Ramp vs Hyperbots: The Real ROI of AI-Powered AP Automation

Looking beyond spend controls to what actually drives AP savings

When finance teams talk about Ramp ROI, they're usually thinking about corporate cards, spend controls, and maybe some basic automation. And honestly? Ramp does those things well. But here's what most people miss: getting real AP automation savings isn't just about preventing overspending or catching duplicate receipts. It's about fundamentally changing how your accounts payable team works.

The question isn't whether Ramp saves you money. It's whether it saves you enough money, and more importantly, whether it actually makes your team's life easier or just adds another tool to manage.

Let's break down what really matters when you're comparing Ramp vs AI automation solutions like Hyperbots.

What Ramp Actually Does (And What It Doesn't)

Ramp built its reputation on corporate cards with built-in spend management. The pitch is simple: control spending before it happens, automate expense reports, and get some cashback. For companies tired of chasing down receipts and reconciling credit card statements, it's a breath of fresh air.

But here's where things get interesting. Ramp's automation is primarily focused on the expense side of things. Employee purchases, travel expenses, subscriptions you forgot about. That's valuable, sure. But for most mid-sized and enterprise companies, the real pain (and the real money) sits in accounts payable. Vendor invoices, purchase orders, three-way matching, payment approvals... that's where finance teams actually spend most of their time.

Ramp has added some AP features over time. You can receive invoices, route them for approval, and pay vendors through their platform. It's functional. But it's not where their heart is, and you can tell. The AP side often feels like an add-on to their core spend management product rather than a purpose-built solution.

The Copilot Difference: Where Real Automation Happens

This is where Hyperbots takes a completely different approach. Instead of bolting AP onto a corporate card platform, Hyperbots built an AI copilot specifically designed to handle the messy, complex reality of accounts payable.

Think about your typical AP workflow. An invoice comes in. Someone needs to code it. Maybe it needs to match a PO. Then it goes through approvals (often multiple people). Questions come up. "Is this the right cost center?" "Did we actually receive these goods?" "Why is this invoice $200 more than the PO?" Your AP team becomes a help desk, fielding questions and hunting down answers.

Ramp can route that invoice to the right people. That's helpful. But Hyperbots' copilot actually understands the invoice. It knows your vendor history, your approval hierarchies, your coding rules. When someone has a question, they can literally ask the copilot in plain English, and it pulls the answer from your entire financial system. No more digging through emails or old invoices or asking Janet in accounting who's been here for 15 years and just "knows things."

Here's a real scenario: An invoice comes in from a regular vendor, but it's coded to the wrong department. In Ramp, someone catches it (hopefully) and reassigns it. In Hyperbots, the copilot flags it before it even gets to approvals, suggests the correct department based on previous invoices from that vendor, and learns from the correction. Next time, it gets it right automatically.

The Three-Way Match Problem (And Why It Matters More Than You Think)

