Evaluation Guide: Best Purchase Order Software Features for Mid-sized Teams

Streamline procurement with AI-powered PO software built for mid-sized finance teams.

Executive Summary

Mid-sized finance and procurement teams face a constant balancing act: keeping processes compliant while ensuring speed and agility. Manual purchase order (PO) workflows often create unnecessary bottlenecks, slowing down purchasing and driving up costs.

The best purchase order software helps streamline procurement through automation, centralized visibility, and intelligent workflows. For CFOs, Controllers, and Procurement Heads, choosing the right purchase order program requires careful evaluation of features, scalability, and ROI.

This guide explores:

The must-have features of modern PO software.

How to evaluate pricing models and total cost of ownership.

The role of automation in helping teams reduce approval bottlenecks.

Why Hyperbots’ Procurement Copilot and its AI-powered suite are redefining the market.

By the end, you’ll have a feature checklist for selecting PO software that matches the needs of mid-sized finance teams while driving measurable cost savings.

Why Mid-sized Teams Need the Best Purchase Order Software?

For mid-sized companies, procurement inefficiencies are magnified. Unlike large enterprises, they often lack extensive back-office staff, yet the volume of purchase requests grows as the business scales.

Key pain points with manual or outdated PO software:

Long approval cycles create friction with suppliers.

Lack of real-time spend visibility complicates cash flow forecasting.

Compliance risks increase without automated policy checks.

Manual rework drives operational costs higher.

According to a Gartner report, CFOs in mid-market organizations cite procurement digitization as one of the top three levers for reducing overhead. This makes PO automation software not just a tool, but a strategic investment.

Core Features of the Best Purchase Order Software (Feature Checklist)

A robust PO system must balance usability, scalability, and governance. Here’s a feature checklist to guide your evaluation:

1. Automated Approval Workflow

Role-based routing that ensures requests go to the right approvers.

Escalations and re-routing to prevent bottlenecks.

Configurable thresholds for auto-approvals (e.g., purchases under $5,000).

2. ERP and Finance System Integration

Native support for SAP, NetSuite, Oracle, and Microsoft Dynamics.

Bi-directional sync for accurate real-time data.

Minimal reliance on IT for ongoing integrations.

3. Policy-Aware Compliance

Built-in controls aligned with corporate spending policies.

Audit trails for every transaction.

Regulatory compliance support (SOX, IFRS, GAAP).

4. Real-Time Spend Visibility

Dashboards tailored for CFOs and Controllers.

Predictive analytics for forecasting.

Drill-downs by department, vendor, or category.

5. Scalability for Mid-Sized Teams

Cloud-based deployment for fast implementation.

Configurable workflows without coding.

Scales as transaction volumes grow.

Pricing Models for PO Software

Pricing transparency is critical when selecting PO software for mid-sized organizations.

Common pricing approaches:

Subscription-based (SaaS): Per user or per transaction model. Scales with growth but requires monitoring usage.

Tiered feature packages: Entry-level vs enterprise-level plans.

Custom pricing: Often tied to ERP integration complexity.

Key evaluation tip: Always calculate Total Cost of Ownership (TCO), including implementation, integrations, training, and ongoing support.

Hyperbots simplifies this with clear, predictable pricing models aligned to ROI, reducing procurement costs by up to 80% with automation.

