How to Make a Purchase Order: Step-by-Step Guide for Finance Teams

Learn how to make a purchase order with this step-by-step guide. Explore PO basics, best practices, and how Hyperbots automates PO creation.

Executive Summary

Purchase orders (POs) remain a cornerstone of effective procurement and finance operations. A purchase order documents the what, when, and how of business purchases, providing structure, visibility, and accountability. For CFOs, controllers, and procurement leaders, understanding how to make a purchase order is not just an operational necessity, it's a strategic imperative.

Yet, the process is often riddled with manual inefficiencies, compliance risks, and data errors. According to APQC, manual PO processing can cost organizations between $500 and $520 per purchase order, creating a significant drain on time and resources. This challenge compounds as businesses scale, vendors multiply, and reporting needs intensify.

This guide delivers a step-by-step framework for creating POs, explores best practices, and outlines common mistakes to avoid. It also highlights how modern automation platforms, particularly Hyperbots AI Procurement Copilot and its supporting co-pilots are redefining the way enterprises handle purchase orders.

By the end, finance leaders will understand not just how to create a purchase order, but how to transform this once-manual function into an efficient, secure, and value-generating process that directly contributes to ROI and operational agility.

What is a Purchase Order?

A purchase order (PO) is a legally binding document issued by a buyer to a supplier that confirms the intent to purchase goods or services under defined terms. It is a critical checkpoint in procurement and finance because it controls spending, ensures proper authorization, and provides both parties with clarity on the transaction.

A PO typically includes:

Buyer and supplier details

Item description, quantity, and price

Delivery timeline

Payment terms

Reference numbers for reconciliation

POs differ from requisitions, which are internal requests for goods or services, and from invoices, which are bills issued by suppliers after delivery. In practice, the PO acts as a bridge between requisition and invoice.

Types of POs:

Standard Purchase Orders: For one-off purchases.

Planned POs: Outline recurring needs but require releases for execution.

Blanket POs: Cover repetitive purchases over a set period.

Contract POs: Establish long-term supplier agreements.

Why POs Are Critical for Financial Controls

Purchase orders strengthen financial discipline by:

Preventing unauthorized spend.

Enabling better budgeting and forecasting.

Reducing risk of duplicate or fraudulent invoices.

Supporting audit readiness and compliance.

For finance executives, the purchase order is not just paperwork, it's a safeguard for corporate governance.

Why Learning How to Make a Purchase Order Matters

Poorly managed purchase orders can quickly erode profitability. Without clear documentation, organizations face disputes with suppliers, uncontrolled costs, and inefficiencies that ripple across AP and procurement.

Key challenges in unmanaged POs:

Manual entry errors leading to mismatched invoices.

Delays in approvals that stall vendor relationships.

Inconsistent data formats, complicating reporting.

Limited visibility into commitments and liabilities.

For CFOs and controllers, these problems manifest in extended month-end closes, higher audit scrutiny, and increased risk exposure. In industries with tight margins, such inefficiencies can significantly hurt working capital.

On the flip side, mastering how to make a purchase order ensures:

Compliance: Every expense is authorized and traceable.

Efficiency: Approvals and vendor communication flow seamlessly.

Visibility: Finance has a clear view of spend commitments before cash outflow.

Scalability: A structured process supports growth without ballooning headcount.

For finance leaders, a well-structured PO process is both a tactical enabler and a strategic differentiator.