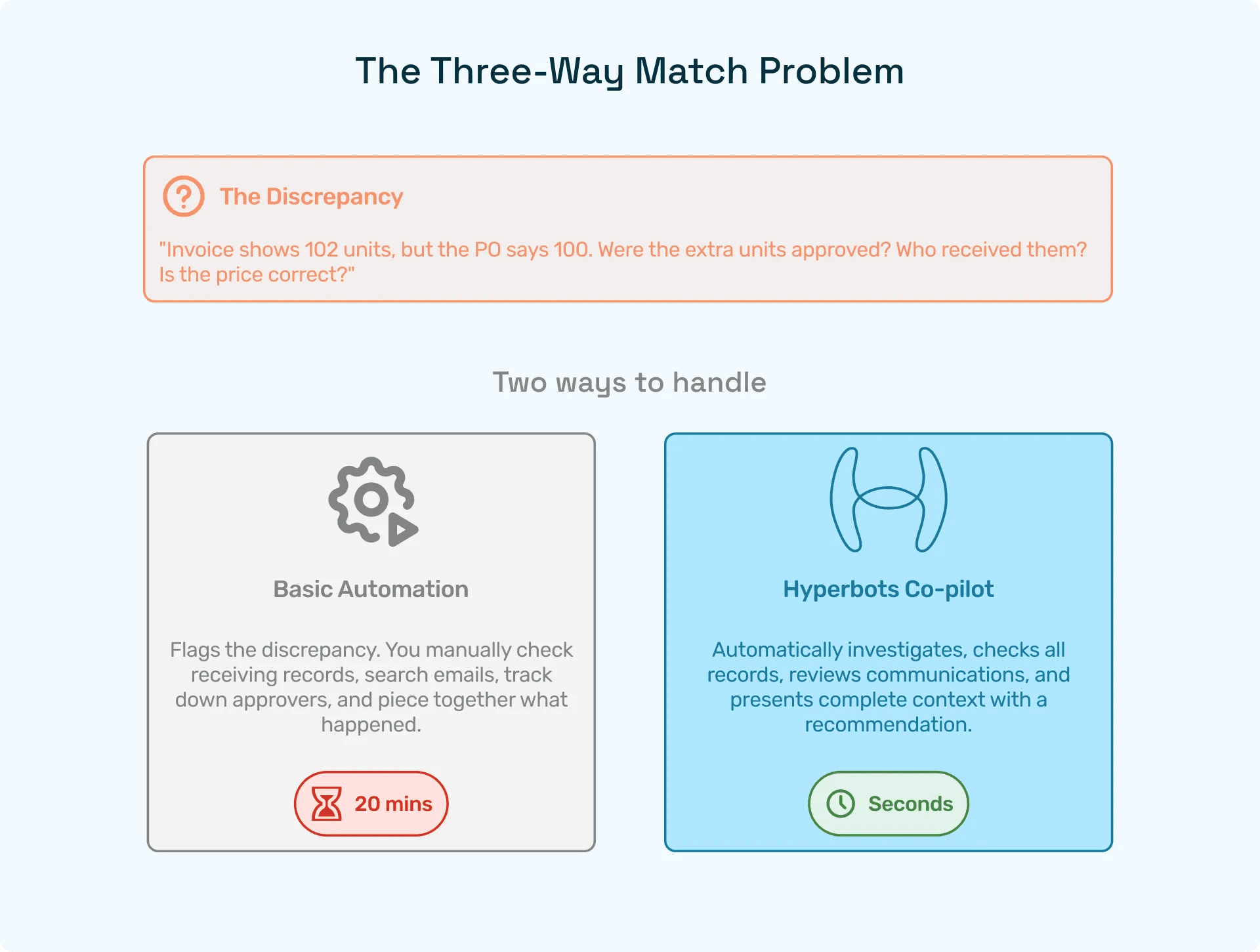

Let's talk about three-way matching, because this is where you really see the difference between basic automation and intelligent automation.

For anyone who hasn't lived this particular joy: three-way matching means verifying that your purchase order, the goods receipt, and the vendor invoice all align before you pay. Quantities match, prices match, everything's accounted for. It's tedious, it's time-consuming, and it's absolutely critical for preventing errors and fraud.

Ramp can help you track POs and link them to invoices. But when there are discrepancies (and there always are), you're back to manual investigation. Someone needs to figure out why the invoice is for 102 units when the PO said 100, whether those extra units were approved, who received them, and whether the price is correct.

Hyperbots' copilot doesn't just flag discrepancies. It investigates them. It checks your receiving records, looks at amendment history, reviews communication with the vendor, and presents the full context to whoever needs to approve the exception. Instead of spending 20 minutes tracking down information, your approver gets a summary in seconds and can make an informed decision immediately.

That's not just faster. It's fundamentally different work. Your AP team shifts from being investigators and paper-pushers to being decision-makers and exception handlers. The copilot handles the routine; humans handle the judgment calls.

The Email Problem Nobody Talks About

Here's something both Ramp and most AP automation tools overlook: a huge amount of AP communication still happens over email. Vendors email invoices. Approvers email questions. Your team emails clarifications. It's chaotic, unstructured, and impossible to track effectively.

Ramp gives you a portal where vendors can submit invoices. That's great for vendors who'll use it. But many won't, especially smaller vendors or international suppliers who work with dozens of companies and don't want to learn a new platform for each one. So you're still getting emailed PDFs and forwarding them into the system manually.

Hyperbots goes through your email inbox for your invoices. When an invoice comes in via email, the copilot reads it, extracts the data, creates the record, and starts the approval workflow automatically. When someone emails a question about an invoice, the copilot can respond directly with the relevant information. It's like having an AP team member who never sleeps and has perfect memory of every transaction.

This matters more than it sounds. Email is where information goes to die in most organizations. Making it part of your automated workflow instead of a parallel chaos stream is a genuine game-changer.

What AP Automation Savings Actually Look Like

Let's get practical about ROI. When people talk about Ramp ROI, they're usually pointing to three things: cashback on card spend, catching subscription waste, and time saved on expense reports. All real, all valuable.

But the AP automation savings from an intelligent copilot are different and often larger:

Time savings that actually matter. Not just "this task takes 5 minutes instead of 10 minutes," but "this entire category of work is now handled automatically." When your AP team isn't spending hours every day on data entry, exception research, and answering the same questions over and over, they can focus on meaningful work like vendor negotiations, process improvement, and financial analysis.

Fewer errors, fewer late payments. Every manual step is an opportunity for mistakes. Wrong codes, missed approvals, duplicate payments. Ramp can catch some of these, but an AI copilot that understands context and learns from patterns catches more. And when you're not constantly dealing with errors, you're not dealing with late payment fees, vendor relationship problems, or rushed correcting entries at month-end.

Scaling without hiring. This is where the ROI really compounds. As your company grows, your invoice volume grows. With traditional automation (or Ramp's approach), you still need to hire more AP people to handle the volume. With an intelligent copilot, the same team can handle significantly more volume because the copilot scales infinitely. You're paying for software instead of salaries, benefits, and office space.

