Ramp Exception Handling vs Hyperbots AI: Who Handles Edge Cases Better?

What really happens when automation runs into real-world complexity

When your AP automation system runs smoothly, everything feels amazing. Invoices flow through like magic, approvals happen in seconds, and your finance team actually has time to think strategically instead of drowning in paperwork. But here's the thing: automation never runs smoothly 100% of the time. There are always edge cases, weird exceptions, and those annoying one-off situations that make you wonder if the robots have actually taken over or if they're just pretending.

So when it comes to Ramp exception handling versus what Hyperbots AI brings to the table, who actually deals with the messy stuff better? Let's dig in and find out what happens when things don't go according to plan.

What Actually Is Exception Handling in AP Automation?

Before we get into the comparison, let's clear up what we're even talking about. Exception handling is basically what happens when your automated system hits something it can't process automatically. Maybe it's an invoice with a price that doesn't match the purchase order. Maybe someone forgot to attach a receipt. Maybe the vendor sent a duplicate invoice, or there's a weird tax calculation that doesn't add up.

According to Ardent Partners, roughly 22.5% of all invoices need someone from AP to manually fix errors or discrepancies. That's more than one in five invoices causing headaches. And here's the kicker: when even the best AP teams face exception rates up to 30%, with a third of those exceptions leading to late payments, you're talking about real money getting lost in the shuffle.

Exception handling isn't just about catching mistakes after they happen. It's about having systems smart enough to know when to escalate, when to auto-fix, and when to just let things through with a tolerance level that makes sense for your business.

How Ramp Approaches Exception Handling

Ramp has built a solid reputation as a corporate card and spend management platform. Their whole pitch revolves around simplicity and automation. For straightforward expense management tasks like receipt matching and basic policy enforcement, Ramp works pretty well. The platform can flag policy violations, send automated reminders when receipts are missing, and keep things moving along when everything fits the standard template.

But when it comes to exception handling specifically? That's where some cracks start to show.

What Users Actually Say About Ramp's Exception Handling

Looking at real user feedback from G2 and other review platforms, there's a clear pattern emerging. Users appreciate Ramp's clean interface and ease of use, but they also point out some frustrating limitations when things get complicated.

One recurring theme in reviews is that users find issues with transaction review processes and wish there were better management features. Several reviewers specifically mention that reporting interfaces are difficult to manage and navigate, which becomes a real problem when you're trying to track down exceptions or understand why certain transactions got flagged.

Another pain point? Users struggle with the inability to submit expenses without receipts and find the receipt upload process frustrating. When you're dealing with exceptions, the last thing you want is a rigid system that can't accommodate real-world scenarios where documentation might be delayed or incomplete.

The inability to have multi-functioning roles within the Ramp system is also noted as a limitation, which matters when you need flexibility in handling complex exception scenarios that might require input from different levels of authority.

Perhaps most telling, the reviews reveal a clear pattern: the platform works well for Ramp corporate card management but falls short when businesses need robust AP automation and advanced workflows.