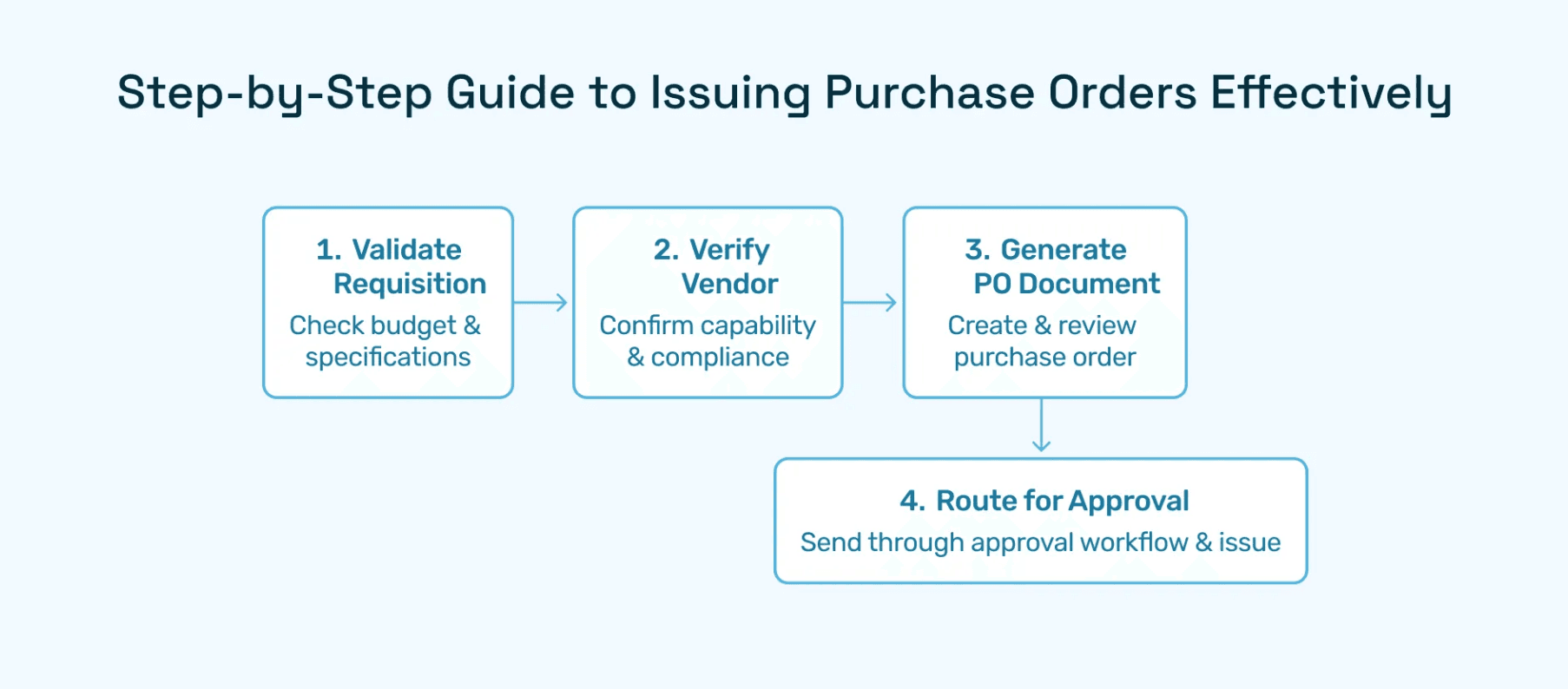

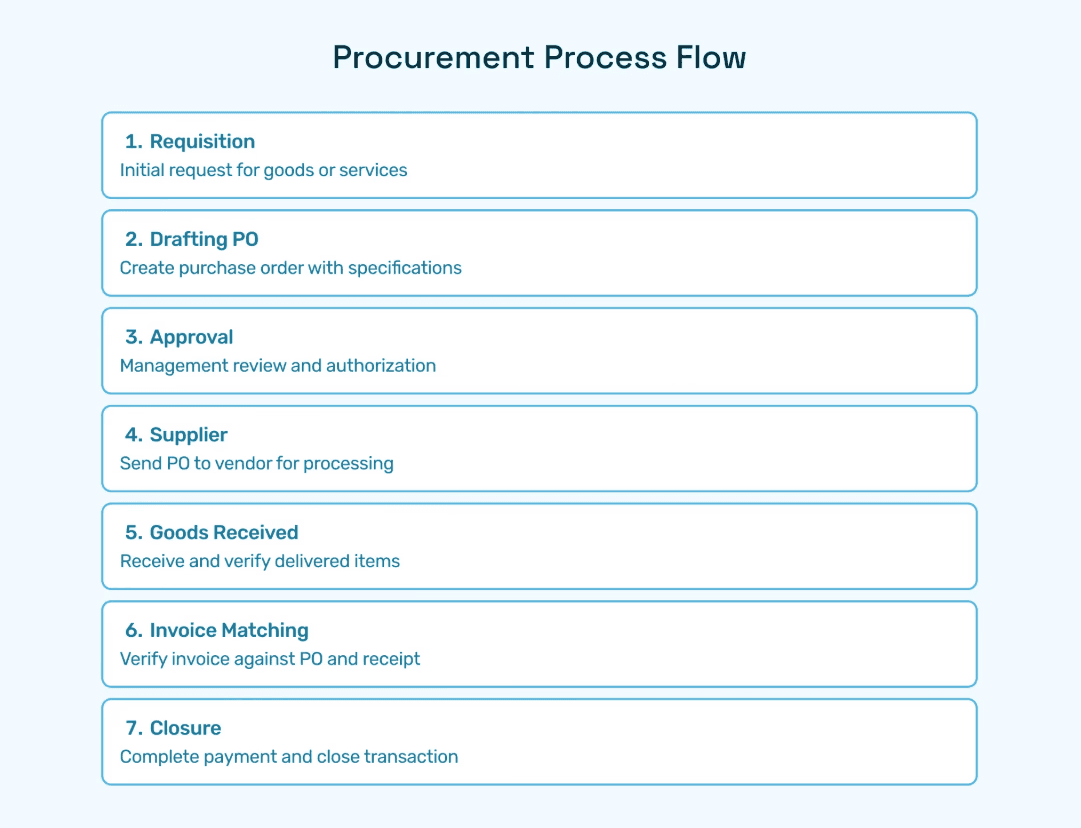

Steps to Make a Purchase Order (Step-by-Step Guide)

Learning how to make a purchase order involves several deliberate steps. Below is a structured approach that finance and procurement teams can adopt.

Step 1: Identify the Purchase Need

The process begins when an employee, department, or project identifies a need for goods or services.

Clear justification helps finance evaluate necessity and budget fit.

Step 2: Create a Requisition

Internal requisition forms are drafted and routed for initial approval.

Details should include type of goods, specifications, quantity, and estimated cost.

Step 3: Draft the Purchase Order

The buyer creates a PO with:

Supplier information

Line-item details (items, quantity, unit price)

Payment terms and delivery dates

Consistency in formatting reduces downstream errors.

Step 4: Approval Workflow

Supervisors, budget owners, or procurement leads review the PO.

Digital workflows streamline multi-level approvals.

Step 5: Send PO to Supplier

The approved PO is transmitted to the supplier (email, EDI, or procurement system).

Supplier acknowledgment confirms acceptance.

Step 6: Goods/Services Fulfillment

Supplier delivers according to terms.

Goods receipt or service confirmation is logged internally.

Step 7: Three-Way Matching

Accounts payable matches PO, invoice, and receipt.

Discrepancies are flagged for resolution.

Step 8: Closure and Archiving

Once reconciled and paid, the PO is closed.

Archival supports audits and spend analysis.

Best Practices in Writing a Purchase Order

Always include complete vendor details and reference numbers.

Use structured templates for consistency.