Better financial visibility. When everything is coded correctly, matched properly, and processed consistently, your financial data is actually useful. You can see spending patterns, identify cost-saving opportunities, and make decisions based on real-time information instead of waiting for month-end cleanup.

Integration: The Unsexy Thing That Matters Most

Here's something that doesn't make it into marketing materials but destroys ROI projections: integration headaches.

Ramp integrates with major accounting systems. They have to, it's table stakes. But their integration is built around their core product (cards and expenses) with AP as secondary. So you might find yourself doing workarounds for AP-specific workflows or maintaining parallel processes.

Hyperbots was built to live inside your existing financial systems. It connects to your ERP, your email, your document management, your approval workflows. The copilot works across all of them, pulling information from wherever it lives and updating records wherever they need to go. You're not replacing your accounting system or learning a whole new platform. You're adding intelligence to what you already have.

This matters enormously for adoption. Finance teams are notoriously resistant to change, and for good reason. They've seen tools come and go, and they know that "user-friendly" often means "completely different from what we're used to." A copilot that works within familiar systems gets used. A whole new platform that requires retraining everyone and changing established processes gets resisted.

The Human Element: What Gets Better (And What Doesn't)

Let's be honest about what automation can and can't do.

Ramp won't make your vendor relationships better. It won't help you negotiate better terms. It won't give you strategic insights into your spending patterns beyond basic categorization. It's a tool for control and efficiency, which is valuable, but it's not transformative.

An AI copilot doesn't do those things directly either. But here's what it does: it frees your AP team to actually do them. When your senior AP person isn't spending half their day answering "where's my payment?" emails and tracking down invoice details, they have time to look at vendor performance, identify consolidation opportunities, and build better relationships.

That's the ROI calculation nobody puts in their spreadsheet. What could your team accomplish if they had 10 or 15 hours a week back? What insights are hiding in your financial data that nobody has time to look for? What vendor issues are festering because your team is too buried in processing to address them proactively?

What This Means For Your AP Automation Decision

If your biggest pain point is employee spending and expense reports, Ramp makes sense. If you want better spend controls and some basic AP functionality in one platform, Ramp works fine.

But if you're serious about transforming your accounts payable operation, if you're looking for real AP automation savings that compound over time, if you want your finance team spending time on finance instead of data entry... then you need something built specifically for that problem.

Hyperbots' copilot isn't trying to be everything to everyone. It's laser-focused on making AP work better. Smarter matching, intelligent coding, automatic exception handling, natural language interaction. The boring, tedious, error-prone work that eats up your team's time gets handled automatically. The complex, judgment-based work gets easier because all the context and information is immediately available.

The Real Question You Should Be Asking

The Ramp ROI question isn't really "does Ramp save money?" It's "does Ramp solve my actual problems?"

For many companies, the answer is "partially." Ramp solves the expense and spend control problem really well. It makes a dent in the AP problem. And if AP is just a small piece of your finance operation, that might be enough.

But for companies where AP is a significant time sink, where invoice volume is growing, where the team is overwhelmed and errors are piling up... partial solutions don't cut it. You need something purpose-built for the problem.

That's not even a knock on Ramp. They're excellent at what they're designed to do. But "corporate card platform with some AP features" and "AI-powered AP copilot" are fundamentally different products solving different problems.

Making The Honest Comparison

Here's how to think about this practically:

Ramp is better if: You primarily need spend control, your AP volume is low, you want one platform for cards and basic bill pay, and you're okay with manual processes for exceptions and complex workflows.

Hyperbots is better if: AP is a major pain point, you're drowning in invoice volume, you need intelligent matching and exception handling, you want your team doing strategic work instead of data entry, and you need something that actually understands the context of every transaction.

You might need both if: You want Ramp's spend management for employees and Hyperbots' intelligent automation for AP. They're not mutually exclusive. In fact, several Hyperbots customers use Ramp for cards and expenses while using the copilot for their core AP work.

The key is being honest about where your pain actually is and what will genuinely make your team's life better. AP automation savings come from actually automating the hard parts, not just digitizing the easy parts.

The Path Forward

The future of finance isn't about having fewer tools. It's about having smarter tools. Tools that learn, adapt, and actually understand the work instead of just digitizing existing processes.

Ramp modernized corporate spending. That was important and valuable. But the AP side of the house has been stuck in the same basic processes for decades, just with slightly better software. An AI copilot that actually thinks, learns, and handles complexity... that's different. That's the next step.

Your AP team shouldn't be doing work that software could handle. They should be doing work that requires human judgment, relationship skills, and strategic thinking. Everything else? Let the copilot handle it.

That's the real ROI of intelligent AP automation. Not just saving time or reducing errors (though those are real). It's fundamentally changing what your finance team can accomplish and how they spend their days. It's turning a cost center into a strategic function.

And that's worth a lot more than cashback on office supplies.