The Real Problem: When Edge Cases Don't Fit the Template

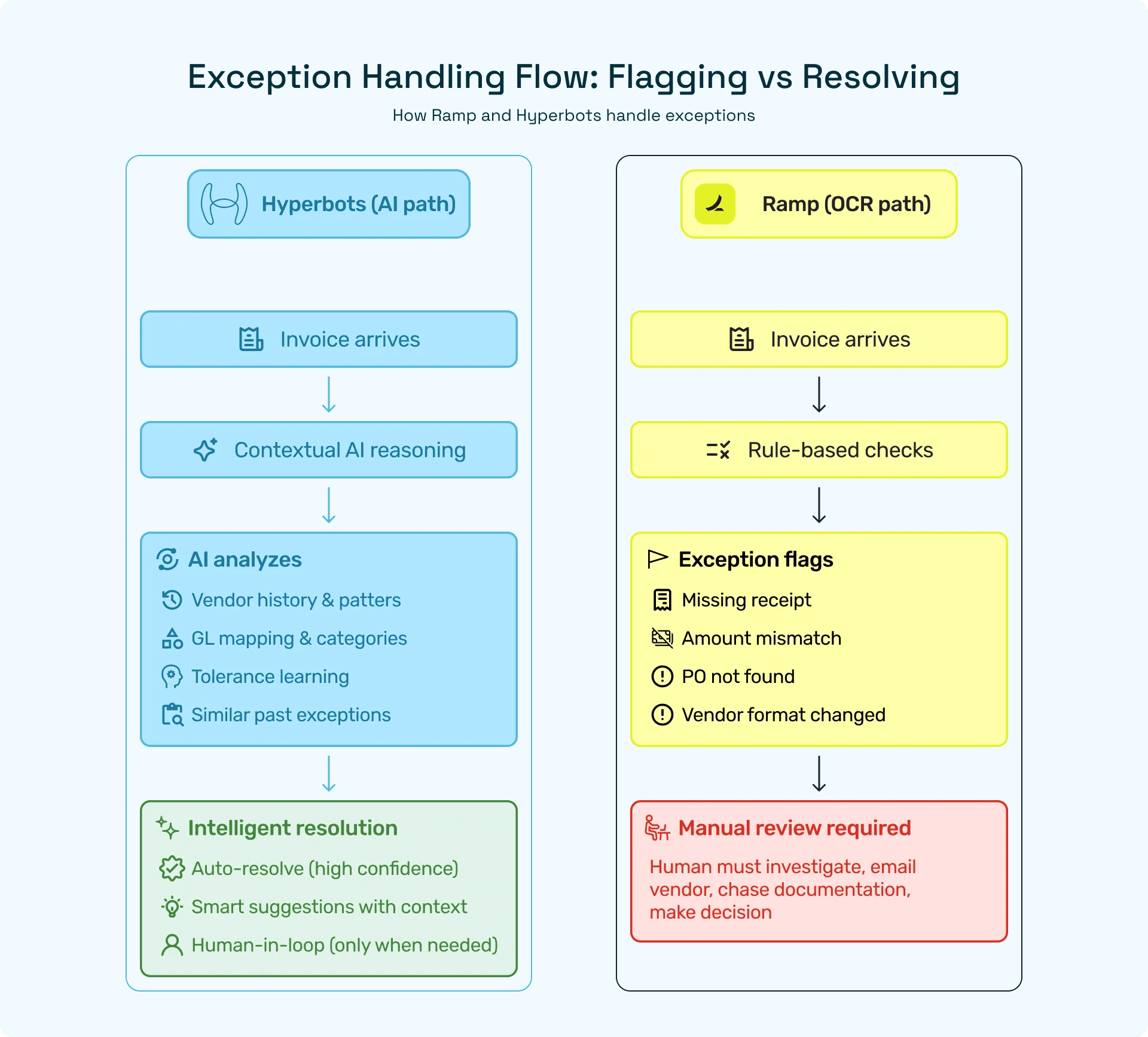

Ramp's exception handling operates primarily through rule-based automation. That means it's great at catching things that match predefined scenarios. Missing receipt? Flagged. Amount over spending limit? Blocked. Pretty straightforward stuff.

But what about the weird situations? What about when a vendor changes their invoice format? What about when there's a legitimate reason for a price variance that doesn't fit neatly into a percentage tolerance? What about when you're dealing with international vendors with complex tax structures?

This is where rule-based systems hit their limits. They're reactive rather than proactive. They can tell you something's wrong, but they often can't tell you why or suggest intelligent solutions. And when you're dealing with thousands of invoices, having a system that just creates exception queues without helping you resolve them quickly becomes a massive bottleneck.

How Hyperbots Takes a Different Approach

Hyperbots’ AI was built from the ground up with a fundamentally different philosophy. Instead of treating exceptions as annoying interruptions to be flagged for humans, Hyperbots uses agentic AI that can actually reason through edge cases and make intelligent decisions.

How Hyperbots Goes Beyond OCR and Rules?

Here's where things get interesting. Hyperbots don't just use basic OCR or simple matching rules. The platform achieves 99.8% accuracy in converting unstructured data to structured fields through a multimodal MOE model integrating LLMs, VLMs, and layout models, with contextual validation ensuring 99.8% accuracy for deployed agents.

What does that mean in practice? It means the system can actually understand context, not just match patterns. When an invoice comes in with a slight price variance, the AI doesn't just flag it. It looks at historical data, checks if this vendor typically has minor fluctuations, considers whether the variance falls within reasonable business norms, and can even auto-resolve the issue by creating appropriate GL line adjustments.

Hyperbots achieve up to 80% straight-through processing of invoices, significantly reducing manual effort. But that 80% STP rate is only part of the story because what really matters is what happens with the other 20%.

How Hyperbots Handles the Messy Stuff

The key difference is in how exceptions are approached. The Hyperbots Agentic AI platform offers highly flexible workflows for each task, allowing companies to customize exception handling by business unit, category, or cost center.