Standardize payment and delivery terms.

Integrate POs with ERP or accounting systems.

Common Mistakes to Avoid

Missing details such as unit of measure or tax codes.

Skipping approval steps.

Using unverified vendor data.

Treating POs as clerical forms instead of financial controls.

With these steps and practices, finance teams can ensure every PO adds value rather than friction.

Manual vs. Automated PO Creation

Manual purchase order creation is still common in mid-sized organizations. However, it introduces significant cost and compliance risks.

Manual PO Characteristics:

Spreadsheet or paper-based creation.

Email-based approval routing.

Higher risk of lost or delayed POs.

Labor-intensive reconciliation.

Automated PO Characteristics:

Digital templates and pre-filled vendor data.

Built-in approval workflows.

Integration with ERP and AP systems.

Real-time visibility into PO status.

Cost Impact:

According to APQC, the cost of manually processing a PO ranges from $500–$520 per order. With automation, that cost drops, freeing finance teams to focus on analysis rather than paperwork.

Compliance Impact:

Automation enforces approval hierarchies, reduces fraud exposure, and simplifies audits. For CFOs, this translates into fewer compliance headaches and improved stakeholder confidence.

For enterprises, moving from manual to automated POs is not optional, it's a prerequisite for scale and efficiency.

Purchase Order Compliance and Risk Management

For CFOs and controllers, purchase orders represent more than operational efficiency—they are critical risk mitigation instruments. Understanding how to make a purchase order with compliance at its core protects organizations from financial, legal, and reputational exposure.

