyzing variances, strategic review, forecasting) instead of detective work.

That's the real measure of accuracy. Can you trust your numbers without verification? Can your accounting team focus on analysis instead of validation? Can you make decisions based on real-time data instead of waiting for month-end cleanup?

What This Means For Your Decision

If you're evaluating AP automation and comparing options, accuracy should be your first question, not your fifth.

Don't ask: "Does this platform automate invoices?"

Ask: "What percentage of invoices process correctly without human intervention?"

Don't ask: "Can this do three-way matching?"

Ask: "How does it handle matching exceptions, and what's the error rate?"

Don't ask: "Does it integrate with our ERP?"

Ask: "Will it understand our coding logic well enough to be accurate, or just pass data through?"

Ramp will tell you they automate AP. That's true. They will not tell you their accuracy rate, because it's not competitive. It's not bad, necessarily. It's just not at a level where you can truly trust the system and step back.

Hyperbots puts accuracy front and center because it's our actual differentiator. We maintain 99.8% accuracy because the AI genuinely understands AP workflows, learns from your specific business, and catches errors before they become problems.

The Bottom Line On Accuracy (And Speed)

Here's the thing: you shouldn't have to choose between speed and accuracy. That's a false tradeoff that mediocre automation forces on you.

Hyperbots processes invoices fast, often within minutes of receipt. But unlike platforms that sacrifice accuracy for speed, our processing is both instant and correct. The AI makes decisions in real-time because it actually understands what it's looking at, not because it's skipping verification steps.

Speed without accuracy just means you're making mistakes faster. But accuracy without speed means you're still creating bottlenecks. You need both, and with true AI understanding, you get both.

Accurate automation lets you scale your AP operation without hiring. You can close your books faster. You can trust your financial data. You can free your team to do meaningful work. And you can do all of it at the speed modern business requires.

Without accuracy? You're just digitizing chaos, no matter how fast you do it.

Ramp offers decent automation for companies with simple AP needs and tolerance for manual review. If your invoice volume is low and your workflows are straightforward, their accuracy level might be acceptable.

But if you're serious about transforming AP, if you need to handle complexity at scale, if you want automation you can actually trust? You need the accuracy that only true AI understanding can deliver.

That's not marketing speak. That's the difference between 90% and 99.8%. Between "pretty decent" and "actually works." Between software that sort of helps and software that fundamentally changes what's possible.

Your AP team deserves automation that's accurate enough to trust. Your business deserves financial data that's accurate enough to use. And neither of those things happen with platforms that treat AP as an afterthought to their core product.

Accuracy matters. And when it comes to AP automation, Hyperbots delivers it in a way Ramp simply can't match.