Instead of dumping every exception into a generic queue, Hyperbots categorizes exceptions by type and severity, automatically routes them to the right people, and provides contextual information that makes resolution faster. The system doesn't just say "there's a problem." It says "here's what the problem is, here's why it might have happened, and here are three suggested ways to resolve it."

Even better, Hyperbots Co-pilots enable human-in-the-loop collaboration through exception handling, approval workflows, and contextual insights, ensuring control and transparency where human judgment adds value.

This isn't about replacing human judgment entirely. It's about bringing humans in only when they're actually needed, and when they do get involved, giving them all the context and tools to make decisions quickly and confidently.

The Learning Element

Here's something Ramp fundamentally can't do: learn from exceptions over time. Because Ramp's exception handling is primarily rule-based, it handles the same exception the same way every single time unless someone manually updates the rules.

Hyperbots, on the other hand, gets smarter with every exception it handles. When a human reviews and resolves an exception, that decision feeds back into the AI models. Next time a similar situation comes up, the confidence level is higher, and eventually, what used to be an exception becomes part of the automated flow.

Their model at MVP stage has already surpassed human-level accuracy for many tasks, and the system is trained on millions of accounting documents and transactions. That's not marketing fluff. That's the difference between a system that's stuck with the rules you programmed versus one that evolves with your actual business patterns.

The Practical Impact: Processing Speed and Accuracy

Let's talk numbers because that's what actually matters to CFOs and finance teams.

With Ramp, you get decent automation for straightforward transactions. But when exceptions occur, you're often back to manual intervention, email chains, and the kind of back-and-forth that defeats the whole purpose of automation in the first place.

Hyperbots reduce invoice processing time from an industry average of 11 days to less than one minute due to straight-through processing achieved through AI. Even when exceptions occur, the resolution time is dramatically faster because the system provides intelligent guidance instead of just flagging issues.

The accuracy difference is even more striking. Traditional AP automation (which is essentially what Ramp offers for invoice processing) typically achieves exception rates of 10% to 15% according to industry benchmarks. That's better than manual processing at 25% to 30%, but it still means one in ten invoices requires manual intervention.

With Hyperbots' approach, AI achieves up to 80% straight-through processing, freeing up staff bandwidth by 80%, with retained staff empowered by AI Co-pilot with pinpointed reasons for quick decisions on business exceptions.

Real-World Scenarios: Where the Difference Shows Up

Scenario 1: The Vendor Format Change

Your long-time supplier decides to update their invoice template. New layout, different fields in different places, maybe a new format for line items.

With Ramp: Every invoice from this vendor now becomes an exception because the system doesn't recognize the new format. Someone needs to manually update rules or contact support to adjust the configuration. Meanwhile, all those invoices pile up in the exception queue.

With Hyperbots: The AI recognizes it's the same vendor based on multiple data points (tax ID, bank details, historical patterns). It adapts to the new format automatically, extracts the data correctly, and keeps processing without interruption. Maybe the first invoice gets flagged for verification, but after that, the system learns and moves on.

Scenario 2: The Price Variance That Makes Sense

An invoice comes in for $10,200 when the PO says $10,000. Technically, that's outside standard tolerance.

With Ramp: Exception. Someone needs to investigate, reach out to the vendor, check if this was authorized, and manually approve or reject. This takes time, creates friction, and might delay payment.

With Hyperbots: The AI checks historical patterns and sees this vendor typically includes freight charges separately. It identifies the $200 as a legitimate shipping cost, suggests creating a separate GL line for shipping expenses, and routes it for approval only if the shipping cost is unusual for this vendor. If it's within normal range, it auto-processes with full audit trail documentation.

Scenario 3: The Missing PO

An invoice arrives without a PO number. Maybe it's for a subscription service, maybe it's an emergency purchase, maybe someone just forgot to create the PO.

With Ramp: Hard stop. Exception. Manual intervention required. The system doesn't know what to do with non-PO invoices unless you've manually configured specific rules for specific vendors.

With Hyperbots: The AI looks at the vendor, checks historical patterns, identifies if this is a recurring subscription or a new purchase, can match it to budget categories, and routes it through the appropriate approval workflow based on amount and context. It doesn't just stop; it actively helps resolve the issue.

The Integration Story

Both platforms integrate with major ERPs and accounting systems, but how they handle integrations during exception scenarios differs significantly.

Ramp offers integrations with QuickBooks, NetSuite, Sage, and other major systems. But sync depth is limited with daily batch updates lacking the bi-directional, real-time integration finance teams often require. When exceptions occur, this creates additional delays because data isn't flowing in real time.