Regulatory Compliance Considerations:

Purchase orders play a vital role in demonstrating compliance with various regulatory frameworks. Under Sarbanes-Oxley (SOX) requirements, publicly traded companies must maintain robust internal controls over financial reporting. POs serve as primary evidence of authorization controls and segregation of duties. Similarly, organizations subject to FCPA (Foreign Corrupt Practices Act) regulations rely on PO documentation to demonstrate legitimate business purposes and prevent bribery or corruption.

For government contractors, the Federal Acquisition Regulation (FAR) mandates specific PO requirements, including detailed specifications, pricing transparency, and delivery terms. Non-compliance can result in contract termination, financial penalties, or debarment from future government work.

Tax and Audit Implications:

Purchase orders create a clear audit trail that connects requisitions, approvals, receipts, and payments. During tax audits, POs substantiate business expenses and support deduction claims. They provide evidence of the business purpose, timing, and legitimacy of expenditures—critical factors when defending against IRS challenges or VAT audits in international operations.

Modern tax authorities increasingly demand digital records with complete transaction histories. Organizations that maintain comprehensive PO systems can respond to audit requests within hours rather than weeks, reducing disruption and demonstrating strong governance.

Fraud Prevention Through PO Controls:

According to the Association of Certified Fraud Examiners (ACFE), procurement fraud accounts for approximately 9% of all organizational fraud cases, with median losses exceeding $200,000 per incident. Robust PO processes combat several common fraud schemes:

Split purchases: Dividing purchases to stay under approval thresholds. Automated systems flag patterns of sequential POs to the same vendor.

Phantom vendors: Creating fictitious suppliers to divert funds. PO systems with vendor validation prevent payments to unverified entities.

Kickback schemes: Employees receiving benefits from vendors in exchange for favorable treatment. Approval workflows and vendor rotation policies reduce this risk.

Invoice manipulation: Submitting fake invoices without corresponding POs. Three-way matching makes this virtually impossible.

Financial leaders who treat POs as compliance tools rather than administrative tasks significantly reduce organizational risk exposure while strengthening their overall control environment.

Integrating Purchase Orders with Strategic Procurement

While mastering how to make a purchase order addresses tactical needs, forward-thinking finance organizations are elevating POs to strategic instruments that drive procurement optimization and supply chain resilience.

Data-Driven Procurement Decisions:

Every purchase order generates valuable data that, when aggregated and analyzed, reveals spending patterns, supplier performance, and optimization opportunities. Finance teams using advanced PO systems can:

Identify consolidation opportunities where multiple departments purchase similar items from different suppliers at varying prices

Track supplier reliability metrics including on-time delivery rates, quality issues, and pricing consistency

Forecast future spending based on historical PO patterns, improving budget accuracy

Negotiate better terms by demonstrating purchase volume across the organization

These insights transform procurement from a reactive function into a strategic advantage.

Supplier Relationship Management:

Purchase orders set the foundation for supplier relationships. Inconsistent or unclear POs create friction, erode trust, and can result in unfavorable terms or priority deprioritization during supply constraints.

Best-in-class organizations use PO systems to strengthen supplier partnerships by:

Providing suppliers with consistent, professional documentation that reduces ambiguity

Enabling accurate demand forecasting that helps suppliers optimize their operations

Processing POs quickly, allowing suppliers to begin fulfillment sooner

Maintaining transparent communication channels through integrated systems

During supply chain disruptions - whether from natural disasters, geopolitical events, or market volatility, organizations with strong supplier relationships secured through reliable PO processes maintain better access to critical materials and services.

Purchase Orders in Multi-Entity Organizations:

For CFOs overseeing multiple subsidiaries, divisions, or international operations, standardizing how to make a purchase order across entities presents unique challenges and opportunities. Decentralized PO processes create:

Inconsistent approval hierarchies that complicate internal controls

Disparate vendor relationships that reduce negotiating leverage

Fragmented spend visibility that obscures optimization opportunities

Increased compliance risk across different regulatory jurisdictions

Leading platforms like Hyperbots address these challenges through centralized policy management with localized execution. Finance leaders can establish enterprise-wide PO standards while accommodating regional requirements such as local language support, currency handling, and jurisdiction-specific compliance needs.

This approach delivers the dual benefits of operational consistency and local flexibility, critical for organizations pursuing growth through acquisition or international expansion while maintaining financial discipline.