How Purchase Order Automation Helps Reduce Approval Bottlenecks

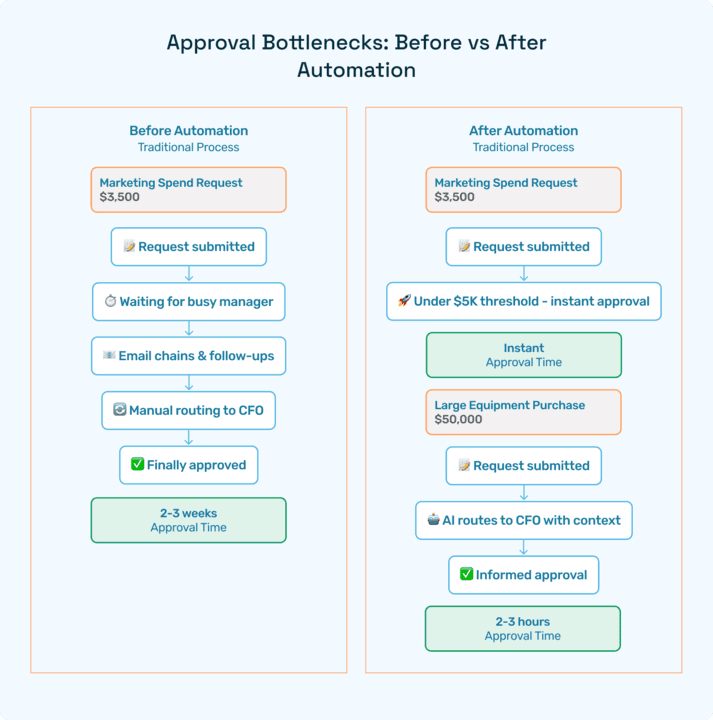

One of the biggest challenges for mid-sized teams is approval delays. Traditional approval chains often depend on busy executives, leading to stalled requests.

How automation solves this:

Smart AI agents automatically reroute stalled requests.

Policy-aware thresholds allow instant auto-approvals.

CFOs get real-time visibility into pending approvals.

Example: With Hyperbots’ Procurement Copilot, a $3,500 marketing spend request can be auto-approved instantly, while a $50,000 request is routed with contextual insights to the CFO. This eliminates weeks of delay, cutting cycle times from weeks to hours.

Hyperbots’ Differentiated Approach

Unlike generic PO automation tools, Hyperbots delivers a suite of AI Co-Pilots that work across the procure-to-pay cycle:

Procurement Copilot: Shrinks cycle times with ERP-synced approvals.

Invoice Processing Copilot: Automates invoice validation and matching.

Vendor Management Copilot: Streamlines supplier onboarding and compliance.

Accruals Copilot: Provides real-time expense visibility.

Payments Copilot: Ensures secure, compliant disbursements.

Why this matters: Mid-sized teams don’t just need PO automation. They need end-to-end visibility and compliance across procurement. Hyperbots is the only platform purpose-built for CFOs and Controllers.

ROI of the Best Purchase Order Software

The ROI of purchase order automation is both tangible and intangible.

Tangible Returns:

5 minutes PR creation time.

Up to 80% reduction in manual procurement effort.

Intangible Returns:

Better supplier relationships from timely approvals.

Higher employee satisfaction (fewer repetitive tasks).

Stronger decision-making with real-time visibility.

Improved vendor compliance.

In “Shifting the Dial in Procurement”, McKinsey estimates that digital tools like automation can unlock 3–10% annual cost savings in procurement functions, proving the strategic impact of automation.

Steps to Evaluate the Best PO Software for Mid-Sized Teams

When building your shortlist, follow a structured approach:

Define Objectives: Faster cycle times? Better compliance? Lower costs?

Build a Feature Checklist: Use the must-have features outlined earlier.

Assess Integrations: Ensure compatibility with your ERP/finance stack.

Review Pricing: Compare TCO, not just monthly license fees.

Pilot and Measure: Run a 3-month trial to measure cycle time reduction.

Select a Scalable Partner: Choose a vendor that grows with your needs.

Hyperbots check every box, with AI-powered automation purpose-built for finance leaders.

Hyperbots Platform Capabilities

Hyperbots is differentiated by its Agentic AI Platform, designed specifically for finance automation:

Handles unstructured financial data from contracts, PDFs, and invoices.

Native ERP integrations with SAP, NetSuite, Oracle, Microsoft Dynamics.

Advanced AI features including anomaly detection, redaction, and predictive analytics.

Human-in-the-loop controls so CFOs and Controllers always stay in charge.

This balance of speed, compliance, and control positions Hyperbots as the most advanced solution in the market.

Moving Procurement Forward

For mid-sized teams, investing in the best purchase order software isn’t just about automation- it’s about agility, compliance, and cost leadership. Hyperbots’ AI Co-Pilots deliver measurable ROI, reducing costs by 80% while freeing finance teams from manual bottlenecks.

FAQs

Q1. What is PO software?

PO software is a digital solution that automates purchase order creation, routing, and approvals, replacing manual spreadsheets and emails.

Q2. How does automation reduce approval bottlenecks?

By auto-approving low-value requests and rerouting stalled approvals, automation eliminates delays in the workflow.

Q3. How is Hyperbots different from other vendors?

Unlike generic PO tools, Hyperbots delivers AI Co-Pilots purpose-built for finance leaders, integrated across the full procure-to-pay cycle.

Q4. What is the typical ROI?

Enterprises see 70–90% cycle time reductions, up to 80% cost savings, and improved compliance within the first year.

Q5. Is it suitable for mid-sized teams?

Yes, Hyperbots’ cloud-based, scalable design makes it ideal for mid-sized finance and procurement teams.