Hyperbots Co-pilots natively integrate with both on-premise ERP and cloud ERP platforms, enabling secure, high-speed data exchange and consistent finance automation. More importantly, the Co-pilots ensure data integrity by verifying ERP postings with read-back checks, employing optimal retries for failures, and providing exception reporting for user resolution.

That read-back verification is crucial for exception handling. It means the system doesn't just push data to your ERP and hope for the best. It confirms the data landed correctly, catches any integration failures immediately, and can retry or route for resolution automatically.

The Human Element: When You Actually Need People

The best exception handling isn't about eliminating humans entirely. It's about bringing them in at the right time, with the right information, to make the right decisions.

Ramp's approach is essentially: "Here's an exception. You figure it out." You get notified, you dig through the transaction details, you chase down information, you make a decision. It's functional, but it's not particularly intelligent about minimizing the human burden.

Hyperbots take a collaborative approach. The AI handles what it can with high confidence. When human input is genuinely needed, it generates contextual and configurable notifications across all processes, providing real-time updates and actionable insights, ensuring transparency and efficient user intervention when needed.

It's the difference between "something's wrong, go fix it" versus "here's what's wrong, here's the context, here's what similar situations looked like in the past, and here are your options." One approach respects your time and expertise. The other just dumps work on your desk.

The Scalability Factor

As your business grows, exception handling becomes even more critical. What works when you're processing 1,000 invoices a month falls apart at 10,000 invoices a month.

Ramp's rule-based approach doesn't scale particularly well because exceptions don't grow linearly. As you add vendors, add complexity, add business units, the number of edge cases and weird situations multiplies exponentially. More exceptions mean more manual work, which means hiring more people, which means higher costs per invoice processed.

Hyperbots envisions their transformer-based proprietary models will help achieve over 80% straight-through-processing of otherwise completely human operated processes. And because the AI learns and adapts, it actually gets better at handling your specific edge cases as you scale. The system that struggled with 5,000 exceptions becomes proficient at handling 50,000 because it's seen similar patterns before.

What CFOs and Finance Leaders Should Consider

If you're evaluating these platforms, here are the questions you should actually be asking:

How much time does your team currently spend resolving exceptions?

If it's more than 10 hours per week, you need an intelligent exception handling system, not just an automation platform. Ramp will help with the easy stuff, but it won't dramatically reduce that exception resolution time. Hyperbots was built specifically to tackle this problem.

How diverse are your invoice types and vendors?

If you're dealing with standard vendors sending standard invoices, Ramp's rule-based approach might suffice. But if you have international vendors, complex tax situations, multiple business entities, or frequent vendor changes, you need the adaptability that AI-driven exception handling provides.

What's your tolerance for manual intervention?

Be honest about this. If you're fine with your team manually handling a lot of invoices, Ramp is a perfectly reasonable choice. If you want to push that down to 15-20% or less, you need something smarter.

How important is learning and continuous improvement?

Ramp will be roughly as good at exception handling next year as it is today (unless they fundamentally change their architecture). Hyperbots will be significantly better next year because it learns from every exception resolved. That compounding improvement matters over time.

The Verdict: It's About Your Complexity

Here's the honest take: if your AP needs are relatively straightforward, if you're primarily using corporate cards for employee expenses, if your vendor relationships are stable and standardized, Ramp is probably fine. It's not going to blow your mind with exception handling, but it'll get the job done.

But if you're dealing with real complexity, if exceptions are eating up significant team time, if you need intelligence rather than just automation, Hyperbots is in a different league. The difference between rule-based exception flagging and AI-driven exception resolution is massive when you're at scale.

Hyperbots has taken a comprehensive end-to-end approach to solve this problem and designed their product grounds-up after closely working with prominent CFOs from various sectors. That CFO-centric design philosophy shows up most clearly in how the platform handles the messy, complicated situations that every finance team faces.

Ramp built a great expense management and corporate card platform that added AP automation later. Hyperbots built an AI-first AP automation platform that understands exceptions aren't bugs to be flagged but opportunities to deliver value through intelligence.

When it comes to exception handling and edge cases, the gap is clear. One platform flags issues and stops there. The other explains what broke, why it broke, and how to fix it. For finance teams expected to move faster with fewer resources, that context isn’t a nice-to-have. It’s what keeps work moving.

If you want to see how this plays out in real workflows, a short demo is the easiest way to tell whether it fits your team.