Environmental and Social Governance (ESG) Through POs:

Modern stakeholders increasingly evaluate organizations on ESG commitments. Purchase orders provide an unexpected but powerful tool for advancing these objectives. By incorporating sustainability criteria and social responsibility factors into PO systems, finance leaders can:

Track spending with diverse suppliers, supporting diversity and inclusion initiatives

Monitor environmental impact through supplier certifications and product specifications

Ensure ethical labor practices by requiring supplier attestations

Generate ESG reports directly from procurement data

Organizations that integrate ESG into their PO processes not only strengthen their sustainability credentials but also attract ESG-focused investors and customers while reducing regulatory risk.

How Hyperbots Simplifies Purchase Order Creation

While several tools claim to automate procurement, Hyperbots AI Procurement Copilot redefines what automation means in the finance back office.

Key Capabilities:

AI-driven PO Drafting: Hyperbots automatically creates POs from requisitions, pulling in vendor data and contract terms.

Approval Workflows: Multi-level approval logic built into the system, configurable for organizational hierarchies.

Vendor Validation: Automatic data enrichment ensures vendor information is current and accurate.

Real-Time ERP Sync: POs sync directly with QuickBooks, NetSuite, SAP, and Microsoft Dynamics.

Dual-Write Mode: For safe transitions between accounting systems without data loss.

Differentiation from Competitors:

Native AI agents handle exceptions autonomously.

Procurement Copilot works alongside Invoice Processing Copilot, Payments Copilot, and Tax Copilot for end-to-end automation.

Exception alerts delivered in real-time via Slack or Teams.

SOC 2 Type 2 and ISO 27001 certification for enterprise-grade security.

ROI and Impact on Finance Teams

Reduced cost per PO from hundreds of dollars to a fraction.

Faster approvals → improved supplier relationships.

Audit-ready records that cut close time by days.

Hyperbots does not just help finance leaders understand how to create a purchase order, it transforms the function into a strategic lever.

ROI of Automated Purchase Orders

The financial case for automation is compelling. Automating POs reduces direct processing time by 80%, while indirect benefits compound over time.

Tangible ROI:

Lower FTE hours spent on clerical work.

Reduced supplier disputes.

Faster cycle times = better cash flow management.

Strategic ROI:

Visibility into commitments improves budget accuracy.

Stronger compliance posture during audits.

Enhanced vendor satisfaction, driving better contract terms.

According to Deloitte, organizations that automate procurement functions experience 30% faster cycle times and up to 2x stronger compliance scores compared to peers.

Automation is not just an efficiency play, it is an enterprise resilience strategy.

FAQs on How to Make a Purchase Order

1. What information should a purchase order include?

A: A PO should include buyer and supplier details, item descriptions, quantities, pricing, delivery dates, payment terms, and reference numbers.

2. What's the difference between a PO and an invoice?

A: A PO confirms the buyer's intent to purchase; an invoice requests payment after goods/services are delivered.

3. Can small businesses benefit from purchase orders?

A: Yes. POs help small firms control spend, avoid disputes, and maintain professionalism with suppliers.

4. How does automation improve purchase orders?

A: Automation reduces manual errors, enforces approvals, and integrates directly with ERP/AP systems.

5. Is automation only for large enterprises?

A: No. Hyperbots offers solutions tailored for startups, SMBs, and enterprises alike.

6. How do POs support audits?

A: POs provide a documented trail of intent, authorization, and delivery, simplifying audit preparation.

7. What systems do Hyperbots integrate with?

A: QuickBooks, NetSuite, SAP, Microsoft Dynamics, and other leading ERP platforms.

Moving Toward Smarter POs with Hyperbots

Purchase orders are more than transaction records, they are financial guardrails that enable scale, compliance, and efficiency. For finance leaders, the ability to create and manage POs effectively separates reactive organizations from proactive ones.

However, manual processes cannot keep pace with modern finance demands. Hyperbots AI Procurement Copilot, supported by its family of co-pilots, eliminates inefficiencies, reduces cost per PO, and ensures every transaction strengthens the organization's financial position.

Forward-thinking CFOs and controllers are no longer asking how to make a purchase order - they are asking how to make POs smarter, faster, and more compliant. Hyperbots provides the answer.

👉 Explore how Hyperbots can transform your procurement workflows. Request a demo today.